Filed by Equifax Inc. Commission File No. 001-06605 pursuant to Rule 425 under the Securities Act of 1933, as amended Subject Company: Boa Vista Serviços S.A. December 19, 2022 Boa Vista Servicos Acquisition Offer Investor Update CkEVpbp7dKASKNOIZJZ1WLTQ2lsQQgSn

Forward-looking statements This presentation contains certain forward-looking information to help you understand Equifax and its business environment. All statements that address operating performance and events or developments that we expect or anticipate will occur in the future, including statements relating to future financial and operating results, our strategy, our ability to successfully negotiate and consummate the proposed transaction with Boa Vista Servicos, the ability of Boa Vista Servicos to receive shareholder approval if a definitive agreement is signed, the expected financial and operational benefits, synergies and growth from the proposed transaction, our ability to integrate Boa Vista Servicos and its products, services, technologies, IT systems and personnel into our operations, the impact of COVID-19 and changes in U.S. and worldwide economic conditions, and similar statements about our outlook and our business plans are forward-looking statements. We believe these forward-looking statements are reasonable as and when made. However, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from our historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to, those described in our 2021 Form 10-K and subsequent SEC filings. As a result of such risks and uncertainties, we urge you not to place undue reliance on any forward-looking statements. Forward-looking statements speak only as of the date when made. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. PROPRIETARY | 2

No Offer or Solicitation; Filings with the SEC NO OFFER OR SOLICITATION This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of the U.S. Securities Act of 1933, as amended. This presentation is for informational purposes only and should not, under any circumstances, constitute, be interpreted or understood as an investment recommendation, nor as an offer to acquire any of the securities of Equifax or Equifax Brazil. FILINGS WITH THE SEC Equifax® (NYSE: EFX) and Equifax Brazil plan to file a Registration Statement on Form S-4/F-4 with the U.S. Securities and Exchange Commission (SEC) in connection with the Boa Vista Servicos transaction. The Form S-4/F-4 will contain an exchange offer prospectus and other documents. The Form S-4 and prospectus will contain important information about Equifax, Equifax Brazil, Boa Vista Servicos, the transaction and related matters. Investors and shareholders of Boa Vista Servicos should read the prospectus and the other documents filed with the SEC in connection with the transaction carefully before they make any decision with respect to the transaction. The Form S-4/F-4 and the prospectus and all other documents filed with the SEC in connection with the acquisition will be available when filed free of charge at the SEC’s web site at www.sec.gov. In addition, the prospectus and all other documents filed with the SEC in connection with the acquisition will be made available to investors free of charge by calling or writing to Equifax Inc., Attn: Office of Corporate Secretary, P.O. Box 4081, Atlanta, Georgia 30302, telephone (404) 885-8000. PROPRIETARY | 3

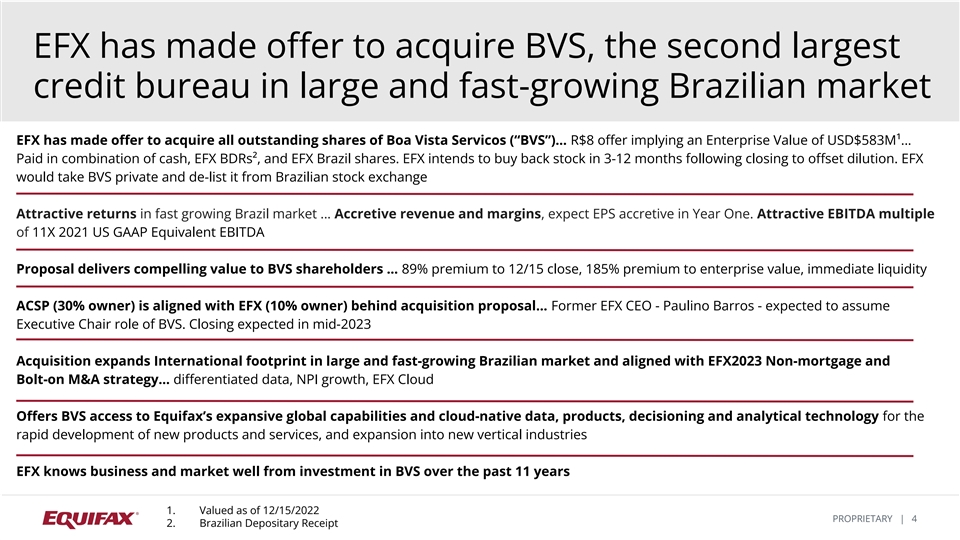

EFX has made offer to acquire BVS, the second largest credit bureau in large and fast-growing Brazilian market EFX has made offer to acquire all outstanding shares of Boa Vista Servicos (“BVS”)… R$8 offer implying an Enterprise Value of USD$583M¹… Paid in combination of cash, EFX BDRs², and EFX Brazil shares. EFX intends to buy back stock in 3-12 months following closing to offset dilution. EFX would take BVS private and de-list it from Brazilian stock exchange Attractive returns in fast growing Brazil market … Accretive revenue and margins, expect EPS accretive in Year One. Attractive EBITDA multiple of 11X 2021 US GAAP Equivalent EBITDA Proposal delivers compelling value to BVS shareholders … 89% premium to 12/15 close, 185% premium to enterprise value, immediate liquidity ACSP (30% owner) is aligned with EFX (10% owner) behind acquisition proposal… Former EFX CEO - Paulino Barros - expected to assume Executive Chair role of BVS. Closing expected in mid-2023 Acquisition expands International footprint in large and fast-growing Brazilian market and aligned with EFX2023 Non-mortgage and Bolt-on M&A strategy… differentiated data, NPI growth, EFX Cloud Offers BVS access to Equifax’s expansive global capabilities and cloud-native data, products, decisioning and analytical technology for the rapid development of new products and services, and expansion into new vertical industries EFX knows business and market well from investment in BVS over the past 11 years 1. Valued as of 12/15/2022 PROPRIETARY | PROPRIETARY | 4 4 2. Brazilian Depositary Receipt

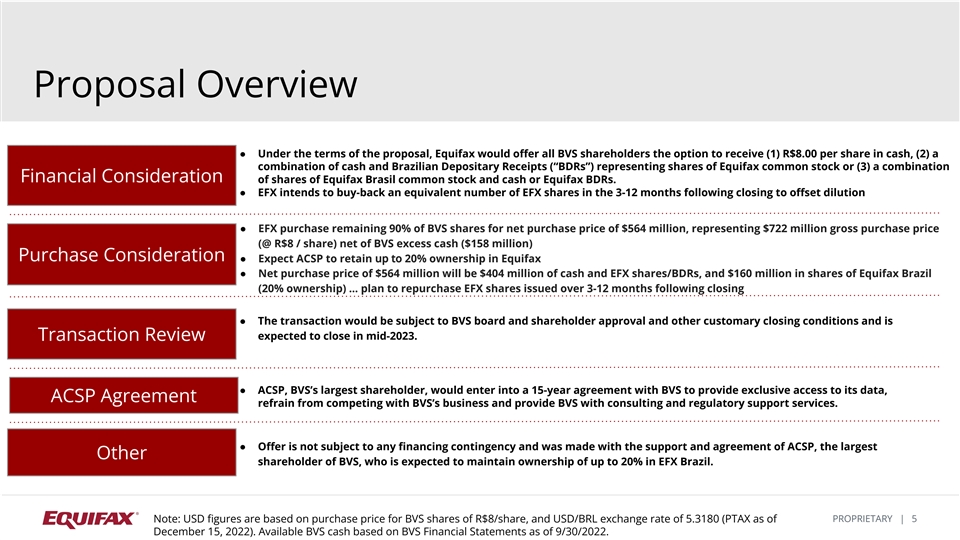

Proposal Overview ● Under the terms of the proposal, Equifax would offer all BVS shareholders the option to receive (1) R$8.00 per share in cash, (2) a combination of cash and Brazilian Depositary Receipts (“BDRs”) representing shares of Equifax common stock or (3) a combination Financial Consideration of shares of Equifax Brasil common stock and cash or Equifax BDRs. ● EFX intends to buy-back an equivalent number of EFX shares in the 3-12 months following closing to offset dilution ● EFX purchase remaining 90% of BVS shares for net purchase price of $564 million, representing $722 million gross purchase price (@ R$8 / share) net of BVS excess cash ($158 million) Purchase Consideration ● Expect ACSP to retain up to 20% ownership in Equifax Brazil ● Net purchase price of $564 million will be $404 million of cash and EFX shares/BDRs, and $160 million in shares of Equifax Brazil (20% ownership) … plan to repurchase EFX shares issued over 3-12 months following closing ● The transaction would be subject to BVS board and shareholder approval and other customary closing conditions and is expected to close in mid-2023. Transaction Review ● ACSP, BVS’s largest shareholder, would enter into a 15-year agreement with BVS to provide exclusive access to its data, ACSP Agreement refrain from competing with BVS’s business and provide BVS with consulting and regulatory support services. ● Offer is not subject to any financing contingency and was made with the support and agreement of ACSP, the largest Other shareholder of BVS, who is expected to maintain ownership of up to 20% in EFX Brazil. Note: USD figures are based on purchase price for BVS shares of R$8/share, and USD/BRL exchange rate of 5.3180 (PTAX as of PROPRIETARY | PROPRIETARY | 5 5 December 15, 2022). Available BVS cash based on BVS Financial Statements as of 9/30/2022.

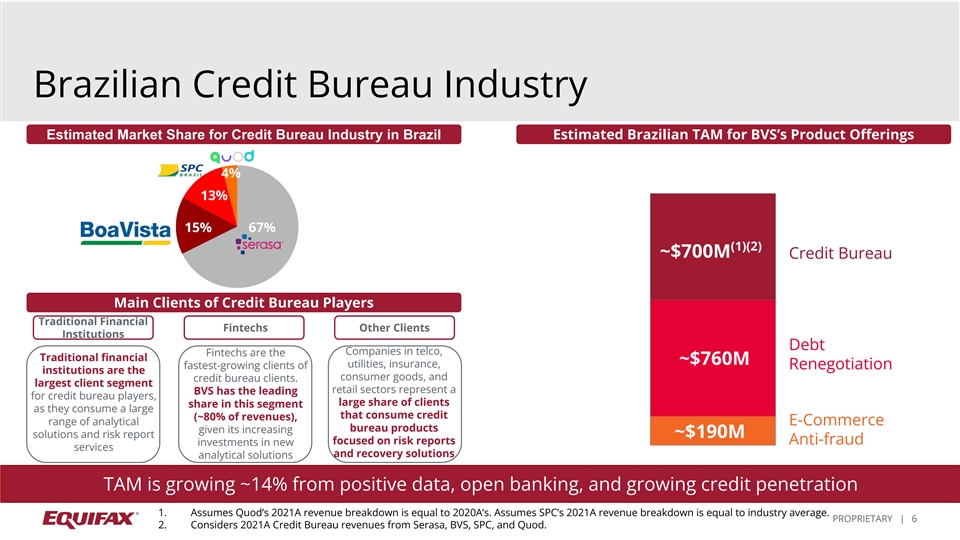

Brazilian Credit Bureau Industry Estimated Market Share for Credit Bureau Industry in Brazil Estimated Brazilian TAM for BVS’s Product Offerings 4% 13% 15% 67% (1)(2) ~$700M Credit Bureau Main Clients of Credit Bureau Players Traditional Financial Fintechs Other Clients Institutions Debt Companies in telco, Fintechs are the Traditional financial ~$760M utilities, insurance, fastest-growing clients of Renegotiation institutions are the consumer goods, and credit bureau clients. largest client segment retail sectors represent a BVS has the leading for credit bureau players, large share of clients share in this segment as they consume a large that consume credit (~80% of revenues), range of analytical E-Commerce bureau products given its increasing solutions and risk report ~$190M focused on risk reports Anti-fraud investments in new services and recovery solutions analytical solutions TAM is growing ~14% from positive data, open banking, and growing credit penetration 1. Assumes Quod’s 2021A revenue breakdown is equal to 2020A’s. Assumes SPC’s 2021A revenue breakdown is equal to industry average. PROPRIETARY | PROPRIETARY | 6 6 2. Considers 2021A Credit Bureau revenues from Serasa, BVS, SPC, and Quod.

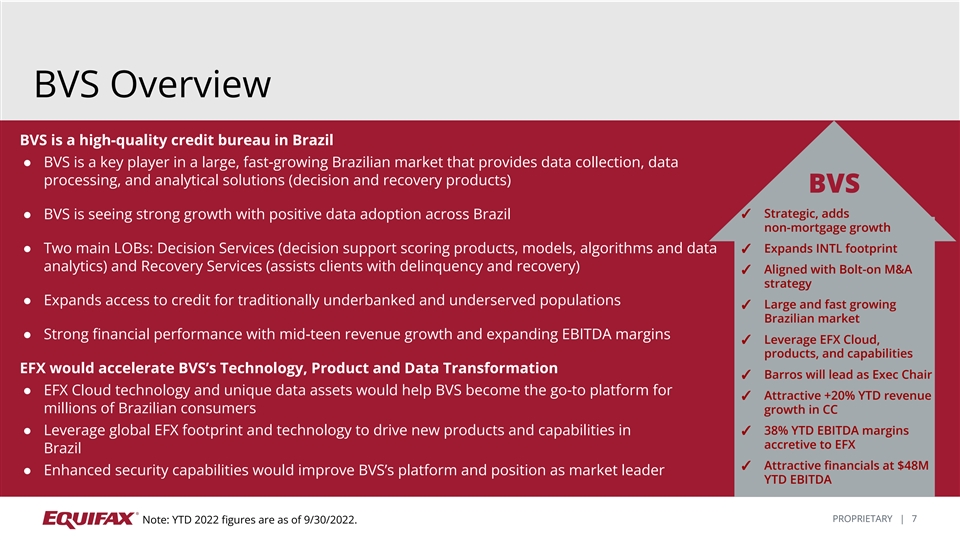

BVS Overview BVS is a high-quality credit bureau in Brazil ● BVS is a key player in a large, fast-growing Brazilian market that provides data collection, data processing, and analytical solutions (decision and recovery products) BVS ✓ Strategic, adds ● BVS is seeing strong growth with positive data adoption across Brazil non-mortgage growth ● Two main LOBs: Decision Services (decision support scoring products, models, algorithms and data ✓ Expands INTL footprint analytics) and Recovery Services (assists clients with delinquency and recovery) ✓ Aligned with Bolt-on M&A strategy ● Expands access to credit for traditionally underbanked and underserved populations ✓ Large and fast growing Brazilian market ● Strong financial performance with mid-teen revenue growth and expanding EBITDA margins ✓ Leverage EFX Cloud, products, and capabilities EFX would accelerate BVS’s Technology, Product and Data Transformation ✓ Barros will lead as Exec Chair ● EFX Cloud technology and unique data assets would help BVS become the go-to platform for ✓ Attractive +20% YTD revenue millions of Brazilian consumers growth in CC ✓ 38% YTD EBITDA margins ● Leverage global EFX footprint and technology to drive new products and capabilities in accretive to EFX Brazil ✓ Attractive financials at $48M ● Enhanced security capabilities would improve BVS’s platform and position as market leader YTD EBITDA PROPRIETARY | PROPRIETARY | 7 7 Note: YTD 2022 figures are as of 9/30/2022.

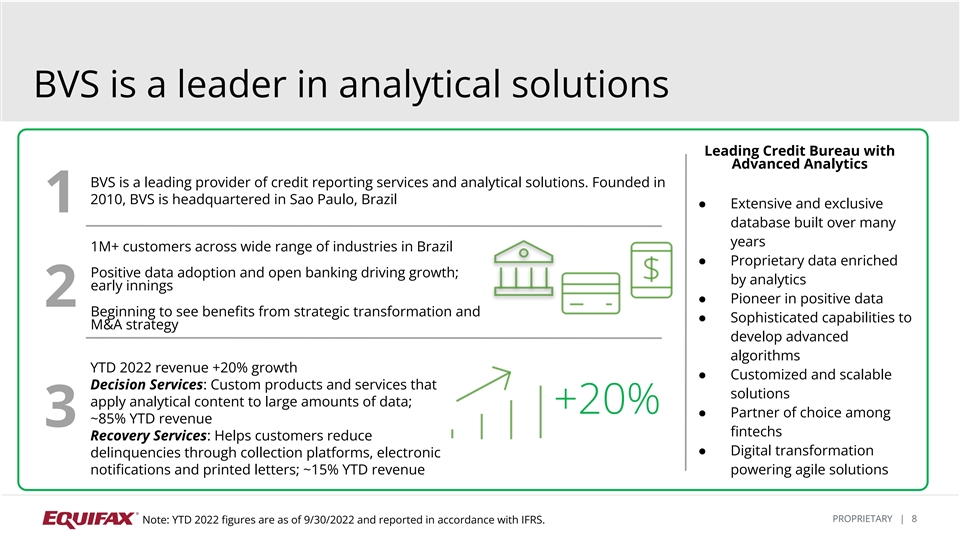

BVS is a leader in analytical solutions Leading Credit Bureau with Advanced Analytics BVS is a leading provider of credit reporting services and analytical solutions. Founded in 2010, BVS is headquartered in Sao Paulo, Brazil ● Extensive and exclusive 1 database built over many years 1M+ customers across wide range of industries in Brazil ● Proprietary data enriched Positive data adoption and open banking driving growth; by analytics early innings ● Pioneer in positive data 2 Beginning to see benefits from strategic transformation and ● Sophisticated capabilities to M&A strategy develop advanced algorithms YTD 2022 revenue +20% growth ● Customized and scalable Decision Services: Custom products and services that solutions apply analytical content to large amounts of data; +20% ● Partner of choice among ~85% YTD revenue 3 fintechs Recovery Services: Helps customers reduce ● Digital transformation delinquencies through collection platforms, electronic notifications and printed letters; ~15% YTD revenue powering agile solutions PROPRIETARY | PROPRIETARY | 8 8 Note: YTD 2022 figures are as of 9/30/2022 and reported in accordance with IFRS.

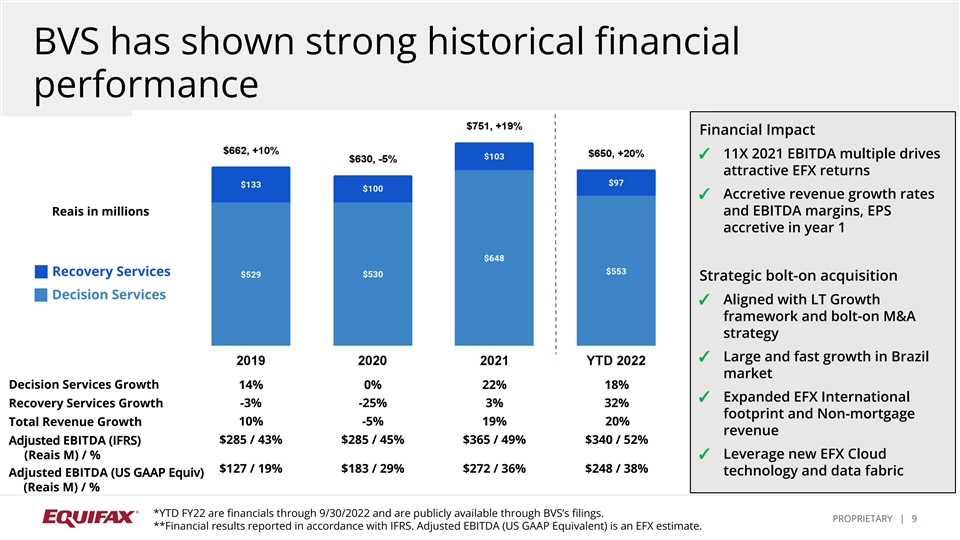

BVS has shown strong historical financial performance Financial Impact ✓ 11X 2021 EBITDA multiple drives attractive EFX returns ✓ Accretive revenue growth rates Reais in millions and EBITDA margins, EPS accretive in year 1 Recovery Services Strategic bolt-on acquisition Decision Services ✓ Aligned with LT Growth framework and bolt-on M&A strategy ✓ Large and fast growth in Brazil market Decision Services Growth 14% 0% 22% 18% ✓ Expanded EFX International Recovery Services Growth -3% -25% 3% 32% footprint and Non-mortgage 10% -5% 19% 20% Total Revenue Growth revenue $285 / 43% $285 / 45% $365 / 49% $340 / 52% Adjusted EBITDA (IFRS) ✓ Leverage new EFX Cloud (Reais M) / % $127 / 19% $183 / 29% $272 / 36% $248 / 38% technology and data fabric Adjusted EBITDA (US GAAP Equiv) (Reais M) / % *YTD FY22 are financials through 9/30/2022 and are publicly available through BVS’s filings. PROPRIETARY | 9 **Financial results reported in accordance with IFRS. Adjusted EBITDA (US GAAP Equivalent) is an EFX estimate.

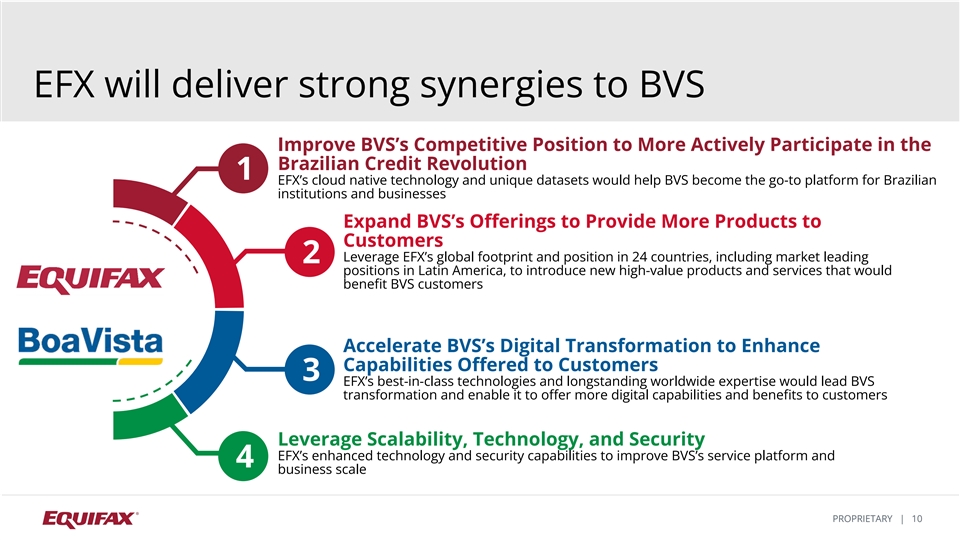

EFX will deliver strong synergies to BVS Improve BVS’s Competitive Position to More Actively Participate in the Brazilian Credit Revolution 1 EFX’s cloud native technology and unique datasets would help BVS become the go-to platform for Brazilian institutions and businesses Expand BVS’s Offerings to Provide More Products to Customers Leverage EFX’s global footprint and position in 24 countries, including market leading 2 positions in Latin America, to introduce new high-value products and services that would benefit BVS customers Accelerate BVS’s Digital Transformation to Enhance Capabilities Offered to Customers 3 EFX’s best-in-class technologies and longstanding worldwide expertise would lead BVS transformation and enable it to offer more digital capabilities and benefits to customers Leverage Scalability, Technology, and Security EFX’s enhanced technology and security capabilities to improve BVS’s service platform and 4 business scale PROPRIETARY | PROPRIETARY | 10 10

BVS would broaden our global presence in an important growth market CANADA UNITED KINGDOM UNITED STATES IBERIA INDIA Key Revenue Drivers Consumer Credit Brazil LATAM Commercial Credit Employment & Income AUSTRALIA NEW ZEALAND Identity & Fraud Analytics Collections PROPRIETARY | PROPRIETARY | 11 11

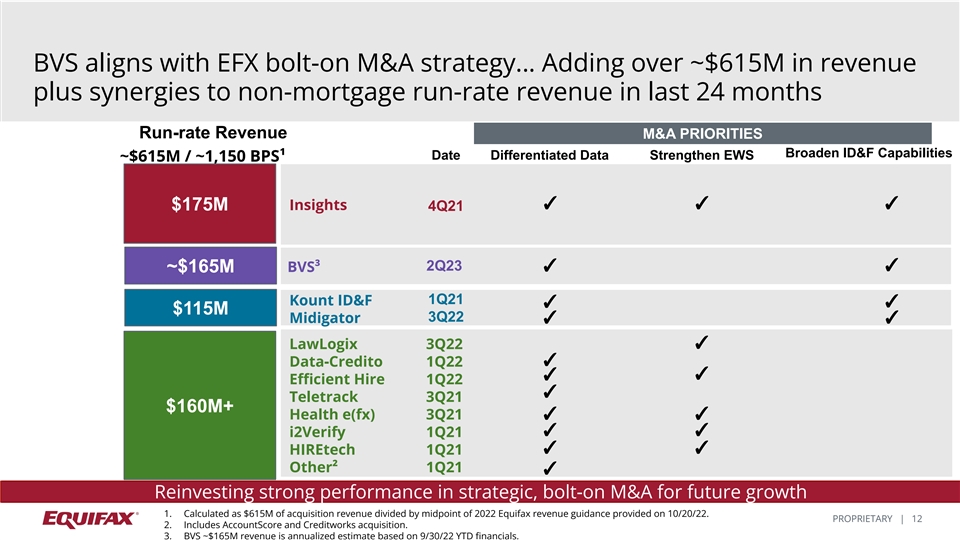

BVS aligns with EFX bolt-on M&A strategy… Adding over ~$615M in revenue plus synergies to non-mortgage run-rate revenue in last 24 months Run-rate Revenue M&A PRIORITIES Broaden ID&F Capabilities Date Differentiated Data Strengthen EWS ~$615M / ~1,150 BPS¹ ✓✓✓ $175M Insights 4Q21 2Q23✓ BVS³✓ ~$165M 1Q21 Kount ID&F ✓✓ $115M 3Q22 Midigator ✓✓ LawLogix 3Q22✓ Data-Credito 1Q22✓ ✓✓ Efficient Hire 1Q22 ✓ Teletrack 3Q21 $160M+ Health e(fx) 3Q21✓✓ ✓✓ i2Verify 1Q21 ✓✓ HIREtech 1Q21 Other² 1Q21 ✓ Reinvesting strong performance in strategic, bolt-on M&A for future growth 1. Calculated as $615M of acquisition revenue divided by midpoint of 2022 Equifax revenue guidance provided on 10/20/22. PROPRIETARY | PROPRIETARY | 12 12 2. Includes AccountScore and Creditworks acquisition. 3. BVS ~$165M revenue is annualized estimate based on 9/30/22 YTD financials.

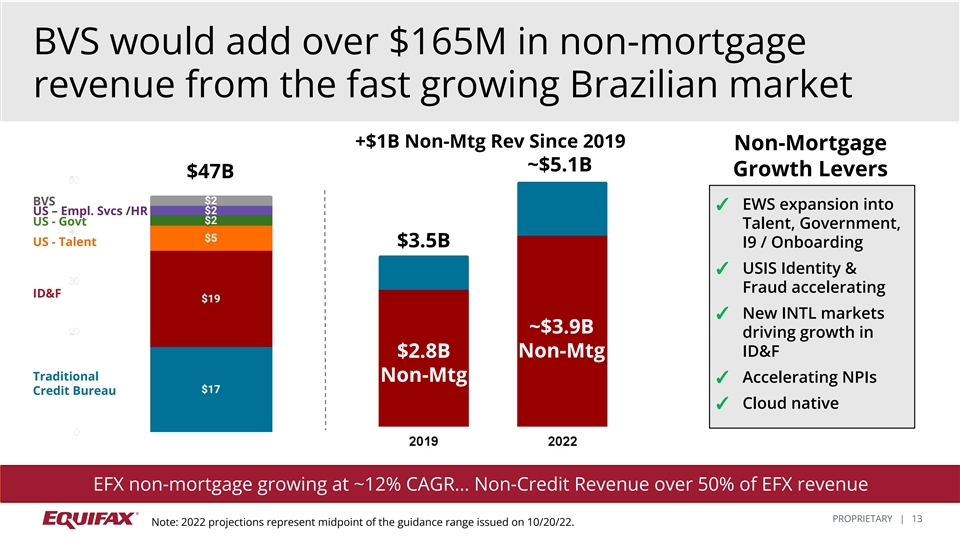

BVS would add over $165M in non-mortgage revenue from the fast growing Brazilian market +$1B Non-Mtg Rev Since 2019 Non-Mortgage ~$5.1B Growth Levers $47B BVS ✓ EWS expansion into US – Empl. Svcs /HR US - Govt Talent, Government, US - Talent $3.5B I9 / Onboarding ✓ USIS Identity & Fraud accelerating ID&F ✓ New INTL markets ~$3.9B driving growth in Non-Mtg ID&F $2.8B Traditional Non-Mtg✓ Accelerating NPIs Credit Bureau ✓ Cloud native EFX non-mortgage growing at ~12% CAGR... Non-Credit Revenue over 50% of EFX revenue PROPRIETARY | PROPRIETARY | 13 13 Note: 2022 projections represent midpoint of the guidance range issued on 10/20/22.

Trevor Burns • Investor Relations • trevor.burns@equifax.com Copyright © 2022 Equifax Inc. All Rights Reserved. Equifax is a registered trademark of Equifax Inc. PROPRIETARY | 14