Filed by Equifax Inc.

(Commission File No. 001-06605)

pursuant to Rule 425 under the Securities Act of 1933, as amended

Subject Company: Boa Vista Serviços S.A.

Boa Vista Merger Presentation June, 2023

Filed by Equifax Inc.

(Commission File No. 001-06605)

pursuant to Rule 425 under the Securities Act of 1933, as amended

Subject Company: Boa Vista Serviços S.A.

Boa Vista Merger Presentation June, 2023

Legal warning The statements contained in this document related to business perspectives, including estimated operating and financial results and those related to growth perspectives of Boa Vista Servi<;os S.A. (“BVS” or “Company”) are merely forecasts and, as such, are based exclusively on the management’s beliefs and assumptions about the future of the business. These expectations depend substantially on market conditions, the performance of the Brazilian economy, the sector and the international markets and, therefore, are subject to change without prior notice. Except as otherwise indicated herein, the variations presented herein are calculated based on the numbers in thousands of reais, as well as rounding. Forward-looking considerations are not guarantees of performance. They involve risks, uncertainties and assumptions, as they refer to future events and, therefore, depend on circumstances that may or may not occur. Investors should understand that general economic conditions, industry conditions and other operating factors may affect the future results of the Company and lead to results that differ materially from those expressed in such forward-looking statements. This presentation is based on performance comments and includes accounting and non-accounting data, such as operating, financial and pro forma data and expectations of the Company’s management. The non-accounting data has not been subject to review by the Company’s independent auditors. This document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus or the required documents meeting the requirements of the applicable jurisdiction. This document is for informational purposes only and should not, under any circumstances, constitute, be construed, or understood as an investment recommendation, nor as an offer to acquire or sell any of the securities of Boa Vista. BoaVista 2 PUBLIC

Forward looking statements, no offer or solicitation, filings with the SEC Forward-Looking Statements This document contains forward-looking statements and forward-looking information about Equifax (“EFX”) and the proposed transaction. All statements that address operating performance and events or developments that EFX expects or anticipates will occur in the future, including statements relating to its ability to consummate the proposed transaction with the Company, the ability of the Company to receive shareholder approval and satisfy other closing conditions, the expected financial and operational benefits, synergies and growth from the proposed transaction and EFX’s ability to integrate the Company and its products, services, technologies, IT systems and personnel into its operations, and similar statements about its outlook and its business plans are forward-looking statements. EFX believes these forward-looking statements are reasonable as and when made. However, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from EFX’s historical experience and its present expectations or projections. These risks and uncertainties include, but are not limited to, those described in EFX’s 2022 Form 10-K and subsequent filings with the U.S. Securities and Exchange Commission (“SEC”). As a result of such risks and uncertainties, EFX urges you not to place undue reliance on any forward-looking statements. Forward-looking statements speak only as of the date when made. EFX undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. No Offer or Solicitation This document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of the U.S. Securities Act of 1933, as amended. This document is for informational purposes only and should not, under any circumstances, constitute, be interpreted or understood as an investment recommendation, nor as an offer to acquire any of the securities of EFX or Equifax do Brasil, S.A. (“EFX Brasil”). Filings with the SEC EFX and EFX Brasil filed a Registration Statement on Form S-4/F-4 with the SEC on March 6, 2023 in connection with the proposed transaction (and have filed amendments to the Registration Statement on April 13, 2023 and May 9, 2023). The Registration Statement was declared effective on May 25, 2023. The Form S-4/F-4 contains a prospectus and other documents. The Form S-4/F-4 and prospectus contain important information about EFX, EFX Brasil, Boa Vista Serviqos, the transaction and related matters. Investors and shareholders of Boa Vista Serviqos should read the prospectus and the other documents filed with the SEC in connection with the transaction carefully before they make any decision with respect to the transaction. The Form S-4/F-4 and the prospectus, and all other documents filed with the SEC in connection with the acquisition will be available when filed free of charge at the SEC’s web site at www.sec.gov. In addition, the prospectus and all other documents filed with the SEC in connection with the acquisition will be made available to investors free of charge by calling or writing to Equifax Inc., Attn: Office of Corporate Secretary, P.O. Box 4081, Atlanta, Georgia 30302, telephone (404) 885-8000.

Table of contents Executive Summary 6 Overview of Boa Vista and Equifax 7 Merger Value Proposition 10 Transaction Highlights 15 Boa Vista’s EGM 22 Final Considerations and Key Takeaways 25 4

Today’s presenters BoaVista Marcio Fabbris Monica Simao Lincoln Pereira CEO and IT Director CFO and IR Director Board Member Sunil Bindal Chief Corporate Development Officer John Gamble CFO and COO Mark Begor(1) CEO and BoD Member Notes: (1) Trevor Burns, SVP of Investor Relations - EFX, will be replacing Mark for some meetings.

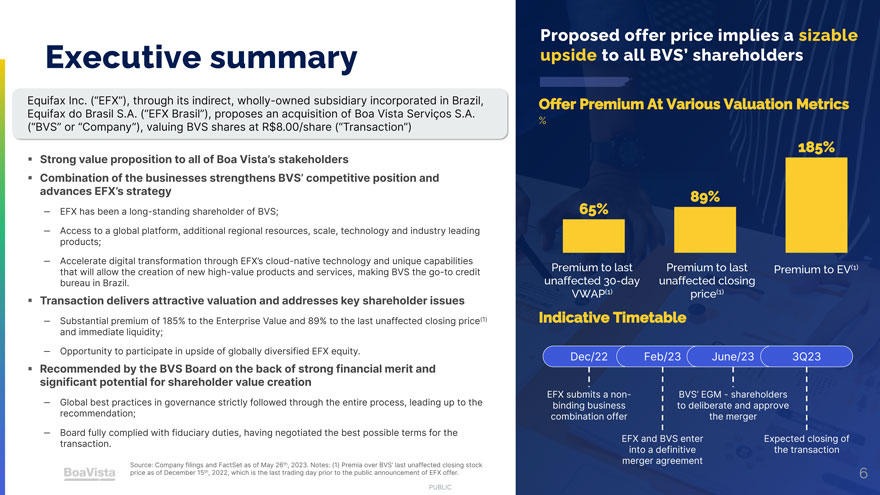

Executive summary Equifax Inc. (“EFX”), through its indirect, wholly-owned subsidiary incorporated in Brazil, Equifax do Brasil S.A. (“EFX Brasil”), proposes an acquisition of Boa Vista Serviqos S.A. (“BVS” or “Company”), valuing BVS shares at R$8.00/share (“Transaction”) Strong value proposition to all of Boa Vista’s stakeholders Combination of the businesses strengthens BVS’ competitive position and advances EFX’s strategy EFX has been a long-standing shareholder of BVS; Access to a global platform, additional regional resources, scale, technology and industry leading products; Accelerate digital transformation through EFX’s cloud-native technology and unique capabilities that will allow the creation of new high-value products and services, making BVS the go-to credit bureau in Brazil. Transaction delivers attractive valuation and addresses key shareholder issues Substantial premium of 185% to the Enterprise Value and 89% to the last unaffected closing price(1) and immediate liquidity; Opportunity to participate in upside of globally diversified EFX equity. Recommended by the BVS Board on the back of strong financial merit and significant potential for shareholder value creation Global best practices in governance strictly followed through the entire process, leading up to the recommendation; Board fully complied with fiduciary duties, having negotiated the best possible terms for the transaction. Source: Company filings and FactSet as of May 26th, 2023. Notes: (1) Premia over BVS’ last unaffected closing stock price as of December 15th, 2022, which is the last trading day prior to the public announcement of EFX offer.

OVERVIEW OF BOA VISTA AND EQUIFAX 7

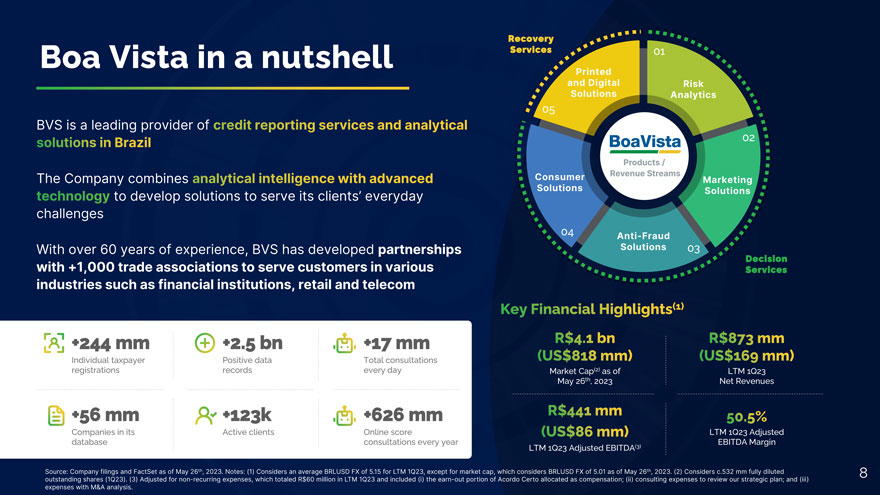

Boa Vista in a nutshell BVS is a leading provider of credit reporting services and analytical solutions in Brazil The Company combines analytical intelligence with advanced technology to develop solutions to serve its clients’ everyday challenges With over 60 years of experience, BVS has developed partnerships with +1,000 trade associations to serve customers in various industries such as financial institutions, retail and telecom Recovery Services Consumer Solutions 1 * w rAj +244 mm Individual taxpayer registrations +2.5 bn Positive data records +17 mm Total consultations every day +56 mm Companies in its database +I23k Active clients +626 mm Online score consultations every year Risk Analytics Fb oaVisI k Re Products / venue Strea ms 1 J Anti-Fraud Solutions 04 03 Key Financial Highlights*1’ R$4.i bn (US$818 mm) Market Cap(2) as of May 26th, 2023 R$441 mm (US$86 mm) LTM 1Q23 Adjusted EBITDA(3) 02 ■ Marketing ‘ Solutions ♦ ♦ ■♦ Decision Services R$873 mm (US$169 mm) LTM 1Q23 Net Revenues 50.5% LTM 1Q23 Adjusted EBITDA Margin Source: Company filings and FactSet as of May 26th, 2023. Notes: (1) Considers an average BRLUSD FX of 5.15 for LTM 1Q23, except for market cap, which considers BRLUSD FX of 5.01 as of May 26th, 2023. (2) Considers c.532 mm fully diluted outstanding shares (1Q23). (3) Adjusted for non-recurring expenses, which totaled R$60 million in LTM 1Q23 and included (i) the earn-out portion of Acordo Certo allocated as compensation; (ii) consulting expenses to review our strategic plan; and (iii) expenses with M&A analysis.

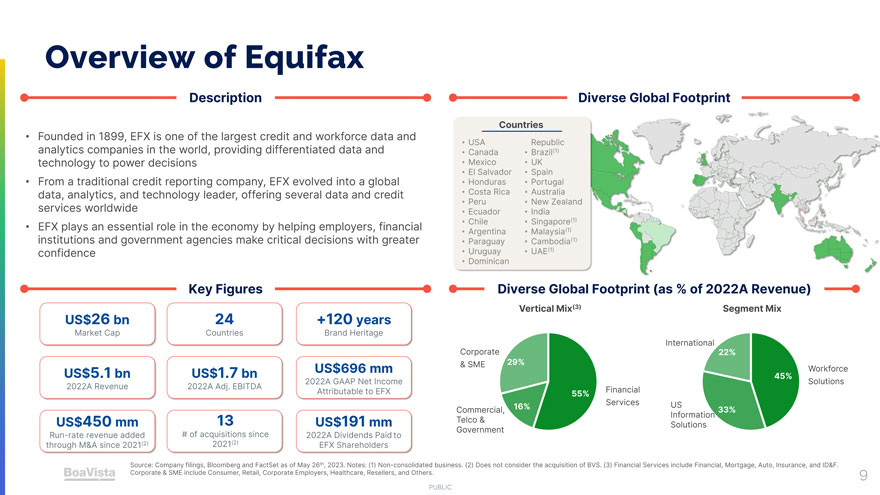

Overview of Equifax Description Diverse Global Footprint Canada Mexico El Salvador Honduras Costa Rica Peru Ecuador Argentina Founded in 1899, EFX is one of the largest credit and workforce data and analytics companies in the world, providing differentiated data and technology to power decisions From a traditional credit reporting company, EFX evolved into a global data, analytics, and technology leader, offering several data and credit services worldwide EFX plays an essential role in the economy by helping employers, financial institutions and government agencies make critical decisions with greater confidence Republic Spain New Zealand Singapore(1) Cambodia(1) Countries Key Figures US$26 bn Market Cap Diverse Global Footprint (as % of 2022A Revenue) Vertical Mix(3) +120 yars Brand Heritage . J US$5.1 bn 2022A Revenue > US$450 mm Run-rate revenue added ^through M&A since 2021(2) j US$1.7 bn 2022A Adj. EBITDA v / US$696 mm 2022A GAAP Net Income Attributable to EFX US$191 mm 2022A Dividends Paid to EFX Shareholders Segment Mix Corporate Commercial, Telco & Government International^ Financial Services Workforce Solutions Information^ Solutions Source: Company filings, Bloomberg and FactSet as of May 26th, 2023. Notes: (1) Non-consolidated business. (2) Does not consider the acquisition of BVS. (3) Financial Services include Financial, Mortgage, Auto, Insurance, and ID&F. Corporate & SME include Consumer, Retail, Corporate Employers, Healthcare, Resellers, and Others.

MERGER VALUE PROPOSITON 10

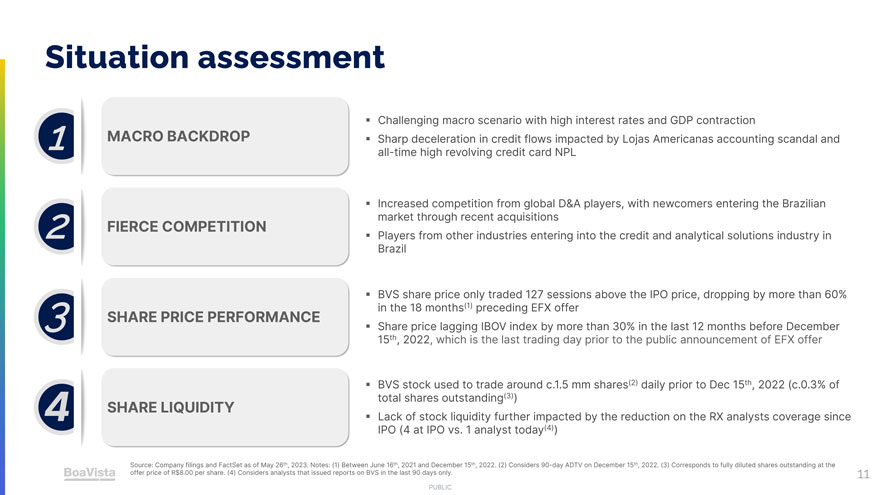

Situation assessment ■ MACRO BACKDROP■ ■ ■ ■ ■ ■ ■ Ci FIERCE COMPET T ON SHARE PR CE PERFORMANCE SHARE LIQUIDITY Challenging macro scenario with high interest rates and GDP contraction Sharp deceleration in credit flows impacted by Lojas Americanas accounting scandal and all-time high revolving credit card NPL Increased competition from global D&A players, with newcomers entering the Brazilian market through recent acquisitions Players from other industries entering into the credit and analytical solutions industry in Brazil BVS share price only traded 127 sessions above the IPO price, dropping by more than 60% in the 18 months*1* preceding EFX offer Share price lagging IBOV index by more than 30% in the last 12 months before December 15th, 2022, which is the last trading day prior to the public announcement of EFX offer BVS stock used to trade around c.1.5 mm shares(2) daily prior to Dec 15th, 2022 (c.0.3% of total shares outstanding*3*) Lack of stock liquidity further impacted by the reduction on the RX analysts coverage since IPO (4 at IPO vs. 1 analyst today*4*) Source: Company filings and FactSet as of May 26th, 2023. Notes: (1) Between June 16th, 2021 and December 15th, 2022. (2) Considers 90-day ADTV on December 15th, 2022. (3) Corresponds to fully diluted shares outstanding at the offer price of R$8.00 per share. (4) Considers analysts that issued reports on BVS in the last 90 days only.

Leverage EFX’s global capabilities to access new high-value proucts and services BVS’ Customers advancement Equifax + Boa Vista: a win for Receive a substantial premium, immediate liquidity and potential for fuure upside BVS’ ShareholderA combination between Equifax and Boa Vista benefits all stakeholders Join a global D&A company and avail opportunities for career Strengthens BVS’ competitive position and advances EFX’s strategy EFX + BV

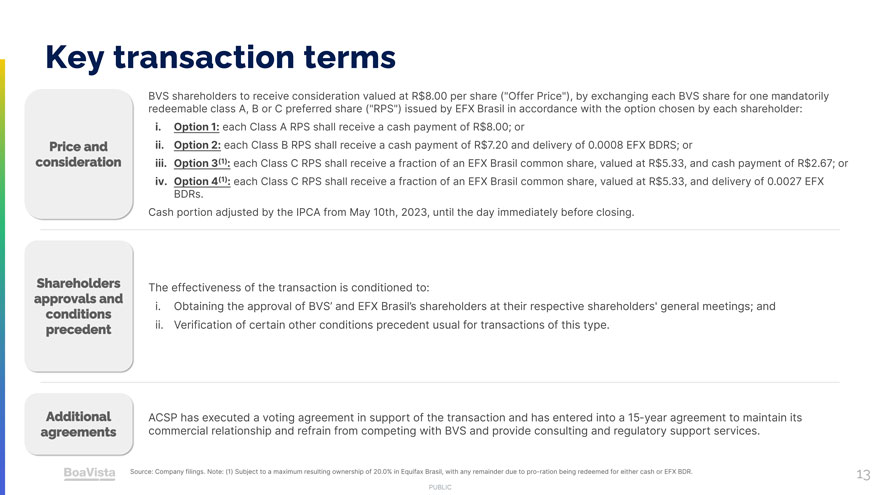

Key transaction terms BVS shareholders to receive consideration valued at R$8.00 per share (“Offer Price”), by exchanging each BVS share for one mandatorily redeemable class A, B or C preferred share (“RPS”) issued by EFX Brasil in accordance with the option chosen by each shareholder: • I. Option 1: each Class A RPS shall receive a cash payment of R$8.00; or Price and ii. Option 2: each Class B RPS shall receive a cash payment of R$7.20 and delivery of 0.0008 EFX BDRS; or consideration iii. Option 3<1l: each Class C RPS shall receive a fraction of an EFX Brasil common share, valued at R$5.33, and cash payment of R$2.67; or iv. Option 4<1l: each Class C RPS shall receive a fraction of an EFX Brasil common share, valued at R$5.33, and delivery of 0.0027 EFX BDRs. Cash portion adjusted by the IPCA from May 10th, 2023, until the day immediately before closing. Shareholders The effectiveness of the transaction is conditioned to: approvals and 1. Obtaining the approval of BVS’ and EFX Brasil’s shareholders at their respective shareholders’ general meetings; and conditions precedent ii. Verification of certain other conditions precedent usual for transactions of this type. Additional ACSP has executed a voting agreement in support of the transaction and has entered into a 15-year agreement to maintain its agreements commercial relationship and refrain from competing with BVS and provide consulting and regulatory support services. BoaVista Source: Company filings. Note: (1) Subject to a maximum resulting ownership of 20.0% in Equifax Brasil, with any remainder due to pro-ration being redeemed for either cash or EFX BDR. 13 PUBLIC

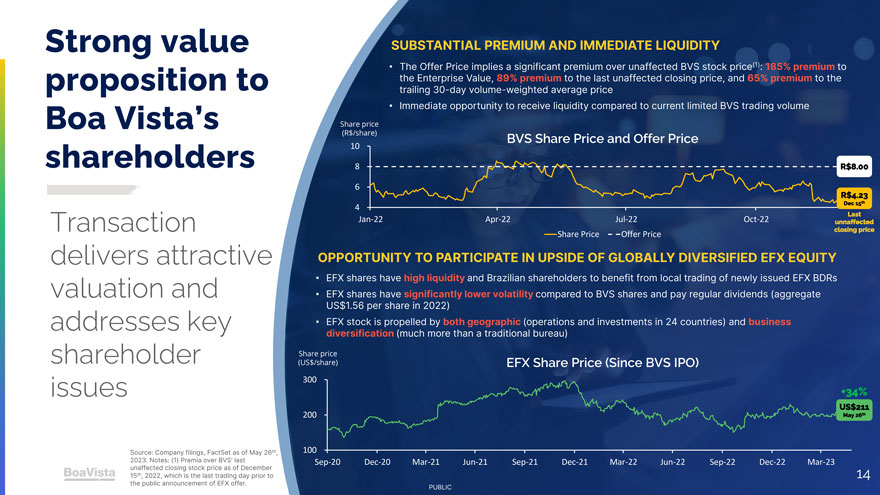

Strong value proposition to Boa Vista’s shareholders Transaction delivers attractive valuation and addresses key 8 6 4 Share price (R$/share) 10 SUBSTANTIAL PREMIUM AND IMMEDIATE LIQUIDITY The Offer Price implies a significant premium over unaffected BVS stock price(1): 185% premium to the Enterprise Value, 89% premium to the last unaffected closing price, and 65% premium to the trailing 30-day volume-weighted average price Immediate opportunity to receive liquidity compared to current limited BVS trading volume BVS Share Price and Offer Price Last unnaffected closing price Share Price —Offer Price OPPORTUNITY TO PARTICIPATE IN UPSIDE OF GLOBALLY DIVERSIFIED EFX EQUITY EFX shares have high liquidity and Brazilian shareholders to benefit from local trading of newly issued EFX BDRs EFX shares have significantly lower volatility compared to BVS shares and pay regular dividends (aggregate US$1.56 per share in 2022) EFX stock is propelled by both geographic (operations and investments in 24 countries) and business diversification (much more than a traditional bureau) shareholder Share price (US$/share) EFX Share Price (Since BVS IPO) issues 300 Source: Company filings, FactSet as of May 26th, 2023. Notes: (1) Premia over BVS’ last unaffected closing stock price as of December 15th, 2022, which is the last trading day prior to the public announcement of EFX offer.

TRANSACTION HIGHLIGHTS 15

Transaction milestones December 2022 February 2023 February 2023 May 2023 On Dec 18th, BVS issues a EFX submits BVS enters into a EGM materials are material fact informing the binding offer definitive merger published, including market and its shareholders (“BO”) to BVS agreement with EFX, management proposal that it had received a non- Board of upon approval by outlining transaction binding business combination Directors majority of votes from rationale offer (“NBO”) from EFX Confirmatory its Board of Directors Due Diligence Registration Statement Non-binding Signing EGM offer materials 16

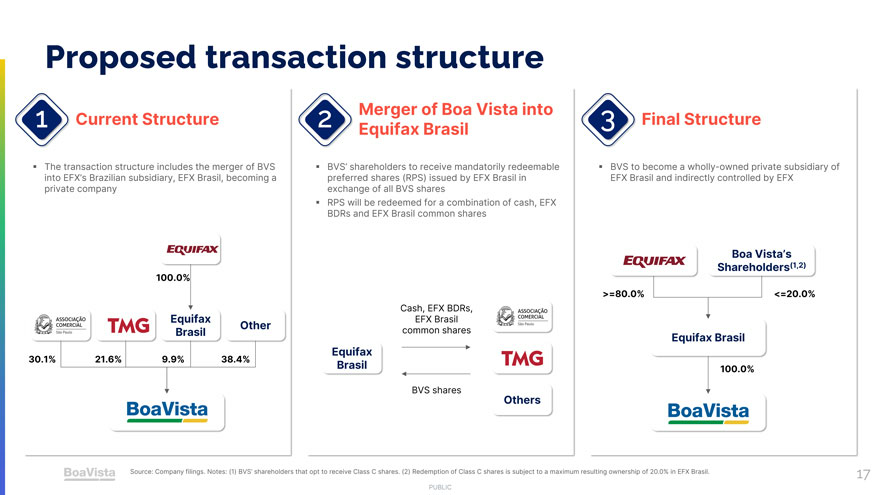

Equifax Brasil Merger of Boa Vista into Proposed transaction structure The transaction structure includes the merger of BVS into EFX’s Brazilian subsidiary, EFX Brasil, becoming a BVS shareholders to receive mandatorily redeemable preferred shares (RPS) issued by EFX Brasil in exchange of all BVS shares RPS will be redeemed for a combination of cash, EFX BVS to become a wholly-owned private subsidiary of EFX Brasil and indirectly controlled by EFX

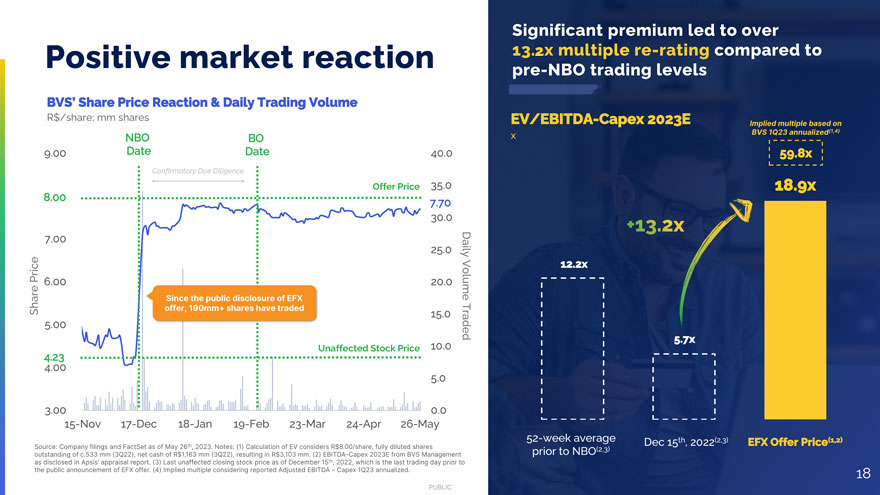

Significant premium led to over Positive market reaction 13.1x multiple re-rating compared to pre-NBO trading levels BVS’ Share Price Reaction & Daily Trading Volume R$/share; mm shares EV/EBITDA-Capex 2023E NBO BO x 9.00 Date Date 40.0 59.8x Confirmatory Due Diligence Offer Price 35.0 18.9x 8.00 7.70 30.0 7.00 25.0 Daily Price 12.2x 6.00 20.0 Volume Share 15.0 5.00 Traded 5.7x Unaffected Stock Price 10.0 4 4..23 00 5.0 3.00 0.0 15-Nov 17-Dec 18-Jan 19-Feb 23-Mar 24-Apr 26-May 52-week average Dec 15th, 2022(2,3) EFX Offer Price(1,2) prior to NBO(2,3) 18

Boa Vista’s board approval process and rationale Since Dec/2022, when EFX sent BVS Board of Directors the combination proposal, BVS’ Directors have fully complied with their fiduciary duties, effectively negotiated the best possible transaction terms, and ultimately approved the Merger Agreement in Feb/2023. The Board of Directors strictly observed Brazil Corporate Law and BVS1 corporate governance guidelines resulting in an informed, thoughtful and unbiased decision The Board of Directors engaged prominent financial and legal advisors (UBS BB and Spinelli Advogados, respectively) with notable specialization and experience in public-company M&A transactions to: (i) favorably negotiate the terms and conditions of the Merger Agreement; (ii) assess the financial merits and fairness of the Transaction, and (iii) seek out other potentially interested parties for competing proposals; Directors with personal conflicts of interest recused themselves from transaction discussions and voting; All non-conflicted board members received timely updates along with drafts of transaction documents and supporting materials to provide full transparency; In the c.50 days between the public announcement of EFX’s offer and signing of the transaction, BVS Board of Directors had discussions with a number of other potential buyers. However, no competing bids emerged; Directors received an opinion from UBS BB stating that the economic terms of the transaction were fair and adequate. Additionally, the Board negotiated the flexibility to receive competing bids even after the execution of the Merger Agreement, but no competing bid has emerged yet. The Directors approved the Transaction by majority vote based on the strong financial merits and expected significant value creation to shareholders Combination offers BVS new business scale and access to EFX’s global platform and resources, accelerating its digital transformation to make it the go-to credit bureau in Brazil Transaction allows immediate liquidity to BVS’ shareholders at 185% premium to the Enterprise Value and 89% premium over unaffected stock price(1); Transaction also removes the BVS shareholders’ exposure to the challenging macroeconomic conditions, worsening competitive environment and operational execution uncertainty. Source: Minutes of the Board of Directors’ Meeting held on February 9th, 2023. Note: (1) Premia over Boa Vista’s last unaffected closing stock price as of December 15th, 2022, which is the last trading day prior to the public announcement of EFX offer.

Boa Vista’s board recommendation BVS board of directors recommends that the shareholders approve the merger of shares by EFX Brasil, so that BVS becomes a private, wholly-owned subsidiary of EFX Brasil in the context of the transaction, with the consequent delisting of BVS1 shares from B3’s Novo Mercado special listing segment Management Proposal OBVS Board of Directors approved the execution of the Merger Protocol and BVS’ Fiscal Council issued a formal opinion on the Transaction on May 30th, 2023 (F?) BVS’ Board of Directors Proposal Approval of the Merger Protocol, negotiated by the management in the scope of the Merger Agreement and which determines all terms and conditions for the implementation of the Transaction Approval of the merger of shares by EFX Brasil, with the consequent delisting of BVS1 shares from B3’s Novo Mercado special listing segment, and waiver of the obligation of EFX Brasil to list its shares in the special listing segment of Novo Mercado of B3, in accordance with the applicable regulation With the conclusion of the transaction, BVS will continue to operate in Brazil as a wholly-owned subsidiary of EFX Brasil

Timetable and next steps February 9th 2023 May 30th 2023 June 29th 2023 3Q’23 (expected) Board of Directors approval and transaction signing + announcement Publishing of EGM materials EGM date Conditions precedent(1): (i) approval at Boa Vista and EFX Brasil’s respective shareholders’ meetings; and (ii) other usual conditions precedent Transaction closing Subject to EGM approval and fulfillment of conditions precedent Source: Company filings. Notes: (1) Regulatory approvals not required 21 PUBLIC

BOA VISTA’S EGM 22

Overview of Boa Vista’s EGM BVS will hold an Extraordinary General Meeting to deliberate on the transaction on June 29th, 2023 The meeting will be held exclusively in a digital format, and BVS’ shareholders may participate via electronic platform or via Remote Voting Ballot (BVD in Portuguese) The deadline to cast the votes via Remote Voting Ballot is June 22nd, 2023. International investors shall be advised that their provider may have an internal deadline In order to participate digitally on the EGM, BVS shareholders shall register via ri@boavistascpc.com.br until 4pm BRT of June 27th, 2023, attaching the proper documentation as described in the management proposal BoaVista source: company filings. 23 PUBLIC

Agenda ©Approval of the Protocol and Justification of the Merger of Boa Vista Servipos S.A. into Equifax do Brasil S.A. (“Protocol and Justification”), executed by the management of BVS and EFX Brasil on May 30th, 2023, which contains all the terms and conditions for the implementation of the business combination, in the form of the definitive association agreement, entered into by the Company, EFX Brasil and EFX on February 9th, 2023 (“Merger Agreement”); Approval of the Merger, in the context of the transaction, resulting in the delisting of BVS and the Company’s exit from the special listing segment of B3 S.A.’s Novo Mercado. - Brasil, Bolsa, Balcao (“B3”), whose effectiveness will be conditioned on the satisfaction (or waiver, as the case may be), and the exemption from EFX Brasil’s obligation to list its shares in the special listing segment of B3’s Novo Mercado, pursuant to the sole paragraph of Article 46 of the Novo Mercado Regulation and the sole paragraph of Article 45 of the Company’s Bylaws, the effectiveness of which shall be conditioned on satisfaction (or waiver, as the case may be), in accordance with article 125 of Law No. 10,406, of January 10th, 2002, as amended, of certain conditions provided for in the Merger Agreement and the Protocol and Justification; The authorization to the Company’s management to take all necessary measures to implement the resolutions related to the Merger and the consequent subscription of the new redeemable preferred shares to be issued by EFX Brasil as a result of the Merger, on behalf of the Company’s shareholders, pursuant to Article 252, paragraph 2, of the Brazilian Corporation Law.

FINAL CONSIDERATIONS AND KEY TAKEAWAYS 25

Closing remarks Strong strategic rationale Access to EFX’s global platform and resources, to accelerate BVS’ digital transformation Sound approval process BVS BoD took all reasonable measures to analyze EFX’s proposal Significant value to BVS’ shareholders Attractive premium of 185% to the Enterprise Value and 9% to last unaffected share closing price d immediate liquidity, and flexibility for BVS’ shareholders Next steps Approval at EGMs and completion of conditions precedent. Closing expected in the third quarter of 2023 Note: (1) Premia over BVS’ last unaffected closing stock price as of December 15th, 2022, which is the last trading day prior to the public announcement of EFX offer.

Key contacts E-mail boavista(g)investor.morrowsodali.com BOA VISTA IR TEAM E-mail ri@boavistascpc.com.br MORROW SODALI Website https://ir.boavistascpc.com.br/ BOAS B3 LISTED NM