UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | |

|

No fee required. |

|

Fee paid previously with preliminary materials. |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Innovating with

artificial intelligence

to help move

people forward

Notice of 2024 Annual Meeting and Proxy Statement

2023 was an energizing year for the New Equifax. As we move closer to completing the Equifax Cloud™ we are pivoting from building to leveraging our new Cloud capabilities, single data fabric, differentiated data, and EFX.AI Artificial Intelligence (AI) capabilities to deliver new solutions for customers and consumers in each of the 24 markets we serve. As we mark our 125-year anniversary in 2024, we are celebrating a culture of continuous innovation as the New Equifax that drives top and bottom line growth and delivers strong financial results for our shareholders.

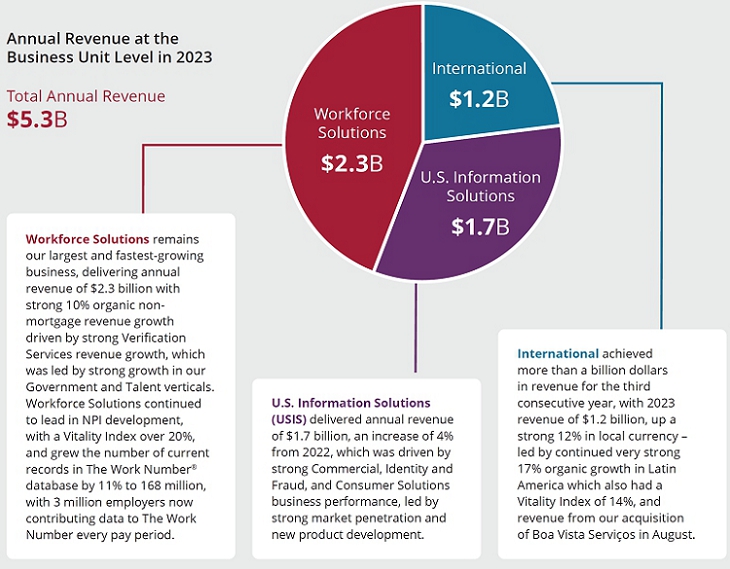

Equifax achieved record 2023 annual revenue of $5.265 billion,

up 4% in constant currency over 2022, during one of the most challenging U.S. mortgage markets in the last 20 years with U.S. mortgage inquiries down 34% and impacting Equifax revenue by about $500 million. The power and breadth of the Equifax business model, as well as our performance and execution against our EFX2025 strategic priorities, is reflected in our strong 7% organic constant currency non-mortgage growth in 2023. We exited 2023 with fourth quarter revenue growth of 11% and non-mortgage local currency revenue growth of 14%. We delivered these strong results while executing on our Cloud customer migrations and overall cost reduction plans, ending the year with about 70% of revenue in the new Equifax Cloud.

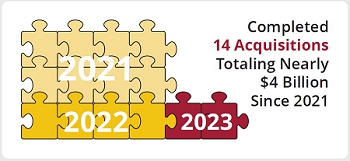

In 2023, Equifax harnessed the power of the Equifax Cloud to deliver record levels of innovation and new products leveraging our new Cloud capabilities. We delivered more than 100 New Product Innovations (NPIs) for the fourth consecutive year with a record Vitality Index (defined as revenue from new products introduced in the last three years) of 14%, well above our 10% long term Vitality target for new products, while accelerating the development of advanced models leveraging our market-leading EFX.AI capabilities. In 2023, 70% of our new models were built using AI and Machine Learning (ML) tools, up from 60% in 2022. And, we continued to invest in strategic, bolt-on acquisitions – completing the purchases of Boa Vista Serviços, the second largest credit bureau in Brazil, and Profile Credit, the leading provider of credit information for the Canadian agri-food industry – bringing our total to 14 acquisitions valued at nearly $4 billion since 2021.

| Equifax Inc. | 2024 Proxy Statement | 1 |

Our 2023 Highlights

| Equifax Inc. | 2024 Proxy Statement | 2 |

Driving AI Innovation with the Equifax Cloud

Equifax has driven AI innovation for nearly a decade – beginning with our introduction of the first Machine Learning (ML) credit scoring system with the ability to generate logical and actionable reason codes for the consumer. Our custom-built Equifax Cloud and advanced data fabric enable us to maximize EFX.AI. Differentiated data and patented AI techniques are infused into solutions that give customers the deeper insights they need to move people forward, faster.

Our more than 1,000 analytics professionals around the world anticipate the evolving challenges that our customers and consumers face – driving AI innovation not just for today, but for the future.

Unique data at scale is at the heart of EFX.AI and we invest millions annually into proprietary, non-public data assets that ‘Only Equifax’ can provide. Central to the Equifax Cloud is our new custom data fabric – an adaptable structure that unifies our deep, accurate and high-quality data (from over 100 siloed data sources) while also enabling us to manage that data in keeping with strict regulatory requirements. Data fabric offers the ability to ingest and analyze our non-public data at scale, and enhances the keying and linking of our data assets for delivery of multi-data solutions.

We are energized by the capabilities that AI brings to strengthen our business and accelerate the value of our proprietary data through richer data combinations, and our AI investments are driving results. In 2023, 70% of our new models around the globe – including the innovative Equifax OneScore for Consumer and OneScore for Commercial U.S. credit scoring models – were built using AI and ML tools, up from 60% in 2022, with a goal of over 80% in 2024.

Responsibility is built into EFX.AI. Our infrastructure is tailored to highly regulated, non-public data to deliver explainable scores, models, and products, and our Equifax AI requirements are aligned to the National Institute of Standards and Technology (NIST) AI Risk Management Framework. Whether it is for innovation, internal development, or operational improvements, Equifax uses AI Systems in a transparent, trustworthy, fair, explainable, and secure manner, to provide benefits to consumers and customers.

As of March 2024, Equifax has more than 90 approved patents supporting our approach to AI, with more than 130 patents pending.

| Equifax Inc. | 2024 Proxy Statement | 3 |

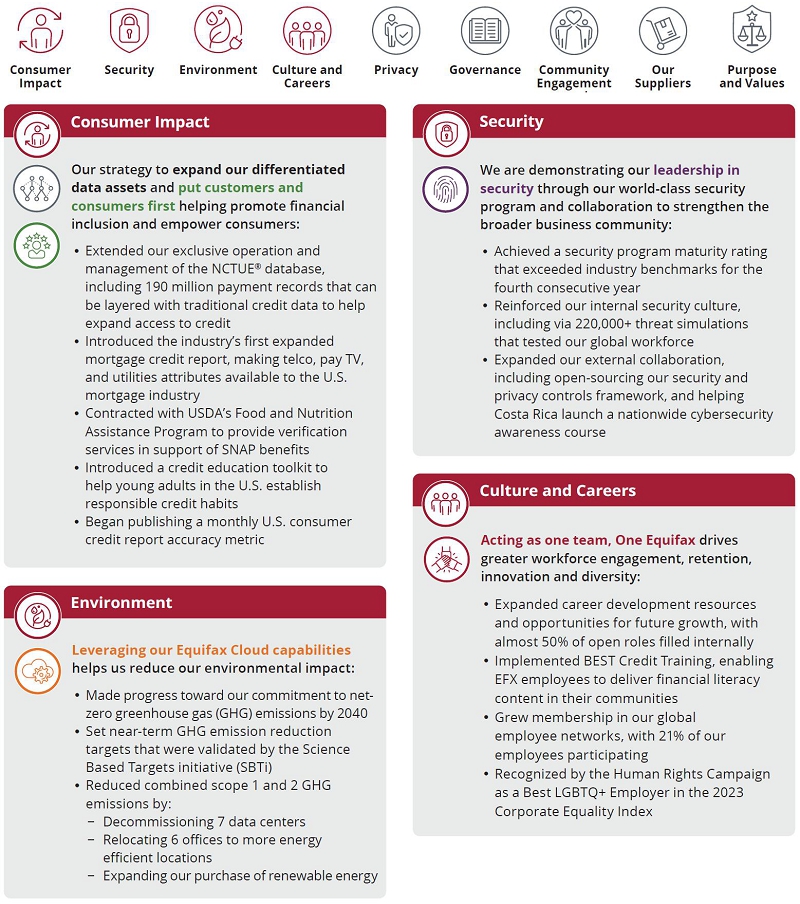

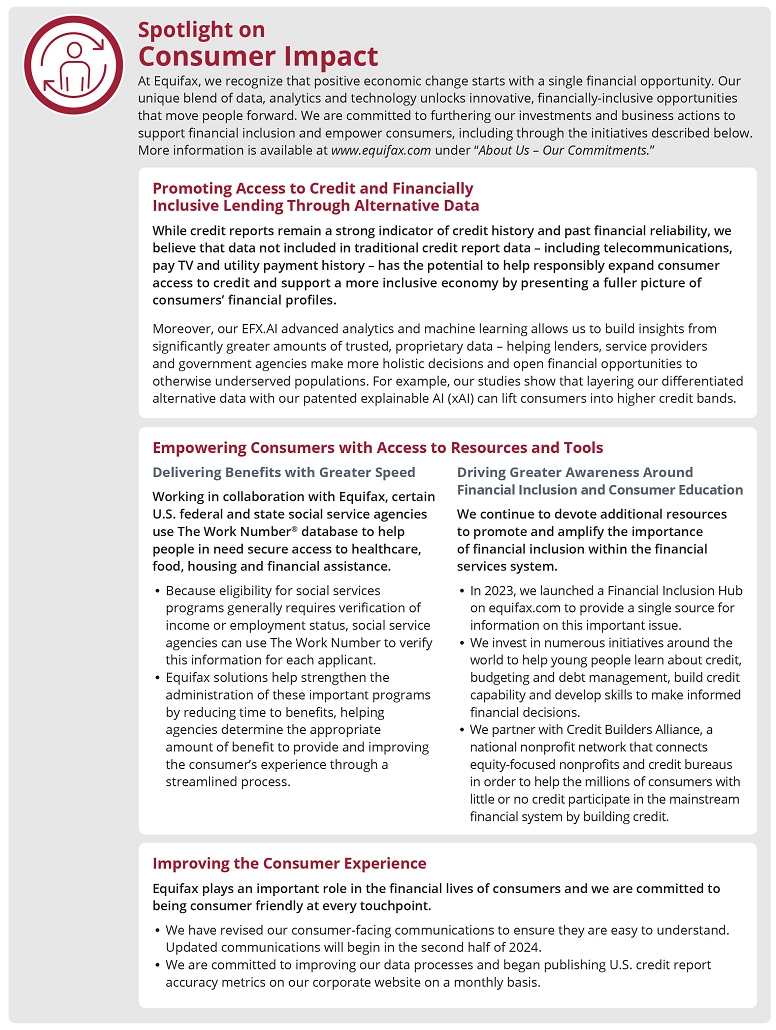

Consumer Impact:

Helping People Live Their Financial Best

Equifax strives to support economically healthy individuals and financially inclusive communities in each of the 24 countries where we do business. Our company Purpose is to help people live their financial best and we are harnessing the power of our proprietary data assets, AI capabilities, and advanced data science to meet that objective.

Our 2023 research shows that 76 million Americans have little-to-no credit history. 61 million people have “thin” files of four accounts or fewer and 16 million are “credit invisible” with no documented credit history.

While credit reports remain a strong indicator of credit history and past financial reliability, we believe that data not included in traditional credit report data has the potential to help responsibly expand consumer access to credit and support a more inclusive economy. Unique alternative data and analytics from Equifax – including information such as verified income, telecommunications and utility payment history, and cash flow insights – that may not be included in traditional credit reports – makes a difference for millions of people worldwide. Leveraging this alternative data could shift 8.4 million more U.S. consumers into scorable credit bands.

Our studies also show that incremental populations become scorable with each use of alternative data and AI. Ultimately, EFX.AI allows us to build insights from significantly greater amounts of our trusted, proprietary, non-public data – helping lenders, service providers, and government agencies to make more holistic decisions and open financial opportunities to otherwise underserved populations.

| Equifax Inc. | 2024 Proxy Statement | 4 |

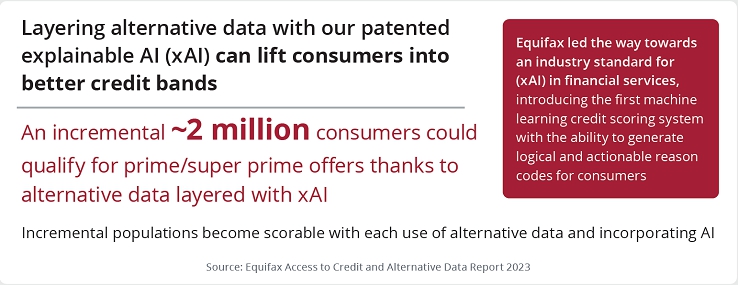

Our impact doesn’t stop there. We understand that government benefits can be a lifeline to people and families in need. Whether it’s helping bridge a gap after losing a job, supporting vulnerable populations, stimulating local economies, or broadly providing a social safety net – it’s critical to connect people with the resources they need as quickly and easily as possible.

Working in collaboration with Equifax, U.S. federal and state social service agencies use The Work Number to help people in need secure access to healthcare, food, housing, and financial assistance. In 2023, The Work Number provided social service verifications for 25 million people seeking benefits – a 19% increase from 2022. Some of these programs include Medicaid, SNAP, Temporary Assistance for Needy Families (TANF), Housing Choice Vouchers, Supplemental Security Income (SSI), and more.

Equifax plays an important role in the financial lives of consumers and we take that responsibility seriously. Our company Purpose – to help people live their financial best – drives our business actions.

| Equifax Inc. | 2024 Proxy Statement | 5 |

EFX2025:

Delivering Against Our Strategic Priorities

Accelerate Innovation and New Products

|

In 2023, we leveraged the Equifax Cloud to accelerate New Product Innovation, marking our fourth consecutive year with over 100 new products developed, and increasing our revenue from new products by about 9% from 2022. During the year, about 84% of new product revenue came from non-mortgage products leveraging the Equifax Cloud.

We also made tremendous progress building advanced models leveraging AI. In 2023, 70% of our new models were built using AI and ML tools, up from 60% in 2022. This includes OneScore for Consumer and OneScore for Commercial, new USIS credit scoring models that combine alternative data insights ‘Only Equifax’ can deliver with the power of the Equifax Cloud and AI capabilities to provide U.S. lenders and service providers with a more comprehensive financial picture of credit seeking consumers and small business applicants. |

OneScore for Consumer and OneScore for Commercial are two of the 15 New Product Innovations introduced by the USIS business unit in 2023. Other launches included the introduction of the industry’s first expanded Mortgage Credit Report making telco, pay TV, and utilities attributes available to the U.S. mortgage industry to provide a fuller picture of consumers’ financial profiles. Not only do these new differentiated insights help automate, save time and resources, and streamline the first mortgage process for every applicant, but they also help create greater homeownership opportunities for more consumers.

Workforce Solutions continues to lead Equifax in New Product Innovation – with solutions like our All Employers Within 36 Months™ offering that includes trended income data on consumers for mortgage applications, and the Smart Screen™ portfolio of consumer reports. Leveraging the Equifax Cloud and the TotalVerify™ data hub, Smart Screen accelerates the delivery of criminal background checks when required by background screeners, employers, and government agencies as part of their established hiring and background screening processes. Additional new offerings like the PeopleHQ™ portal and I-9 Anywhere® virtual capabilities make it easier for employers to streamline management of their HR processes and enhance new hire experiences.

Across the globe, each region of our International business unit outperformed its 2022 results, delivering a total of 77 NPIs in 2023. The Equifax Cloud enables us to quickly extend the impact of our International Solutions by taking successful products from one market and easily introducing them into additional markets while maintaining local data and regulatory requirements. Leveraging the power of the Equifax Cloud, our Kount Identity and Fraud solutions are now available in 47 countries – twice as many locations as the previous year.

|

| Equifax Inc. | 2024 Proxy Statement | 6 |

Leverage Equifax Cloud Capabilities

|

In February 2024, our Chief Information Security Officer Jamil Farshchi expanded his leadership role to become our Chief Technology Officer. Jamil will oversee our work to finalize the Equifax Cloud transformation while maintaining a clear and independent focus on our Technology and Security Leadership.

The Equifax Cloud is a top-tier global technology and security infrastructure that continues to set Equifax apart in the industry. With our Cloud transformation we have created an agile new foundation for the enterprise to develop solutions that are faster, more reliable, more powerful, and more secure than ever before.

More than 40,000 customers have migrated to the Equifax Cloud, and as we near the finish line of our over $1.5 billion security, data, and technology transformation, we are confident that the Equifax Cloud will be central to our differentiation and our competitive advantage for years to come.

We ended 2023 with approximately 70% of Equifax revenue in the Cloud. Our USIS and North American Cloud transformations continue to progress towards our goal of being principally completed in the first half of 2024, and in 2023, Argentina became the first country to have its products and customers fully migrated to the Equifax Cloud. We are on track to reach our goal of having 90% of our revenue in the Equifax Cloud by the end of 2024, with the vast majority of new models and scores being built using EFX.AI. |

The Equifax Cloud is also an important part of our commitment to net-zero greenhouse gas emissions by 2040. In 2023, the Equifax greenhouse gas emissions targets were validated by the Science Based Targets initiative (SBTi). SBTi is a global body enabling businesses to set ambitious emissions reduction targets. Under its target ambitions, we have committed to reduce absolute scope 1 and 2 greenhouse gas emissions 54.6% by 2032, from a 2019 base year. SBTi has determined that the global operational footprint target ambitions set by Equifax are in line with the Paris Agreement 1.5 degrees Celsius goal, currently the most ambitious designation available through the SBTi process.

Data centers, in 2023, made up approximately 39% of the company’s total scope 1 and 2 emissions, net of renewable energy. As a part of our Equifax Cloud transformation we have decommissioned 29 data centers to date, including 7 in 2023 and 3 in the first quarter of 2024. |

Expand Differentiated Data Assets

|

Differentiated data and analytics that ‘Only Equifax’ can provide continue to be at the heart of our business. We began our Equifax Cloud transformation process to redefine how Equifax data is ingested, governed, provisioned and produced – uniting our proprietary data sources through our custom data fabric while managing that data in keeping with strict regulatory requirements.

We also understand that the successful use of AI requires deep, accurate and high-quality data. With the Equifax Cloud, we are expanding the depth and accuracy of our data and helping our customers innovate faster to create more effective insights into the people and communities they serve. |

In 2023, our differentiated, non-public data included: • The Work Number Database – 168 million active employment records and 657 million total employment records for verifications of employment and income from 3 million different U.S. employers. • Core Credit – more than 1.6 billion tradelines with information on more than 245 million consumers. • Relationship with NCTUE – operation and management of the NCTUE database that includes 190 million telecommunications, pay TV, internet, home security and utility payment records. • Insights – 189 million incarceration records from over 2,200 facilities across the United States. |

| Equifax Inc. | 2024 Proxy Statement | 7 |

|

• Partnership with National Student Clearinghouse – access to enrollment and degree verifications for over 97% of all students in public and private U.S. colleges and universities. • DataX and Teletrack – access to 80 million unbanked, underbanked and credit rebuilding consumers – enabling greater access to credit. • IXI – wealth information with $24 trillion in anonymized assets and investments. • Digital Solutions – aggregated data from more than 60 billion consumer interactions.

|

• Partnerships for cash flow data – information on balances, deposits and withdrawals from more than 7,700 participating U.S. financial institutions – allowing access to visibility of 95% of U.S. checking accounts. • Commercial Financial Network powered with acquisitions of PayNet and Ansonia – 224 million commercial tradelines across 178 million businesses.

In 2023, we continued to expand pension income data as part of instant verifications through The Work Number database. Inclusion of this data helps more people obtain streamlined access to decisions for social service benefits and financial services. Additionally in 2023, we signed agreements with 17 payroll processors. For example, our new integration between The Work Number and Payroll Relief software from IRIS Software Group is making automated employment and income verifications available to up to one million additional employees of U.S. small and medium sized businesses. Small businesses account for more than 46 percent of U.S. private sector employees. This partnership helps improve access for consumers that are employees of small and medium sized businesses when applying for services such as a home mortgage, auto loan, or social service benefits. |

Put Customers and Consumers First

|

Our most important job is to put Customers and Consumers first. Our company Purpose of helping people live their financial best and our commitment to being consumer friendly at every touchpoint guides our business actions.

We are always working to make our credit reports as accurate and reliable as possible. When it comes to credit report accuracy, we believe that even one error is one too many. We are committed to improving our data processes and began publishing U.S. credit report accuracy metrics on our corporate website on a monthly basis in September 2023. Between September 2023 and February 2024, our average monthly credit report accuracy metric was 99.81%. This metric is determined by calculating the number of tradelines, collections, and bankruptcy disputes within the month that resulted in a change to a U.S. consumer credit report (regardless of whether that change had any impact on a consumer’s credit score). • We are continuously monitoring and enhancing our processes to improve data quality in consumer credit files and making it easier for consumers to access their Equifax credit report and correct any potential errors quickly. • We also are working with our data furnishers to enhance the accuracy of information reported to us. • And, as part of our over $1.5 billion investment in the Equifax Cloud, we are developing new programs that will allow us to identify potential accuracy issues and correct them quickly before a consumer disputes information on their credit report. |

We believe that helping people live their financial best starts with helping consumers increase their financial capability. We are committed to providing broader credit education, helping people understand both their personal finances and the credit system as well as the role we play in helping to provide access to mainstream, sustainable financial products. • The experience of our more than 20 million myEquifax™ users and 7 million Core Credit™ subscribers continues to evolve in the U.S. to include access to new offers and services. • We reviewed and revised all written U.S. consumer communications – information sent from Equifax by email or the U.S. Postal Service outside of the dispute process – to ensure that they are easy for consumers to understand. Updated communications will begin in the second half of 2024. • Building on our commitment to education, we supplemented our robust online consumer Knowledge Center with the launch of a new consumer credit video education series, “Equifax Learn”, on YouTube to help explain U.S. credit scores, credit reports, and answer consumers’ most asked questions. • And, our USIS team, along with The Credit Builders Alliance (CBA) and The Annie E. Casey Foundation, introduced a national credit education toolkit to help young adults in the U.S. build credit capability at an early age. |

| Equifax Inc. | 2024 Proxy Statement | 8 |

|

In 2023, we supported U.S. victims of crime with more than 22 million notifications through the VINE™ network. VINE, acquired in our purchase of Appriss Insights in 2021, is the leading victim notification network in the U.S. It allows survivors, victims of crimes, and other concerned citizens to access timely and reliable information about offenders or criminal cases in U.S. jails and prisons. Last year, we expanded the service to include VINE Courts™, which provides victims up-to-date information about upcoming hearing times, locations, and court information. This expanded service breaks down barriers that make it hard for victims to be in court and have their voices heard.

We also made significant changes to medical collection debt reporting alongside Experian and TransUnion. In the first quarter of 2023 medical collection debt under $500 was removed from U.S. consumer credit reports to support U.S. consumers faced with unexpected medical bills. This joint industry measure removed nearly 70% of medical collection debt tradelines from consumer credit reports. We also jointly announced the |

permanent extension of free weekly online credit reports to U.S. consumers through the AnnualCreditReport.com website to help them manage their financial health.

Around the world, we worked to further our positive impact on the financial lives of consumers in 2023: • In Canada, we launched a new solution, Credit Health™, that enables Equifax customers to deliver on-demand access to credit scores, reports, and education to consumers. • In Uruguay, we hosted a series on financial wellness, sharing tips on financial health, security, privacy and the role of alternative data in credit through the national morning television, universities and public schools, and podcasts. • In New Zealand, we partnered with financial literacy platform Banqer, to create a credit education module enabling children to learn about credit in their classrooms. Through this program we have helped educate nearly 245,000 children across 2,103 schools. • In the U.K., we partnered with Speakers for Schools to design and deliver a pilot education outreach program for teens. The initiative matches volunteers with local schools to share financial education and skills to help teens make informed financial decisions, providing information on credit scores, budgeting, debt management, and how to protect against online scams.

Equifax plays an important role in the lives of consumers, and these actions were taken with a commitment to creating a positive impact on people’s personal and financial well-being.

|

Executing Bolt-on M&A

|

We are continuing to strengthen the core of Equifax and drive future non-mortgage growth through strategic, bolt-on mergers and acquisitions. Since the beginning of 2021, we have completed 14 acquisitions totaling nearly $4 billion, including two in 2023.

In August 2023, we completed the strategic acquisition of the second largest credit bureau in Brazil, Boa Vista Serviços. This acquisition expanded the Equifax International footprint in the large and fast-growing $2 billion Brazilian total addressable market. We believe that more data drives better decisions, and this acquisition offers Boa Vista Serviços access to global Equifax capabilities and cloud-native data, products, decisioning, and analytical technology for the rapid development of new products and services and expansion into new industry verticals.

In February 2023, we completed the acquisition of the Montreal-based Food Industry Credit Bureau from Profile Credit. This acquisition grows the commercial credit insights available to Equifax customers in Canada and worldwide with information on over 90 percent of the Canadian agri-food industry. Over the last three decades, The Food Industry |

Credit Bureau from Profile Credit has worked in partnership with over 1,000 companies, such as food and beverage service providers, meat and poultry processing, and distribution to provide up-to-date credit data on over 200,000 businesses.

Moving forward, we will continue to look for financially attractive bolt-on M&A aligned with our strategic priorities, including opportunities to grow our differentiated, proprietary data sets as well as opportunities to strengthen our Workforce Solutions and identity protection and fraud prevention capabilities. |

| Equifax Inc. | 2024 Proxy Statement | 9 |

Continue Leadership in Security

|

We continue to deliver on our commitment to being an industry leader in security, building one of the world’s most advanced and effective cybersecurity programs. As our Security Annual Report reflects, our maturity level has outperformed all major industry benchmarks for the last four years, exceeding Technology and Financial Services companies analyzed.

|

As part of our commitment to delivering solutions that benefit the security community, customers and consumers, we became one of the few public companies to make our security and privacy controls framework freely available. Security and privacy controls frameworks give security and privacy teams at organizations of all sizes the tools to design, build and maintain secure processes. Since the framework’s release, it has been accessed by more than 7,000 users in more than 95 countries from Fortune 500 companies to tech startups and small non-profit organizations.

In Costa Rica, our second largest Equifax site worldwide, we are partnering with the government to improve cybersecurity practices across the country for both citizens and municipal employees. Through our partnership, we are offering free nationwide virtual training courses on best practices for everyday digital security. Security is in our DNA, and we are sharing our security resources for the benefit of the communities where we live and work.

We are proud of the work that we do in helping organizations around the world become more secure and continue to actively engage with customers, policymakers, and other organizations regarding the challenges and opportunities in cybersecurity. Jamil Farshchi continues to serve as a Strategic Engagement Advisor to the Federal Bureau of Investigation (FBI), and he co-chaired the Bipartisan Policy Center Report on the Top Cybersecurity Risks in 2023. |

The maturity of our cybersecurity program improved in 2023, outperforming all major industry benchmarks for a fourth consecutive year.

| Equifax Inc. | 2024 Proxy Statement | 10 |

Act as One Team, One Equifax

|

Our nearly 15,000 team members around the world are our greatest asset. We welcomed approximately 1,000 new employees from our 2 acquisitions in 2023, and another approximately 1,000 employees with our new Equifax Product Engineering Centers in Pune and Trivandrum, India.

We are committed to nurturing a culture where everyone feels welcomed, valued and respected.

Cross-functional collaboration and innovation, working as One Equifax, is core to our success. We are committed to nurturing a culture where everyone feels welcomed, valued and respected. Within our senior leadership team, more than half identify as female or as having a diverse racial or ethnic background, and 44% of the Equifax global workforce identify as female.

An important part of supporting our people is supporting the areas where they live and work. The Equifax Foundation made charitable grants to organizations in Atlanta and St. Louis – including On The Rise Financial Center, Westside Future Fund, Prosperity Connection, and Credit Builders Alliance to help low-to-moderate income communities achieve the credit strength needed to live their financial best. In 2023, the Equifax Foundation put our purpose into action by making $1.465 million in direct charitable grants to our Community partners. Additionally, through our |

Equifax Gives program, we matched $1.1 million in employee charitable donations in 2023 for more than $3.5 million in total community impact.

Employee volunteer hours doubled in 2023. And, in the second half of the year, we kicked off a new program, BEST Credit Training, which trains U.S. based employees to deliver financial literacy content in their communities. In only six months of this program, we hosted four events with more than 370 community members served, and we are looking forward to growing this program across our U.S. locations and internationally in 2024.

Equifax also supported internal career development, continuing to make a number of internal and external training opportunities available to our teams worldwide, with our global employees completing more than 140,000 hours of training and professional development. We also showed that we are a place where our employees can grow and develop their careers with almost 50% of open roles filled internally in 2023 – compared to 38% in 2022. |

| Equifax Inc. | 2024 Proxy Statement | 11 |

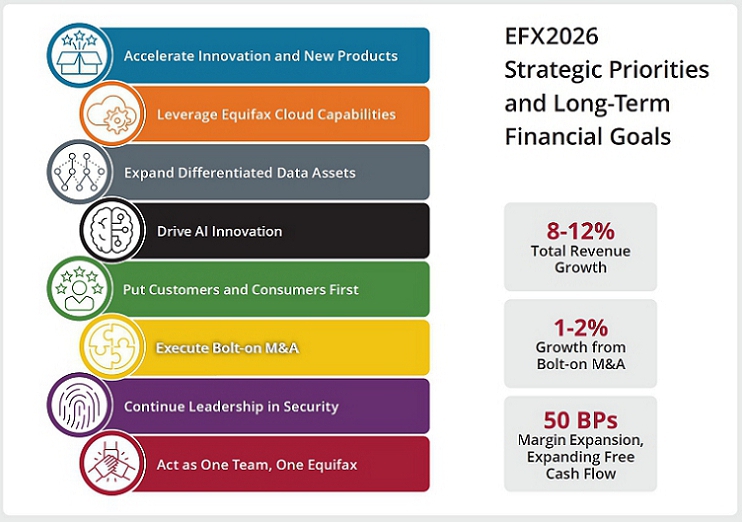

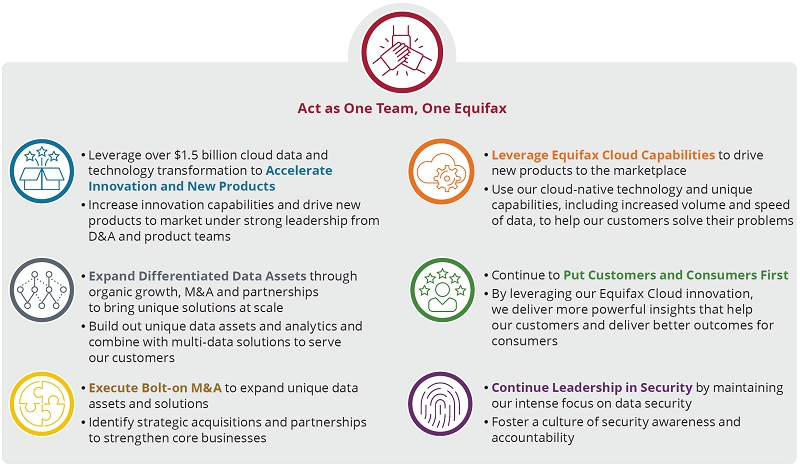

EFX2026

While we take this time to reflect on our accomplishments,

| we are also looking to the future of the New Equifax with our EFX2026 strategic priorities – which include the addition of driving AI innovation to the future of our business as a pillar of our long-term growth strategy. |

In today’s always-on world, speed is a competitive advantage. We use AI and the power of the Equifax Cloud to reduce friction, identify opportunities, and solve problems faster, turning what were once months-long projects into days or weeks-long resolutions. We are convinced that the Equifax Cloud, differentiated data assets in our new single data fabric, our AI capabilities, and our market leading businesses will deliver higher growth, expanded margins and free cash flow in the future.

In 2024, we expect to deliver 9% revenue growth as well as Adjusted EBITDA margin expansion of 110 basis points from revenue growth and our Cloud cost savings plans, despite our assumption that the U.S. mortgage market as measured by credit inquiries will stay at current levels throughout 2024, resulting in about an additional 15% decline in the U.S. mortgage market credit inquiries in 2024 versus 2023. As we look beyond the bottoming of the U.S. mortgage market, in the future as the U.S. mortgage market returns to normal 2015-2019 average levels, this would provide a tailwind to Equifax mortgage revenue of about $1.1 billion, that would deliver EBITDA of about $700 million and Adjusted EPS of over $4/share.*

*At 2024 pricing, penetration and cost levels |

| Equifax Inc. | 2024 Proxy Statement | 12 |

| A big priority for 2024 is to move closer to Equifax Cloud completion with the finalization of our North American Cloud transformation as well as significant portions of our global market transformations, which will result in continued margin expansion and reductions in our capital intensity – a key benefit of our data and technology Cloud transformation. We are moving into the year with strong momentum, and looking forward, we remain focused on delivering 8-12% long-term growth and 50 basis points of margin expansion annually with expanding free cash flow. |

On behalf of the Equifax Board, leadership team, and nearly 15,000 global employees, we thank you for your ongoing support and confidence in our business. We are energized by our strong performance in 2023, but even more energized about the future of the New Equifax!

| Thanks for your support, | ||

|

| |

Mark W. Begor Chief Executive Officer and Director |

Mark L. Feidler Independent Chairman of the Board of Directors |

| Equifax Inc. | 2024 Proxy Statement | 13 |

|

Date and Time May 2, 2024

Meeting Location The Ritz-Carlton, St. Louis

Record date March 1, 2024

REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS:

Via the internet Visit the website listed on your proxy card

By telephone Call the telephone number on your proxy card

By mail Sign, date and return your proxy card in the enclosed envelope

Attend the meeting Attend the meeting in person or virtually and cast your vote |

| Agenda | |

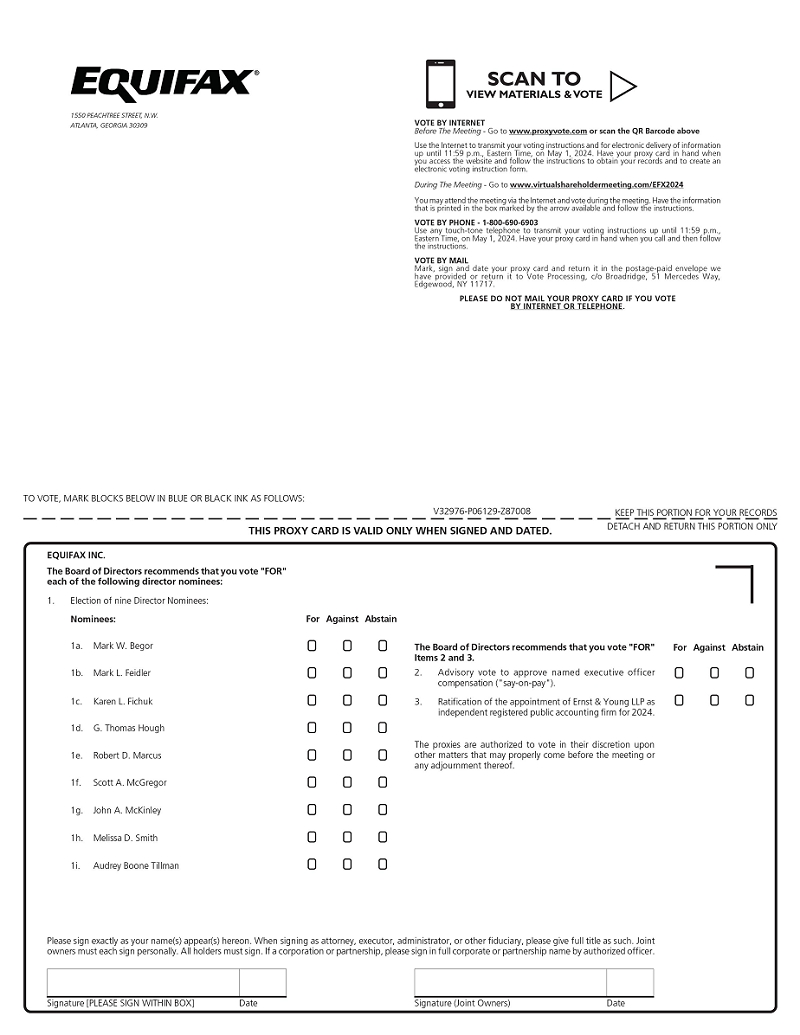

| 1 | Elect the nine director nominees named in the accompanying Proxy Statement. |

| 2 | Hold a non-binding, advisory vote on the compensation paid to the Company’s named executive officers (commonly referred to as “say-on-pay”). |

| 3 | Ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2024. |

| 4 | Consider other business properly brought before the meeting or any adjournment or postponement thereof. |

Proxies in the form furnished are being solicited by the Board of Directors of Equifax Inc. for this meeting or any adjournment or postponement thereof.

Shareholders are cordially invited to participate in the Annual Meeting by attending in person or attending virtually via our live meeting webcast. See page 109 of the Proxy Statement for more information on how to attend, participate in and vote at the Annual Meeting.

YOUR VOTE IS VERY IMPORTANT. PLEASE SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AS SOON AS POSSIBLE, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING. Most shareholders have a choice of voting over the internet, by telephone or by using a traditional proxy card. Please refer to the enclosed proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you.

Proxy materials were first made available to shareholders beginning on March 22, 2024.

By order of the Board of Directors,

Lisa M. Stockard

Assistant Secretary

March 22, 2024

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on May 2, 2024. The Notice, Proxy Statement and Annual Report are available at www.proxyvote.com.

Election to receive electronic delivery of future annual meeting materials.

You can expedite delivery and avoid costly mailings by confirming in advance your preference for electronic delivery. For further information on how to take advantage of this cost-saving service, please see page 113 of the Proxy Statement.

| Equifax Inc. | 2024 Proxy Statement | 14 |

Table of

Contents

| Equifax Inc. | 2024 Proxy Statement | 15 |

This summary highlights certain information contained in this Proxy Statement. This summary does not contain all of the information that you should consider, and we encourage you to read the entire Proxy Statement before voting.

|

|

|

| Time | Date | Meeting Location |

| 8:00 a.m., Central Time | May 2, 2024 | The Ritz-Carlton, St. Louis |

| 100 Carondelet Plaza | ||

| St. Louis, Missouri 63105 | ||

| PROPOSAL 1 |

Election of Nine Directors | ||

|

|

The Board recommends a vote “FOR” the election of each of our director nominees | See page 24 for additional information | |

| PROPOSAL 2 |

Advisory Vote to Approve Named Executive Officer Compensation (“Say-on-Pay”) | ||

|

|

The Board recommends a vote “FOR” the advisory vote to approve named executive officer compensation | See page 47 for additional information | |

| PROPOSAL

3 |

Ratification of Appointment of Ernst & Young LLP as Independent Registered Public Accounting Firm for 2024 | ||

|

|

The Board recommends a vote “FOR” the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2024 | See page 107 for additional information | |

In addition, shareholders may be asked to consider any other business properly brought before the meeting or any adjournment or postponement thereof.

| Equifax Inc. | 2024 Proxy Statement | 16 |

Voting. Holders of our common stock as of the record date, March 1, 2024, are entitled to notice of and to vote at our 2024 Annual Meeting. Each share of common stock outstanding on the record date is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on at our 2024 Annual Meeting. Even if you plan to attend our 2024 Annual Meeting, please cast your vote as soon as possible.

| Review Your Proxy Statement and Vote in One of Four Ways: | |||

|

|

|

|

| Via the internet | By telephone | By mail | Attend the meeting |

| Visit the website listed | Call the telephone number | Sign, date and return your proxy | Attend the meeting in person |

| on your proxy card | on your proxy card | card in the enclosed envelope | or virtually and cast your vote |

Admission. Equifax shareholders as of the record date are entitled to attend the 2024 Annual Meeting. Our 2024 Annual Meeting will be held using a “hybrid” in-person and virtual format. Shareholders of record can attend the meeting in person or virtually using the meeting webcast. Please review the admission procedures in this Proxy Statement under “Questions and Answers about the Annual Meeting.”

References to our website included in this Proxy Statement are provided solely for convenience purposes. Content on our website is not, and shall not be deemed to be, part of this Proxy Statement or incorporated herein or into any of our other filings with the Securities and Exchange Commission (the “SEC”).

| Equifax Inc. | 2024 Proxy Statement | 17 |

Equifax Inc. is a global data, analytics and technology company. We provide information solutions for businesses, governments and consumers, and we provide human resources business process automation and outsourcing services for employers. We have a large and diversified group of clients, including financial institutions, corporations, government agencies and individuals. Headquartered in Atlanta and supported by approximately 15,000 employees worldwide, Equifax operates or has investments in 24 countries in North America, Central and South America, Europe, and the Asia Pacific region.

| $5.3B | $6.71 | $1.7B | $191.8M | +69% | ||||

| Revenue, an increase of 3% from 2022 |

Adjusted EPS*, down from $7.56 in 2022 |

Adjusted EBITDA*, consistent with 2022 |

Dividends paid to shareholders, consistent with 2022 levels |

5-year Total Shareholder Return Relative to S&P 500 |

| * | Adjusted EPS and Adjusted EBITDA are non-GAAP financial measures. Reconciliation of the Company’s non-GAAP financial measures to the corresponding GAAP financial measures can be found in Annex A to this Proxy Statement. |

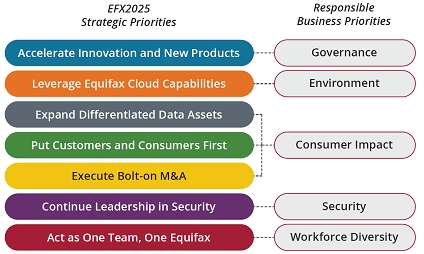

Our strategic imperatives are based on our shift from an era of building, investing and transforming to one of leveraging our substantial cloud investments to drive new product innovation and accelerate growth. With our new Equifax Cloud foundation in place, we are executing against the following strategic priorities:

| Equifax Inc. | 2024 Proxy Statement | 18 |

Our business and strategy are described in more detail in our 2023 Annual Report on Form 10-K filed with the SEC on February 22, 2024. Our 2023 progress against our goals and the link to our 2023 compensation program is described under “Executive Compensation – Compensation Discussion and Analysis – Executive Summary” beginning on page 50.

As a global data, analytics and technology company, we play an essential role in the economy by helping companies in diverse industries such as automotive, communications, utilities, financial services, fintech, healthcare, insurance, mortgage, professional services, retail, e-commerce and government agencies, make critical decisions with greater confidence.

Our unique blend of differentiated data, analytics and technology lets us create the insights that power decisions to move people forward. We help businesses provide a seamless and positive experience during life’s pivotal moments – like applying for a job or mortgage, financing an education or buying a car.

|

Our

Purpose

|

Our purpose is helping people live their financial best.

We strive to create economically healthy individuals and communities everywhere we do business. In a single year, our unique data and analytics change millions of lives across the world. |

|

Our Values | ||||

| Our values express who we are, how we work and the behaviors that support our company, our vision and our purpose. They serve as guiding principles for our global team. They are: | ||||

|

• Be leaders in security and trusted data stewards • Lead with integrity and be personally accountable • Hold high standards in all our markets around the world |

|

• Exceed our customers’ expectations every day • Deliver value and quality to our customers so we grow together • Aspire to be our customers’ first call | |

|

• Deliver results and play to win • Drive excellent execution • Have a sense of urgency, agility, and grit |

|

• Work together as one aligned global team • Assume best intentions from each other • Foster optimism and have fun together | |

|

• Be intellectually curious and insights driven • Optimize our data and technology to sustain market and product leadership • Drive scalable, profitable growth |

|

• Take initiative to develop ourselves and help others grow • Value diversity of experience and thought • Proudly show our Equifax spirit at work and in our communities | |

| Equifax Inc. | 2024 Proxy Statement | 19 |

|

Since our 2023

We contacted

We met with

Directors met with |

• Following our 2023 Annual Meeting, members of management, together with our Independent Chairman or our Compensation Committee Chair for certain conversations, conducted an extensive shareholder outreach program and met with investors holding approximately 70% of our outstanding shares

• During these one-on-one meetings, we discussed our executive compensation program, our responsible business initiatives that align with our strategic business priorities and other governance-related topics (see pages 32-33 for an overview of our shareholder engagement program)

• In particular, investors provided constructive feedback regarding our executive compensation program in view of the 2023 Say-on-Pay vote; we sought to implement appropriate responses to this feedback (see pages 52-53 for a discussion of our shareholder engagement in the context of our compensation program)

• Following these engagements, we continued our long-standing process of sharing feedback received with our Board and relevant Board committees |

| Equifax Inc. | 2024 Proxy Statement | 20 |

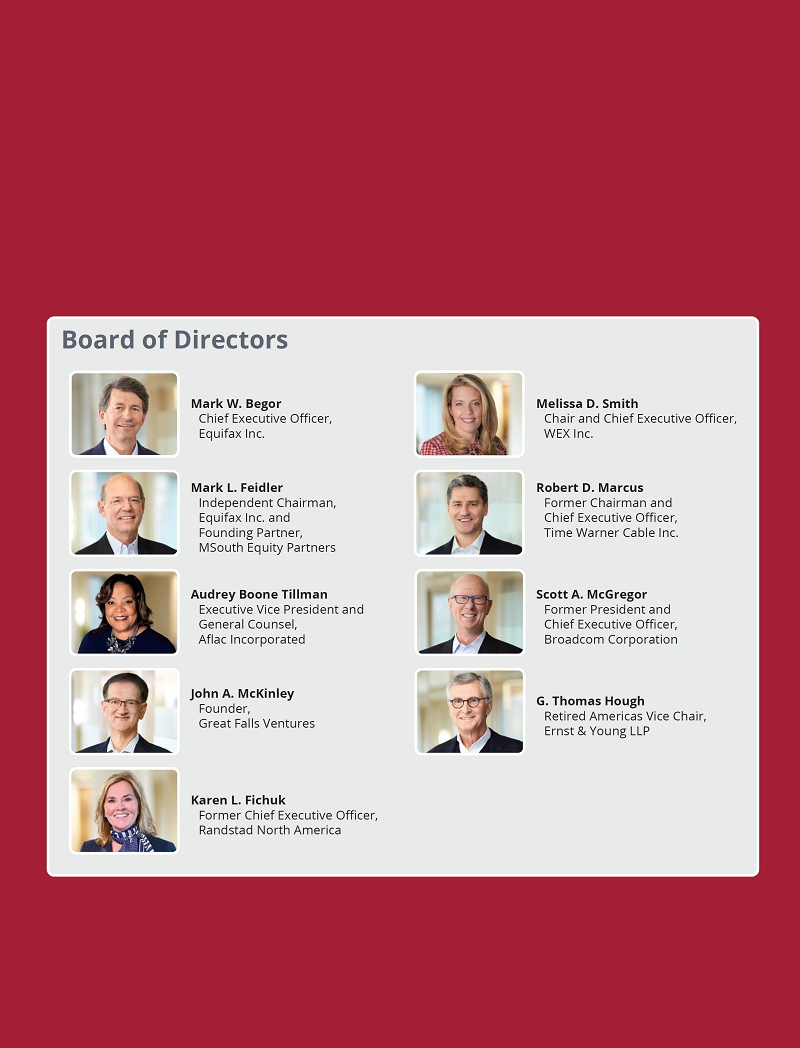

Our Board recommends that you vote FOR each of the director nominees named below for terms that expire at the 2025 Annual Meeting. The following table provides summary information about each nominee, and you can find additional information under “Proposal 1, Election of Director Nominees” on page 24.

| Equifax Inc. | 2024 Proxy Statement | 21 |

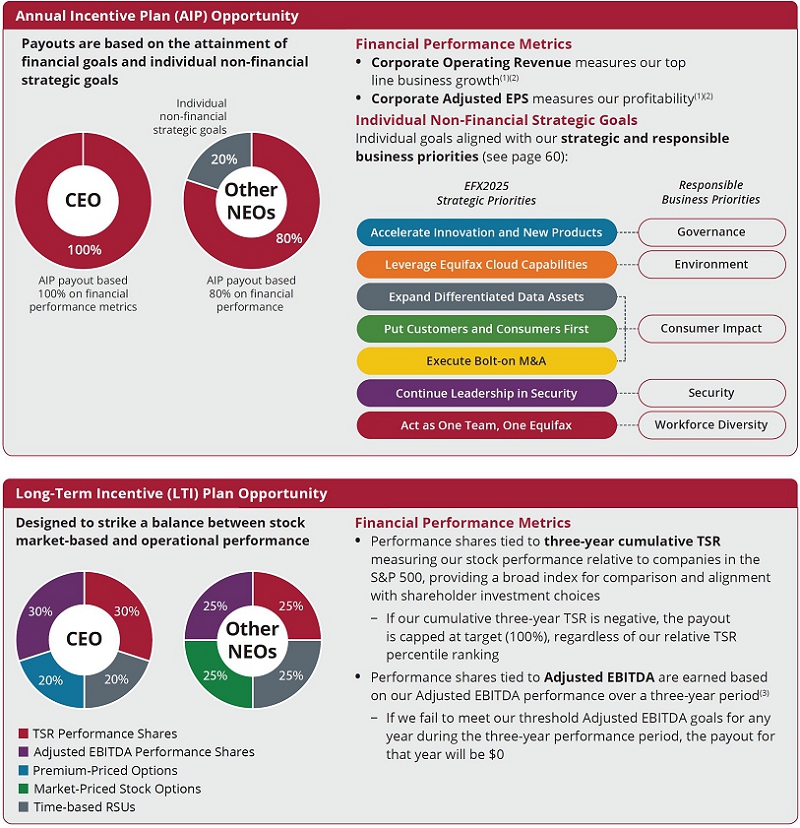

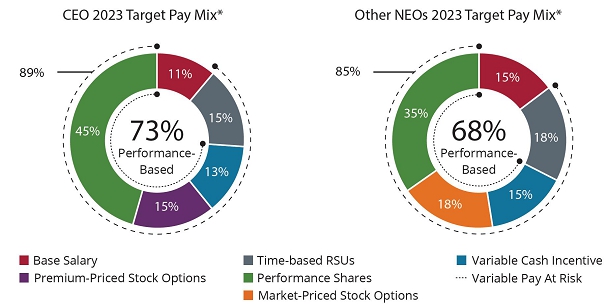

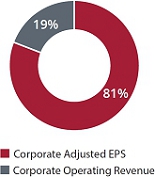

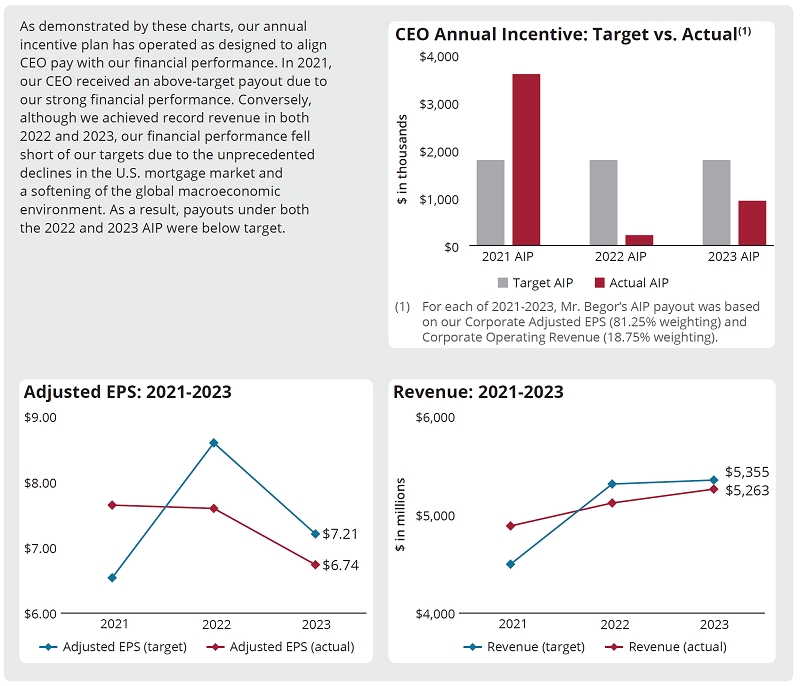

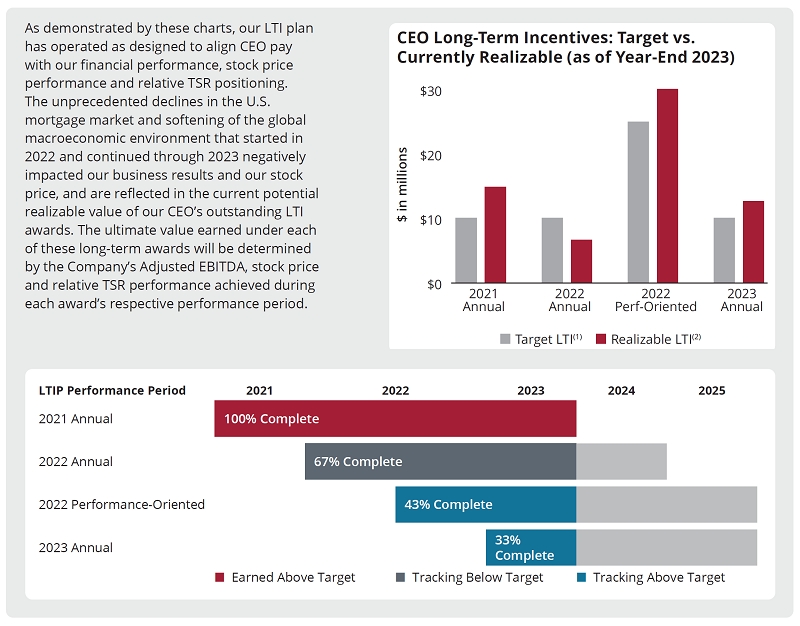

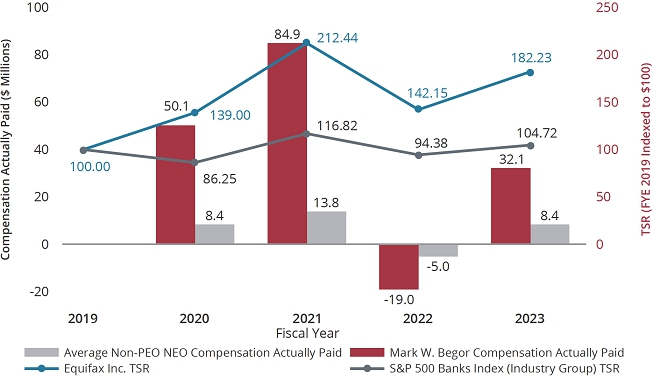

For the 2023 fiscal year, the Committee thoughtfully evaluated the compensation program structure in light of the ongoing evolution of our business strategy and shareholder feedback, when making decisions regarding the program. After evaluation, the Compensation Committee took certain actions with respect to our short- and long-term incentive programs for 2023, as summarized below and described in further detail under “Analysis of 2023 Compensation Decisions” beginning on page 57:

| Our

Board took action to respond to shareholder feedback following the 2023 Say-on-Pay vote (see pages 52-53) |

• At our 2023 Annual Meeting, the Say-on-Pay vote failed to receive support from a majority of votes cast. • Following this vote, we conducted two rounds of extensive engagement with shareholders to capture feedback, and subsequently reviewed our executive compensation structure and practices in light of shareholder guidance. • During these engagements, shareholders sought forward-looking commitments that a similar award would not be granted to our CEO in the future. – In response to this feedback, the Compensation Committee has made a commitment that it does not intend to grant any future one-time awards to our CEO or other NEOs (beyond the awards granted in the process of hiring new employees) absent extraordinary circumstances. • Shareholders also expressed interest in additional disclosure of voluntary holding periods associated with the equity awards. – In response to this feedback, we have shared new details regarding our CEO’s irrevocable elections to defer $67 million of equity (including equity granted to him as part of the 2022 performance-oriented award) over a ten-year period following his retirement from Equifax. | |

| Our compensation program delivers payouts

that align with performance (see pages 51-57) |

• In designing the 2023 compensation program, the Compensation Committee noted that our shareholders generally expressed strong support for the structure and design of our core 2022 compensation program, including the use of performance-based equity award structures to drive alignment of the interests of our executives and shareholders. • As a result of this feedback, the Committee determined not to make any changes to our core compensation program for 2023. • In designing 2023 compensation structures and target pay levels, the Committee sought to ensure that the compensation program reflected our strategic priorities – including our responsible business priorities – while also ensuring that we could attract and retain talented employees in order to create value for shareholders and provide appropriate incentives for executives managing those efforts. | |

| Our

2023 compensation program aligns with strategic initiatives and shareholder feedback (see pages 51-55 and 70-72) |

• Our 2023 compensation program emphasizes long-term equity awards and annual performance-based cash incentives so that a majority of each executive’s total compensation opportunity is linked directly to the Company’s stock price or otherwise tied to performance. • 80% of the long-term incentives granted to our CEO (and 75% of the long-term incentives granted to our other NEOs) in 2023 are performance-based and “at-risk”, meaning awards can result in no payout if threshold goals are not met or stock option exercise price is not exceeded. • As further demonstrated under “CEO Pay for Performance Alignment” on pages 70-72, our incentive plans have operated as designed to align CEO pay with our financial performance, stock price performance and relative TSR positioning. |

|

Independent Compensation Committee advised by independent compensation consultant |

|

Performance-oriented pay philosophy, as evidenced by a target pay mix for our CEO and other NEOs that is predominantly performance-based (see above) |

|

Capped annual and long-term performance-based awards |

|

Double-trigger change in control cash severance benefits and vesting of equity awards |

|

No income tax gross-ups other than for certain relocation or foreign tax expenses |

|

Performance shares are subject to a post-vesting holding period of 12 months |

|

Compensation clawback policy contains financial and reputational harm standard, including in supervisory capacity |

|

Meaningful share ownership requirements for senior executives |

|

Anti-hedging and -pledging policy for directors, officers and other employees |

|

Senior executives cannot purchase or sell Equifax securities except pursuant to a Rule 10b5-1 trading plan with robust requirements |

|

No re-pricing of underwater stock options |

| Equifax Inc. | 2024 Proxy Statement | 22 |

| Independent Board | • 8 of our 9 director nominees are independent | |||

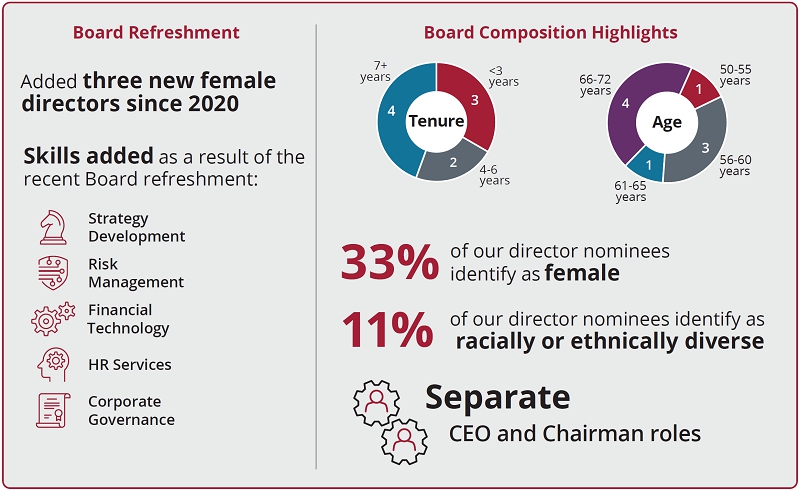

| Board Refreshment | • The Governance Committee has implemented a succession plan to identify highly-qualified and diverse director candidates taking into account scheduled retirements • Since 2020, we have refreshed our Board with three new female directors who bring valuable perspective and expertise, including one member who is also racially diverse |

|||

| Board Diversity | • 33% of our director nominees identify as female and 11% of our director nominees identify as racially or ethnically diverse | |||

| Independent Board Chairman | • We have separated the roles of CEO and Chairman | |||

| Annual Board Leadership Evaluation and Succession Planning | • The Board annually reviews our leadership structure to determine whether a combined Chairman and CEO role or separate roles is in the best interests of shareholders • The Board annually evaluates the CEO’s performance and conducts a rigorous review and assessment of the succession planning process for the CEO and other top officers |

|||

| Limits on Outside Board Service | • Outside directors are limited to service on three other public company boards • Our CEO is limited to two other public company boards (and serves on one outside board) |

|||

| Director and Executive Stock Ownership | • Each independent director is required to own Equifax common stock with a market value of at least 5x his/her annual cash retainer • Our CEO and our other senior executive officers are required to own Equifax common stock with a market value of at least 6x and 3x base salary, respectively |

|||

| Rigorous Trading Policy and Protocols | • Our insider trading policy prohibits our CEO and other senior executives from purchasing or selling Equifax securities except pursuant to an approved Rule 10b5-1 trading plan • Our trading policy and security incident escalation procedures are designed to ensure that those with decision-making authority on trading restrictions and approvals have notice of any potential security incident |

|||

| No “Poison Pill” | • We do not have a stockholder rights plan, or “poison pill,” in place | |||

| Board Oversight of Risk | • Our Board oversees risk management at the Company and exercises direct oversight of strategic risks to the Company and other risk areas not delegated to one of its committees • Our Governance Committee has oversight authority of our strategy with respect to our responsible business priorities • Our Audit Committee reviews our policies related to enterprise risk assessment and risk management. • Our Audit Committee and Technology Committee jointly oversee risk management with respect to cybersecurity |

|||

| Board Oversight of Political Contributions and Lobbying Activities | • Our Governance Committee has oversight authority regarding Company political activity (including corporate political expenditures) pursuant to our political engagement policy • Our political engagement policy prohibits using corporate funds to make political contributions |

|||

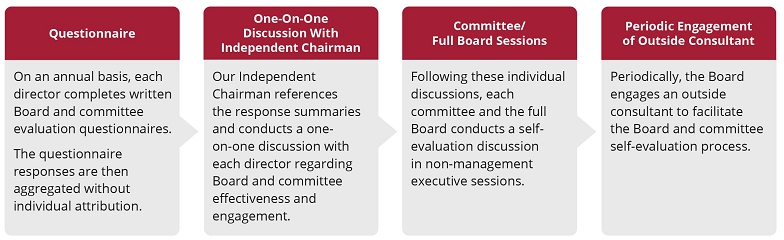

| Annual Self-Evaluation | • We have an annual Board and committee self-evaluation process, which presents the opportunity to examine the Board’s effectiveness and identify areas for improvement • The Board periodically engages a third party consultant to facilitate its annual Board and committee self-evaluation process |

|||

| Director Orientation and Continuing Education | • Upon joining our Board, directors participate in an orientation program regarding our Company, including business operations, strategy, regulatory compliance, cybersecurity and governance • The Board also conducts periodic visits to our key facilities and Board members annually review management’s crisis management planning |

| Equifax Inc. | 2024 Proxy Statement | 23 |

|

PROPOSAL 1 |

Election of |

|

|

All members of our Board are elected to serve until the next annual meeting of shareholders and until their successors have been elected and qualified. The nine nominees for election listed in Proposal 1 have consented to being named in this Proxy Statement and to serve if elected. All director nominees attended 75% or more of the aggregate of the meetings of the Board and of the committees of the Board on which such directors served during 2023. The Company does not have a policy about directors’ attendance at the annual meeting of shareholders, but directors are encouraged to attend. All of the directors then serving attended the 2023 Annual Meeting.

Our director nominees have a variety of backgrounds, which reflects the Board’s continuing objective to achieve a diversity of perspective, experience, gender, age, race and ethnicity. As more fully discussed below under “Director Membership Criteria,” director nominees are considered on the basis of a range of criteria, including their business knowledge and background, reputation and global business perspective. They must also have demonstrated experience and ability that is relevant to the Board’s oversight role with respect to Company business and affairs. Biographical information for each of the nominees is set forth on pages 24-28 and a Board matrix is set forth on page 29. | ||

|

The Board recommends a vote “FOR” the election of each of our director nominees. | ||

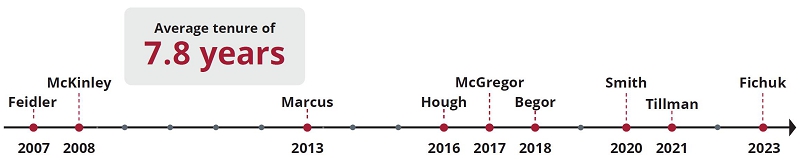

Mark W. Begor | ||

Chief Executive

Director since 2018

Age 65

Other Public Directorships NCR Atleos Corporation |

Mr. Begor has served as our Chief Executive Officer and as a director since April 2018. Prior to joining Equifax, Mr. Begor was a Managing Director in the Industrial and Business Services group at Warburg Pincus, a global private equity investment firm, since June 2016. Prior to Warburg Pincus, Mr. Begor spent 35 years at General Electric Company (“GE”), a global industrial and financial services company, in a variety of operating and financial roles. During his career at GE, Mr. Begor served in a variety of roles leading multibillion dollar units of the company, including President and CEO of GE Energy Management from 2014 to 2016, President and CEO of GE Capital Real Estate from 2011 to 2014, and President and CEO of GE Capital Retail Finance (Synchrony Financial) from 2002 to 2011. Mr. Begor served on the Fair Isaac Corporation (FICO) board of directors from 2016 to 2018.

Overview of Board Qualifications

The Board believes that it is important to have the Company’s Chief Executive Officer also serve as a director. The Board believes Mr. Begor is a proven leader whose strategic vision and unparalleled knowledge of our business make him uniquely qualified to lead the Company and serve as a director during the final stage of our technology transformation and into our next chapter of leveraging our new Equifax Cloud capabilities, single data fabric, differentiated data and artificial intelligence capabilities to deliver new products that drive growth and long-term shareholder value creation. | |

| Equifax Inc. | 2024 Proxy Statement | 24 |

Mark L. Feidler | ||

Independent Chairman

Director since 2007

Age 67

INDEPENDENT

Committees: Compensation

Other Public Directorships New York Life |

Founding Partner of MSouth Equity Partners, a private equity firm based in Atlanta, since February 2007. Mr. Feidler was President and Chief Operating Officer and a director of BellSouth Corporation, a telecommunications company, from 2005 until January 2007. Mr. Feidler served as its Chief Staff Officer during 2004. From 2001 through 2003, Mr. Feidler was Chief Operating Officer of Cingular Wireless and served on the Board of Directors of Cingular from 2005 until January 2007.

Overview of Board Qualifications

Mr. Feidler has extensive operating, financial, legal and regulatory experience through his prior position with a major regional telecommunications company, as well as expertise in private equity investments and acquisitions. This background is relevant to us as we market our products to companies in telecommunications and other vertical markets, while his private equity experience is relevant to our business strategy, including new product development, marketing and acquisition strategies. His public company operating experience and background in finance, accounting, technology and risk management are important resources for our Board. | |

Audrey Boone Tillman | ||

Director since 2021

Age 59

INDEPENDENT

Committees: Governance |

Executive Vice President and General Counsel of Aflac Incorporated, the largest U.S. provider of supplemental insurance, since 2014. Ms. Tillman joined Aflac in 1996 and has held positions of increasing significance, including serving as Senior Vice President of Human Resources. Prior to joining Aflac, she was an associate with Smith, Helms, Mulliss and Moore and an associate professor at the North Carolina Central University School of Law.

Ms. Tillman has received numerous awards and accolades during her career. Most recently, she was named to Black Enterprise magazine’s Most Powerful Women in Business list for the third consecutive year and Women’s Inc.’s Top Corporate Counsel list in 2019. In 2020, she was awarded the Meritorious Public Service Medal by the Department of the United States Army.

Overview of Board Qualifications

Ms. Tillman has a broad legal and business background, involvement in business strategy and operations, as well as a depth of experience in human resources, risk management, compliance and government relations. The Board believes she is a strong business leader who brings deep knowledge in corporate governance, gained over decades of significant experience in the legal and human resources fields. | |

| Equifax Inc. | 2024 Proxy Statement | 25 |

John A. McKinley | ||

Director since 2008

Age 66

INDEPENDENT

Committees: Audit |

Founder of Great Falls Ventures, a venture capital firm based in Washington, D.C., since April 2007. He was Chief Technology Officer of News Corporation from July 2010 to September 2012. He was President, AOL Technologies and Chief Technology Officer from 2003 to 2005 and President, AOL Digital Services from 2004 to 2006. Prior thereto, he served as Executive President, Head of Global Technology and Services and Chief Technology Officer for Merrill Lynch & Co., Inc., from 1998 to 2003; Chief Information and Technology Officer for GE Capital Corporation from 1995 to 1998; and Partner, Financial Services Technology Practice, for Ernst & Young International from 1982 to 1995.

Overview of Board Qualifications

The Board highly values Mr. McKinley’s extensive background in managing complex global technology operations as chief technology officer at a number of leading global companies. This experience is particularly important as we seek to leverage our cloud data and technology transformation to accelerate innovation and new product development. These skills are also highly relevant to the Board’s oversight of risks and opportunities in our technology operations, including data and cybersecurity, risk management and capital investments. The Board also values his technology and industry experience gained from his 12 years as a partner in Ernst & Young’s financial services technology practice, as well as his cybersecurity expertise and his entrepreneurial insights. | |

Karen L. Fichuk | ||

Director since 2023

Age 58

INDEPENDENT

Committees: Audit |

Former Chief Executive Officer of Randstad North America from 2019 until 2023. Prior to joining Randstad North America in 2019, Ms. Fichuk spent more than 25 years with Nielsen Holdings PLC, a global information services leader, where she held various positions, including President, Developed Markets, Executive Vice President of Commercial Go To Market and Global Managing Director for Kraft and Mondelez, among other positions.

Ms. Fichuk is an advisor and investor in startup technology and AI companies. Ms. Fichuk also has significant nonprofit experience, including serving as a trustee for the United States Council for International Business and sitting on the Global Leadership Council of the Colorado State University College of Business.

Overview of Board Qualifications

The Board highly values Ms. Fichuk’s three decades of growth-oriented leadership and her global data and analytics expertise, which will benefit Equifax as we execute against our strategic priorities and work to complete our Equifax Cloud transformation worldwide. In addition, the Board believes Ms. Fichuk’s experience in human resources services will benefit the Board in its oversight of continued growth in the Company’s Workforce Solutions business unit. | |

| Equifax Inc. | 2024 Proxy Statement | 26 |

Melissa D. Smith | ||

Director since 2020

Age 55

INDEPENDENT

Committees: Compensation

Other Public Directorships WEX Inc. |

Chair and Chief Executive Officer of WEX Inc., a global leader in financial technology solutions. Ms. Smith has served as Chief Executive Officer since 2014 and Board Chair since 2019. She joined WEX in 1997 and held several senior leadership positions across different aspects of the business prior to her appointment as Chief Executive Officer, including serving as Chief Financial Officer for ten years. Before joining WEX, Ms. Smith started her career at Ernst & Young LLP.

Ms. Smith also has a history of extensive nonprofit work and currently serves on the MaineHealth board of trustees.

Overview of Board Qualifications

The Board believes Ms. Smith’s strategic vision and broad-based executive leadership experience in the financial technology solutions industry benefit Equifax as we develop and execute on our long-term strategic business priorities. The Board also values Ms. Smith’s experience in driving business growth, as evidenced by the fact that WEX’s annual revenue has increased from $800 million to $2.55 billion during her tenure as CEO. The Board views this experience as particularly valuable as Equifax leverages its cloud investments to drive innovation and accelerate growth. | |

Robert D. Marcus | ||

Director since 2013

Age 58

INDEPENDENT

Committees: Compensation (Chair) |

Former Chairman and Chief Executive Officer of Time Warner Cable Inc., a provider of video, high-speed data and voice services, from January 2014 until the company was acquired by Charter Communications in May 2016. He was named a director of Time Warner Cable Inc. in July 2013 and served as President and Chief Operating Officer from 2010 to 2013. Prior thereto, he was Senior Executive Vice President and Chief Financial Officer from January 2008 and Senior Executive Vice President from August 2005. Mr. Marcus joined Time Warner Cable Inc. from Time Warner Inc. where he held various senior positions from 1998. From 1990 to 1997, he practiced law at Paul, Weiss, Rifkind, Wharton & Garrison.

Mr. Marcus is an Executive Partner at XN LP, a New York-based investment firm. He serves on the Board of Directors of Newhouse Broadcasting Co. as well as the boards of several non-profit organizations, including New Alternatives for Children, Uncommon Schools, Newark Academy and Cooperman Barnabas Medical Center.

Overview of Board Qualifications

Mr. Marcus has extensive operating, financial, legal and regulatory experience through his position as Chairman and CEO of Time Warner Cable, as well as expertise in mergers and acquisitions. This background is relevant to us as we market our products to data and telecommunications companies and other vertical markets. His public company operating and finance experience and background in executive compensation, legal and regulatory matters are an important resource for our Board. | |

| Equifax Inc. | 2024 Proxy Statement | 27 |

Scott A. McGregor | ||

Director since 2017

Age 67

INDEPENDENT

Committees: Audit

Other Public Directorships Applied Materials, Inc. |

Former President, Chief Executive Officer and Director of Broadcom Corporation, a world leader in wireless connectivity, broadband and networking infrastructure. Mr. McGregor served in those positions from 2005 until the company was acquired by Avago in 2016. From 2016 to 2017, Mr. McGregor served on the board of directors of Xactly Corporation. Mr. McGregor served on the board of directors of Ingram Micro, Inc. from 2010 to 2016. From 2001 to 2005, Mr. McGregor served as President and Chief Executive Officer of the Philips Semiconductors division of Royal Philips Electronics. Prior thereto, Mr. McGregor was head of Philips Semiconductors’ Emerging Business unit from 1998.

Overview of Board Qualifications

Mr. McGregor has extensive executive management, cybersecurity, information technology and risk management experience gained in over ten years as President and Chief Executive Officer of Broadcom and in senior positions at Royal Philips Electronics. This experience is particularly important to us as we seek to leverage our cloud data and technology transformation for growth and maintain our intense focus on data security. | |

G. Thomas Hough | ||

Director since 2016

Age 69

INDEPENDENT

Committees: Audit (Chair)

Other Public Directorships Federated Hermes |

Retired Americas Vice Chair of Ernst & Young LLP, an international public accounting firm. He was Vice Chair of Assurance Services of Ernst & Young from 2009 to July 2014, and Americas Vice Chair until his retirement in September 2014. Mr. Hough joined Ernst & Young in 1978 and became a partner in 1987. During his career at Ernst & Young, he led various teams across the firm, including serving as Vice Chair and Southeast Area Managing Partner from 2000 to 2009 and Vice Chair of Human Resources from 1996 to 2000.

Overview of Board Qualifications

Mr. Hough brings invaluable experience in audit, accounting, finance and corporate governance. His background in financial accounting and risk management, including executive leadership experience at a major international accounting firm, is of particular importance to our Board. | |

| Equifax Inc. | 2024 Proxy Statement | 28 |

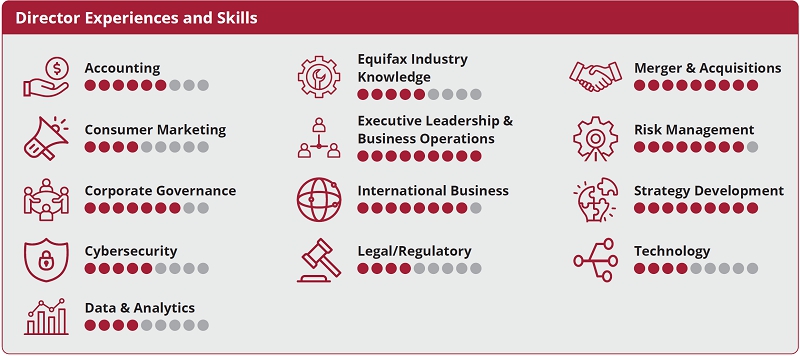

The Board matrix below summarizes certain of the key skills, experience, qualifications and attributes that our director nominees bring to the Board to enable the effective oversight of our Company and execution of our business strategy. This matrix highlights the depth and breadth of the skills and experience of our director nominees. Additional details regarding each director nominee’s skills, experience and background are set forth in the individual biographies that follow.

|

|

|

|

|

|

|

|

| |

| Skills and Experience | |||||||||

| Accounting |  |

|

|

|

|

|

|||

| Consumer Marketing |  |

|

|

|

|||||

| Corporate Governance |  |

|

|

|

|

|

| ||

| Cybersecurity |  |

|

|

|

| ||||

| Data & Analytics |  |

|

|

|

|||||

| Equifax Industry Knowledge |  |

|

|

|

|

||||

| Executive Leadership & Business Operations |  |

|

|

|

|

|

|

|

|

| CEO Experience |  |

|

|

|

|

|

|||

| CFO Experience |  |

|

|

||||||

| International Business |  |

|

|

|

|

|

|

| |

| Legal/Regulatory |  |

|

|

| |||||

| Mergers & Acquisitions |  |

|

|

|

|

|

|

|

|

| Risk Management |  |

|

|

|

|

|

|

| |

| Strategy Development |  |

|

|

|

|

|

|

|

|

| Technology |  |

|

|

|

|||||

| Background | |||||||||

| Tenure/Age/Gender | |||||||||

| Tenure (years) | 6 | 17 | 1 | 7 | 10 | 6 | 15 | 3 | 3 |

| Age | 65 | 67 | 58 | 69 | 58 | 67 | 66 | 55 | 59 |

| Gender (Male or Female) | M | M | F | M | M | M | M | F | F |

| Race and Ethnicity | |||||||||

| Hispanic or Latino | |||||||||

| Black or African American |  | ||||||||

| White |  |

|

|

|

|

|

|

|

|

| Asian | |||||||||

| American Indian or Alaska Native | |||||||||

| Native Hawaiian or Pacific Islander |

| Equifax Inc. | 2024 Proxy Statement | 29 |

When the need to fill a new Board seat or vacancy arises, the Governance Committee proceeds in the manner it deems appropriate to identify a qualified candidate or candidates. Candidates may be identified through the engagement of an outside search firm, recommendations from independent directors, the Chairman of the Board, management or other advisors to the Company, and recommendations by shareholders. The Governance Committee Chair and Chairman of the Board are provided with copies of the resumes for any potential candidates so identified and review them as appropriate with the Governance Committee, our CEO and the full Board.

Our Governance Committee determines the selection criteria and qualifications for director nominees. As set forth in our Governance Guidelines, these criteria include, among other things, a director candidate’s integrity and ethical standards, independence from management, an ability to provide sound and informed judgment, a history of achievement that reflects superior standards and willingness to commit sufficient time. Cybersecurity is one of the skills that the Governance Committee specifically considers in its assessment of Board membership criteria. With respect to the most recent additions to the Board, the Governance Committee was also very focused on expertise in corporate strategy development, risk management, data and analytics, financial technology, HR Services and corporate governance.

Although the Committee does not have a formal diversity policy for Board membership, it considers whether a director nominee contributes or will contribute to the Board in a way that can enhance the perspective and experience of the Board as a whole through, among other things, diversity in gender, age, race and ethnicity. When current Board members are considered for nomination for re-election, the Committee also takes into consideration their prior Board contributions, performance and meeting attendance records. The effectiveness of the Board’s skills, expertise and background, including its diversity, is also considered as part of the Board’s annual self-assessment.

Directors are limited to service on three other public company boards, not including our Board. Audit Committee members may not serve on the audit committee of more than three public companies absent a Board determination that such service will not impair the ability of such member to serve effectively on our Audit Committee. In addition, when our CEO is a member of our Board, he or she may not serve on more than two other public company boards. These policies – and our directors’ compliance with these policies – are reviewed at least annually and all directors currently comply with these limitations.

See “Questions and Answers about the Annual Meeting” beginning on page 109 for information on the procedures for shareholders to recommend director nominees for consideration by the Governance Committee.

| Equifax Inc. | 2024 Proxy Statement | 30 |

Our Board of Directors and management team are committed to achieving and maintaining high standards of corporate governance, ethics and integrity. We conduct our business in a manner that is socially responsible, values-based and in compliance with the law. We periodically review our governance policies and practices against evolving standards and make changes as appropriate. We also value the perspectives of our shareholders and other stakeholders, including our employees and the communities in which we operate.

The following sections summarize our corporate governance policies and practices including our Board leadership structure, our criteria for director selection and the responsibilities and activities of our Board and its committees. Our corporate governance documents, including our Corporate Governance Guidelines (“Governance Guidelines”), our Board committee charters and our Code of Ethics and Business Conduct applicable to directors, officers and employees, are available at www.equifax.com/about-equifax/corporate-governance, or in print upon request to Equifax Inc., Attn: Office of Corporate Secretary, P.O. Box 4081, Atlanta, Georgia 30302, telephone (404) 885-8000. The Code of Ethics and Business Conduct provides our policies and expectations on a number of topics, including our commitment to good citizenship, providing transparency in our public disclosures, prohibiting insider trading, avoiding conflicts of interest, honoring the confidentiality of sensitive information, preservation and use of Company assets, compliance with all laws and operating with integrity.

See “Corporate Governance Highlights” on page 23 for a summary of our key governance practices.

| Equifax Inc. | 2024 Proxy Statement | 31 |

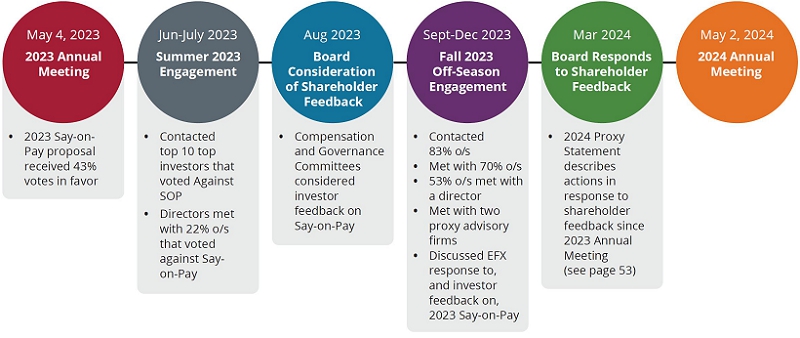

Our Board of Directors and management team value the constructive feedback received from shareholders through our proactive and regular engagement. Investor engagement continues to prompt review of and changes to our governance practices, and our Board remains committed to seeking out and responding to investor feedback. Our integrated outreach team, led by our Office of Corporate Secretary and Investor Relations personnel, and joined by members of our Board for certain conversations, discusses a wide variety of issues with our shareholders.

This past year, we continued our extensive outreach efforts, paying particular attention to shareholder focus areas following the 2023 Say-on-Pay vote. As detailed below, we undertook a multi-phased investor outreach program, beginning with discussions leading up to our 2023 Annual Meeting and followed by extensive engagement in response to the 2023 Say-on-Pay vote.

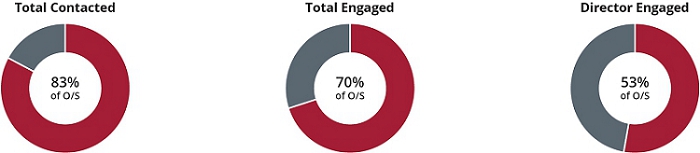

Following our 2023 Annual Meeting, we reached out to shareholders holding approximately 83% of our outstanding common shares (“O/S”) and engaged with shareholders holding approximately 70% of our outstanding shares, including many who did not support our proposal. We thoughtfully considered shareholder input on topics ranging from compensation strategy, including our performance-oriented equity award, to corporate governance and responsible business. Our Independent Chair and our Compensation Committee Chair led several of these engagement meetings. We also engaged with both of the leading proxy advisory firms.

| Equifax Inc. | 2024 Proxy Statement | 32 |

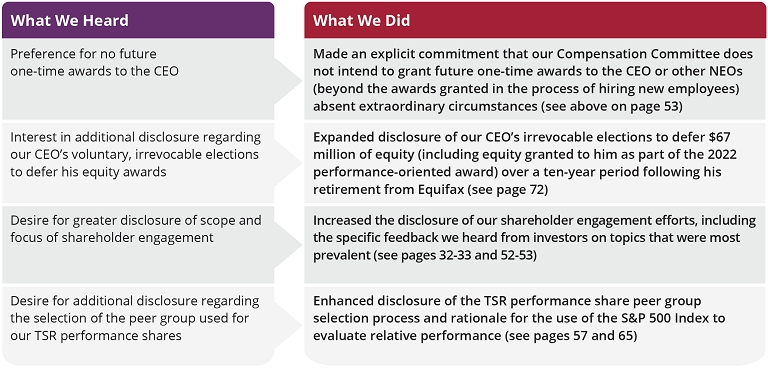

Our Board conducted an in-depth review of the shareholder feedback provided in 2023 to develop an appropriate response to the 2023 Say-on-Pay vote and responsible business topics raised by investors, evaluating actions both in terms of potential changes to practices and disclosure, as described below and under “Shareholder Engagement on Executive Compensation” on pages 52-53.

|

What We Heard |

What We Did | |

| Executive Compensation | ||

| Preference for no future one-time awards to the CEO |  |

Made an explicit commitment that our Compensation Committee does not intend to grant future one-time awards to the CEO or other NEOs (beyond the awards granted in the process of hiring new employees) absent extraordinary circumstances (see page 53) |

| Interest in additional disclosure of voluntary holding periods associated with our CEO’s equity awards |  |

Expanded disclosure of our CEO’s irrevocable elections to defer $67 million of equity (including equity granted to him as part of the 2022 performance-oriented award) over a ten-year period following his retirement from Equifax (see page 72) |

| Desire for greater disclosure of scope and focus of shareholder engagement |  |

Increased the disclosure of our shareholder engagement efforts, including the specific feedback we heard from investors on topics that were most prevalent (see pages 32 and 52-53) |

| Desire for additional disclosure regarding the selection of the peer group used for our TSR performance shares |  |

Enhanced disclosure of the TSR performance share peer group selection process and rationale for the use of the S&P 500 Index to evaluate relative performance (see pages 57 and 65) |

| Responsible Business Topics | ||

| Desire for additional disclosure regarding our initiatives related to consumers, including financial inclusion, expanded access to credit and consumer experience |  |

Began publishing a monthly U.S. consumer credit report accuracy metric as part of our commitment to improve data processes (see Equifax.com/about-equifax/consumer-experience/)

Enhanced proxy statement and website disclosure to highlight our initiatives and 2023 progress related to financial inclusion, access to credit and consumer experience (see pages 40-41 and Equifax.com/about-equifax/our-commitments/) |

| Interest in additional human capital-related disclosures, including topics related to employee engagement, turnover rates and retention and recruitment efforts |  |

Enhanced proxy statement disclosure to highlight employee engagement initiatives (see page 42)

Enhanced disclosure regarding employee turnover rates in our 2023 SASB Report (see Equifax.com/ESG)

Published a Human Rights Policy, taking into consideration shareholder feedback received (see Equifax.com/about-equifax/corporate-governance/) |

| Support for obtaining SBTi-approval of near-term GHG emission reduction targets |  |

Set near-term GHG emission reduction targets that were validated by the Science Based Targets initiative (SBTi) (see Equifax.com/about-equifax/environment/) |

| Request for disclosure regarding our approach to artificial intelligence risks and opportunities |  |

Published additional information about our commitment to responsible AI innovation, including our Responsible AI Policies and Principles, which are designed to operationalize Responsible AI and help ensure that we consistently and appropriately design, implement and use AI Systems for approved use cases (see Equifax.com/about-equifax/ai/) |

| Equifax Inc. | 2024 Proxy Statement | 33 |