UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | |

|

No fee required. |

|

Fee paid previously with preliminary materials. |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

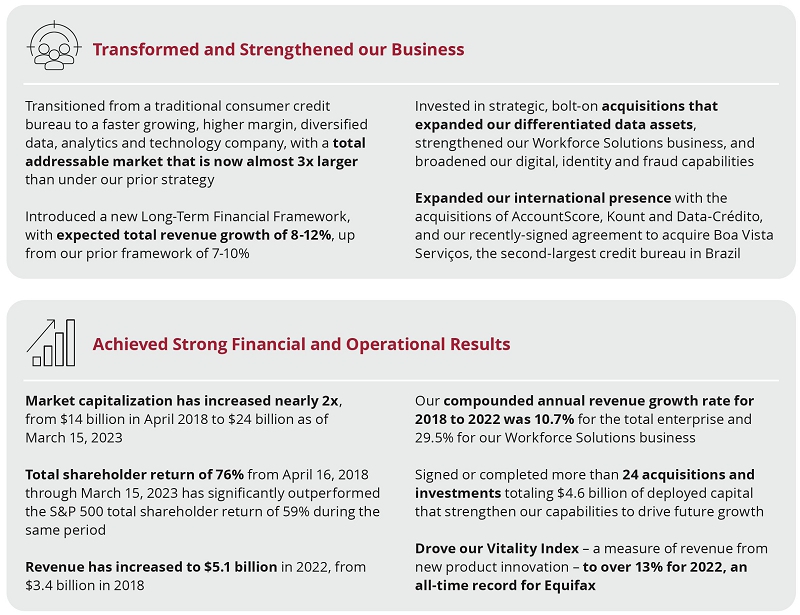

2022 was a strong year for the New Equifax. We are truly a diversified data, analytics and technology company that is shifting into our Next Gear and extending well beyond a traditional credit bureau in the markets we serve worldwide. We are driving innovation to meet the evolving needs of global consumers and customers while delivering strong financial results for our shareholders.

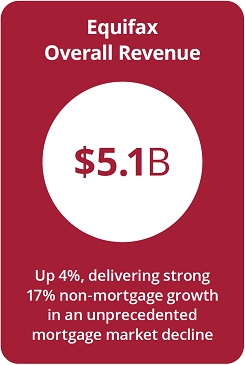

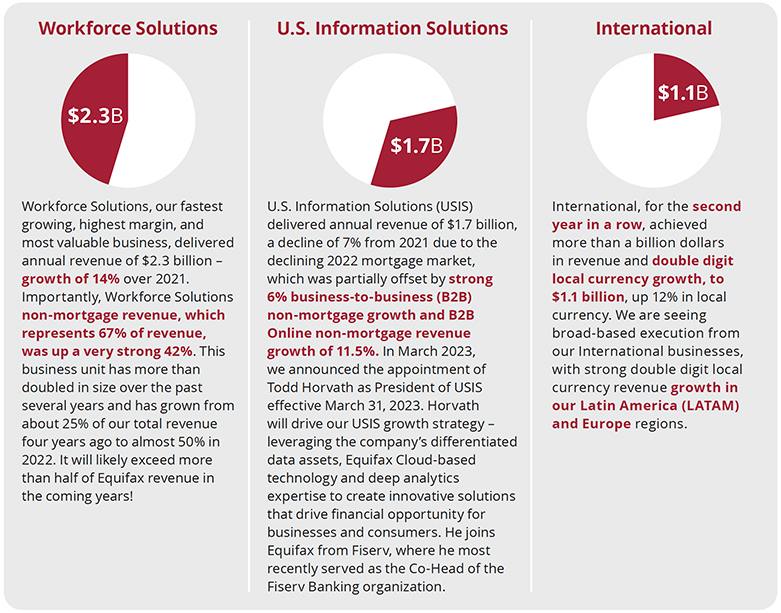

up 4% over 2021 despite an unprecedented estimated 56% decline in U.S. mortgage originations and a softening of the global macroeconomic environment. The power of the Equifax business model and our execution against our EFX2025 strategic priorities is reflected in our eight consecutive quarters of strong, double digit core revenue growth – and strong 17% non-mortgage growth in 2022. Our non-mortgage businesses comprised 77% of Equifax and delivered growth in 2022 well above our 8-12% long-term growth framework.

In 2022, we harnessed the power of our new Equifax Cloud™ capabilities and differentiated data to deliver more than 100 new products for a record setting Vitality Index (defined as revenue from new products introduced in the last three years) of 13%, which is well above our 10% long term vitality target for new products and 400 basis points above 2021. North American revenue from products delivered from an application running in the new Equifax Cloud reached a record of approximately 70%, up from 50% in 2021. We also continued to invest in strategic, bolt-on acquisitions to strengthen our company and drive future growth and have signed or completed 14 transactions for consideration totaling $4.1 billion since the beginning of 2021. We continue to set ourselves apart in the industry with innovative solutions and differentiated data assets that ‘Only Equifax’ can provide.

3

Our strong financial performance was supported by the significant strides we have made to complete our Equifax Cloud transformation. This new Cloud infrastructure is delivering always-on capabilities and faster New Product Innovation, with integrated data assets, faster data delivery and industry leading enterprise security. Approximately 70% of our North American revenue is now being delivered from the Equifax Cloud and in 2023 we are focused on completing our North American cloud transformation to become the only cloud native data and analytics company.

The strength of the New Equifax worldwide is supported by our nearly 14,000 Equifax employees in 24 countries who have helped our customers adapt to a challenging post-COVID economic landscape, enabling them to support rapidly evolving consumer needs.

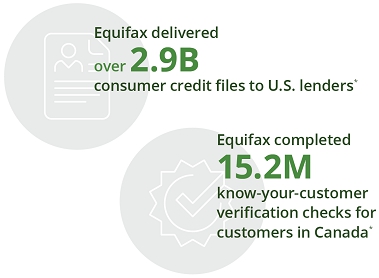

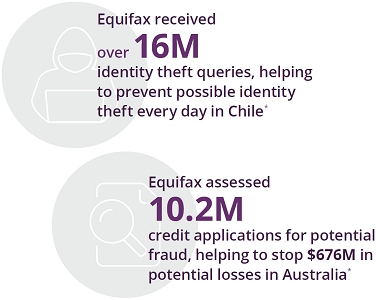

A few of our 2022 highlights include:

4

Our company purpose is to help people live their financial best and Equifax strives to support economically healthy individuals and financially inclusive communities in each of the 24 countries where we do business. This purpose-driven focus was recognized in 2022 with a Google Customer Award for Diversity, Equity and Inclusion.

Financial inclusion is at our core and Equifax is committed to helping people and small businesses access useful and affordable financial products and services that meet their needs – including payments, savings, credit, insurance and government benefits – delivered in a responsible and sustainable way. Every financial first – whether it’s a first job, a college education, a bank account, credit card, car loan, apartment lease, small business loan, government benefit or mortgage – can spur positive economic change.

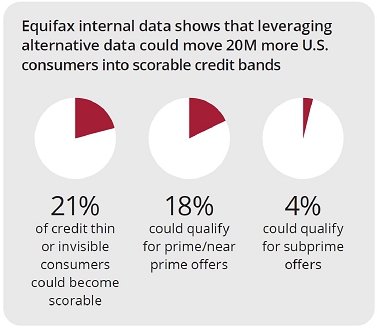

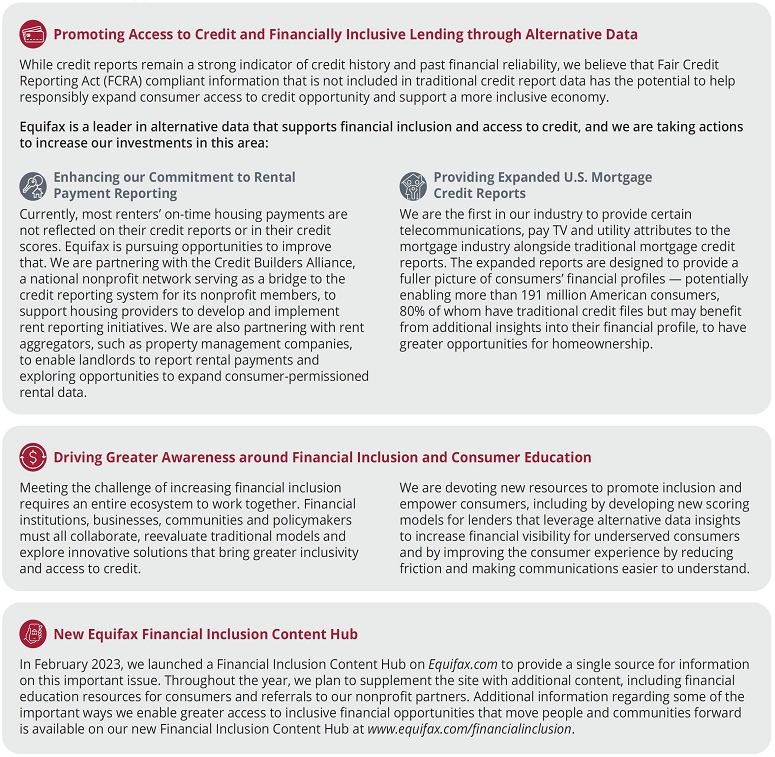

While credit reports remain a strong indicator of credit history and past financial reliability, we believe that Fair Credit Reporting Act (FCRA) compliant information that is not included in traditional credit report data has the potential to help responsibly expand consumer access to credit and support a more inclusive economy. Equifax is a leader in alternative data that supports financial inclusion and access to credit.

In 2022, we publicly announced plans to become the first in the industry to provide certain telecommunications, pay TV and utilities attributes to the mortgage industry to help streamline the mortgage underwriting process and support loans within the secondary mortgage market. Effective Q1 2023, these telecommunications, pay TV and utilities attributes are now available to the mortgage industry to provide a fuller picture of consumers’ financial profiles. The majority of American adults have at least one utility or cell phone bill in their name. Delivering certain telecommunications, pay TV and utilities attributes to mortgage lenders alongside traditional credit reports can help create greater home ownership opportunities for more than 191 million U.S. consumers, 80% of whom have traditional credit files, but may benefit from additional insights into their financial profile that can make mortgage underwriting faster and easier. The use of these expanded data insights can also provide visibility to millions of credit invisible consumers – those without traditional credit files – and enhance the financial profiles of younger, thin-file, and unscorable consumers as they complete first mortgage applications – helping to expand access to credit.

Equifax plays an important role in the financial lives of consumers and we take that responsibility seriously. As we strive to become the most consumer-friendly credit bureau, our company purpose drives our business actions.

5

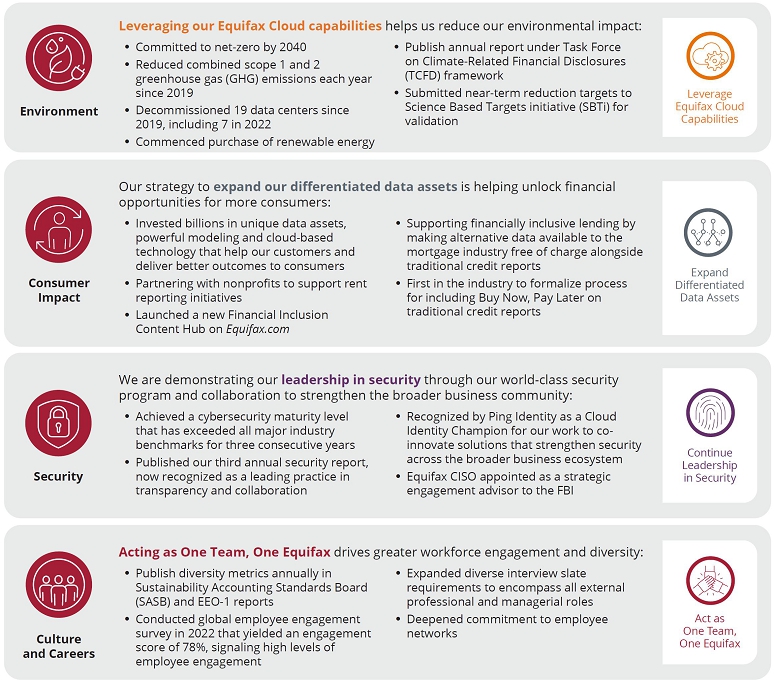

Data, analytics and technology is a powerful force in addressing pressing issues facing the world around us and Equifax has committed to reaching net-zero greenhouse gas emissions by 2040, an important sustainability commitment enabled by our Equifax Cloud. As we move from physical, on-premise data centers to cloud-based technology, we are working to increase system reliability and reduce operating expenses while also transitioning to more renewable energy sources, consuming energy more efficiently and reducing our carbon footprint. These strategic business actions also have the potential to help reduce greenhouse gas emissions.

For Equifax in 2022, data centers made up approximately 50% of the company’s total scope 1 and 2 emissions, net of renewable energy. As a part of our Equifax Cloud transformation we have decommissioned 19 data centers to date, including seven decommissions in 2022. As we complete our North American Cloud transformation in 2023, we expect to close about 15 additional data centers, consolidate development centers, and continue to reduce our software application footprint. In 2022, we accelerated our plan to purchase renewable energy associated with our offices and data centers, which will continue to have a positive impact on our sustainability commitments.

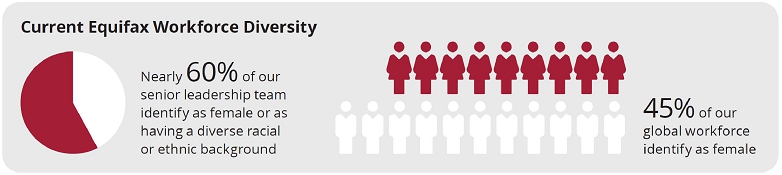

Equifax makes quantitative Environmental, Social and Governance (ESG) diversity disclosures available annually in accordance with the Sustainability Accounting Standards Board (SASB) framework, and we were one of the first in our industry to publicly disclose our Equal Employment Opportunity (EEO-1) and SASB diversity reports. We are committed to nurturing a culture where everyone feels welcomed, valued and respected. Within our senior leadership team, nearly 60% identify as female or as having a diverse racial or ethnic background, and 45% of the Equifax global workforce identify as female.

In support of our commitment to inclusion and diversity and the creation of an environment where all team members can flourish, we also developed and launched the Equifax Inclusive Leader Framework in 2022 to articulate the habits and behaviors expected of leaders across Equifax. And all members of our Global Leadership Team had an ESG goal as part of their performance objectives last year.

In January 2023, Equifax appointed Karen Fichuk, former Chief Executive Officer of Randstad North America, as an independent director. Fichuk’s election is part of the board’s regular succession planning process in connection with the scheduled retirement of independent director Bob Selander in May 2023. Forty percent of our director nominees for election at the 2023 Annual Meeting identify as female.

6

We move into 2023 with significant momentum in the underlying growth of our businesses and in the execution of our EFX2025 strategic priorities. Our Equifax team around the world delivered against every component of our EFX2025 growth strategy in 2022 as we worked to rapidly build the New Equifax and shift into our Next Gear of operations.

|

||

Accelerate Innovation and New Products

Equifax truly accelerated New Product Innovation in 2022 with over 100 new products for the third year in a row, and a record full year Vitality Index of over 13% with over 90% of new product revenue from non-mortgage products. This 13% Vitality Index is an all-time high since our Vitality Index program’s inception in 2007, and is greater than 400 basis points above our strong 2021 results and more than 300 basis points higher than our long-term growth framework.

As we complete the new Equifax Cloud, we are positioned to bring exciting new products to market that leverage our diversified assets and unique capabilities to unlock growth opportunities for our customers. A majority of our New Product Innovations, about 75% in total, leverage global capabilities from our Equifax Cloud platform, which drives both scale and efficiency. Our time to market is averaging 77 days from start to launch, which is just a third of the time needed only three years ago. Revenue driven from new products reached the highest level in our history at $650 million in 2022.

Workforce Solutions continues to lead Equifax in New Product Innovation with offerings like the TotalVerify data hub, delivering a business unit Vitality Index at more than twice our long-term 10% Vitality Index target. Workforce Solutions is the first Equifax business to be substantially complete with their Equifax Cloud transformation and the growth of the Workforce Solutions Vitality Index from the low single digits in 2019 to its record levels in 2022 is a testament to the power of the Equifax Cloud to drive innovation and new products today and in the future.

Innovation and development across all regions is increasingly powered by our investment in the Equifax Cloud. It enables us to scale and replicate our innovations across the globe – and we have grown our multi-market launches as a percentage of total New Product Innovation from 2% in 2018 to over 20% in 2022 and growing. The LATAM region leads Equifax with this approach. With a regional Vitality Index well above our 10% long term target, the International team is creating solutions that fit each of the 11 countries in the Equifax LATAM region to expand and accelerate growth.

As we complete the Equifax Cloud, we are positioned to bring exciting new products to market.

As we move into 2023, our Equifax Cloud-based data fabric capabilities will further accelerate our New Product Innovation-based revenue growth worldwide. We are in the early days of leveraging these new capabilities but remain confident that they will differentiate us commercially, expand our New Product Innovation capabilities, and accelerate our top line growth.

7

|

||

Leverage Equifax Cloud Capabilities

We are entering 2023 in the final chapter of completing our Equifax Cloud data and technology transformation that we started almost five years ago. This massive, over $1.5 billion multi-year investment in the Equifax Cloud is central to our differentiation and to our competitive advantage today and in the years to come. We have created an agile new foundation for the enterprise to develop solutions that are faster, more reliable, more powerful, and more secure than ever before.

In 2022, North American revenue from the Equifax Cloud reached a record of about 70%, up from 50% in 2021.

In 2022, North American revenue from the Equifax Cloud reached a record of about 70%, up from 50% in 2021. We made the strategic decision in 2022 to increase capital spending by approximately $175 million to $625 million for the year to accelerate the completion of our North American Cloud transformation. The progress made in 2022 will enable substantial completion of the North American transformation and customer migrations in 2023, including the ability to decommission applications and major North American data centers. Our International transformation also continues to progress towards our goal of being principally complete by the end of 2024 and we are on track to reach our goal of 80% of our global revenue being delivered from the Equifax Cloud in the near future.

Other highlights of our work to complete the Equifax Cloud in 2022 include:

| • | We decommissioned seven data centers, bringing our total to 19, which serves to help increase our system reliability and reduce our operating expenses while reducing our carbon footprint and fueling our commitment to reach Net Zero greenhouse gas (GHG) emissions by 2040. |

| • | We deployed a Global Network Security Stack to enable a standard, secure and scalable Cloud infrastructure globally. This drives substantially decreased latency and increased security protection and encryption, translating to faster application onboarding and customer response time. |

| • | Workforce Solutions accelerated growth with the Equifax Cloud, moving The Work Number database to our Data Fabric – scaling employer records to more than 2.6 million U.S. employers – and transforming Verification Services. |

| • | Equifax completed 53,000 customer migrations globally in 2022, an increase from the 30,000 customer migrations completed in 2021. |

| • | We strengthened our competitive edge in 2022 with the launch of a unified global keying and linking platform in our enterprise Data Fabric that will soon allow us to replace 10 disparate systems. |

| • | Our first consumer credit product, Automated Data View, moved to the Equifax Cloud, enabling 1,500 U.S. Information Solutions customers to access our Core Credit exchange on the Data Fabric for faster insights. |

| • | Canada began to transform their Consumer Exchange with almost 50% of online consumer transaction volume migrated. This is the first location outside of the U.S. to begin this shift. |

| • | Kount Identity Verification, our global Identity Verification and Adaptive Authentication platform, went live in the U.K. replacing a legacy system and unlocking Equifax Cloud savings. |

| • | Latin America completed more than 20,000 of our total customer migrations in 2022, while also delivering more than 30 new Equifax Cloud-based products and a regional Vitality Index well above our 10% long term target. |

| • | Australia and New Zealand successfully loaded 100% of their historical consumer data into the Data Fabric. |

| • | India made substantial transformation progress, deploying the International Work Number to the Equifax Cloud. |

As we focus on completing our North America Cloud transformation in 2023, we will pivot to leveraging our differentiated data assets and new Cloud infrastructure to drive new product roll-outs and top-line growth. Workforce Solutions will accelerate its focus on leveraging their new Equifax Cloud capabilities and USIS and Canada will complete their consumer credit, alternative data and Identity & Fraud Solutions transformations. These are milestones that Equifax has been building towards for nearly five years. We are energized to be pivoting from building the cloud to leveraging our new Equifax Cloud technology to drive innovation, new products, growth, and margin expansion.

8

|

||

Expand Differentiated Data Assets

Differentiated data and analytics that Only Equifax can provide continue to be at the heart of our business. Unlocking deeper decision intelligence to help our customers deliver better outcomes for consumers at scale is a primary focus of our Equifax Cloud transformation. This requires exceptional data stewardship, including strong processes to ensure the accuracy of our differentiated data, and providing the highest level of regulated services in support of our goal to become the most consumer-friendly credit bureau.

Unlocking deeper decision intelligence to help our customers deliver better outcomes for consumers at scale is a primary focus of our Equifax Cloud transformation.

In 2021, we united our Technology, Product and Data & Analytics teams under the leadership of Bryson Koehler to create heightened connectivity and positive synergies across these critical teams. In 2022, we announced the appointment of Harald Schneider as Chief Data & Analytics officer, reporting to Koehler. Schneider brings more than two decades of multinational experience to the role of Chief Data & Analytics Officer. In this role, he will champion global data innovation, maximizing the benefits of Equifax differentiated data assets, leading analytics capabilities and single data fabric within the Equifax Cloud to drive new products and growth while overseeing our data acquisition strategy and data quality management.

Strengthening our data assets and connecting them to drive unique, real-time insights for our customers is central to the Next Gear of our operations. In 2022, the differentiated data that Only Equifax can provide included:

| • | The Work Number Database: 152 million active employment records and 604 million total employment records for verifications of employment and income from 2.6 million different US employers |

| • | Core Credit: More than 1.6 billion tradelines with information on 240 million+ consumers |

| • | Insights: 180 million incarceration records and 600 million court records |

| • | Partnership with National Student Clearinghouse: Access to 130 million degrees from 2,700 colleges and universities |

| • | DataX and Teletrack: Access to 80 million unbanked, underbanked and credit rebuilding consumers – enabling greater access to credit |

| • | Partnerships for cash flow data: Information on balances, deposits and withdrawals from more than 7,700 participating U.S. financial institutions – allowing access to 99% of the U.S. population |

| • | IXI: Wealth information with $24 trillion in anonymized assets and investments |

| • | Kount: 56 billion consumer identity interactions |

| • | Commercial Financial Network powered with acquisitions of PayNet and Ansonia: 180 million tradelines across 155 million businesses |

We will continue to maximize our differentiated data assets to drive new products and solutions leveraging alternative data assets to provide a fuller financial picture of consumers to lenders and service providers.

The bottom line goal of our Equifax Cloud innovation and investment is to help our customers deliver better outcomes for consumers and businesses at scale and in 2023 we will continue to maximize our differentiated data assets to drive new products and solutions leveraging alternative data assets to provide a fuller financial picture of consumers to lenders and service providers.

| * | Based on actual and estimated results from January-December 2022; Sources: Data and analytics captured by Equifax business units (U.S. Information Solutions, Workforce Solutions, and International) |

9

|

||

Put Customers and Consumers First

Migrating our products and solutions to the Cloud gives customers access to the most up-to-date data, which forms the most comprehensive profiles for consumers and businesses – helping to propel them forward. We are also driving more powerful consumer experiences through product innovation and improved services.

Our goal of becoming the most consumer-friendly Consumer Reporting Agency guides our actions:

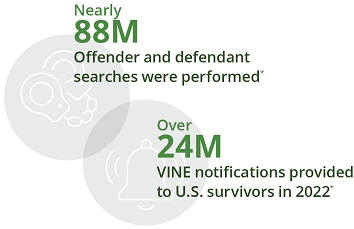

| • | In 2022, we supported victims of crime with more than 24 million notifications through the VINE network. VINE, acquired in our purchase of Appriss Insights in 2021, is the leading victim notification network in the U.S. It allows survivors, victims of crime, and other concerned citizens to access timely and reliable information about offenders or criminal cases in U.S. jails and prisons. |

| • | Our onboarding solutions helped one in 10 U.S. employees start their new jobs, and we provided consumers with access to 23 million tax forms to help them complete their tax returns. |

| • | We enhanced the consumer experience on The Work Number portal in 2022, making it even simpler for individuals to view, understand and control their employment data. The fully refreshed site now includes a mobile-friendly design with enhanced accessibility and new educational tools. |

| • | The experience of our U.S. myEquifax consumer portal, which surpassed 17 million users, 5.9 million Core Credit™ subscribers, and 626,000 paid product subscribers in 2022, has evolved over the last year to include access to new offers and services, helping to simplify processes like finding auto loans on behalf of the consumers we serve. |

Along with TransUnion and Experian, we announced significant changes to medical collection debt reporting to support consumers faced with unexpected medical bills.

| • | And, along with TransUnion and Experian, we announced significant changes to medical collection debt reporting to support consumers faced with unexpected medical bills. These joint measures will remove nearly 70% of medical collection debt tradelines from consumer credit reports. We also jointly announced the extension of free weekly credit reports to U.S. consumers through the end of 2023 to help consumers manage their financial health during a period of economic uncertainty. |

Equifax plays an important role in the financial lives of consumers and we take that responsibility seriously. Ensuring the accuracy of our differentiated data and of consumer credit reports is our most important job and as we work to complete our transformation in 2023, we are examining our business processes and technology platforms as we work to improve them.

| * | Based on actual and estimated results from January-December 2022; Sources: Data and analytics captured by Equifax business units (U.S. Information Solutions, Workforce Solutions, and International) |

10

|

||

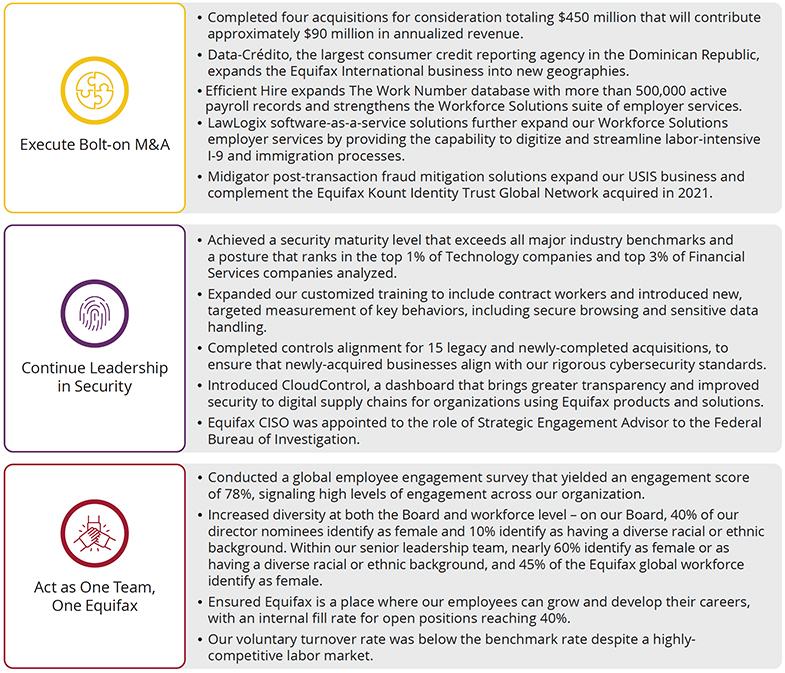

Execute Bolt-on M&A

Equifax continues to re-invest our strong performance in strategic, bolt-on acquisitions to strengthen our company and drive future non-mortgage growth. We have signed or completed 14 transactions totaling $4.1 billion since the beginning of 2021.

In 2022, we completed four acquisitions totaling $450 million that will contribute approximately $90 million in annualized revenue.

In 2022, we completed four acquisitions totaling $450 million that will contribute approximately $90 million in annualized revenue. The accretive acquisitions of Data-Crédito, Efficient Hire, LawLogix and Midigator not only grow our core revenue, but strengthen our business with new data assets, capabilities and talented team members.

| • | Data-Crédito expands the Equifax International business into new geographies. As the largest consumer credit reporting agency in the Dominican Republic, Data-Crédito is a bridge to the Caribbean that will allow Equifax to connect and stay close to strategic regional clients and to better serve consumers. By bringing the power of the Equifax Cloud to credit reporting and scoring in the Dominican Republic, Equifax will enable financial institutions to gain new insights into consumers’ financial profiles as part of the lending process, helping them to responsibly open up new mainstream financial services opportunities to underbanked individuals. |

| • | Efficient Hire expands The Work Number database with more than 500,000 active payroll records and strengthens the Workforce Solutions suite of employer services with solutions specifically tailored to meet the needs of hourly employers, with an emphasis on helping firms in the restaurant, staffing, building services, senior care and hospitality industries, to help them efficiently scale their workforces. Employee acquisition and retention in these industries continue to impact consumer experiences in a hiring environment that has been challenged since the beginning of the COVID pandemic. |

| • | LawLogix Software-as-a-Service solutions further expand our Workforce Solutions employer services by providing the capability to digitize and streamline labor-intensive I-9 and immigration processes while helping thousands of organizations, including several of the largest businesses and most recognized immigration law firms in the United States comply with complicated regulatory frameworks. |

| • | Midigator post-transaction fraud mitigation solutions expand our USIS business and complement the Equifax Kount Identity Trust Global Network acquired in 2021. With global omnichannel digital payments expected to grow from 2.6 billion users in 2020 to over 4.4 billion in 2025, dispute and chargeback rates present growing problems for businesses around the world. Midigator offers a technology platform designed to not only automate the dispute response process, but to provide the real-time data businesses need to know why chargebacks are occurring in the first place and better understand their customers. |

Non-mortgage revenue growth is a key priority for Equifax and a critical driver of our M&A priorities. The acquisitions we completed in 2022 are expected to deliver growth synergies in 2023 and 2024 as we complete their technology and product integrations into the Equifax Cloud – enabling us to create new products and drive new capabilities for our customers.

In 2021, we completed the strategic acquisitions of Kount and Appriss Insights. In 4Q 2022, Equifax expanded Kount business operations in the United Kingdom and made Kount digital identity trust and fraud prevention solutions available in Latin America and Australia. And, the Workforce Solutions talent solutions and government verticals are benefiting from the addition of new Insights data at the Federal, State, and Local level.

We continued to reinvest free cash flow in strategic acquisitions in the first part of 2023, signing a definitive agreement to acquire Boa Vista Serviços, the second largest credit bureau in Brazil.

Building on that success, we continued to reinvest free cash flow in strategic acquisitions in the first part of 2023, signing a definitive agreement to acquire Boa Vista Serviços, the second largest credit bureau in Brazil. The transaction is subject to Boa Vista Serviços’ shareholder approval and other customary closing conditions and is expected to be completed in mid-2023, at which time the company will become a part of our International business. We also announced the acquisition of The Food Industry Credit Bureau, the leading provider of credit information for the food industry in Canada, from Montreal-based Profile Credit in January.

11

|

||

Continue Leadership in Security

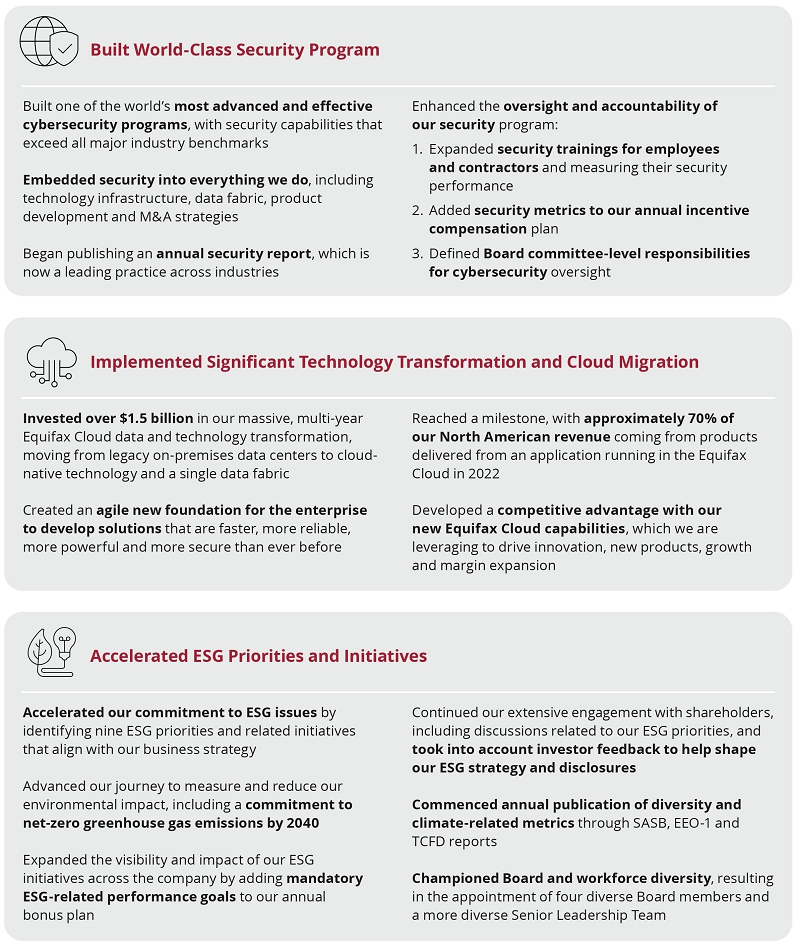

Security has become a point of strength and a competitive advantage for Equifax. We’ve built one of the world’s most advanced and effective cybersecurity programs, with a maturity level that has exceeded all major industry benchmarks for three consecutive years and a posture that ranks in the top 1% of Technology companies and top 3% of Financial Services companies analyzed.

We’ve built one of the world’s most advanced and effective cybersecurity programs, with a maturity level that has exceeded all major industry benchmarks for three consecutive years.

Since 2018, we have built a culture where security is part of our global team’s DNA. Every employee receives customized training and has visibility into their own security performance. In 2022, we expanded our customized training to include contract workers and introduced new, targeted measurement of key behaviors, including secure browsing and sensitive data handling. These performance measures are included in the calculation of annual incentive compensation for all bonus-eligible employees.

From our technology infrastructure, data fabric and product development, to our merger and acquisition strategies, security is embedded in everything we do. Over the last year, the security team has enhanced our acquisition processes by establishing tiered control priority, a subset of key controls, and risk-based reporting – critical in supporting our acquisition goals. To ensure that newly-acquired businesses align with our rigorous cybersecurity standards, we completed controls alignment for 15 acquisitions, including the four transactions completed in 2022.

As part of our commitment to delivering solutions that benefit the security community, customers and consumers, Equifax developed and introduced CloudControl, a dashboard that brings greater transparency and improved security to digital supply chains for organizations using Equifax products and solutions. Through the CloudControl dashboard, Equifax customers are provided with deep insights into control effectiveness, empowering them with the information they need to make informed risk decisions.

In our third Annual Security Report, released in the first quarter of 2023, we noted our continued optimization of security systems over the last year, driving additional cloud security and augmenting our security toolset for better governance, reduced risk, and less friction for the business. We worked in partnership with other technology providers to co-design solutions that are now available to the market at large, strengthening security across the broader business ecosystem. As part of these co-innovation efforts, we were recognized by Ping Identity with their Cloud Identity Champion award for “work that pushes our industry forward.”

We also continue to actively engage with customers, policymakers, and other organizations regarding the challenges and opportunities in cybersecurity.

We also continue to actively engage with customers, policymakers, and other organizations regarding the challenges and opportunities in cybersecurity. As part of this engagement, Equifax Chief Information Security Officer Jamil Farshchi has expanded on his Equifax responsibilities by taking on the role of Strategic Engagement Advisor to the Federal Bureau of Investigation (FBI). In this capacity, Farshchi supports the FBI’s efforts to strengthen their relationship with the private sector to address the range of cyber threats facing businesses across America.

| * | Based on actual and estimated results from January-December 2022; Sources: Data and analytics captured by Equifax business units (U.S. Information Solutions, Workforce Solutions, and International) |

12

|

||

Act as One Team, One Equifax

Our greatest competitive advantage and asset is our people. Nurturing a team environment that fosters cross-functional collaboration and innovation and working as One Equifax is core to our success.

Critical to that collaboration is face-to-face interaction. In 2022, we implemented a 3/2 + 2 return to office framework – open to any employee who can perform work outside of the office and whose role does not require routine weekly travel, such as our sales associates. As part of this framework, Tuesday, Wednesday and Thursday are standard “in office days,” and employees have the option to work from home on Mondays and Fridays, if desired. Our “+2” policy enables employees to work remotely for two full weeks of their choosing each year.

Our teams operated very well throughout the COVID-19 pandemic and have come together in new ways as we have returned to our office environment. In our 2022 Employee Engagement Survey, Equifax attained an engagement score of 78%, signaling high levels of engagement across the enterprise. Equifax continues to make a number of internal and external training opportunities available to our team worldwide, with our global employees completing more than 140,000 hours of training and professional development, including more than 14,000 hours of leadership and management development, and almost 45,000 hours of technical training in 2022. Equifax is a place where our employees can grow and develop their careers, with an internal fill rate for open positions reaching 40% in 2022.

An important part of supporting our people is supporting the areas where they live and work. The Equifax Foundation partners with organizations in Atlanta and St. Louis to help low-to-moderate income communities achieve the credit strength needed to live their financial best. In 2022, the Equifax Foundation put our purpose into action by making more than $1.9 million in direct charitable grants to our Community partners. Building financial capability is a critical step to establishing individual financial health and generational wealth that can change the trajectory and livelihood of families and communities. Additionally, through our Equifax Gives program, we matched a record $1.1 million in employee gifts for more than $4 million in total community impact.

We are energized by both our delivery against our EFX2025 strategic priorities and our 8 consecutive quarters of strong, double digit core revenue growth – but even more energized about the future of the New Equifax in 2023 and beyond. Our Equifax Cloud based technology, differentiated data assets in our new single data fabric, new product roll-outs, strategic bolt-on M&A and our market leading businesses will enable us to shift into our Next Gear to deliver higher growth, expanded margins and free cash flow in the future.

In 2023, we expect to deliver revenue growth at a midpoint of 4% in total with non-mortgage growth of over 8%, despite continuing challenges in the mortgage market and more uncertain broader economic outlook. Looking forward, we remain focused on growing the company to $7 billion in revenue and 39% EBITDA margins by 2025. Our strong top-line growth and expanding margins will expand our excess free cash flow substantially. We are moving into 2023 on offense and focused on completing the Equifax Cloud, bolstered by underlying business growth and taking proactive measures to ensure we execute and outperform.

On behalf of the Equifax board, leadership team, and nearly 14,000 team members around the world, we thank you for your ongoing support and confidence in our business. We are energized by our continued strong performance in 2022, and are shifting into our Next Gear to deliver on the power of the New Equifax in the future.

Thanks for your support,

|

| |

| Mark W. Begor | Mark L. Feidler | |

| Chief Executive Officer and Director | Independent Chairman of the Board of Directors |

13

1550 Peachtree Street, N.W.

Atlanta, Georgia 30309

Agenda

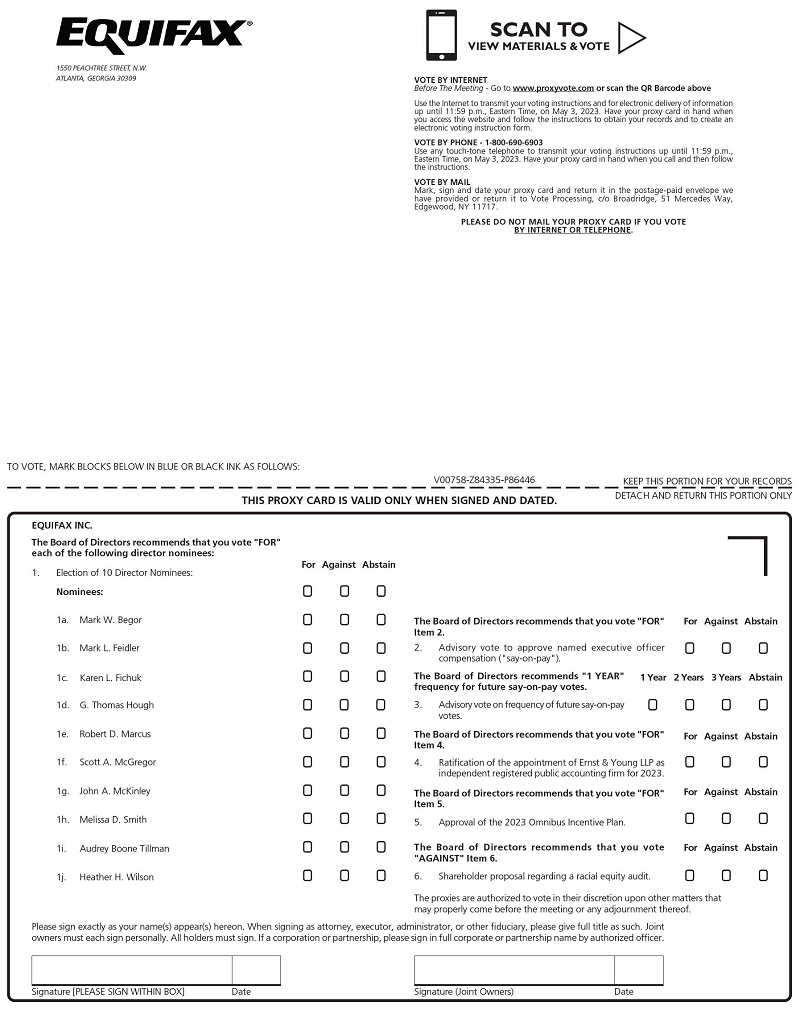

| 1. | Elect the 10 director nominees named in the accompanying Proxy Statement. |

| 2. | Hold a non-binding, advisory vote on the compensation paid to the Company’s named executive officers (commonly referred to as “say-on-pay”). |

| 3. | Hold a non-binding, advisory vote on the frequency of submission to shareholders of future say-on-pay votes. |

| 4. | Ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2023. |

| 5. | Approve the 2023 Omnibus Incentive Plan. |

| 6. | Vote on the shareholder proposal described in the accompanying Proxy Statement, if properly presented at the meeting and not previously withdrawn. |

| 7. | Consider other business properly brought before the meeting or any adjournment or postponement thereof. |

Proxies in the form furnished are being solicited by the Board of Directors of Equifax Inc. for this meeting or any adjournment or postponement thereof.

Shareholders are cordially invited to participate in the Annual Meeting by attending in person. See page 125 of the Proxy Statement for more information on how to attend, participate in and vote at the Annual Meeting.

YOUR VOTE IS VERY IMPORTANT. PLEASE SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AS SOON AS POSSIBLE, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING. Most shareholders have a choice of voting over the internet, by telephone or by using a traditional proxy card. Please refer to the enclosed proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you.

Proxy materials were first made available to shareholders beginning on March 23, 2023.

| March 23, 2023 |

By order of the Board of Directors,

Lisa M. Stockard Assistant Secretary |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on May 4, 2023. The Notice, Proxy Statement and Annual Report are available at www.proxyvote.com.

| REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS: | ||||||

|

|

|

| |||

| Via the internet Visit the website listed on your proxy card |

By telephone Call the telephone number on your proxy card |

By mail Sign, date and return your proxy card in the enclosed envelope |

Attend the meeting Attend the meeting in person and cast your vote | |||

Election to receive electronic delivery of future annual meeting materials. You can expedite delivery and avoid costly mailings by confirming in advance your preference for electronic delivery. For further information on how to take advantage of this cost-saving service, please see page 129 of the Proxy Statement. |

15

16

This summary highlights certain information contained in this Proxy Statement. This summary does not contain all of the information that you should consider, and we encourage you to read the entire Proxy Statement before voting.

|

|

|

||||

| Time 9:30 a.m., Eastern Time |

Date May 4, 2023 |

Meeting Location Equifax Inc. 1550 Peachtree Street, N.W. Atlanta, Georgia 30309 |

| Items for Vote | Board

Voting Recommendation | ||

| 1. | Election of 10 directors | FOR ALL NOMINEES | |

| 2. | Advisory vote to approve named executive officer compensation (“say-on-pay”) | FOR | |

| 3. | Advisory vote on frequency of future say-on-pay votes | ANNUAL VOTE | |

| 4. | Ratification of appointment of Ernst & Young LLP as independent registered public accounting firm for 2023 | FOR | |

| 5. | Approval of the 2023 Omnibus Incentive Plan | FOR | |

| 6. | Shareholder proposal as described in this Proxy Statement, if properly presented at the meeting and not previously withdrawn | AGAINST | |

In addition, shareholders may be asked to consider any other business properly brought before the meeting or any adjournment or postponement thereof.

Voting. Holders of our common stock as of the record date, March 3, 2023, are entitled to notice of and to vote at our 2023 Annual Meeting. Each share of common stock outstanding on the record date is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on at our 2023 Annual Meeting. Even if you plan to attend our 2023 Annual Meeting, please cast your vote as soon as possible.

| REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS: | ||||||

|

|

|

| |||

| Via

the internet Visit the website listed on your proxy card |

By

telephone Call the telephone number on your proxy card |

By

mail Sign, date and return your proxy card in the enclosed envelope |

Attend

the meeting Attend the meeting in person and cast your vote | |||

Admission. Equifax shareholders as of the record date are entitled to attend the 2023 Annual Meeting, which will be held in person. Please review the admission procedures in this Proxy Statement under “Questions and Answers about the Annual Meeting.”

References to our website included in this Proxy Statement are provided solely for convenience purposes. Content on our website is not, and shall not be deemed to be, part of this Proxy Statement or incorporated herein or into any of our other filings with the Securities and Exchange Commission (the “SEC”).

17

Equifax Inc. is a global data, analytics and technology company. We provide information solutions for businesses, governments and consumers, and we provide human resources business process automation and outsourcing services for employers. Headquartered in Atlanta and supported by nearly 14,000 employees worldwide, Equifax operates or has investments in 24 countries in North America, Central and South America, Europe, and the Asia Pacific region.

|

$5.1B Revenue, |

$7.56 Adjusted EPS*, |

$1.7B Adjusted EBITDA*, |

$191.1M Dividends paid to |

| * | Adjusted EPS and Adjusted EBITDA are non-GAAP financial measures. Reconciliation of the Company’s non-GAAP financial measures to the corresponding GAAP financial measures can be found in Annex A to this Proxy Statement. |

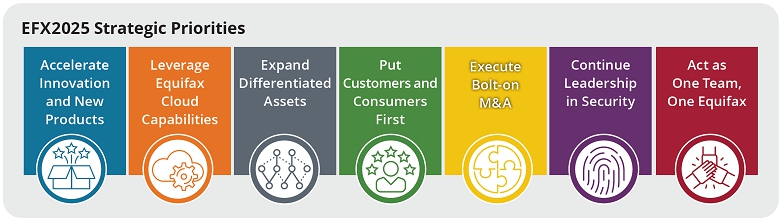

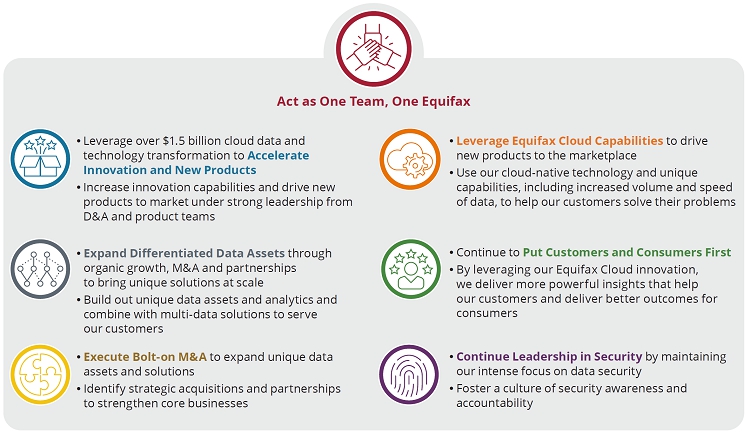

Our strategic imperatives are based on our shift from an era of building, investing and transforming to one of leveraging our massive cloud investments to drive new product innovation and accelerate growth. With our new Equifax Cloud foundation in place, we are executing against the following strategic priorities:

18

Our business and strategy are described in more detail in our 2022 Annual Report on Form 10-K filed with the SEC on February 23, 2023. Our 2022 progress against our goals and the link to our 2022 compensation program is described under “Executive Compensation—Compensation Discussion and Analysis—Executive Summary” beginning on page 46.

As a global data, analytics and technology company, we play an essential role in the economy by helping companies in diverse industries such as automotive, communications, utilities, financial services, fintech, healthcare, insurance, mortgage, professional services, retail, e-commerce and government agencies, make critical decisions with greater confidence.

Our unique blend of differentiated data, analytics and technology lets us create the insights that power decisions to move people forward. We help businesses provide a seamless and positive experience during life’s pivotal moments—like applying for a job or mortgage, financing an education or buying a car.

|

Our purpose is helping people live their financial best.

We strive to create economically healthy individuals and communities everywhere we do business. In a single year, our unique data and analytics change millions of lives across the world. |

Our values express who we are, how we work and the behaviors that support our company, our vision and our purpose. They serve as guiding principles for our global team. They are:

|

• Be leaders in security and trusted data stewards • Lead with integrity and be personally accountable • Hold high standards in all our markets around the world |

|

• Deliver results and play to win • Drive excellent execution • Have a sense of urgency, agility, and grit |

|

• Be intellectually curious and insights driven • Optimize our data and technology to sustain market and product leadership • Drive scalable, profitable growth |

|

• Exceed our customers’ expectations every day • Deliver value and quality to our customers so we grow together • Aspire to be our customers’ first call |

|

• Work together as one aligned global team • Assume best intentions from each other • Foster optimism and have fun together |

|

• Take initiative to develop ourselves and help others grow • Value diversity of experience and thought • Proudly show our Equifax spirit at work and in our communities |

19

|

Since our 2022

We contacted investors representing 83% of our shares

We met with investors representing 68% of our shares |

• Following our 2022 Annual Meeting, members of management, together with our Independent Chairman or our Compensation Committee Chair for certain conversations, conducted investor outreach meetings with shareholders representing approximately 68% of our shares • During these one-on-one meetings, we discussed our business strategy and governance-related topics, including executive compensation, progress related to our ESG priorities, and board composition and refreshment (see page 32 for an overview of our shareholder engagement program) • Investors provided constructive feedback regarding our 2022 executive compensation program, including the performance-oriented equity award granted to our CEO in July 2022 (see page 49 for a discussion of our shareholder engagement in the context of our compensation program and pages 66-69 for details regarding the CEO equity award) • Investors also provided valuable feedback regarding our ESG priorities and voiced support for our approach of aligning our ESG priorities with our business strategy • Following these engagements, we continued our long-standing process of sharing feedback received with our Board and relevant Board committees |

20

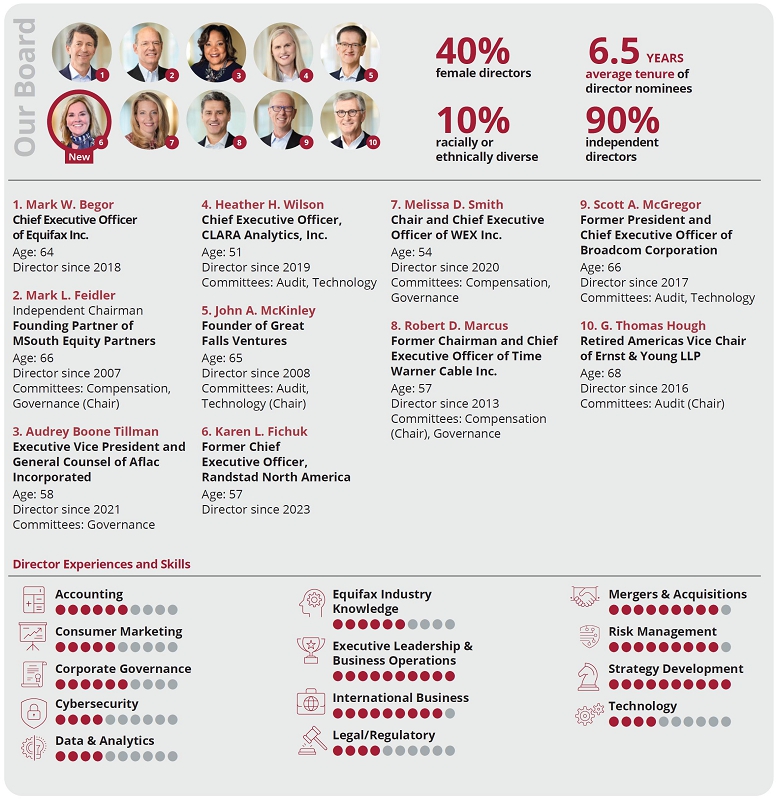

Our Board recommends that you vote FOR each of the director nominees named below for terms that expire at the 2024 Annual Meeting. The following table provides summary information about each nominee, and you can find additional information under “Proposal 1, Election of Director Nominees” on page 26.

21

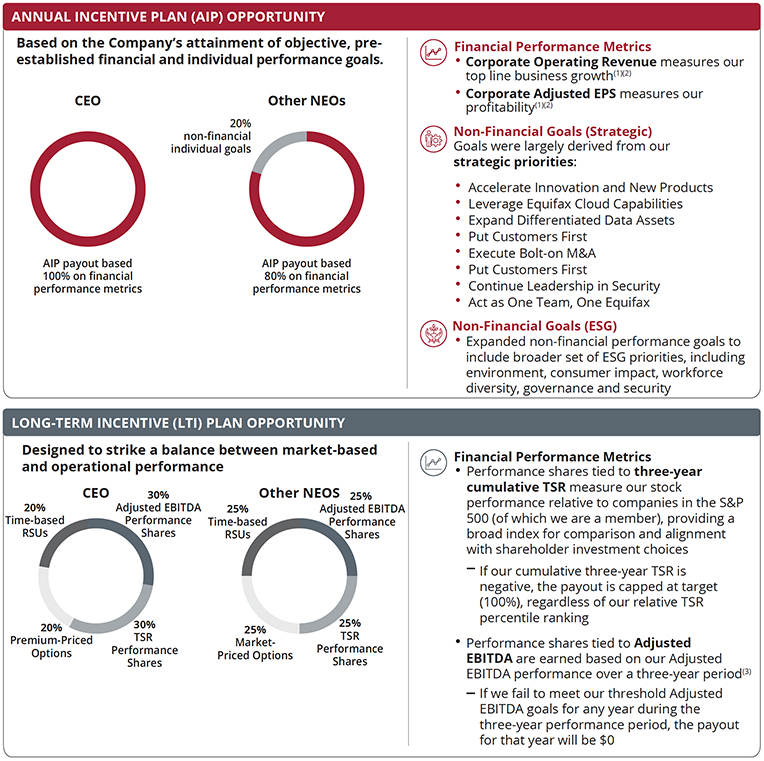

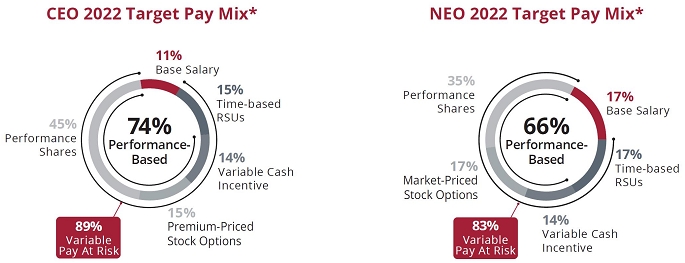

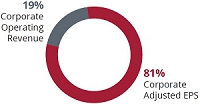

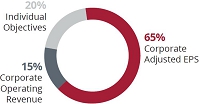

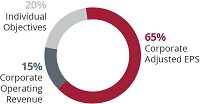

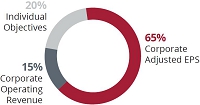

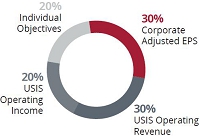

For the 2022 fiscal year, the Committee thoughtfully evaluated the compensation program structure in light of the ongoing evolution of our business strategy and shareholder feedback, when making decisions regarding the program. After evaluation, the Compensation Committee took certain actions with respect to our short- and long-term incentive programs for 2022, as summarized below and described in further detail under “Analysis of 2022 Compensation Decisions” beginning on page 54:

| Expanded

ESG goals under the Annual Incentive Plan (AIP) (see page 57) |

• Since 2018, our AIP has incorporated an ESG element in the area of security. • For the 2022 AIP, the Committee expanded the use of ESG goals, such that all members of our senior leadership team — including our CEO and other NEOs — had goals addressing the following areas: (i) environment; (ii) consumer impact (including financial inclusion and access to credit); (iii) workforce diversity; (iv) security; and (v) governance. • These ESG goals were a component of the non-financial goals that were set by the Committee and comprised 20% of each NEO’s AIP opportunity. Consistent with investor feedback, our CEO’s 2022 AIP payout was based entirely on financial performance metrics, although he is still responsible for meeting non-financial goals. | |

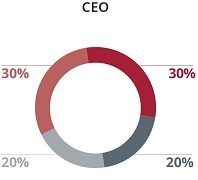

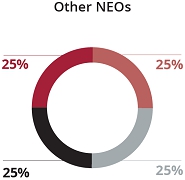

| Added an operational

metric to the Annual Long-Term Incentive (LTI) program (see page 62) |

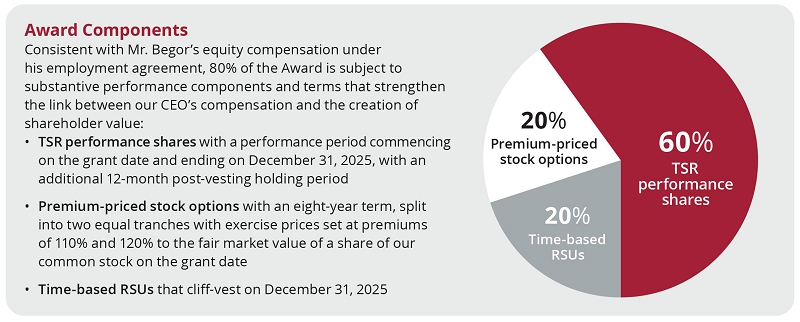

• In response to investor feedback, the Committee added an operational metric to the 2022 Annual LTI program in the form of Adjusted EBITDA performance shares. • The 2022 Annual LTI mix for our NEOs other than the CEO consisted of Adjusted EBITDA performance shares (weighted 25%), TSR performance shares (weighted 25%), market-priced stock options (weighted 25%) and time-based RSUs (weighted 25%). • The 2022 Annual LTI mix for our CEO as set forth in his employment agreement consisted of Adjusted EBITDA performance shares (weighted 30%), TSR performance shares (weighted 30%), premium-priced stock options (weighted 20%) and time-based RSUs (weighted 20%). | |

| Granted

performance-oriented award to our CEO (see pages 66-69) |

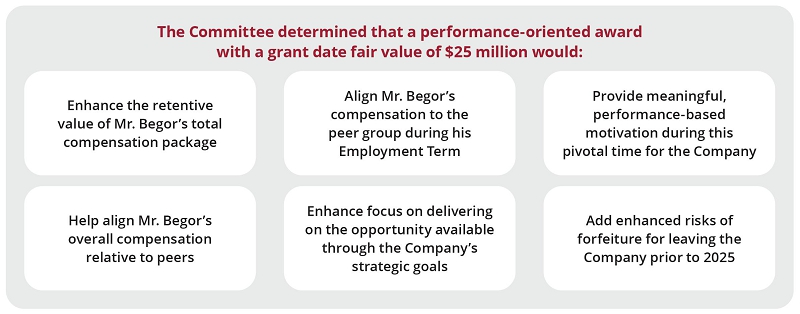

• In July 2022, the Committee granted to our CEO a performance-oriented equity award that cliff vests at the end of his term of employment. The award is intended to ensure Mr. Begor’s leadership during this critical time of our Company’s strategic shift from an era of building, investing and transforming, to one of leveraging our massive cloud investments to drive new product innovation and accelerate growth. |

|

Independent Compensation Committee advised by independent compensation consultant |

|

Performance-oriented pay philosophy, as evidenced by a target pay mix for our CEO and other NEOs that is predominantly performance-based (see page 50) |

|

Capped annual and long-term performance-based awards |

|

Double-trigger change in control cash severance benefits and vesting of equity awards |

|

No income tax gross-ups other than for certain relocation or foreign tax expenses |

|

Performance shares granted in 2021 and after are subject to a post-vesting holding period of 12 months |

|

Compensation clawback policy contains financial and reputational harm standard, including in supervisory capacity |

|

Meaningful share ownership requirements for senior executives |

|

Anti-hedging and -pledging policy for directors, officers and other employees |

|

Senior executives cannot purchase or sell Equifax securities except pursuant to a Rule 10b5-1 trading plan with robust requirements, reflecting governance best practices |

|

No re-pricing of underwater stock options |

22

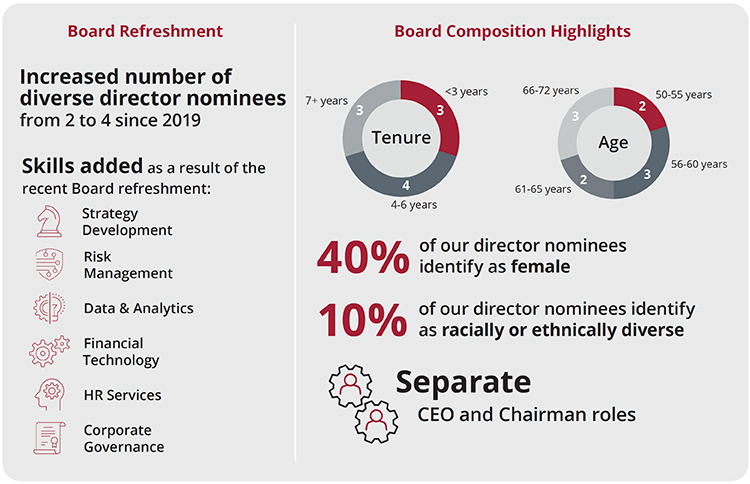

| Independent Board | • 9 of our 10 director nominees are independent |

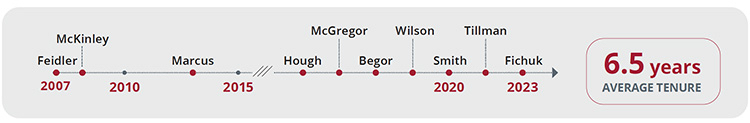

| Board Refreshment | • The Governance Committee has implemented a succession plan to identify highly-qualified and diverse director candidates taking into account scheduled retirements • Since 2019, we have refreshed our Board with four new female directors who bring valuable perspective and expertise, including one member who is also racially diverse • Upon election of the Board’s nominees at the 2023 Annual Meeting, the average director tenure will be 6.5 years |

| Board Diversity | • 40% of our director nominees identify as female and 10% of our director nominees identify as racially or ethnically diverse |

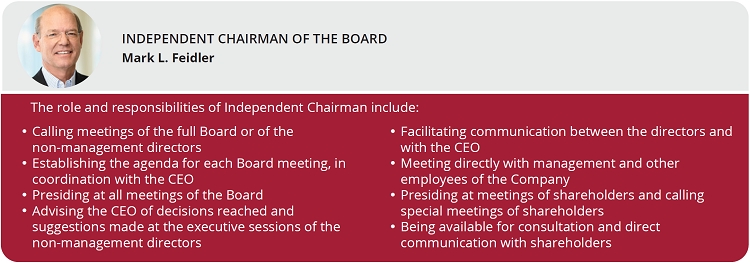

| Independent Board Chairman | • We have separated the roles of CEO and Chairman |

| Annual Board Leadership Evaluation and Succession Planning | • The Board annually reviews the leadership structure to determine whether a combined Chairman and CEO role or separate roles is in the best interests of shareholders • The Board annually evaluates the CEO’s performance and conducts a rigorous review and assessment of the succession planning process for the CEO and other top officers |

| Limits on Outside Board Service | • Outside directors are limited to service on three other public company boards • Our CEO is limited to two other public company boards (and serves on one outside board) |

| Director and Executive Stock Ownership | • Each independent director is required to own Equifax common stock with a market value of at least five times his or her annual cash retainer • Our CEO and our other senior executive officers are required to own Equifax common stock with a market value of at least six and three times their base salary |

| Rigorous Trading Policy and Protocols | • We have implemented risk escalation processes to support rapid escalation and internal notification of potentially significant events, including the impact of such events on our decision of whether to halt trading under our insider trading policy – Senior leadership team members and their direct reports are subject to trade pre-clearance requirements; a broader group of employees is subject to quarterly open trading windows – Our trading policy and risk escalation notification procedures are designed to ensure that those with decision-making authority on trading restrictions and pre-clearance requests have notice of any potential security incident • Our insider trading policy prohibits our CEO and other senior executives from purchasing or selling Equifax securities except pursuant to an approved Rule 10b5-1 trading plan |

| No “Poison Pill” | • We do not have a stockholder rights plan, or “poison pill,” in place |

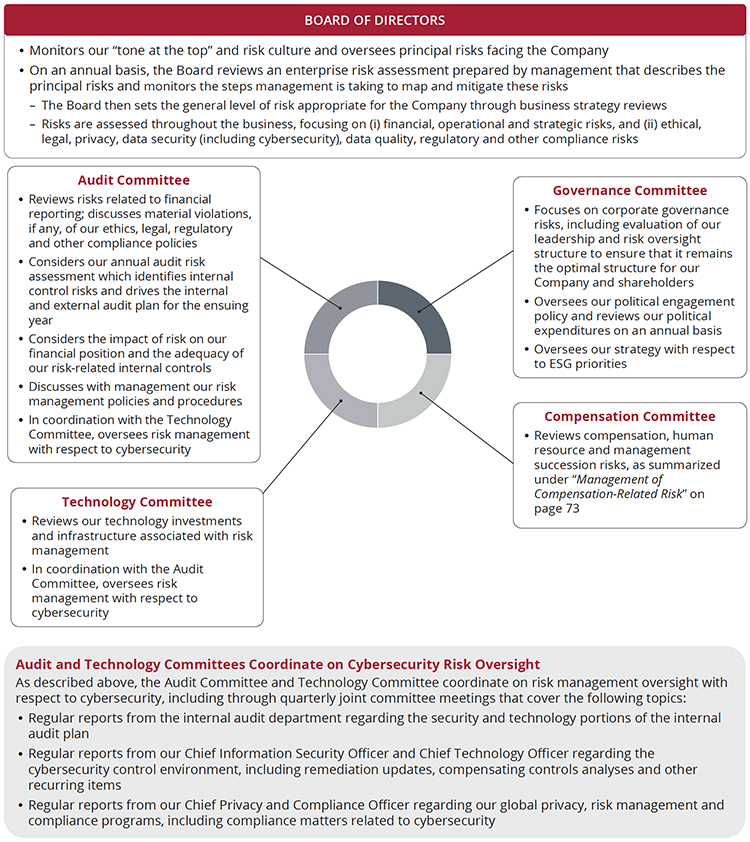

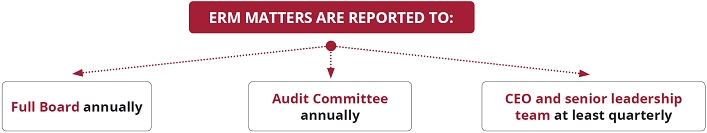

| Board Oversight of Risk | • Our Board oversees risk management at the Company and exercises direct oversight of strategic risks to the Company and other risk areas not delegated to one of its committees • Our Governance Committee has oversight authority of our strategy with respect to ESG priorities • Our Audit Committee reviews our policies related to enterprise risk assessment and risk management • Our Audit Committee and Technology Committee jointly oversee risk management with respect to cybersecurity |

| Board Oversight of Political Contributions and Lobbying Activities | • Our Governance Committee has oversight authority regarding Company political activity (including corporate political expenditures) pursuant to our political engagement policy • Our political engagement policy prohibits the Company from making political contributions with corporate funds |

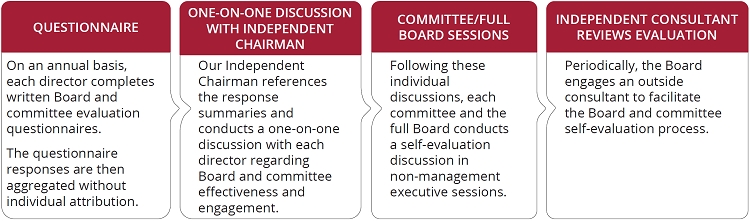

| Annual Self-Evaluation | • We have a rigorous annual Board and committee self-evaluation process, which presents the opportunity to examine the Board’s effectiveness and identify areas for improvement • The Board periodically engages an independent consultant to facilitate its annual Board and committee self-evaluation process |

| Director Orientation and Continuing Education | • Upon joining our Board, directors participate in an orientation program regarding our Company, including business operations, strategy, regulatory compliance, cybersecurity, governance and company policies • The Board also conducts periodic visits to our key facilities and Board members participate in crisis management simulations and/or training with management |

23

We have identified environmental, social and governance (“ESG”) priorities that are aligned with our corporate strategy:

By aligning our ESG priorities with our corporate strategy, we remain focused on the areas of most relevance for our business, which drives the creation of shareholder value while at the same time positioning our company for long-term sustainability. Highlights of our ESG initiatives and related business strategies are described below. Additional information on our ESG journey can be found on our website at www.equifax.com/ESG.

24

| ESG Priority Spotlight: Financial Inclusion |

At Equifax, we recognize that positive economic change starts with a single financial opportunity. Our company purpose is to help people live their financial best and Equifax strives to create economically healthy individuals and financially inclusive communities in each of the 24 countries where we do business.

Financial inclusion is at our core and Equifax is committed to helping people and small businesses to access useful and affordable financial products and services that meet their needs – including payments, savings, credit, insurance and government benefits – delivered in a responsible and sustainable way. We are committed to furthering our investments and business actions to support financial inclusion, including through the initiatives described below.

25

All members of our Board are elected to serve until the next annual meeting of shareholders and until their successors have been elected and qualified. The 10 nominees for election listed in Proposal 1 have consented to being named in this Proxy Statement and to serve if elected. All director nominees attended 75% or more of the aggregate of the meetings of the Board and of the committees of the Board on which such directors served during 2022. The Company does not have a policy about directors’ attendance at the annual meeting of shareholders, but directors are encouraged to attend. All of the directors then serving attended the 2022 Annual Meeting.

Our director nominees have a variety of backgrounds, which reflects the Board’s continuing objective to achieve a diversity of perspective, experience, gender, age, race and ethnicity. As more fully discussed below under “Director Membership Criteria,” director nominees are considered on the basis of a range of criteria, including their business knowledge and background, reputation and global business perspective. They must also have demonstrated experience and ability that is relevant to the Board’s oversight role with respect to Company business and affairs. Biographical information for each of the nominees is set forth below beginning on page 28.

THE BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF OUR DIRECTOR NOMINEES.

When the need to fill a new Board seat or vacancy arises, the Governance Committee proceeds in the manner it deems appropriate to identify a qualified candidate or candidates. Candidates may be identified through the engagement of an outside search firm, recommendations from independent directors, the Chairman of the Board, management or other advisors to the Company, and recommendations by shareholders. The Governance Committee Chair and Chairman of the Board are provided with copies of the resumes for any potential candidates so identified and review them as appropriate with the Governance Committee, our CEO and the full Board.

Our Governance Committee determines the selection criteria and qualifications for director nominees. As set forth in our Governance Guidelines, these criteria include, among other things, a director candidate’s integrity and ethical standards, independence from management, an ability to provide sound and informed judgment, a history of achievement that reflects superior standards and willingness to commit sufficient time. Cybersecurity is one of the skills that the Governance Committee specifically considers in its assessment of Board membership criteria. With respect to the four most recent additions to the Board, the Governance Committee was also very focused on expertise in corporate strategy development, risk management, data and analytics, financial technology, HR Services and corporate governance.

Although the Committee does not have a formal diversity policy for Board membership, it considers whether a director nominee contributes or will contribute to the Board in a way that can enhance the perspective and experience of the Board as a whole through, among other things, diversity in gender, age, race and ethnicity. When current Board members are considered for nomination for re-election, the Committee also takes into consideration their prior Board contributions, performance and meeting attendance records. The effectiveness of the Board’s skills, expertise and background, including its diversity, is also considered as part of the Board’s annual self-assessment.

Directors are limited to service on three other public company boards, not including our Board. Audit Committee members may not serve on the audit committee of more than three public companies absent a Board determination that such service will not impair the ability of such member to serve effectively on our Audit Committee. In addition, when our CEO is a member of our Board, he or she may not serve on more than two other public company boards.

See “Questions and Answers about the Annual Meeting” beginning on page 125 for information on the procedures for shareholders to recommend director nominees for consideration by the Governance Committee.

26

The Board matrix below summarizes certain of the key skills, experience, qualifications and attributes that our director nominees bring to the Board to enable the effective oversight of our Company and execution of our business strategy. This matrix highlights the depth and breadth of the skills and experience of our director nominees. Additional details regarding each director nominee’s skills, experience and background are set forth in the individual biographies that follow.

| Begor | Feidler | Fichuk | Hough | Marcus | McGregor | McKinley | Smith | Tillman | Wilson | |||||||||||

| Skills and Experience | ||||||||||||||||||||

| Accounting |  |

|

|

|

|

|

||||||||||||||

| Consumer Marketing |  |

|

|

|

| |||||||||||||||

| Corporate Governance |  |

|

|

|

|

|

||||||||||||||

| Cybersecurity |  |

|

|

|

||||||||||||||||

| Data & Analytics |  |

|

|

| ||||||||||||||||

| Equifax Industry Knowledge |  |

|

|

|

|

| ||||||||||||||

| Executive Leadership & Business | ||||||||||||||||||||

| Operations |  |

|

|

|

|

|

|

|

|

| ||||||||||

| CEO Experience |  |

|

|

|

|

|

| |||||||||||||

| CFO Experience |  |

|

|

|||||||||||||||||

| International Business |  |

|

|

|

|

|

|

|

| |||||||||||

| Legal/Regulatory |  |

|

|

|

||||||||||||||||

| Mergers & Acquisitions |  |

|

|

|

|

|

|

|

|

|||||||||||

| Risk Management |  |

|

|

|

|

|

|

|

| |||||||||||

| Strategy Development |  |

|

|

|

|

|

|

|

|

| ||||||||||

| Technology |  |

|

|

| ||||||||||||||||

| Background | ||||||||||||||||||||

| Tenure/Age/Gender | ||||||||||||||||||||

| Tenure (years) | 5 | 16 | 0 | 6 | 9 | 5 | 14 | 2 | 2 | 4 | ||||||||||

| Age | 64 | 66 | 57 | 68 | 57 | 66 | 65 | 54 | 58 | 51 | ||||||||||

| Gender (Male or Female) | M | M | F | M | M | M | M | F | F | F | ||||||||||

| Race and Ethnicity | ||||||||||||||||||||

| Hispanic or Latino | ||||||||||||||||||||

| Black or African American |  |

|||||||||||||||||||

| White |  |

|

|

|

|

|

|

|

| |||||||||||

| Asian | ||||||||||||||||||||

| American Indian or Alaska Native | ||||||||||||||||||||

| Native Hawaiian or Pacific Islander | ||||||||||||||||||||

27

| Mark W. Begor | Chief Executive Officer | |

Director since 2018 Age 64

|

Mr. Begor has served as our Chief Executive Officer and as a director since April 2018. Prior to joining Equifax, Mr. Begor was a Managing Director in the Industrial and Business Services group at Warburg Pincus, a global private equity investment firm, since June 2016. Prior to Warburg Pincus, Mr. Begor spent 35 years at General Electric Company (“GE”), a global industrial and financial services company, in a variety of operating and financial roles. During his career at GE, Mr. Begor served in a variety of roles leading multibillion dollar units of the company, including President and CEO of GE Energy Management from 2014 to 2016, President and CEO of GE Capital Real Estate from 2011 to 2014, and President and CEO of GE Capital Retail Finance (Synchrony Financial) from 2002 to 2011. Mr. Begor served on the Fair Isaac Corporation (FICO) board of directors from 2016 to 2018. Other Public Directorships • NCR Corporation

Overview of Board Qualifications The Board believes that it is important to have the Company’s Chief Executive Officer also serve as a director. The Board values Mr. Begor’s broad depth of leadership experience, including 35 years at General Electric, and his proven track record of transforming, growing and strengthening businesses. | |

| Mark L. Feidler | Independent Chairman of the Board | |

Director since 2007 Age 66 INDEPENDENT Committees: • Compensation • Governance (Chair) |

Founding Partner of MSouth Equity Partners, a private equity firm based in Atlanta, since February 2007. Mr. Feidler was President and Chief Operating Officer and a director of BellSouth Corporation, a telecommunications company, from 2005 until January 2007. Mr. Feidler served as its Chief Staff Officer during 2004. From 2001 through 2003, Mr. Feidler was Chief Operating Officer of Cingular Wireless and served on the Board of Directors of Cingular from 2005 until January 2007.

Other Public Directorships • New York Life Insurance Company

Overview of Board Qualifications Mr. Feidler has extensive operating, financial, legal and regulatory experience through his prior position with a major regional telecommunications company, as well as expertise in private equity investments and acquisitions. This background is relevant to us as we market our products to companies in telecommunications and other vertical markets, while his private equity experience is relevant to our new product development, marketing and acquisition strategies. His public company operating experience and background in financial, accounting, technology and risk management are important resources for our Board. | |

| Audrey Boone Tillman | ||

Director since 2021 Age 58 INDEPENDENT Committees: • Governance |

Executive Vice President and General Counsel of Aflac Incorporated, the largest U.S. provider of supplemental insurance, since 2014. Ms. Tillman joined Aflac in 1996 and has held positions of increasing significance, including serving as Senior Vice President of Human Resources. Prior to joining Aflac, she was an associate with Smith, Helms, Mulliss and Moore and an associate professor at the North Carolina Central University School of Law. Ms. Tillman has received numerous awards and accolades during her career. Most recently, she was named to Black Enterprise magazine’s Most Powerful Women in Business list for the third consecutive year and Women’s Inc.’s Top Corporate Counsel list in 2019. In 2020, she was awarded the Meritorious Public Service Medal by the Department of the United States Army.

Overview of Board Qualifications Ms. Tillman has a broad legal and business background, involvement in business strategy and operations, as well as a depth of experience in human resources, risk management, compliance and government relations. The Board believes she is a strong business leader who brings deep knowledge in corporate governance, gained over decades of significant experience in the legal and human resources fields. | |

28

| Heather H. Wilson | ||

Director since 2019 Age 51 INDEPENDENT Committees: • Audit • Technology |

Chief Executive Officer of CLARA Analytics, Inc., a provider of artificial intelligence technology in the commercial insurance industry, since June 2021. Prior to that, she served as Chief Data Scientist of L Brands, Inc., an American fashion retailer, from 2016 to 2020. From 2012 to 2016, Ms. Wilson served as chief data officer at American International Group, Inc. From 2010 to 2012, she was chief data officer of Citigroup and Global Head of Decision Sciences. Prior thereto, Ms. Wilson was global head of innovation and advanced technology at Kaiser Permanente from 2007 to 2010. Ms. Wilson has also been a steady supporter of diversity throughout her career, launching the Kaiser Permanente Women in Technology group, serving as an executive member of Citi4Women at Citigroup, founding the Global Women in Technology at AIG and acting as executive sponsor of Girls Who Code. She currently serves on the Audit Committee of Shenandoah University.

Overview of Board Qualifications The Board highly values Ms. Wilson’s technology experience, executive leadership and expertise in analytics, data science and artificial intelligence. Her technological insight, particularly her deep knowledge of data science and its impact on business transformation across several industries, is of tremendous value to our company, our Board and our customers as we seek to leverage our cloud data and technology transformation to implement our business imperatives. | |

| John A. McKinley | ||

Director since 2008 Age 65 INDEPENDENT Committees: • Audit • Technology (Chair) |

Founder of Great Falls Ventures, a venture capital firm based in Washington, D.C., since April 2007. He was Chief Technology Officer of News Corporation from July 2010 to September 2012. He was President, AOL Technologies and Chief Technology Officer from 2003 to 2005 and President, AOL Digital Services from 2004 to 2006. Prior thereto, he served as Executive President, Head of Global Technology and Services and Chief Technology Officer for Merrill Lynch & Co., Inc., from 1998 to 2003; Chief Information and Technology Officer for GE Capital Corporation from 1995 to 1998; and Partner, Financial Services Technology Practice, for Ernst & Young International from 1982 to 1995.

Overview of Board Qualifications The Board highly values Mr. McKinley’s extensive background in managing complex global technology operations as chief technology officer at a number of leading global companies. This experience is particularly important as we seek to leverage our cloud data and technology transformation to accelerate innovation and new product development. These skills are also highly relevant to the Board’s oversight of risks and opportunities in our technology operations, including data and cybersecurity, risk management and capital investments. The Board also values his technology and industry experience gained from his 12 years as a partner in Ernst & Young’s financial services technology practice, as well as his cybersecurity expertise and his entrepreneurial insights. | |

| Karen L. Fichuk | ||

Director since 2023 Age 57 INDEPENDENT

|

Former Chief Executive Officer of Randstad North America from 2019 until 2023. Prior to joining Randstad North America in 2019, Ms. Fichuk spent more than 25 years with Nielsen Holdings PLC, a global information services leader, where she held various positions, including President, Developed Markets, Executive Vice President of Commercial Go To Market and Global Managing Director for Kraft and Mondelez, among other positions. Ms. Fichuk also has significant nonprofit experience, including serving as a trustee for the United States Council for International Business and sitting on the Global Leadership Council of the Colorado State University College of Business.

Overview of Board Qualifications The Board highly values Ms. Fichuk’s three decades of growth-oriented leadership and her global data and analytics expertise, which will benefit Equifax as we execute against our strategic priorities and work to complete our Equifax Cloud transformation worldwide. In addition, the Board believes Ms. Fichuk’s experience in human resources services will benefit the Board in its oversight of continued growth in the Company’s Workforce Solutions business unit. | |

29

| Melissa D. Smith | ||

Director since 2020 Age 54 INDEPENDENT Committees: • Compensation • Governance |

Chair and Chief Executive Officer of WEX Inc., a global leader in financial technology solutions. Ms. Smith has served as Chief Executive Officer since 2014 and Board Chair since 2019. She joined WEX in 1997 and held several senior leadership positions across different aspects of the business prior to her appointment as Chief Executive Officer, including serving as Chief Financial Officer for ten years. Before joining WEX, Ms. Smith started her career at Ernst & Young LLP. Ms. Smith also has a history of extensive nonprofit work and currently serves on the MaineHealth board of trustees.

Other Public Directorships • WEX Inc.

Overview of Board Qualifications The Board believes Ms. Smith’s strategic vision and broad-based executive leadership experience in the financial technology solutions industry will benefit Equifax as we develop and execute on our long-term strategic business priorities. The Board also values Ms. Smith’s experience in driving business growth, as evidenced by the fact that WEX’s annual revenue has increased from $800 million to $2.4 billion during her tenure as CEO. The Board views this experience as particularly valuable as Equifax leverages its cloud investments to drive innovation and accelerate growth. | |

| Robert D. Marcus | ||

Director since 2013 Age 57 INDEPENDENT Committees: • Compensation (Chair) • Governance |

Former Chairman and Chief Executive Officer of Time Warner Cable Inc., a provider of video, high-speed data and voice services, from January 2014 until the company was acquired by Charter Communications in May 2016. He was named a director of Time Warner Cable Inc. in July 2013 and served as President and Chief Operating Officer from 2010 to 2013. Prior thereto, he was Senior Executive Vice President and Chief Financial Officer from January 2008 and Senior Executive Vice President from August 2005. Mr. Marcus joined Time Warner Cable Inc. from Time Warner Inc. where he held various senior positions from 1998. From 1990 to 1997, he practiced law at Paul, Weiss, Rifkind, Wharton & Garrison. Mr. Marcus is an Executive Partner at XN LP, a New York-based investment firm. He serves on the Board of Directors of Newhouse Broadcasting Co. as well as the boards of several non-profit organizations, including New Alternatives for Children, Uncommon Schools, Newark Academy and Saint Barnabas Medical Center.

Overview of Board Qualifications Mr. Marcus has extensive operating, financial, legal and regulatory experience through his position as Chairman and CEO of Time Warner Cable, as well as expertise in mergers and acquisitions. This background is relevant to us as we market our products to data and telecommunications companies and other vertical markets. His public company operating and finance experience and background in executive compensation, legal and regulatory matters are an important resource for our Board. | |

| Scott A. McGregor | ||

Director since 2017 Age 66 INDEPENDENT Committees: • Audit • Technology |

Former President, Chief Executive Officer and Director of Broadcom Corporation, a world leader in wireless connectivity, broadband and networking infrastructure. Mr. McGregor served in those positions from 2005 until the company was acquired by Avago in 2016. From 2016 to 2017, Mr. McGregor served on the board of directors of Xactly Corporation. Mr. McGregor served on the board of directors of Ingram Micro, Inc. from 2010 to 2016. From 2001 to 2005, Mr. McGregor served as President and Chief Executive Officer of the Philips Semiconductors division of Royal Philips Electronics. Prior thereto, Mr. McGregor was head of Philips Semiconductors’ Emerging Business unit from 1998.

Other Public Directorships • Applied Materials, Inc.

Overview of Board Qualifications Mr. McGregor has extensive executive management, cybersecurity, information technology and risk management experience gained in over ten years as President and Chief Executive Officer of Broadcom and in senior positions at Royal Philips Electronics. This experience is particularly important to us as we seek to leverage our cloud data and technology transformation for growth and maintain our intense focus on data security. | |

30

| G. Thomas Hough | ||

|

Director since 2016 Age 68 INDEPENDENT Committees: • Audit (Chair) |

Retired Americas Vice Chair of Ernst & Young LLP, an international public accounting firm. He was Vice Chair of Assurance Services of Ernst & Young from 2009 to July 2014, and Americas Vice Chair until his retirement in September 2014. Mr. Hough joined Ernst & Young in 1978 and became a partner in 1987. During his career at Ernst & Young, he led various teams across the firm, including serving as Vice Chair and Southeast Area Managing Partner from 2000 to 2009 and Vice Chair of Human Resources from 1996 to 2000.

Other Public Directorships • Federated Hermes Fund Family • Haverty Furniture Companies, Inc.

Overview of Board Qualifications Mr. Hough brings invaluable experience in audit, accounting, finance and corporate governance. His background in financial accounting and risk management, including executive leadership experience at a major international accounting firm, is of particular importance to our Board. | |

31

Our Board of Directors and management team are committed to achieving and maintaining high standards of corporate governance, ethics and integrity. We conduct our business in a manner that is socially responsible, values-based and in compliance with the law. We periodically review our governance policies and practices against evolving standards and make changes as appropriate. We also value the perspectives of our shareholders and other stakeholders, including our employees and the communities in which we operate.

The following sections summarize our corporate governance policies and practices including our Board leadership structure, our criteria for director selection and the responsibilities and activities of our Board and its committees. Our corporate governance documents, including our Corporate Governance Guidelines (“Governance Guidelines”), our Board committee charters and our Code of Ethics and Business Conduct applicable to directors, officers and employees, are available at www.equifax.com/about-equifax/corporate-governance, or in print upon request to Equifax Inc., Attn: Office of Corporate Secretary, P.O. Box 4081, Atlanta, Georgia 30302, telephone (404) 885-8000. The Code of Ethics and Business Conduct provides our policies and expectations on a number of topics, including our commitment to good citizenship, providing transparency in our public disclosures, prohibiting insider trading, avoiding conflicts of interest, honoring the confidentiality of sensitive information, preservation and use of Company assets, compliance with all laws and operating with integrity.

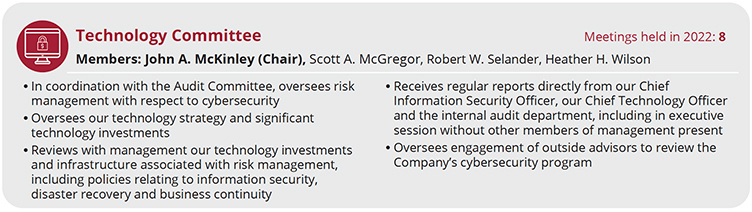

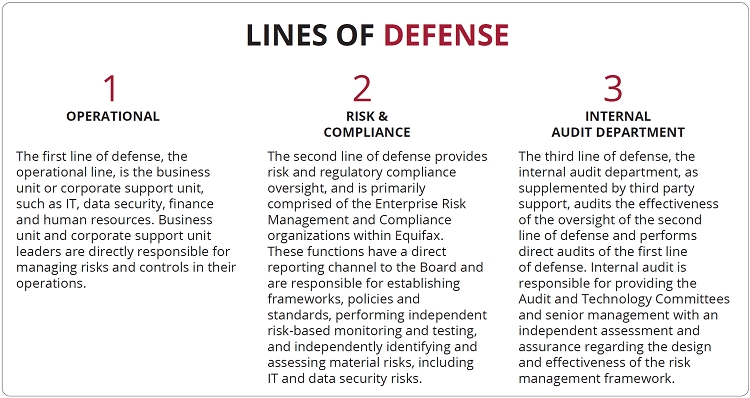

See “Corporate Governance Highlights” on page 23 for a summary of our key governance practices.