UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

EQUIFAX INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | |

|

No fee required. |

|

Fee paid previously with preliminary materials. |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

To Our Shareholders:

2021 was another strong year for Equifax as we continue to invest for the future while delivering record financial results for our shareholders. We are rapidly building a new company – a New Equifax – a faster growing, higher margin, diversified data, analytics and technology company that has expanded well beyond a traditional consumer credit bureau with a total addressable market almost three times larger than the past. We have delivered 8 consecutive quarters of strong double-digit growth and record revenue of $4.9B in 2021, which was up an impressive 19%. We made strong progress on our multi-year $1.5B cloud technology and single data fabric investment, moving over 50% of our revenue to the new Equifax Cloud. We delivered a record 151 new products last year leveraging our new Equifax Cloud for a Vitality Index of just under 9%. And, we completed a record 8 acquisitions totaling close to $3B to broaden and strengthen Equifax for the future. We have set ourselves apart in the industry by maximizing our investments leveraging the power of the new Equifax Cloud to drive record company growth and unmatched new product innovation. We are a New Equifax and we are just getting started!

|

EQUIFAX INC | 2022 PROXY STATEMENT | 2 |

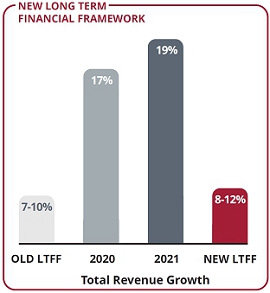

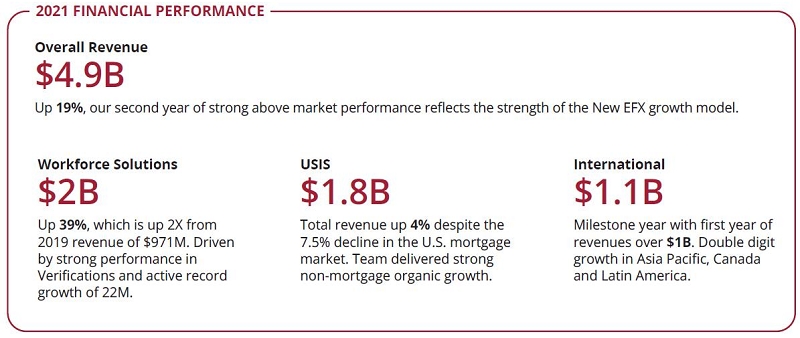

While COVID-19 continued to impact the communities where we operate, 2021 was another year of tremendous growth for Equifax. Our revenue of $4.9B was up 19%, well above our new Long Term Financial Framework growth target of 8 to 12%, reflecting the breadth and strength of the New Equifax growth model. This was a truly outstanding year, substantially stronger than we expected when we entered 2021, despite a U.S. mortgage market that was down 7.5%. We have delivered two years of above market performance with 17% growth in 2020 and 19% growth in 2021.

In 2021, we drove record growth and unprecedented results:

| • | Workforce Solutions, our fastest growing, highest margin and most valuable business, delivered another outstanding year, with revenue growing 39% over last year to surpass $2B in annual revenue! This is on top of 51% growth in 2020, demonstrating the power of its unique and fast-growing income and employment data. Workforce Solutions has grown from about 25% of our total revenue 3 years ago to over 40% in 2021 and will likely grow to over 50% of Equifax in the coming years. |

| • | U.S. Information Solutions also had a very strong year with total revenue of $1.8B. Non-mortgage revenue grew 16% and U.S. B2B mortgage revenue grew 19% despite a 7.5% decline in the mortgage market and off of over 80% revenue growth in 2020. The USIS sales team delivered record wins up 25% over last year and the new deal pipeline remains very strong. |

| • | International delivered a milestone in 2021, with their first year of revenues over $1B. As international regions began to recover from COVID lockdowns, we saw five consecutive quarters of revenue growth from Q4 2020 through Q4 2021, with an overall annual growth of 10% in local currency for 2021. |

Information regarding our Long Term Financial Framework reflects forward-looking information; actual results may differ materially from our historical experience and our present expectations or projections. See Annex B.

2021 FINANCIAL PERFORMANCE Overall Revenue $4.9B Up 19%, our second year of strong above market performance reflects the strength of the New EFX growth model. Workforce Solutions USIS International $2B $1.1B $1.1B Up 39%, which is up 2X from 2019 revenue of $971M. Driven by strong performance in Verifications and active record growth of 22M. Total revenue up 4% despite the 7.5% decline in the U.S. mortgage market. Team delivered strong non-mortgage organic growth. Milestone year with first year of revenues over $1B. Double digit growth in Asia Pacific, Canada and Latin America.

| www.equifax.com | EQUIFAX INC | 2022 PROXY STATEMENT | 3 |

In addition to this record financial performance, we continued to make tremendous progress executing the Equifax Cloud data and technology transformation. We now have about half of our revenue being delivered from the new Equifax Cloud. This will build meaningfully in 2022 as we expect to substantially complete our North America cloud migrations and move towards 80% of our revenue in the new Equifax Cloud. We have completed almost 112,000 business-to-business migrations, over 10 million consumer migrations and 1 million data contributor migrations. In North America, our principal consumer exchanges are in production on our new cloud-based single data fabric and delivering to customers. Our International transformation is also progressing and is expected to be principally completed by the end of 2023. We remain on track and confident in our plan to become the only cloud native data and analytics company.

The strength of our New Equifax is supported by our 13,000 Equifax employees in 25 countries who have anticipated and responded to changing customer needs in a new global economic normal – helping our customers navigate the evolving pandemic and connect with consumers in increasingly digital ways. A few highlights that the EFX team delivered in 2021:

| • | We have delivered 8 consecutive quarters of strong, above market double digit growth, reflecting the power of the New EFX business model and our execution against our EFX2023 strategic priorities. |

| • | We introduced the new Equifax Long Term Financial Framework, with expected total revenue growth of 8 to 12%, up from our prior Framework of 7-10% and expected margin expansion of 50 bps per year up from our prior Framework of 25 bps. This will help us deliver expected Adjusted EPS growth of 12 to 16%, which combined with our 1% dividend yield target will allow us to deliver total return to shareholders of 13 to 18% in the future. |

| • | We delivered a record 151 new products – up from 134 in 2020 and 70-90 historically – with a Vitality Index of just under 9% – our highest level since 2018. |

| • | We completed 8 strategic and accretive bolt-on acquisitions totaling almost $3B. We substantially strengthened and broadened Workforce Solutions through the acquisition of Appriss Insights, as well as Health e(fx), HIREtech, and i2Verify. We strengthened our Identity and Fraud portfolio through the acquisition of Kount, and our USIS differentiated data assets through both the Teletrack and Kount acquisitions. |

| • | The Work Number® reached 136 million active records, an increase of 19%, or 22 million records, from a year ago, and included 105 million unique individuals, which is almost 70% of U.S. non-farm payroll. We are now receiving records every pay period from 2.5 million companies, up from 1 million at the beginning 2021. |

| • | USIS is leading the industry in offering a flexible structure for Buy Now Pay Later companies to report customer credit data onto the Equifax U.S. credit exchange, which will provide Equifax customers and partners the flexibility to include the fast growth BNPL data in credit decisioning or to exclude it, based on their specific needs. |

| • | We announced an expansion of our global footprint for Workforce Solutions with the launch of our new U.K. income and employment verification platform. This adds to our existing Australia, Canada and India WS business launches. |

Workforce Solutions: Our fastest growing, highest margin, and most valuable business

Workforce Solutions continues to deliver outstanding performance, and is clearly our strongest, fastest growing, highest margin and most valuable business. It now delivers over 40% of Equifax revenue, up from 25% a short three years ago and will likely grow to over 50% of Equifax in the coming years. 2021 growth of 39% is well above the 13-15% long-term framework for Workforce Solutions and on top of 51% growth in 2020 which is highly accretive to Equifax’s overall revenue growth rate. Workforce Solutions is delivering these strong top-line results with EBITDA margins of 55% which are industry leading and over 2000 bps above Equifax’s average margin rate. At the end of 2021, The Work Number reached 136 million active records, an increase of 19%, or 22 million records from a year ago, and included 105 million unique individuals, which is almost 70% of U.S. non-farm payroll. We are now receiving records every pay period from 2.5 million companies, up from 1 million when we started 2021 and 27,000 contributors a short two-plus years ago. Our lens is expanding beyond U.S. non-farm payroll to include the 40-50 million gig and self-employed workers and 20-30 million pensioners that will allow Workforce Solutions to significantly increase its data set. Beyond the 136 million active records, we have over 535 million total records that give us the ability to deliver historical income and employment data solutions to many markets.

In recent years, the business has expanded its lens beyond verification of income and employment for financial services and FinTech solutions including mortgage, auto, personal loans, and credit cards into new verticals including Employer Services, Talent Solutions, and Government markets. In 2021, half of Workforce Solutions revenue was in these faster growing verticals outside our traditional financial services markets. We substantially

|

EQUIFAX INC | 2022 PROXY STATEMENT | 4 |

strengthened and broadened Workforce Solutions in 2021 through the acquisition of Appriss Insights, as well as Health e(fx), HIREtech and i2Verify. The very strong growth of The Work Number and the addition of Appriss Insights and expansion of the Workforce Solutions Data Hub, have dramatically expanded the Workforce Solutions addressable markets across Talent Solutions, Government, and Employee Services including Onboarding, as well as their core Mortgage and Financial Service markets. Our ability to access these markets with our unique and still expanding employment, income and talent based data and services will allow Workforce Solutions to continue to deliver above market core growth and power Equifax in the future.

Global Impact and ESG Priorities

As the needs of customers and consumers have changed worldwide, Equifax remains committed to our Purpose of helping people live their financial best.

In 2021, we introduced innovative solutions around the world to tackle the challenge of financial inclusion and help bring more mainstream financial services opportunities to unbanked and underbanked individuals. As part of this commitment, we introduced the industry’s first and only U.S. credit report in Spanish available online or via mail. This vital service that ‘Only Equifax’ provides will help 62 million Spanish speakers in the U.S. better understand their credit profiles, so that they are empowered to move forward in all aspects of their financial journey – another step that demonstrates our commitment to financial inclusion and ensuring greater access to credit.

We also have a big commitment to expanding access to credit that aligns with our Purpose of helping people live their financial best. We strive to create economically healthy individuals and communities everywhere we do business and we play a critical role in people’s lives by helping them apply for a job or mortgage, finance their education or buy a car. We have invested heavily in new data sets to enable access to credit for the over 60 million U.S. consumers who are either un- or under-banked and are forced to access higher cost financial products. Utilizing our unique data assets including The Work Number income and employment data, NCTUE cell phone and utility payment data, rental payment data, and our 80 million alternative payment data records from our DataX and Teletrack acquisitions, we can help convert an unbanked or thin credit file consumer to a scorable consumer or help them improve their financial profile to allow them to enter the lower cost formal financial services market.

We are also committed to maintaining and enhancing the accuracy of our data and credit reports. We continue to invest to make it easier for consumers to access their credit reports including extending free access to credit reports through 2022 as U.S. consumers manage the COVID pandemic. Beyond that, we are investing in new technology to make it easier for consumers to address errors on their credit reports including new on-line processes and alerts.

We also continue to recognize that data, analytics and technology is a powerful force in addressing pressing issues facing the world around us. Last year, we accelerated our commitment to Environmental, Social and Governance (ESG) priorities, announcing a market-leading sustainability commitment to net-zero greenhouse gas emissions by 2040 enabled by the Equifax Cloud. Our move to the Equifax Cloud is expected to propel the company on its journey to net-zero by significantly reducing the footprint of on-site technology and data centers and leveraging the enhanced energy efficiency of our cloud service providers.

We further committed to making quantitative ESG diversity disclosures available annually in accordance with the Sustainability Accounting Standards Board (SASB) framework, and we are one of the first in our industry to publicly disclose our Equal Employment Opportunity (EEO-1) and SASB diversity reports. We are committed to nurturing a culture where diverse talent thrives. In 2021, 77% of the Equifax senior leadership team was diverse, 38% of Equifax global senior leadership identified as female, and women comprised 44% of the Equifax global workforce. During that same time period, 41% of Equifax U.S. employees identified with diverse racial and ethnic groups.

Beginning in 2022, in support of the expansion of these ESG commitments, all members of our Global Leadership Team will include an ESG goal as part of their performance objectives. We recognize that this is just a start. There is more to do and we are committed to transparency in our journey.

WORKFORCE DIVERSITY 77% Global senior leadership is diverse 38% Global senior leadership are women 44% Global workforce are women 41% U.S. employees are racially or ethnically diverse

|

EQUIFAX INC | 2022 PROXY STATEMENT | 5 |

EFX2023: Our Foundation

Our compass for the future lies in our EFX2023 strategy, which builds upon our EFX2020 priorities. Executing these priorities, including our industry leading data and technology Cloud transformation, will lead to stronger revenue growth, faster margin expansion and higher cash flow to allow us to continue to invest in Equifax for growth, complete bolt-on acquisitions, and return cash directly to shareholders. Our EFX2023 imperatives reflect our strategic shift from an era of building, investing, and transforming to one of leveraging our massive cloud investments for innovation, new products, and accelerated growth. With our new Equifax Cloud foundation in place, we are Leveraging the Equifax Cloud for Innovation, New Products and Growth through these priorities, which provide a foundation for our ongoing performance.

|

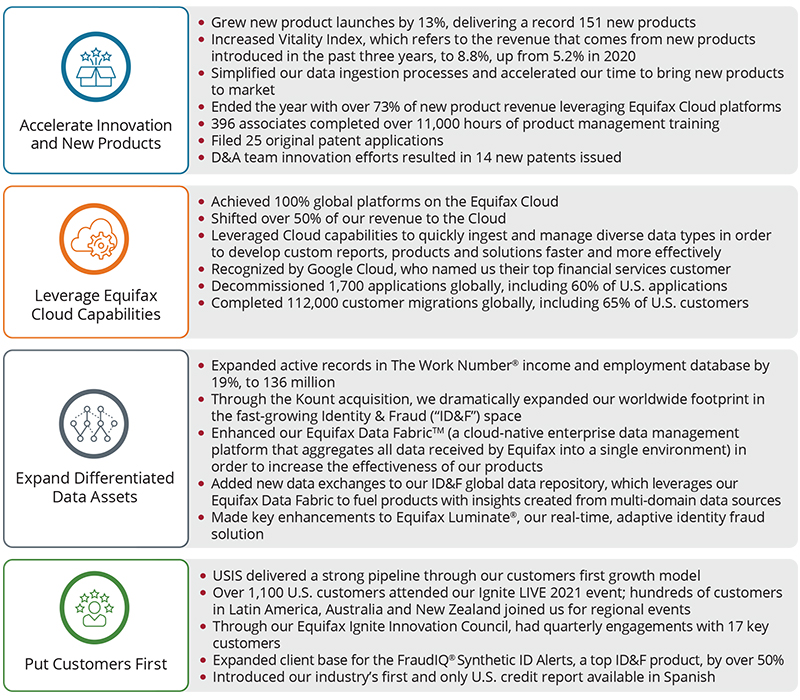

Accelerate Innovation and New Products |

New products are a long-term driver of top-line growth for the New Equifax. In 2021, we delivered a record 151 new products – up from 134 in 2020 and nearly twice the number of solutions developed historically. Not only did we speed our time to market by 45% over the last 24 months, we achieved a Vitality Index – which refers to the revenue that comes from new products introduced in the past 3 years – of just under 9%. This was stronger than our 8% Vitality Index expectations when we started in 2021 and the highest level we have achieved since 2018.

The New Equifax launches products at a volume over 60% higher than in our pre-Transformation era. But, it’s not just

about launching new products. We have redesigned how our product teams operate to ideate, develop and bring products to market and to ensure that those new products meet rapidly-evolving market needs. Our enhancements are generating a far more efficient pipeline to convert ideas into products that drive value for customers. We’re focused on ensuring strong revenue growth and strengthening our Vitality Index. And, we’ll continue to drive a balance between multi-generational product lines for customers who want evergreen products that grow with them, alongside net-new product launches each year – all leveraging the unified data from the Equifax Cloud. Our

|

EQUIFAX INC | 2022 PROXY STATEMENT | 6 |

new solutions help our customers grow and drive our top and bottom line.

The Equifax Cloud and our common data fabric gives us the ability to ingest and manage diverse data types and then develop custom reports through Equifax One and custom scores using Equifax decisioning much more easily, which substantially accelerates our time to market. As we move through 2022, you will see this capability further accelerate our New Product Innovation (NPI) based revenue growth. Leveraging our new Equifax Cloud capabilities to drive new product roll-outs, we expect to deliver a Vitality Index in 2022 of over 10%, which equates to over $500 million of revenue in 2022 from new products introduced in the past three years.

|

Leverage Equifax Cloud Capabilities |

We spent the past three years building the Equifax Cloud and now we are in the early days of leveraging our new and uniquely Equifax cloud-based technology and single data fabric capabilities. As we move into 2022 and beyond, we will increasingly realize the top-line, cost, and cash benefits from these new ‘Only Equifax’ cloud capabilities.

Our EFX Cloud strategy called for us to transform first in the U.S. with International as a fast follow and we’ve executed against that plan. The result? In 2021, over 50% of Equifax revenue was delivered from the new EFX Cloud – and we expect this to build meaningfully in 2022 to 80% of our global revenue as we move towards becoming the only cloud native company in our space.

Our innovative thinking, technical excellence and transformation execution has been recognized by Google Cloud, who named us as their top financial services customer in 2021. That’s a testament to our best-in-class use of cloud technology and our tenacity in implementation.

| • | In 2021 we completed almost 112,000 business-to-business migrations, 10 million consumer migrations, and 1 million data contributor migrations. |

| • | Our global platform capabilities are now live on 7 Google Cloud regions around the world and we have closed 12 data centers – reducing 1,000 metric tons of carbon emissions. |

| • | In North America, our principal consumer exchanges are in production on our common data fabric, and delivering to customers. We expect to be substantially complete with our North American cloud transformation by the end of 2022. |

| • | Our International transformation is also progressing and is expected to be principally completed by the end of 2023, with some migrations continuing in 2024. |

| • | And, we’ve reduced over 1,200 duplicative products globally. |

These business actions bring substantial energy and resource savings and are strong indicators of how we will deliver in a more nimble and efficient way as we move forward. A great example of this is our launch of the Workforce Solutions Verification Exchange in Australia, Canada, India, and the U.K. Similar to how The Work Number service operates in the U.S., Verification Exchange helps increase access, reduce fraud, support compliance, and mitigate risk throughout the verification process using automated systems designed in accordance with a country’s regulatory framework. Our single data fabric completely changes our approach to data management and revolutionizes the products that we can provide as well as the speed with which we can develop them. With the Equifax Cloud, we can build something once and then deploy it in any of our 25 markets quickly, with market specific customizations that require very little engineering. This speeds our delivery timelines dramatically, while also lowering the costs to our customers.

We remain on track in our plan to move from half of Equifax in the new Equifax Cloud to close to 80% by the end of 2022 as we move towards becoming the only cloud native data, analytics and technology company in our space. We remain confident that the Equifax Cloud will differentiate us commercially, expand our NPI capabilities, accelerate our top line growth, and expand our margins from the growth and cost savings in 2022 and beyond.

| Our EFX2023 imperatives reflect our strategic shift from an era of building, investing, and transforming to one of leveraging our massive cloud investments for innovation, new products, and accelerated growth. |

| www.equifax.com | EQUIFAX INC | 2022 PROXY STATEMENT | 7 |

|

Expand Differentiated Data Assets |

The New Equifax is a holistic transformation of how we work, including our operating models and structures, to maximize the benefits of our differentiated data assets and the Equifax Cloud to accelerate growth and new product innovation for our customers around the world. Our cloud capabilities and data fabric are helping us deliver new products – with assets from multiple data sources – in ways we could only imagine before.

With this in mind, Bryson Koehler has assumed an expanded role of Chief Technology, Product and Data & Analytics Officer. In this new role, Bryson will take his considerable background across all three of these critical Equifax functions – Technology, Product, and D&A – to lead heightened connectivity and positive synergies across these three critical teams.

Differentiated data that ‘Only Equifax’ can provide is at the heart of the New Equifax:

| • | The Work Number Database – 136 million active payroll records, over 500 million historic records, from more than 2 million different U.S. employers |

| • | Core Credit – more than 1.6 billion tradelines with information on 220 million+ consumers across half a billion accounts |

| • | Appriss Insights – 170 million incarceration records and 600 million court records |

| • | Exclusive Partnership with National Student Clearinghouse – 130 million degrees from 3,600 colleges and universities |

| • | DataX and Teletrack – access to 80 million unbanked, underbanked and credit rebuilding consumers –enabling greater access to credit |

| • | Partnerships for cash flow data – information on balances, deposits and withdrawals from more than 7,700 participating U.S. financial institutions – allowing access to 99% of the U.S. population |

| • | IXI – wealth information with $20 trillion in anonymized assets and investments |

| • | Kount – 32 billion unique consumer identity interactions |

| • | Equifax Commercial powered with acquisitions of PayNet and Ansonia – 134 million businesses across 161 million tradelines |

These are very unique data assets at scale – information that Only Equifax has that outperform the competition. The addition of Appriss Insights in October, educational information from the National Student Clearinghouse in August, and significant growth in The Work Number in 2021 substantially expanded the Workforce Solutions Data Hub, supporting continued customer expansion and NPIs.

One of the most impactful elements of our transformation is how we have revolutionized our approach to data management. Siloed data is a huge challenge in our industry. Equifax is now the only company in our space that has implemented a system to bring all of our enterprise data together – in every region, business unit and product line with a common key for every person, place and thing we catalog. Our global data fabric unifies more than 100 data silos into a single platform. We now have more than 250 billion records keyed and linked in a common format. This allows us to stream data on demand to our data scientists and customers and eliminates the months of labor required in the past to prepare complex data sets. As important, our single data fabric allows the rapid delivery of multi-data solutions that drives predictability and higher approval rates, lower losses, and higher performance for our customers.

|

Put Customers First |

Equifax is committed to being the most consumer-friendly credit reporting agency. In 2021, the myEquifax consumer portal surpassed 13 million users, 4 million Core Credit™ subscribers, and 600,000 paid product subscribers. We evolved this experience by launching personalized savings alerts to consumers and a new service that grants consumers on-line access to their locked or frozen credit files. We also extended the portal to Canada with the launch of monEquifax. And in January, we announced along with TransUnion and Experian that we were extending free weekly credit reports for a 3rd year as a service during the pandemic through the end of 2022.

| Our focus on putting customers first enables us to be more proactive in solving problems better and faster for customers while delivering enhanced operational readiness to provide a better customer experience. |

A Customer-First mentality for our business customers means continuously helping them to solve problems and working in partnership with them to drive their growth in a rapidly evolving economy. It also means exceeding customer expectations by delivering solutions with speed, flexibility, stability and performance.

|

EQUIFAX INC | 2022 PROXY STATEMENT | 8 |

With the Equifax Cloud and our cloud-native architecture, our customers are seeing a significant lift in speed and performance. In 2021, we reduced the complexity of our infrastructure by 50%. As a result, our mortgage platform has seen a 3,500% increase in performance for end users. And the Equifax Cloud is running at “four nines” of end-user measured availability – far better than legacy environments can achieve.

As part of our commitment to bringing businesses the insights they need to deliver convenience, flexibility and a more personalized experience to their customers, Equifax introduced a new InnovationX immersive customer collaboration experience to help fast growing FinTechs, established financial institutions and other organizations accelerate innovation in today’s competitive market. This unique testing ground for new financial services products enables organizations to validate ideas and understand new markets with ready access to real-time, cloud-native data and advanced analytics that only Equifax can provide.

Our focus on putting customers first enables us to be more proactive in solving problems better and faster for customers while delivering enhanced operational readiness to provide a better customer experience.

|

Execute Bolt-on M&A |

Reinvesting our strong cash flow in accretive and strategic bolt-on M&A is central to our EFX2023 growth strategy. 2021 marked the most active M&A phase in our company’s history – with 8 acquisitions closed totaling $2.95 billion that added $300 million to run rate revenue excluding synergies. We expect to add 1-2% of revenue growth each year from bolt-on M&A.

Our M&A priorities are clear and focused on expanding and strengthening our core, with emphasis on enhancing our strongest and fastest growing business, Workforce Solutions; adding unique data assets; expanding in the fast growing $19B Identity and Fraud space; and continuing to expand our credit bureau footprint globally.

We substantially strengthened and broadened Workforce Solutions through the acquisition of Appriss Insights, the second largest acquisition in Equifax history, for $1.825 billion. Their unique 170 million criminal justice and incarceration data is used in the hiring and social services spaces and will expand the breadth of our differentiated data sources, expand Workforce Solutions verification capabilities, enhance our identity and fraud prevention offerings, and advance our strategy for a comprehensive Workforce Solutions data hub.

We further expanded our core Employer Services capabilities with the acquisitions of Health (e)fx, HIREtech and i2Verify. Health e(fx) provides ACA compliance software solutions to employers, serving 25% of Fortune 100 and 75 companies in the Fortune 500. HIREtech offers a robust technology platform that offers businesses access to data and intelligence that helps guide important financial and hiring decisions. Bridging the gap between human resources, tax, and finance, the HIREtech capabilities will help expedite Workforce Solutions innovation. i2Verify, an income and employment verification firm focused on clients in the healthcare and education sectors, helps grow both our Employer Services and Verification Services businesses.

We also strengthened our Identity & Fraud capabilities through the acquisition of Kount, a provider of Artificial Intelligence (AI)-driven fraud prevention and digital identity solutions, for $640 million. Kount expands the Equifax worldwide footprint in digital identity and fraud prevention solutions with their 32 billion consumer interactions annually, helping businesses better engage with their customers while combating fraud. In 2022, we are integrating our Identity, Fraud and Compliance Platform groups under Brad Wiskirchen, our Kount leader, to unify and scale our Global ID&F product platform. With our cloud data & analytics capabilities and Kount’s e-commerce model, EFX is poised to capitalize on new revenue streams and retail relationships, broadening our digital identity footprint in the fast growing Identity & Fraud space.

U.S. Information Solutions differentiated data assets were also expanded through the Teletrack acquisition. Teletrack is a leading specialty CRA that provides non-traditional credit data and insights to the alternative financial services industry. The combination of Teletrack with the Equifax DataX business will create a leading U.S. specialty consumer reporting agency, with data on more than 80 million thin-file, unbanked, underbanked and credit rebuilding consumers, that can help to expand access to credit through alternative data insights.

We are focusing on integrating these acquisitions and executing our synergy and growth plans in order to leverage our new data, products, and capabilities. Leveraging our strong free cash flow to reinvest in bolt-on M&A that strengthens and broadens the core of Equifax and adds 1-2% to our long term growth rate is central to the future of Equifax.

| Leveraging our strong free cash flow to reinvest in bolt-on M&A that strengthens and broadens the core of Equifax and adds 1-2% to our long term growth rate is central to the future of Equifax. |

| www.equifax.com | EQUIFAX INC | 2022 PROXY STATEMENT | 9 |

|

Continue Leadership in Security |

As a data, analytics, and technology company, we are entrusted with sensitive consumer information, and we are committed to being a leader in data security. We are extremely proud of the incredible progress that we have made toward embedding security into everything we do – from our technology infrastructure, data fabric, and product development, to our merger and acquisition strategies, to our incentive compensation plans.

At Equifax, we firmly believe that security should not be a trade secret. We recognize that part of being an industry leader in data security is being transparent about our learnings and actively sharing the best practices that we are collecting as we work to implement change. Our security transformation has set the tone for other companies across industries, and in 2021, we introduced our inaugural Annual Security Report. Almost every aspect of our security program has been completely overhauled since 2017 and the results speak volumes. In multiple independent ratings, our security capabilities now exceed every major industry benchmark.

We remain committed to working openly with our peers, customers, and partners to tackle emerging security challenges, document best practices, provide vital data security thought leadership, and work together to deliver solutions that benefit both the security community and consumers.

The tone for our security program comes from the top, with our Equifax Board actively engaged in the oversight of our security program and every Equifax employee and Board member receiving annual security training. In addition, continuing in 2021, all bonus-eligible employees had a security performance measure included in the calculation of their annual incentive compensation – helping them to understand how they contribute to protecting our systems and treat security as a personal priority and tracking progress through a quarterly scorecard. This reinforces our culture and aligns our employees with progress against our security program goals.

Taken together – our technology… our capabilities… our expertise – it’s clear that security has become a competitive advantage for Equifax. We’re now able to meet new regulatory requirements – and quickly adapt to ever-changing cyber threats – in ways that others in our industry cannot.

| Almost every aspect of our security program has been completely overhauled since 2017 and the results speak volumes. In multiple independent ratings, our security capabilities now exceed every major industry benchmark. |

|

Act as One Team, One Equifax |

In the fourth quarter of 2021, we consolidated our Global Consumer Services operations into our Workforce Solutions, USIS, and International business units. This move aligned our direct-to-consumer and partner businesses closer to the markets in which they operate. We’ve also aligned our Breach Services business under our Chief Information Security Officer, Jamil Farshchi, to best leverage our security team’s leadership and industry knowledge.

At Equifax, we are focused on nurturing our people by providing meaningful opportunities for career advancement and development, fostering an inclusive and diverse work environment, and promoting employee engagement and recognition. We leverage our enterprise-wide talent initiatives to develop, retain and attract a highly-qualified workforce in order to promote our culture of innovation, add diverse perspectives and deliver on our business strategy.

Our teams have operated exceptionally well over the past 2 years of the COVID pandemic. We learned a lot about the positives of a flexible work environment but at our heart, we are a collaborative team whose best work happens when we are face to face. We were energized to roll-out our new EFXFlex 3/2 +2 Framework which allows for 2 hybrid days/week and 2 full hybrid work weeks/ year that combines the power of in-person collaboration with the benefits of hybrid work. In 2021, we introduced Equifax CLIMB, our new on-demand learning experience platform. More than 8,000 Equifax employees accessed the platform to complete over 271,000 courses, videos, books or audiobooks totaling nearly 23,000 learning hours, elevating both technical and professional capabilities throughout the company.

|

EQUIFAX INC | 2022 PROXY STATEMENT | 10 |

We Are Just Getting Started

We spent the last 4 years investing over $1.5 billion in the new Equifax Cloud and single data fabric, expanding our differentiated data assets, completing more than 20 acquisitions totaling $3.5 billion that strengthen and broaden Equifax, and investing in product centric resources to leverage our new Equifax Cloud. Over the last two years, we have leveraged our investments in the Equifax Cloud to deliver record revenue growth of 17% in 2020 and 19% last year. We are in the early days of leveraging our new EFX Cloud capabilities as we move from building our cloud framework to truly capitalizing on the speed and power that it brings to our competitiveness, ability to deliver new and innovative solutions, and drive above market growth.

As we move through 2022 and into 2023 and beyond, the next gear for Equifax will be to leverage our differentiated data and new Equifax Cloud native technology to enable seamless delivery of new products that will drive our top and bottom line. We expect to see continued strong and balanced, above market core growth, reflecting benefits from the strength of Workforce Solutions, the new Equifax Cloud and accelerated NPIs leveraging the Equifax Cloud. We are in the early days of leveraging our new Equifax Cloud capabilities but remain confident that they will differentiate us commercially, expand our NPI capabilities, accelerate our top line growth and expand our margins from the growth and cost savings in 2022 and beyond. Under our new Long Term Financial Framework, we expect to grow revenue 8-12% in the future while expanding our EBITDA margins by 500 bps between 2021 and 2025. This will deliver higher free cash flow to allow us to continue to invest in the future of Equifax and deliver strong shareholder returns.

On behalf of the Equifax Board, leadership team, and 13,000 associates around the globe, thank you for your support and confidence. We are energized about the future of your company. The New EFX is a faster growing, higher margin, and higher returning company ...and we are just getting started!

Thanks for your support,

|

|

| Mark W. Begor | Mark L. Feidler |

| Chief Executive Officer and Director | Independent Chairman of the Board of Directors |

| www.equifax.com | EQUIFAX INC | 2022 PROXY STATEMENT | 11 |

1550 Peachtree Street, N.W.

Atlanta, Georgia 30309

Notice of 2022 Annual Meeting of Shareholders

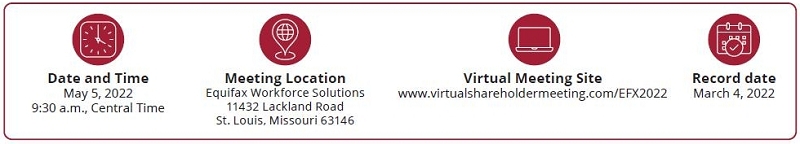

Date and Time May 5, 2022 9:30 a.m., Central Time Meeting Location Equifax Workforce Solutions 11432 Lackland Road St. Louis, Missouri 63146 Virtual Meeting Site www.virtualshareholdermeeting.com/EFX2022 Record date March 4, 2022

Agenda

| 1. | Elect the 10 director nominees named in the accompanying Proxy Statement. |

| 2. | Hold a non-binding, advisory vote on the compensation paid to the Company’s named executive officers (commonly referred to as a “say-on-pay” proposal). |

| 3. | Ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2022. |

| 4. | Consider other business properly brought before the meeting or any adjournment or postponement thereof. |

Proxies in the form furnished are being solicited by the Board of Directors of Equifax Inc. for this meeting or any adjournment or postponement thereof.

Shareholders are cordially invited to participate in the Annual Meeting by attending in person or attending virtually via our live meeting webcast. See page 93 of the Proxy Statement for more information on how to attend, participate in and vote at the Annual Meeting.

YOUR VOTE IS VERY IMPORTANT. PLEASE SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AS SOON AS POSSIBLE, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING. Most shareholders have a choice of voting over the internet, by telephone or by using a traditional proxy card. Please refer to the enclosed proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you.

Proxy materials were first made available to shareholders beginning on March 24, 2022.

By order of the Board of Directors,

Lisa M. Stockard

Assistant Secretary

March 24, 2022

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on May 5, 2022. The Notice, Proxy Statement and Annual Report are available at www.proxyvote.com.

REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS: | |||

|

|

|

|

| Via the internet Visit the website listed on your proxy card |

By telephone Call the telephone number on your proxy card |

By mail Sign, date and return your proxy card in the enclosed envelope |

Attend the meeting Attend the meeting in person or virtually and cast your vote |

|

Election to receive electronic delivery of future annual meeting materials.

You can expedite delivery and avoid costly mailings by confirming in advance your preference for electronic delivery. For further information on how to take advantage of this cost-saving service, please see page 98 of the Proxy Statement. |

| www.equifax.com | EQUIFAX INC | 2022 PROXY STATEMENT | 13 |

|

EQUIFAX INC | 2022 PROXY STATEMENT | 14 |

This summary highlights certain information contained in this Proxy Statement. This summary does not contain all of the information that you should consider, and we encourage you to read the entire Proxy Statement before voting.

|

|

|

|

| Time | Date | Meeting Location | Virtual Meeting Site |

| 9:30 a.m., Central Time | May 5, 2022 | 11432 Lackland Road St. Louis, Missouri 63146 |

www.virtualshareholdermeeting.com/EFX2022 |

| Items for Vote | Board Voting Recommendation | ||

| 1. | Election of 10 directors | FOR ALL NOMINEES | |

| 2. | Advisory vote to approve named executive officer compensation (“say-on-pay”) | FOR | |

| 3. | Ratification of appointment of Ernst & Young LLP as independent registered public accounting firm for 2022 | FOR | |

In addition, shareholders may be asked to consider any other business properly brought before the meeting or any adjournment or postponement thereof.

Voting and Admission Information

Voting. Holders of our common stock as of the record date, March 4, 2022, are entitled to notice of and to vote at our 2022 Annual Meeting. Each share of common stock outstanding on the record date is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on at our 2022 Annual Meeting. Even if you plan to attend our 2022 Annual Meeting (either in person or via meeting webcast), please cast your vote as soon as possible.

| REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS: | |||

|

|

|

|

| Via the internet Visit the website listed on your proxy card |

By telephone Call the telephone number on your proxy card |

By mail Sign, date and return your proxy card in the enclosed envelope |

Attend the meeting Attend the meeting in person or virtually and cast your vote |

Admission. Equifax shareholders as of the record date are entitled to attend the 2022 Annual Meeting. Our 2022 Annual Meeting will be held using a “hybrid” in-person and virtual format. Shareholders of record can attend the meeting in person or virtually using the meeting webcast. Please review the admission procedures in this Proxy Statement under “Questions and Answers about the Annual Meeting.”

References to our website included in this Proxy Statement are provided solely for convenience purposes. Content on our website is not, and shall not be deemed to be, part of this Proxy Statement or incorporated herein or into any of our other filings with the Securities and Exchange Commission (the “SEC”).

| www.equifax.com | EQUIFAX INC | 2022 PROXY STATEMENT | 15 |

Overview

Equifax Inc. is a global data, analytics and technology company. We provide information solutions for businesses, governments and consumers, and we provide human resources business process automation and outsourcing services for employers. Headquartered in Atlanta and supported by 13,000 employees worldwide, Equifax operates or has investments in 25 countries in North America, Central and South America, Europe and the Asia Pacific region.

2021 Performance Highlights

| $4.9B | $7.64 | 52.8% | $190M | |||

| Revenue, an increase of 19% from 2020 | Adjusted EPS*, an increase of 10% from 2020 | One-year total shareholder return, compared to 28.7% for the S&P 500 | Dividends paid to shareholders, consistent with 2020 levels |

| * | Adjusted EPS is a non-GAAP financial measure. Reconciliation of the Company’s non-GAAP financial measures to the corresponding GAAP financial measures can be found in Annex A to this Proxy Statement. |

Strategy

In February 2021, we announced the launch of EFX2023, our strategic priorities that will serve as our company-wide compass through 2023. Our EFX2023 imperatives are based on our strategic shift from an era of building, investing and transforming to one of leveraging our massive cloud investments for innovation, new products and accelerated growth.

With our Equifax Cloud foundation in place, we are Leveraging the Cloud for innovation, new products and growth through the following strategic priorities:

|

EQUIFAX INC | 2022 PROXY STATEMENT | 16 |

Our business and strategy are described in more detail in our 2021 Annual Report on Form 10-K filed with the SEC on February 24, 2022. Our 2021 progress against our goals and the link to our 2021 compensation program is described under “Executive Compensation—Compensation Discussion and Analysis—Executive Summary” beginning on page 44.

Our Purpose, Vision and Values

Our work is guided by our purpose, our vision and our shared values.

|

Our purpose is helping people live their financial best.

Our vision is to be the trusted global leader in data, advanced analytics, and technology that creates innovative solutions and insights that help customers drive growth and move people forward. |

Our values define who we are and how we will act to fully realize and sustain our business strategy. They are a step forward to further align our behaviors and expectations with where our business is now—and where we are going. They are:

Who We Are | |

|

• Be leaders in security and trusted data stewards • Lead with integrity and be personally accountable • Hold high standards in all our markets around the world |

|

• Deliver results and play to win • Drive excellent execution • Have a sense of urgency, agility, and grit |

|

• Be intellectually curious and insights driven • Optimize our data and technology to sustain market and product leadership • Drive scalable, profitable growth |

|

• Exceed our customers’ expectations every day • Deliver value and quality to our customers so we grow together • Aspire to be our customers’ first call |

|

• Work together as one aligned global team • Assume best intentions from each other • Foster optimism and have fun together |

|

• Take initiative to develop ourselves and help others grow • Value diversity of experience and thought • Proudly show our Equifax spirit at work and in our communities |

| www.equifax.com | EQUIFAX INC | 2022 PROXY STATEMENT | 17 |

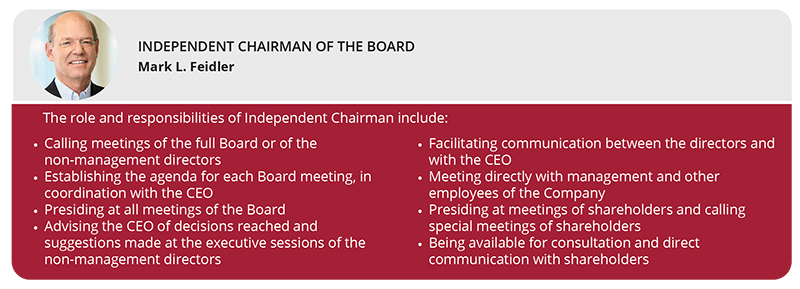

Board Leadership Structure

| • | Our independent Board structure includes separate positions for our Chairman and CEO |

| • | Mark Feidler serves as Independent Chairman of the Board and Mark Begor serves as our CEO |

Board Composition and Refreshment

53% conducted investor outreach meetings with shareholders representing 53% of our shares

| • | Following our 2021 Annual Meeting, members of management, together with our Independent Chairman for certain conversations, conducted investor outreach meetings with shareholders representing approximately 53% of our shares |

| • | During these one-on-one meetings, we discussed our business strategy and governance-related topics, including board composition, ESG initiatives, cybersecurity, human capital management, the environment and executive compensation. |

| (see page 30 for an overview of our shareholder engagement program) | |

| • | Investors provided constructive feedback regarding our 2021 executive compensation program (see page 47 for a discussion of our shareholder engagement in the context of our compensation program) |

| • | Investors also provided constructive feedback regarding our ESG priorities (see page 22 for an overview of ESG-related shareholder feedback) |

| • | Following these engagements, we continued our long-standing process of sharing feedback received with our Board |

|

EQUIFAX INC | 2022 PROXY STATEMENT | 18 |

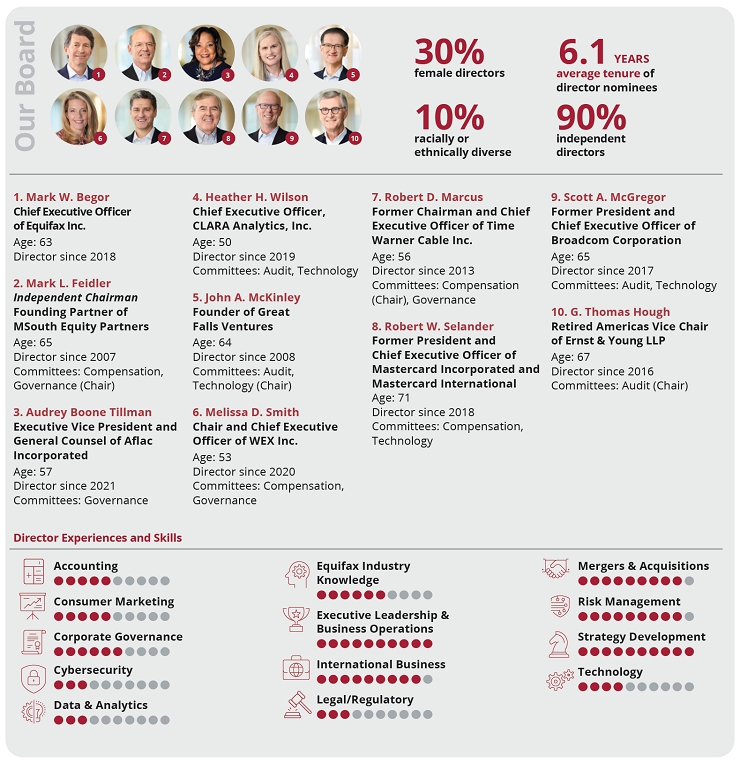

Our Board recommends that you vote FOR each of the director nominees named below for terms that expire at the 2023 Annual Meeting. The following table provides summary information about each nominee, and you can find additional information under “Proposal 1, Election of Director Nominees” on page 24.

| www.equifax.com | EQUIFAX INC | 2022 PROXY STATEMENT | 19 |

CORPORATE GOVERNANCE HIGHLIGHTS

| Independent Board | • 9 of our 10 director nominees are independent |

| Board Refreshment |

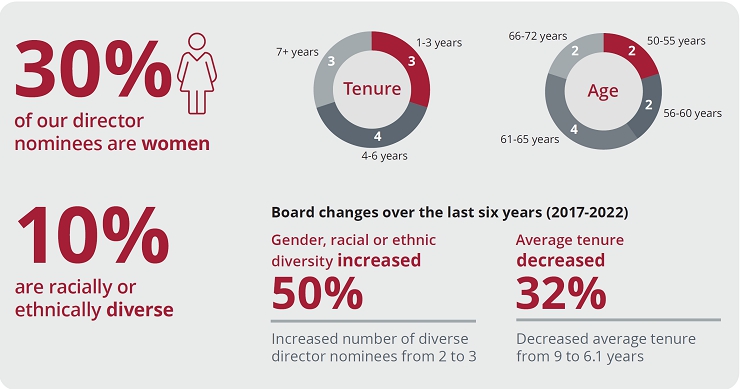

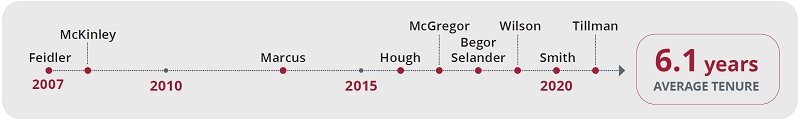

• The Governance Committee has implemented a succession plan to identify highly-qualified and diverse director candidates taking into account scheduled retirements • Since 2017, the Board has appointed five new independent directors with expertise and skill sets in executive leadership, corporate strategy, cybersecurity, technology, data and analytics, risk management and corporate governance, while also enhancing the gender and racial diversity of the Board • The Board periodically engages an independent consultant to facilitate its annual Board and committee self-evaluation process • The Governance Committee will continue its ongoing succession planning in 2022 to identify highly-qualified and diverse director candidates to succeed Bob Selander upon his scheduled retirement in May 2023 • Upon election of the Board’s nominees at the 2022 Annual Meeting, the average director tenure will be 6.1 years |

| Board Diversity | • 30% of our director nominees are women and 10% of our director nominees are racially or ethnically diverse |

| Independent Board Chairman | • We have separated the roles of CEO and Chairman, with Mark Feidler serving as Independent Chairman of the Board |

| Annual Board Leadership Evaluation and Succession Planning |

• The Board annually reviews the leadership structure to determine whether a combined Chairman and CEO role or separate roles is in the best interests of shareholders • The Board annually evaluates the CEO’s performance and conducts a rigorous review and assessment of the succession planning process for the CEO and other top officers |

| Annual Director Election | • Each director is elected on an annual basis |

| Limits on Outside Board Service |

• Outside directors are limited to service on three other public company boards • Our CEO is limited to two other public company boards |

| Director and Executive Stock Ownership |

• Each independent director is required to own Equifax common stock with a market value of at least five times his or her annual cash retainer. New directors have five years to achieve the ownership requirements • Our CEO and our other senior executive officers are required to own Equifax common stock with a market value of at least six and three times their base salary, respectively, within five years of assuming their respective positions |

| Rigorous Trading Policy and Protocols |

• We have implemented risk escalation processes to support rapid escalation and internal notification of potentially significant events, such as a potential security incident, including the impact of such events on our decision of whether to halt trading under our insider trading policy – Senior leadership team members and their direct reports are subject to trade pre-clearance requirements; a broader group of employees is subject to quarterly open trading windows – Our trading policy and risk escalation notification procedures are designed to ensure that those with decision-making authority on trading restrictions and pre-clearance requests have notice of any potential security incident • Our insider trading policy prohibits our directors, officers and employees from owning financial instruments or participating in investment strategies that hedge the economic risk of owning Equifax stock • We prohibit directors, officers and other employees from pledging Equifax securities as collateral for loans (including margin loans) • Our insider trading policy prohibits our CEO and other senior executives from purchasing or selling Equifax securities except pursuant to an approved Rule 10b5-1 trading plan |

| Proxy Access Bylaws | • Our Bylaws include a proxy access provision that allows shareholders meeting certain requirements to nominate directors and have such nominees included in the proxy statement |

| No “Poison Pill” | • We do not have a stockholder rights plan, or “poison pill,” in place |

| Board Oversight of Political Contributions and Lobbying Activities |

• Our Governance Committee has oversight authority regarding Company political activity (including corporate political expenditures) pursuant to our political engagement policy • We disclose aggregate annual political contributions made directly by the Company with corporate funds on our website • Our political engagement policy specifically addresses lobbying activities and our Governance Committee’s oversight of such activities |

|

EQUIFAX INC | 2022 PROXY STATEMENT | 20 |

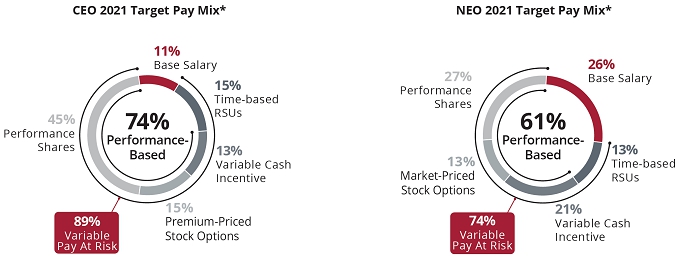

Executive Compensation Philosophy

| • | The Compensation Committee is responsible for the Company’s executive compensation policies and plans. |

| • | The Committee works to ensure that incentives are performance-based and aligned with shareholders’ interests, while guarding against metrics or goals that create inappropriate or excessive risk reasonably likely to have an adverse effect on the Company. |

| • | The Committee has designed and regularly reviews our compensation program to ensure we are providing competitive pay opportunities to attract and retain executive talent. |

2021 Compensation Decisions

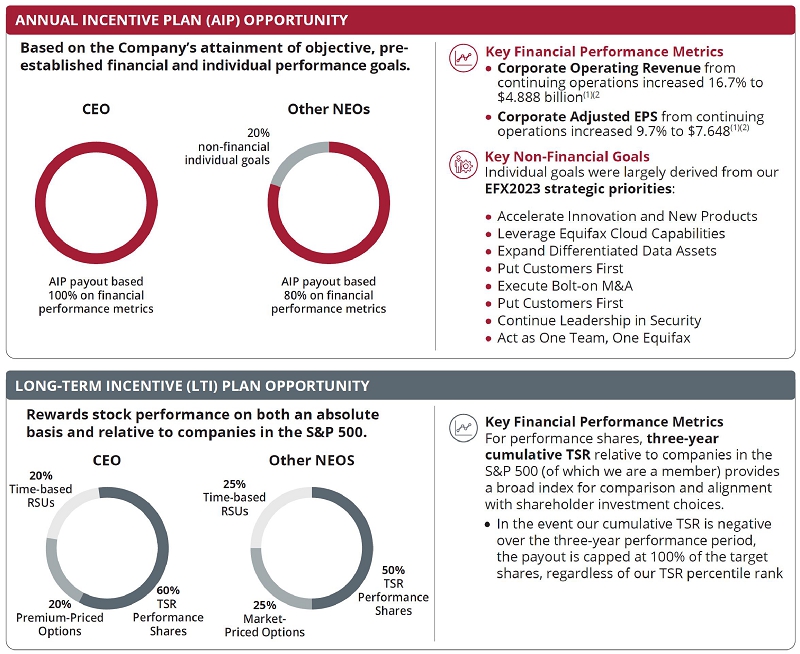

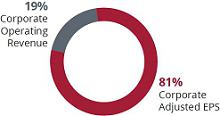

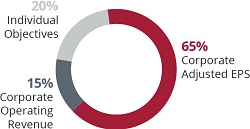

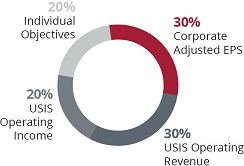

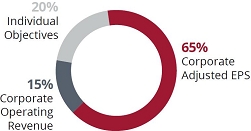

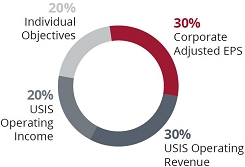

For the 2021 fiscal year, the Committee thoughtfully evaluated the compensation program structure in light of the ongoing evolution of our business strategy and shareholder feedback, when making decisions regarding the program. After evaluation, the Compensation Committee took certain actions with respect to our short- and long-term incentive programs for 2021, as summarized below and described in further detail under “Analysis of 2021 Compensation Decisions” beginning on page 51:

| Began including technology transformation costs in Adjusted EPS, a key AIP metric (see page 52) |

• Decided to no longer exclude technology transformation costs when calculating Adjusted EPS, one of the two key financial metrics under the AIP |

| Retained

Cybersecurity Metric in

AIP (see page 54) |

• Since 2018, cybersecurity has been a performance measure under our AIP • In view of our continued progress in strengthening our security program, the Committee moved cybersecurity from a single company-wide AIP performance metric to a required component of the non-financial goals that comprised up to 20% of the 2021 AIP opportunity for all bonus-eligible employees (including our NEOs) |

| Approved an increased target AIP award for our CEO that is based entirely on financial goals (see pages 54-55) |

• In connection with the extension of our CEO’s employment agreement, approved an increased target AIP award for our CEO based exclusively on achievement measured against Company financial goals (previously 80% financial goals and 20% individual objectives) |

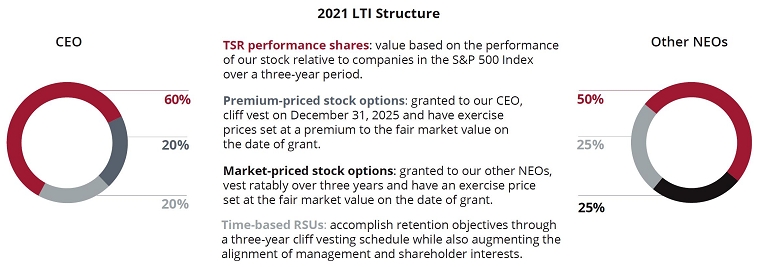

| Increased the performance-based elements of our CEO’s LTI awards (see page 58) |

• In connection with the extension of our CEO’s employment agreement, approved an LTI award mix for our CEO consisting of TSR performance shares (weighted 60%), premium-priced stock options (weighted 20%) and time-based RSUs (weighted 20%) • The portion of our CEO’s long-term incentives subject to substantive performance elements increased to 80% under the 2021 LTIP, compared to 75% under his 2020 LTIP award and 50% under his original employment agreement |

Compensation Best Practices

|

Independent Compensation Committee advised by independent compensation consultant |

|

Performance-oriented pay philosophy, as evidenced by a target pay mix for our CEO and other NEOs that is predominantly performance-based (see page 47) |

|

Capped annual and long-term performance-based awards |

|

Executive change in control severance plan provides flexibility to determine severance payments for our executive officers as the Committee deems appropriate |

|

Double-trigger change in control cash severance benefits and vesting of equity awards |

|

No income tax gross-ups other than for certain relocation or foreign tax expenses |

|

Compensation clawback policy contains financial and reputational harm standard, including in supervisory capacity |

|

Meaningful share ownership requirements for senior executives |

|

Anti-hedging and -pledging policy for directors, officers and other employees |

|

Senior executives cannot purchase or sell Equifax securities except pursuant to a Rule 10b5-1 trading plan with robust requirements, reflecting governance best practices |

|

No re-pricing of underwater stock options |

| www.equifax.com | EQUIFAX INC | 2022 PROXY STATEMENT | 21 |

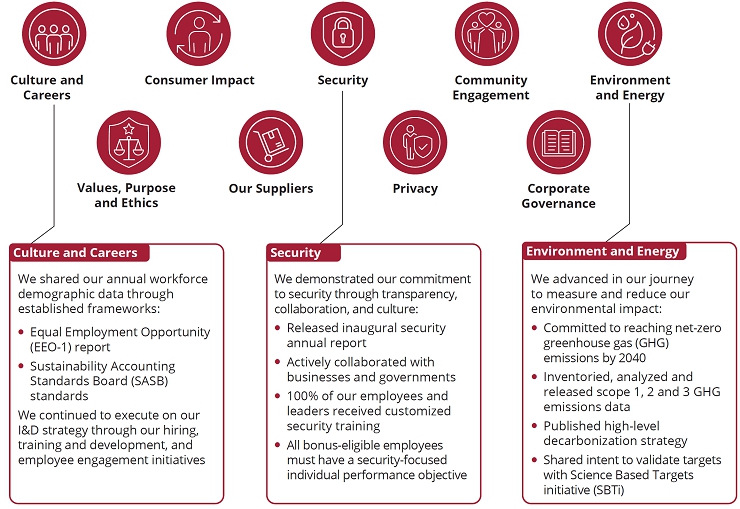

We accelerated our commitment to Environmental, Social and Governance (ESG) priorities in 2021. Our expanded ESG initiatives and disclosures underscore our commitment to ongoing transparency and accountability. Below are a few highlights of our enhanced ESG initiatives, a full description of which is available on our website at www.equifax.com/ESG:

Shareholder Feedback on ESG

Through direct engagement, our Board and management team have gathered valuable feedback regarding our shareholders’ key ESG focus areas. During recent one-on-one meetings, our investors praised the strong progress we have made on our ESG journey, and continued to provide constructive feedback on our ESG priorities, as well as other topics including business strategy and executive compensation.

Investor engagement plays an important role in shaping our ESG strategy. Our ESG progress highlighted in this section, including our SASB, EEO-1 and Task Force on Climate-related Financial Disclosures (TCFD), incorporates feedback received from our shareholders.

ESG-related topics discussed with our investors since May 2021 Environment Governance Security Consumer Impact Human Capital

ESG-related topics discussed with our investors since May 2021 Environment Governance Security Consumer Impact Human Capital

|

EQUIFAX INC | 2022 PROXY STATEMENT | 22 |

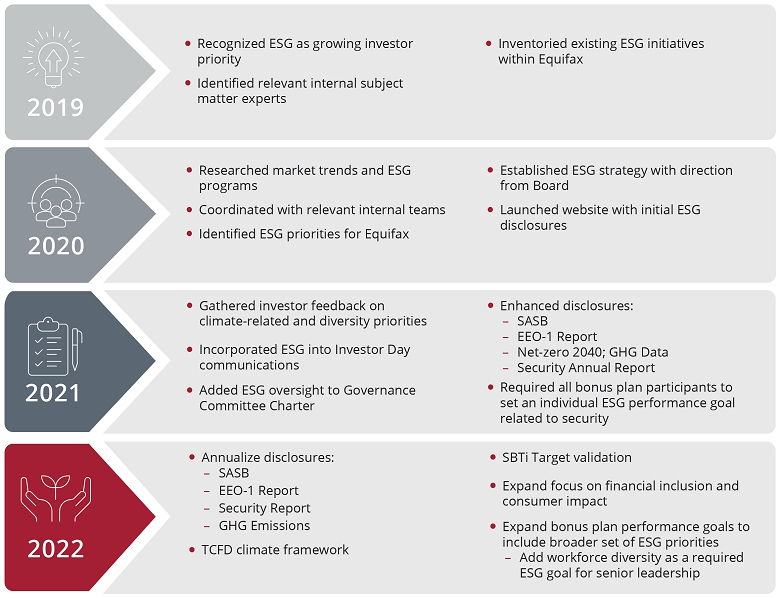

Advancing Our ESG Journey

As highlighted on the prior page, 2021 was a key milestone year in our ESG journey, as we made several meaningful initial quantitative disclosures and committed to reaching net-zero greenhouse gas emissions by 2040. This sustainability pledge is enabled by our Equifax Cloud™ transformation, which is expected to propel the company on its journey to net-zero by significantly reducing the footprint of our on-site technology and data centers while leveraging the enhanced energy efficiency of our cloud service providers. Our significant investment in cloud technology exemplifies the alignment between our business strategy and our ESG priorities.

We are energized about our enhanced ESG disclosures and recognize

that a strong ESG strategy is imperative to creating a more inclusive global economy and sustainable company. Our ESG journey continues

to evolve and mature as shown in the timeline below and on our website. We are dedicated to communicating with our employees, communities,

customers and investors transparently and encourage you to follow our journey through the regular updates available on our ESG

website.

| www.equifax.com | EQUIFAX INC | 2022 PROXY STATEMENT | 23 |

All members of our Board are elected to serve until the next annual meeting of shareholders and until their successors have been elected and qualified. The 10 nominees for election listed below have consented to being named in this Proxy Statement and to serve if elected. All director nominees attended 75% or more of the aggregate of the meetings of the Board and of the committees of the Board on which such directors served during 2021. The Company does not have a policy about directors’ attendance at the annual meeting of shareholders, but directors are encouraged to attend. All of the directors then serving attended the 2021 Annual Meeting.

Our director nominees have a variety of backgrounds, which reflects the Board’s continuing objective to achieve a diversity of perspective, experience, gender, age, race and ethnicity. As more fully discussed below under “Director Membership Criteria,” director nominees are considered on the basis of a range of criteria, including their business knowledge and background, reputation and global business perspective. They must also have demonstrated experience and ability that is relevant to the Board’s oversight role with respect to Company business and affairs. Biographical information for each of the nominees is set forth below beginning on page 26.

THE BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF OUR DIRECTOR NOMINEES.

Director Membership Criteria

When the need to fill a new Board seat or vacancy arises, the Governance Committee proceeds in the manner it deems appropriate to identify a qualified candidate or candidates. Candidates may be identified through the engagement of an outside search firm, recommendations from independent directors, the Chairman of the Board, management or other advisors to the Company, and recommendations by shareholders. The Governance Committee Chair and Chairman of the Board are provided with copies of the resumes for any potential candidates so identified and review them as appropriate with the Governance Committee, our CEO and the full Board.

Our Governance Committee determines the selection criteria and qualifications for director nominees. As set forth in our Governance Guidelines, these criteria include, among other things, a director candidate’s integrity and ethical standards, independence from management, an ability to provide sound and informed judgment, a history of achievement that reflects superior standards and willingness to commit sufficient time. Cybersecurity is one of the skills that the Governance Committee specifically considers in its assessment of Board membership criteria. With respect to the three most recent additions to the Board, the Governance Committee was also very focused on expertise in corporate strategy development, risk management, data and analytics, information technology and corporate governance.

Although the Committee does not have a formal diversity policy for Board membership, it considers whether a director nominee contributes or will contribute to the Board in a way that can enhance the perspective and experience of the Board as a whole through, among other things, diversity in gender, age, race, ethnicity and professional experience. When current Board members are considered for nomination for re-election, the Committee also takes into consideration their prior Board contributions, performance and meeting attendance records. The effectiveness of the Board’s skills, expertise and background, including its diversity, is also considered as part of the Board’s annual self-assessment.

Directors are limited to service on three other public company boards, not including our Board. Audit Committee members may not serve on the audit committee of more than three public companies absent a Board determination that such service will not impair the ability of such member to serve effectively on our Audit Committee. In addition, when our CEO is a member of our Board, he or she may not serve on more than two other public company boards.

|

EQUIFAX INC | 2022 PROXY STATEMENT | 24 |

See “Questions and Answers about the Annual Meeting” beginning on page 93 for information on the procedures for shareholders to recommend director nominees for consideration by the Governance Committee.

Board Matrix

The Board matrix below summarizes certain of the key skills, experience, qualifications and attributes that our director nominees bring to the Board to enable the effective oversight of our Company and execution of our business strategy. This matrix highlights the depth and breadth of the skills and experience of our director nominees. Additional details regarding each director nominee’s skills, experience and background are set forth in the individual biographies that follow.

| Begor | Feidler | Hough | Marcus | McGregor | McKinley | Selander | Smith | Tillman | Wilson | |||||||||||

| Skills and Experience | ||||||||||||||||||||

| Accounting |  |

|

|

|

|

|||||||||||||||

| Consumer Marketing |  |

|

|

|

| |||||||||||||||

| Corporate Governance |  |

|

|

|

|

|

||||||||||||||

| Cybersecurity |  |

|

|

|||||||||||||||||

| Data & Analytics |  |

|

| |||||||||||||||||

| Equifax Industry Knowledge |  |

|

|

|

|

| ||||||||||||||

| Executive Leadership & Business | ||||||||||||||||||||

| Operations |  |

|

|

|

|

|

|

|

|

| ||||||||||

| CEO Experience |  |

|

|

|

|

|

| |||||||||||||

| CFO Experience |  |

|

|

|||||||||||||||||

| International Business |  |

|

|

|

|

|

|

|

| |||||||||||

| Legal/Regulatory |  |

|

|

|||||||||||||||||

| Mergers & Acquisitions |  |

|

|

|

|

|

|

|

|

|||||||||||

| Risk Management |  |

|

|

|

|

|

|

|

| |||||||||||

| Strategy Development |  |

|

|

|

|

|

|

|

|

| ||||||||||

| Technology |  |

|

|

| ||||||||||||||||

| Background | ||||||||||||||||||||

| Tenure/Age/Gender | ||||||||||||||||||||

| Tenure (years) | 4 | 15 | 5 | 8 | 4 | 13 | 4 | 1 | 1 | 3 | ||||||||||

| Age | 63 | 65 | 67 | 56 | 65 | 64 | 71 | 53 | 57 | 50 | ||||||||||

| Gender (Male or Female) | M | M | M | M | M | M | M | F | F | F | ||||||||||

| Race and Ethnicity | ||||||||||||||||||||

| Hispanic or Latino | ||||||||||||||||||||

| Black or African American |  |

|||||||||||||||||||

| White |  |

|

|

|

|

|

|

|

| |||||||||||

| Asian | ||||||||||||||||||||

| American Indian or Alaska Native | ||||||||||||||||||||

| Native Hawaiian or Pacific Islander | ||||||||||||||||||||

| www.equifax.com | EQUIFAX INC | 2022 PROXY STATEMENT | 25 |

| Mark W. Begor | Chief Executive Officer |

Director since 2018

Age 63 |

Mr. Begor has served as our Chief Executive Officer and as a director since April 2018. Prior to joining Equifax, Mr. Begor was a Managing Director in the Industrial and Business Services group at Warburg Pincus, a global private equity investment firm, since June 2016. Prior to Warburg Pincus, Mr. Begor spent 35 years at General Electric Company (“GE”), a global industrial and financial services company, in a variety of operating and financial roles. During his career at GE, Mr. Begor served in a variety of roles leading multibillion dollar units of the company, including President and CEO of GE Energy Management from 2014 to 2016, President and CEO of GE Capital Real Estate from 2011 to 2014, and President and CEO of GE Capital Retail Finance (Synchrony Financial) from 2002 to 2011. Mr. Begor served on the Fair Isaac Corporation (FICO) board of directors from 2016 to 2018.

Other Public Directorships • NCR Corporation (Lead Independent Director)

|

Overview of Board Qualifications The Board believes that it is important to have the Company’s Chief Executive Officer also serve as a director. The Board values Mr. Begor’s broad depth of leadership experience, including 35 years at General Electric, and his proven track record of transforming, growing and strengthening businesses.

|

| Mark L. Feidler | Independent Chairman of the Board |

Director since 2007

Age 65

INDEPENDENT

Committees: • Compensation • Governance (Chair) |

Founding Partner of MSouth Equity Partners, a private equity firm based in Atlanta, since February 2007. Mr. Feidler was President and Chief Operating Officer and a director of BellSouth Corporation, a telecommunications company, from 2005 until January 2007. Mr. Feidler served as its Chief Staff Officer during 2004. From 2001 through 2003, Mr. Feidler was Chief Operating Officer of Cingular Wireless and served on the Board of Directors of Cingular from 2005 until January 2007.

Other Public Directorships • New York Life Insurance Company

|

Overview of Board Qualifications Mr. Feidler has extensive operating, financial, legal and regulatory experience through his prior position with a major regional telecommunications company, as well as expertise in private equity investments and acquisitions. This background is relevant to us as we market our products to companies in telecommunications and other vertical markets, while his private equity experience is relevant to our new product development, marketing and acquisition strategies. His public company operating experience and background in financial, accounting, technology and risk management are important resources for our Board.

|

| Audrey Boone Tillman | |

Director since 2021

Age 57

INDEPENDENT

Committees: • Governance |

Executive Vice President and General Counsel of Aflac Incorporated, the largest U.S. provider of supplemental insurance, since 2014. Ms. Tillman joined Aflac in 1996 and has held positions of increasing significance, including serving as Senior Vice President of Human Resources. Prior to joining Aflac, she was an associate with Smith, Helms, Mulliss and Moore and an associate professor at the North Carolina Central University School of Law. Ms. Tillman has received numerous awards and accolades during her career. Most recently, she was named to Black Enterprise magazine’s Most Powerful Women in Business list for the third consecutive year and Women’s Inc.’s Top Corporate Counsel list in 2019. In 2020, she was awarded the Meritorious Public Service Medal by the Department of the United States Army.

|

Overview of Board Qualifications Ms. Tillman has a broad legal and business background, involvement in business strategy and operations, as well as a depth of experience in human resources, risk management, compliance and government relations. The Board believes she is a strong business leader who brings deep knowledge in corporate governance, gained over decades of significant experience in the legal and human resources fields. Ms. Tillman is also involved in many local initiatives to improve the community in and around the Columbus, Georgia area.

| |

|

EQUIFAX INC | 2022 PROXY STATEMENT | 26 |

| Heather H. Wilson | |

Director since 2019

Age 50

INDEPENDENT

Committees: • Audit • Technology |

Chief Executive Officer of CLARA Analytics, Inc., a provider of artificial intelligence technology in the commercial insurance industry, since June 2021. Prior to that, she served as Chief Data Scientist of L Brands, Inc., an American fashion retailer, from 2016 to 2020. From 2012 to 2016, Ms. Wilson served as chief data officer at American International Group, Inc. From 2010 to 2012, she was chief data officer of Citigroup and Global Head of Decision Sciences. Prior thereto, Ms. Wilson was global head of innovation and advanced technology at Kaiser Permanente from 2007 to 2010.

|

Overview of Board Qualifications The Board highly values Ms. Wilson’s technology experience, executive leadership and expertise in analytics, data science and artificial intelligence. Her technological insight, particularly her deep knowledge of data science and its impact on business transformation across several industries, is of tremendous value to our company, our Board and our customers as we seek to leverage our cloud data and technology transformation to implement our business imperatives. Ms. Wilson has also been a steady supporter of diversity, launching the Kaiser Permanente Women in Technology group, serving as an executive member of Citi4Women at Citigroup, founding the Global Women in Technology at AIG and acting as executive sponsor of Girls Who Code.

| |

| John A. McKinley | |

Director since 2008

Age 64

INDEPENDENT

Committees: • Audit • Technology (Chair) |

Founder of Great Falls Ventures, a venture capital firm based in Washington, D.C., since April 2007. He was Chief Technology Officer of News Corporation from July 2010 to September 2012. He was President, AOL Technologies and Chief Technology Officer from 2003 to 2005 and President, AOL Digital Services from 2004 to 2006. Prior thereto, he served as Executive President, Head of Global Technology and Services and Chief Technology Officer for Merrill Lynch & Co., Inc., from 1998 to 2003; Chief Information and Technology Officer for GE Capital Corporation from 1995 to 1998; and Partner, Financial Services Technology Practice, for Ernst & Young International from 1982 to 1995.

|

Overview of Board Qualifications The Board highly values Mr. McKinley’s extensive background in managing complex global technology operations as chief technology officer at a number of leading global companies. This experience is particularly important as we seek to leverage our cloud data and technology transformation to accelerate innovation and new product development. These skills are also highly relevant to the Board’s oversight of risks and opportunities in our technology operations, including data and cybersecurity, risk management and capital investments. The Board also values his technology and industry experience gained from his 12 years as a partner in Ernst & Young’s financial services technology practice, as well as his entrepreneurial insights.

| |

| Melissa D. Smith | |

Director since 2020

Age 53

INDEPENDENT

Committees: • Compensation • Governance |

Chair and Chief Executive Officer of WEX Inc., a global payment processing and information services provider. Ms. Smith has served as Chief Executive Officer since 2014 and Board Chair since 2019. She joined WEX in 1997 and held several senior leadership positions across different aspects of the business prior to her appointment as Chief Executive Officer, including serving as Chief Financial Officer for ten years. Before joining WEX, Ms. Smith held the role of senior auditor at Ernst & Young LLP. Other Public Directorships • WEX Inc.

|

Overview of Board Qualifications The Board believes Ms. Smith’s strategic vision and broad-based executive leadership experience in the financial technology solutions industry will benefit Equifax as we continue to execute on our strategic priorities, including executing bolt-on M&A transactions and leveraging our cloud technology to drive new product innovation and growth. Ms. Smith also brings a history of involvement in extensive nonprofit work, including serving as a trustee of Maine Health and as a former board member for the Center for Grieving Children.

| |

| www.equifax.com | EQUIFAX INC | 2022 PROXY STATEMENT | 27 |

| Robert D. Marcus | |

Director since 2013

Age 56

INDEPENDENT

Committees: • Compensation (Chair) • Governance |

Former Chairman and Chief Executive Officer of Time Warner Cable Inc., a provider of video, high-speed data and voice services, from January 2014 until the company was acquired by Charter Communications in May 2016. He was named a director of Time Warner Cable Inc. in July 2013 and served as President and Chief Operating Officer from 2010 to 2013. Prior thereto, he was Senior Executive Vice President and Chief Financial Officer from January 2008 and Senior Executive Vice President from August 2005. Mr. Marcus joined Time Warner Cable Inc. from Time Warner Inc. where he held various senior positions from 1998. From 1990 to 1997, he practiced law at Paul, Weiss, Rifkind, Wharton & Garrison. Other Public Directorships • Ocean Outdoor Limited

|

Overview of Board Qualifications Mr. Marcus has extensive operating, financial, legal and regulatory experience through his position as Chairman and CEO of Time Warner Cable, as well as expertise in mergers and acquisitions. This background is relevant to us as we market our products to data and telecommunications companies and other vertical markets. His public company operating and finance experience and background in executive compensation, legal and regulatory matters are an important resource for our Board.

| |

| Robert W. Selander | |

Director since 2018

Age 71

INDEPENDENT

Committees: • Compensation • Technology |

Former President and Chief Executive Officer of Mastercard Incorporated and Mastercard International from 1997 to 2010. He joined Mastercard International Inc. in 1994, where he served as President of Mastercard’s Europe, Middle East, Africa and Canada regions until his appointment as President and Chief Executive Officer. Prior to Mastercard, he spent 20 years with Citicorp/Citibank, N.A., where he held several leadership positions including managing parts of Citibank’s Consumer Financial Services business in the United States, Brazil, Puerto Rico and the United Kingdom. Other Public Directorships • HealthEquity, Inc. (Independent Chairman)

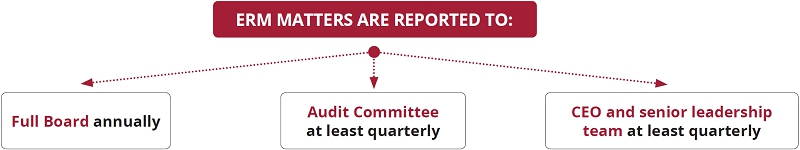

|