Equifax Joins Other Consumer Credit Bureaus to Level-Set on Health of Subprime Auto Lending Market

New research from Equifax indicates loan performance remains stable

ATLANTA, Jan. 24, 2017 /PRNewswire/ -- Equifax Inc. (NYSE: EFX) today joined other U.S. Credit Bureau representatives at the American Financial Services Association (AFSA) Vehicle Financing Conference and Expo in New Orleans to address concerns around the stability of the subprime auto lending market.

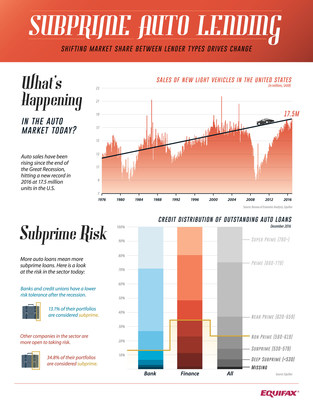

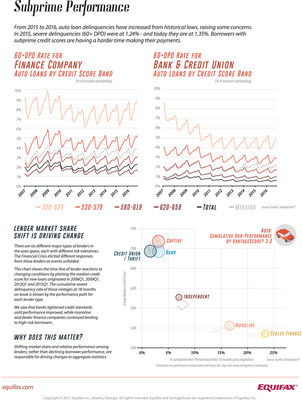

In response to mixed reports and conflicting analysis in the marketplace, Equifax conducted research examining auto lending dynamics and the resulting performance differences. Findings point to continued strength within subprime auto lending in what has increasingly become a segmented sector within which different lender types specialize in narrow credit bands. The research also found that most lenders remain very conservative relative to their pre-recession lending habits, while some are meeting the needs of consumers with lower credit scores.

"The fact is loan performance is good relative to historical levels and the slight weakening we are seeing cannot be attributed to a change in how lenders are underwriting their loans or call into question the stability of the subprime market as a whole," said Amy Crews Cutts, senior vice president and Chief Economist for Equifax. "Consumer data tells us that market share is shifting across different lender types and specialty lenders are lending in higher-risk segments that are not otherwise being served."

An infographic highlighting the Equifax research on subprime lending in the U.S. can be viewed here: http://www.visualcapitalist.com/subprime-auto-loans/.

Over the last 10 years, Equifax has focused on utilizing the data it has on hand to support the sustainability of the financial marketplace, as well as the needs of creditworthy consumers. Consumer credit data is one of the most accurate way to assess a consumer's financial health and a useful tool in assessing current economic performance. Equifax is working to revolutionize consumer credit information to enhance its offerings in support of consumers and economies around the world.

About Equifax

Equifax powers the financial future of individuals and organizations around the world. Using the combined strength of unique trusted data, technology and innovative analytics, Equifax has grown from a consumer credit company into a leading provider of insights and knowledge that helps its customers make informed decisions. The company organizes, assimilates and analyzes data on more than 820 million consumers and more than 91 million businesses worldwide, and its databases include employee data contributed from more than 6,600 employers.

Headquartered in Atlanta, Ga., Equifax operates or has investments in 24 countries in North America, Central and South America, Europe and the Asia Pacific region. It is a member of Standard & Poor's (S&P) 500® Index, and its common stock is traded on the New York Stock Exchange (NYSE) under the symbol EFX. Equifax employs approximately 9,400 employees worldwide.

Some noteworthy achievements for the company include: Ranked 13 on the American Banker FinTech Forward list (2015); named a Top Technology Provider on the FinTech 100 list (2004-2015); named an InformationWeek Elite 100 Winner (2014-2015); named a Top Workplace by Atlanta Journal Constitution (2013-2015); named one of Fortune's World's Most Admired Companies (2011-2015); named one of Forbes' World's 100 Most Innovative Companies (2015). For more information, visit www.equifax.com

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/equifax-joins-other-consumer-credit-bureaus-to-level-set-on-health-of-subprime-auto-lending-market-300395769.html

SOURCE Equifax Inc.

Released January 24, 2017