UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

EQUIFAX INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

1550 Peachtree Street, N.W.

Atlanta, Georgia 30309

www.equifax.com

March 18, 2014

Dear Shareholder:

You are cordially invited to attend the 2014 Annual Meeting of Shareholders of Equifax Inc., which will be held on Friday, May 2, 2014, at 9:30 a.m., Eastern Daylight Time, at our headquarters at 1550 Peachtree St., N.W., Atlanta, Georgia. Details of the business to be presented at the meeting can be found in the accompanying Proxy Statement. We hope you are planning to attend the meeting. Your vote is important. Whether or not you are able to attend, I encourage you to submit your proxy as soon as possible so that your shares will be represented at the meeting.

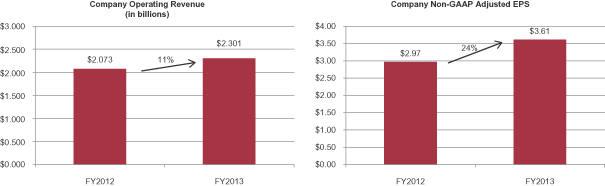

I am pleased to report that our company delivered the best financial results since I joined the Company in 2005. Reported earnings per share and operating revenue rose by 25% and 11%, respectively. In February 2013, our Board of Directors raised the quarterly dividend by 22% to $0.22 per share and, in February 2014, by 14% to $0.25 per share, the fourth consecutive annual increase in the dividend, for a 16% compound annual growth rate over the last three years. Our cumulative total shareholder return, including reinvested dividends, for the one-, three- and five-year periods ended December 31, 2013, was 30%, 104% and 178%, respectively, compared to 32%, 57% and 128% for the S&P 500 stock index.

Our compensation program is aligned with performance that matters to shareholders. Our executive officers are compensated in a way that rewards them based on performance, both absolute and relative to our peers, that creates value for our shareholders. In 2013, we surpassed our target adjusted earnings per share performance goal and finished just under our target operating revenue goal. The proxy statement summary that follows on pages 1-4 provides highlights of our performance and 2013 compensation actions and refers you to the appropriate sections of this Proxy Statement for additional information.

On behalf of the Board of Directors and management of Equifax, I extend our appreciation for your continued support.

| Sincerely, |

|

| Richard F. Smith |

| Chairman and Chief Executive Officer |

1550 Peachtree Street, N.W.

Atlanta, Georgia 30309

NOTICE OF 2014 ANNUAL MEETING OF SHAREHOLDERS

To the Shareholders of Equifax Inc.:

Notice is hereby given that the 2014 Annual Meeting of shareholders (the “Annual Meeting”) of Equifax Inc. (the “Company” or “Equifax”) will be held on Friday, May 2, 2014 at 9:30 a.m., Eastern Daylight Time, at the Company’s principal executive offices located at the address shown above to consider and vote on the following items of business described in the accompanying Proxy Statement:

| 1. | Election of the ten nominees to the Board of Directors (the “Board”) named in the Proxy Statement as Directors, each for a term of one year; |

| 2. | Ratification of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2014; |

| 3. | Consideration of an advisory vote to approve named executive officer compensation; and |

| 4. | Transaction of such other business as may properly come before the meeting. |

You may vote if you owned shares of the Company’s common stock at the close of business on March 4, 2014. Shares represented by properly executed proxies will be voted in accordance with the instructions specified therein.

We are mailing to most of our shareholders a Notice of Internet Availability of Proxy Materials (the “Notice”) instead of a paper copy of this Proxy Statement and our 2013 Annual Report. We believe that this process allows us to provide our shareholders with the information they need in a timelier manner, while reducing the costs of delivery and environmental impact of the Annual Meeting. The Notice contains instructions on how to access those documents on the Internet. The Notice also contains instructions on how to request a paper copy of our proxy materials, including the Proxy Statement, our 2013 Annual Report and a form of proxy card or voting instruction card. All shareholders who have previously requested paper copies of our proxy materials will continue to receive a paper copy of the proxy materials by mail.

Your vote is important. Whether or not you plan to attend the meeting in person, please complete, sign, date and return the proxy card or voting instruction card as instructed or vote by telephone or using the Internet as instructed on the proxy card, voting instruction card or the Notice.

By order of the Board of Directors,

| Sincerely, |

| Dean C. Arvidson |

| Corporate Secretary |

Atlanta, Georgia

March 18, 2014

| Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be Held on May 2, 2014:

The Company’s Notice of 2014 Annual Meeting of Shareholders, Proxy Statement, proxy card and 2013 Annual Report to Shareholders are available on our website at http://investor.equifax.com as well as at www.proxyvote.com. |

| |

1 |

| ||

| 5 | ||||

| 8 | ||||

| 18 | ||||

| 18 | ||||

| 24 | ||||

| 26 | ||||

| 28 | ||||

| 28 | ||||

| 28 | ||||

| 52 | ||||

| 69 | ||||

| 69 | ||||

| 69 | ||||

| 70 | ||||

| 71 | ||||

| 71 | ||||

| Review, Approval or Ratification of Transactions with Related Persons |

71 | |||

| Shareholder Proposals and Director Nominations for 2015 Annual Meeting |

72 | |||

| |

A-1 |

| ||

| Appendix B—Guidelines for Determining the Independence of Directors |

B-1 | |||

This summary highlights information contained elsewhere in our Proxy Statement but does not contain all of the information that you should consider. You should read the entire Proxy Statement carefully before voting.

Annual Meeting of Shareholders

| Time and date: |

9:30 a.m., Eastern Daylight Time, on Friday, May 2, 2014 | |

| Place: |

Equifax Inc., 1550 Peachtree St., N.W., Atlanta, Georgia 30309 | |

| Record date: |

March 4, 2014 | |

| How to vote: |

In general, you may vote either in person at the Annual Meeting or by telephone, the Internet, or mail. See “How to Vote” on page 6 for more details. | |

| Admission: |

Satisfactory proof of share ownership as of the record date is required to enter the Annual Meeting. See “Shareholders Entitled to Vote; Attendance at the Meeting” on page 5. |

Voting Matters

|

Board Voting Recommendation |

Page Reference (for more detail) |

|||||||

| Election of Directors |

FOR EACH NOMINEE | 18 | ||||||

| Ratification of Appointment of Ernst & Young LLP as the Company’s Independent Registered Public Accounting Firm for 2014 | FOR | 24 | ||||||

| Advisory Vote on Executive Compensation |

FOR | 26 | ||||||

Director Nominees

|

|

Committee Memberships | |||||||||||||||

| Name & Occupation | Age | Director Since |

Independent | Audit | Compensation, Human Resources & Management Succession |

Executive | Governance | Technology | ||||||||

| James E. Copeland, Jr. | ||||||||||||||||

| Retired CEO, Deloitte & Touche and Deloitte Touche Tohmatsu | 69 | 2003 | Ö | Chair | x | |||||||||||

| Robert D. Daleo Retired Vice Chairman Thomson Reuters |

64 | 2006 | Ö | x | x | |||||||||||

| Walter W. Driver, Jr. Chairman—Southeast Goldman, Sachs & Co. |

68 | 2007 | Ö | x | x | |||||||||||

| Mark L. Feidler Founding Partner, MSouth Equity Partners |

57 | 2007 | Ö | x | x | |||||||||||

| L. Phillip Humann Retired Chairman & CEO SunTrust Banks, Inc. |

68 | 1992 | Ö

Independent Presiding Director |

Chair | Chair | x | ||||||||||

| Robert D. Marcus Chairman & CEO Time Warner Cable Inc. |

48 | 2013 | Ö | x | ||||||||||||

| Siri S. Marshall Retired Senior Vice President, General Counsel & Secretary General Mills, Inc. |

65 | 2006 | Ö | x | x | Chair | ||||||||||

| John A. McKinley CEO, SaferAging, Inc. & Co-Founder, LaunchBox Digital |

56 | 2008 | Ö | x | x | Chair | ||||||||||

| Richard F. Smith Chairman & CEO Equifax Inc. |

54 | 2005 | ||||||||||||||

| Mark B. Templeton President & CEO Citrix Systems, Inc. |

61 | 2008 | Ö | x | x | |||||||||||

1

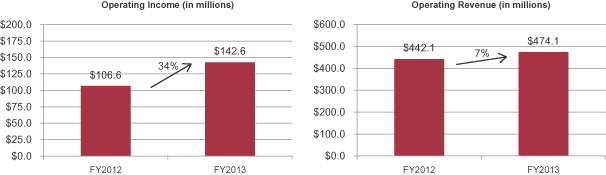

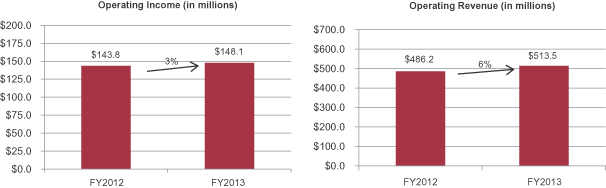

2013 Company Financial Performance and 1-, 3- and 5-Year Total Shareholder Return

| Ÿ | Operating revenue rose 11% to a record $2.3 billion for 2013. |

| Ÿ | Net income from continuing operations attributable to Equifax increased 25%, to $333.4 million. |

| Ÿ | Adjusted EPS(1) was $3.60, up 24% compared to Adjusted EPS of $2.91 in 2012, on a non-GAAP basis; non-GAAP Adjusted EPS for 2013 was $3.61 at our budgeted foreign exchange rates. |

| Ÿ | We returned $118.6 million to shareholders, through $106.7 million in dividends and $11.9 million in share repurchases. |

| Ÿ | The quarterly dividend was increased by 22% in February 2013 to $0.22 per share and, in February 2014, by 14% to $0.25, the fourth consecutive dividend increase. Over the past three years, our dividend has grown at a 16% compound annual growth rate. |

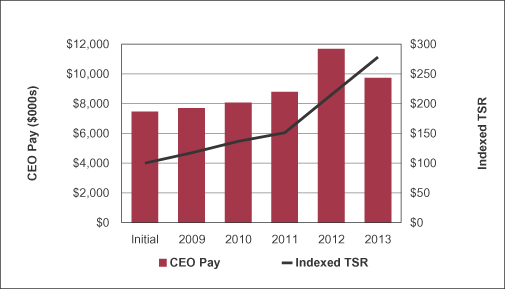

| Ÿ | Our cumulative total shareholder return (stock price appreciation plus dividends, or “TSR”) was slightly below the S&P 500 index for the one-year period ended December 31, 2013, and substantially above the S&P 500 for the three- and five-year periods. Our TSR was 30%, 104% and 178%, respectively, compared to 32%, 57% and 128% for the S&P 500 index. |

2013 Executive Compensation Alignment

| Ÿ | The 2013 compensation of our named executive officers (as set forth in the Summary Compensation Table on page 52) reflects the close alignment of Company performance and shareholder value creation. Although Company financial performance in 2013 was strong on an absolute basis as noted above, it was not as exceptional as the results achieved in 2012 and therefore total direct compensation (salary, bonus and equity award value) declined as compared to 2012. |

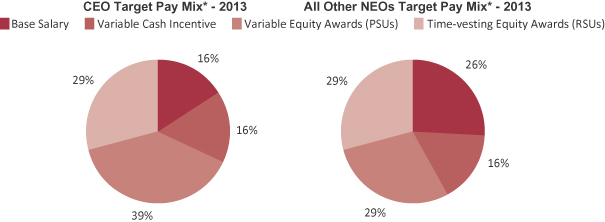

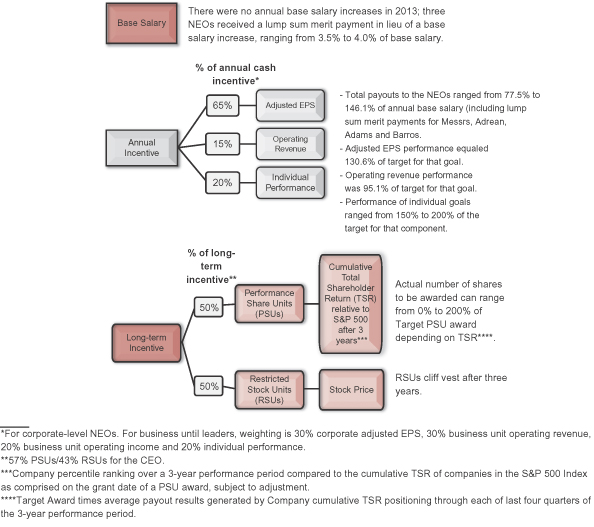

| Ÿ | Most (84%) of the targeted total direct compensation for our CEO was variable, at-risk incentive and stock-based compensation tied to the achievement of internal performance targets or our stock price performance, with 68% in the form of long-term equity compensation (an average of 74% and 58%, respectively, for the other named executive officers). |

| Ÿ | We made no 2013 base salary increases. Mr. Smith’s base salary has not changed since 2008; all 2013 compensation increases were applied to his performance-based, long-term incentive opportunity. Mr. Kelley joined the Company as Chief Legal Officer in January 2013 and was not eligible for a merit salary increase in 2013. Our other named executive officers received lump sum merit payments in lieu of base salary increases ranging from 3.5% to 4.0% of base salary to reward individual performance while maintaining alignment of base salary levels to prior year levels. |

| Ÿ | Target long-term incentive award values for our CEO were granted 57% in performance-based stock units (“PSUs”) and 43% in three-year time-based restricted stock units (“RSUs”). Other named executive officers were granted 50% in PSUs and 50% in RSUs. PSUs will vest, if at all, after three years based on the Company’s TSR relative to that of the companies that comprised the S&P 500 index on the grant date. No dividend equivalents accrue on unvested PSUs or RSUs. |

| Ÿ | Based on 2013 corporate financial performance above the target level for Adjusted EPS and below the target level for operating revenue, as well as individual performance, 2013 annual cash incentives were paid at an average of 135.9% of target for the named executive officers with Company-wide responsibilities (Messrs. Smith, Adrean and Kelley), and for the named executive officers with business unit responsibilities, at 170.5% of target for Mr. Adams and 135.2% of target for Mr. Barros. |

| 1 | “Adjusted EPS” is non-GAAP diluted earnings per share from continuing operations attributable to Equifax, excluding certain items to show the performance of our core operations. On a GAAP basis, diluted EPS from continuing operations attributable to Equifax was $2.69 in 2013, $2.18 in 2012 and $1.86 in 2011. We provide a reconciliation of the differences between non-GAAP Adjusted EPS and GAAP EPS in Appendix A to this Proxy Statement. |

2

Executive Compensation Governance and Practices

In addition to our executive compensation program’s strong pay-for-performance focus, we believe our other policies and pay practices contribute to ensuring an alignment of executives’ and shareholders’ interests and discouraging inappropriate risk taking by our executives.

| What We Do | What We Don’t Do | |

| ü Meaningful share ownership requirements for senior officers

ü Strong executive compensation recoupment (“clawback”) policy

ü Anti-hedging and pledging stock policies for officers and directors

ü Capped annual and long-term incentive awards

ü Independent Compensation Committee advised by independent compensation consultant |

ü No dividend equivalents paid on unearned share units ü No repricing of underwater stock options ü No single-trigger change-in-control cash severance benefits ü No tax gross-ups for perquisites or new change-in-control agreements ü No additional years of supplemental pension service credit since 2011 | |

Additional Shareholder Engagement Actions

| Ÿ | Senior management has engaged with and received specific feedback from 19 of our top 25 shareholders, representing approximately 51% of our outstanding shares, on various topics relating to our Company including executive compensation and corporate governance practices and policies. There were no significant areas of concern noted in these discussions. We also regularly review our investors’ comments with the Governance Committee of our Board. |

| Ÿ | Although last year’s annual meeting of shareholders and most discussions with shareholders took place after we established the 2013 executive compensation program, the Compensation Committee of our Board weighed this shareholder feedback, the increased weighting on performance-based long-term incentives for the CEO, and advice from its independent compensation consultant and concluded that our 2013 and ongoing executive compensation program is appropriately designed with challenging performance metrics and incentives and a mix of fixed and at-risk variable pay. |

Corporate Governance Highlights

| Ÿ | Director independence. The Board believes that a substantial majority of the directors should be independent. Currently, nine of ten members of the Board are independent in accordance with the applicable rules and the Board’s guidelines for determining director independence. |

| Ÿ | Independent Presiding Director. The Board believes in the value of an active, independent Presiding Director. The duties of the Presiding Director include chairing executive sessions of the Board, calling meetings of the non-employee directors, reviewing and approving agenda, schedule and materials for board meetings, facilitating communication between the non-employee directors and the Chairman and CEO, meeting directly with management and non-management employees of the Company, and being available for consultation and direct communication with shareholders as appropriate. |

3

| Ÿ | Majority voting for directors. Under our Bylaws, if in an uncontested election for directors a nominee does not receive a majority of the votes cast “for” the nominee, the nominee is required to offer his or her resignation and the independent members of the Board will determine and promptly publicly announce the action to be taken with respect to the resignation offer. |

| Ÿ | Annual director terms. Each director is elected on an annual basis. |

| Ÿ | Director stock ownership. To align director interests with those of our shareholders, each director is required to own Equifax common stock with a market value of at least five times his or her annual cash retainer, within five years of becoming a director. |

| Ÿ | Enterprise risk management. Equifax has a rigorous enterprise risk management program targeting controls over operational, financial, environmental, legal/regulatory compliance, reputational, technology, security, strategic and other risks that could adversely affect the Company’s business. Risks are identified, assessed, managed and monitored. The program also includes crisis management and business continuity planning. See “The Board’s Role in Risk Oversight” on page 9. |

| Ÿ | No “over-boarding.” Directors are limited to service on five other public company boards, and none of our directors currently serves on the board of directors of more than two other publicly-held corporations. |

| Ÿ | Stock hedging and pledging policies. Our insider trading policy bars our directors, officers and employees from owning financial instruments or participating in investment strategies that hedge the economic risk of owning Equifax stock. We also prohibit officers and directors from pledging Equifax securities as collateral for loans (including margin loans). |

Shareholder Proposals and Director Nominations for 2015 Annual Meeting

| Ÿ | Notice of any proposal or director nomination that a shareholder wishes to propose for consideration at the 2015 Annual Meeting, including any proposal that a shareholder wishes to submit for inclusion in the Company’s proxy materials for such meeting, must be delivered to us no later than November 18, 2014. See “Shareholder Proposals and Director Nominations for 2015 Annual Meeting” on page 72. |

4

1550 Peachtree Street, N.W.

Atlanta, Georgia 30309

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS—MAY 2, 2014

Proxy Solicitation

Proxies in the form furnished are being solicited by the Board for the 2014 Annual Meeting. The accompanying notice of meeting, this Proxy Statement and the form of proxy card and Notice of Internet Availability of Proxy Materials are first being made available to shareholders on or about March 18, 2014.

Proposals to be Voted On

The following proposals will be voted on at the Annual Meeting:

| Proposal 1— |

Election of Directors | |

| Proposal 2— |

Ratification of Appointment of Independent Registered Public Accounting Firm | |

| Proposal 3— |

Advisory Vote on Executive Compensation |

All shares represented by proxies received will be voted in accordance with instructions contained in the proxies. In the absence of voting instructions to the contrary, shares represented by validly executed and dated proxies or voting instruction cards will be voted in accordance with the foregoing recommendations.

On or about March 18, 2014, we mailed a Notice of Internet Availability of Proxy Materials to our shareholders who have not previously requested electronic access to our proxy materials or the receipt of paper proxy materials advising them that they can access this Proxy Statement, the 2013 Annual Report and voting instructions over the Internet at www.proxyvote.com. You may then access these materials and vote your shares over the Internet or by telephone. The notice contains a 12-digit control number that you will need to vote your shares over the Internet or by telephone. Please keep the notice for your reference through the meeting date.

Alternatively, you may request that a printed copy of the proxy materials be mailed to you. If you want to receive a printed copy of the proxy materials, you may request one via the Internet at www.proxyvote.com, by calling toll-free 1-800-579-1639 or by sending an email to sendmaterial@proxyvote.com. There is no charge to you for requesting a copy. Please make your request for a copy on or before April 18, 2014 to facilitate timely delivery. If you previously elected to receive our proxy materials electronically, we will continue to send these materials to you via email unless you change your election.

The Company has retained AST Phoenix Advisors to assist in soliciting proxies for an annual fee not to exceed $7,500 plus expenses, and will bear the cost of soliciting proxies. Directors, officers and other Company associates also may solicit proxies by telephone or otherwise. Brokers and other nominees will be requested to solicit proxies or authorizations from beneficial owners and will be reimbursed for their reasonable expenses.

Shareholders Entitled to Vote; Attendance at the Meeting

Company shareholders of record at the close of business on March 4, 2014 are entitled to notice of, and to vote at, the meeting. As of such date, there were 121,863,151 shares of Company common stock outstanding, each entitled to one vote.

5

If your shares are held in the name of a bank, broker or other holder of record (also known as “street name”) and you wish to attend the meeting, you must present proof of ownership as of the record date, such as the Notice of Internet Availability of proxy materials or the voting instruction card that is sent to you or a current bank or brokerage account statement, to be admitted. The Company also may request appropriate identification such as a valid government-issued photo identification as a condition of admission.

Quorum; Required Vote

Quorum. The holders of a majority of the shares entitled to vote at the meeting must be present in person or represented by proxy to constitute a quorum. Abstentions and shares that brokers do not have the authority to vote in the absence of timely instructions from the beneficial owners (“broker non-votes”) will be treated as present for the purposes of determining a quorum. If a quorum is not present, the meeting may be adjourned from time to time until a quorum is present.

Election of Ten Directors. Each director nominee for whom more shares are voted “for” than “against” his or her election will be elected as a director at the meeting. Under our Bylaws, if more votes are cast “against” than are cast “for” a nominee, the nominee shall offer his or her resignation. The independent members of the Board will determine and promptly publicly announce the action to be taken with respect to acceptance or rejection of the resignation offer.

All Other Proposals. For all of the other proposals described in this Proxy Statement, the proposal will be approved if more votes are cast “for” than are cast “against” the proposal. Although the vote on Proposal 3 is advisory in nature and non-binding even if approved by our shareholders, our Board and Compensation Committee will carefully review the results of the vote and, consistent with our record of shareholder engagement, will take the results into account in formulating future executive compensation policy.

Broker Non-Votes and Abstentions. Under certain circumstances, including the election of directors and matters involving executive compensation (“non-routine” matters), banks and brokers are prohibited from exercising discretionary authority for “street name” owners who have not provided voting instructions to the broker. In these cases, and in cases where the shareholder abstains from voting on a matter, those shares will be counted for the purpose of determining if a quorum is present but will not be included as votes cast with respect to those matters. Whether a bank or broker has authority to vote its shares on uninstructed matters is determined by stock exchange rules. We expect that brokers will be allowed to exercise discretionary authority for beneficial owners who have not provided voting instructions only with respect to Proposal 2, but not with respect to any of the other proposals to be voted on at the Annual Meeting. Broker non-votes and abstentions will have no effect on any of the proposals to be considered at the Annual Meeting.

Other Voting Matters

The Company is not aware, as of the date of this Proxy Statement, of any other matters to be voted on at the Annual Meeting. If any other matters are properly brought before the meeting for a vote, the persons named as proxies on the proxy card will vote all shares represented at the meeting (other than shares that are voted by the holder in person at the meeting) on such matters in accordance with the Board’s recommendation.

How to Vote

Shareholders of record. Shareholders of record may attend and cast their votes at the meeting. In addition, shareholders of record may cast their vote by proxy and participants in the Company’s benefit plans described below may submit their voting instructions by:

| • | using the Internet and voting at the website listed on the enclosed proxy/voting instruction card (the “proxy card”); |

6

| • | using the toll-free telephone number listed on the enclosed proxy card; or |

| • | signing, completing and returning the enclosed proxy card in the enclosed postage-paid envelope. |

Votes cast through the Internet and telephone voting procedures are authenticated by use of a personal identification number. This procedure allows shareholders to appoint a proxy (or Company benefit plan participants to provide voting instructions) and to confirm that their actions have been properly recorded. Specific instructions to be followed are set forth on the enclosed proxy card. If you vote through the Internet or by telephone, you do not need to return your proxy card.

Beneficial owners. If you are the beneficial owner of shares held in “street name,” you have the right to direct your bank, broker or other nominee on how to vote your shares by using the voting instruction form provided to you by them, or by following their instructions for voting through the Internet or by telephone. In the alternative, you may vote in person at the meeting if you obtain a valid proxy from your bank, broker or other nominee and present it at the meeting. In order for your shares to be voted on all matters presented at the meeting, we urge all shareholders whose shares are held in street name by a bank, brokerage firm or other nominee to provide voting instructions to such record holder.

Participants in the Equifax Inc. 401(k) Plan and the Equifax Canada Retirement Savings Program for Salaried Employees (collectively, the “Company Plans”). Participants in the Company Plans may instruct the applicable plan trustee how to vote all shares of Company common stock allocated to their accounts. To allow sufficient time for the plan trustees to vote, the trustees must receive your voting instructions no later than 11:59 p.m. Eastern Time on April 30, 2014. The 401(k) Plan trustee will vote shares for which it has not received instructions in the same proportion as the shares for which it has received instructions. The Canada Retirement Savings Program trustee will only vote those plan shares for which voting instructions are received prior to this deadline. Participants in the Company Plans may not vote the shares owned through such plans after this deadline, including at the Annual Meeting.

Revocation of Proxies or Change of Instructions

A proxy given by a shareholder of record may be revoked at any time before it is voted by sending written notice of revocation to the Corporate Secretary of the Company at the address set forth below, by delivering a proxy (by one of the methods described above) bearing a later date or by voting in person at the meeting. Participants in the plans described above may change their voting instructions by delivering new voting instructions by one of the methods described above.

If you are the beneficial owner of shares held in “street name,” you may submit new voting instructions in the manner provided by your bank, broker or other nominee, or you may vote in person at the Annual Meeting in the manner described above under “How to Vote.”

Multiple Company shareholders who share an address may receive only one copy of this Proxy Statement and the 2013 Annual Report from their bank, broker or other nominee, unless contrary instructions are received. We will deliver promptly a separate copy of this Proxy Statement and the 2013 Annual Report to any shareholder who resides at a shared address and to which a single copy of the documents was delivered, if the shareholder makes a request by contacting the Office of Corporate Secretary, Equifax Inc., P.O. Box 4081, Atlanta, Georgia 30302, telephone (404) 885-8000. Beneficial owners sharing an address who are receiving multiple copies of this proxy statement and the 2013 Annual Report and who wish to receive a single copy in the future will need to contact their bank, broker or other nominee.

Voting Results

You can find the official results of voting at the meeting in our Current Report on Form 8-K that we will file with the Securities and Exchange Commission (“SEC”) within four business days after the

7

Annual Meeting. If the official results are not available at that time, we will provide preliminary voting results in the Form 8-K and will provide the final results in an amendment to the Form 8-K as soon as they become available.

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

General

The Board oversees, counsels and directs management in the long-term interests of the Company and our shareholders. The Board’s responsibilities include:

| Ÿ | selecting and evaluating the performance of the Chief Executive Officer (the “CEO”) and other senior executives; |

| Ÿ | planning for succession with respect to the position of Chairman and CEO and monitoring management’s succession planning for other senior executives; |

| Ÿ | reviewing and approving our major financial objectives, strategic and operating plans, and other significant actions; |

| Ÿ | overseeing the conduct of our business and the assessment of our business risks to evaluate whether the business is being properly managed; and |

| Ÿ | overseeing the processes for maintaining the integrity of our financial statements and other public disclosures, and compliance with law and ethics. |

Our Board is comprised of ten members each of whom is serving an annual term expiring at the Annual Meeting. The Board has determined that nine to 12 directors is currently the appropriate size for our Board. The Board believes this range is sufficient to ensure the presence of directors with diverse experience and skills, without hindering effective decision-making or diminishing individual responsibility. The Board also believes this range is flexible enough to permit the recruitment, if circumstances so warrant, of any outstanding director candidate in whom the Board may become interested. The Governance Committee periodically reviews the size of the Board and recommends changes as appropriate.

Leadership Structure of the Board

In accordance with our Bylaws, the Board elects our CEO and our Chairman of the Board, and these positions may be held by the same person. Under the Board’s Mission Statement and Guidelines on Significant Corporate Governance Issues (the “Governance Guidelines”), the Board does not have a policy, one way or another, on whether the roles of the Chairman and the CEO should be separate and, if it is to be separate, whether the Chairman should be selected from among the non-employee directors or be an employee. If the Chairman is not an independent director, however, the Governance Guidelines require that a Presiding Director shall be recommended by the Governance Committee and elected by a majority of independent directors. The Governance Committee charter provides that it shall recommend to the Board the corporate governance structure of the Company.

The Chairman of the Board is responsible for chairing Board and shareholder meetings, setting the agenda for Board meetings and providing information to the Board members in advance of meetings and between meetings. The duties of the Presiding Director as provided in the Governance Guidelines include the following:

| Ÿ | advising the Chairman and CEO of decisions reached, and suggestions made, at the executive sessions of the non-employee directors; |

| Ÿ | calling meetings of the non-employee directors; |

| Ÿ | presiding at each Board meeting at which the Chairman is not present; |

| Ÿ | reviewing and approving the agenda, schedule and materials for Board meetings; |

8

| Ÿ | facilitating communication between the non-employee directors and the Chairman and CEO; |

| Ÿ | meeting directly with management and non-management employees of the Company; and |

| Ÿ | being available for consultation and direct communication with shareholders as appropriate. |

All directors may interact directly with the Chairman and CEO and provide input on presentations by management at Board and Committee meetings, and each has complete access to our management and employees.

The Governance Committee and the Board have determined that our current Board structure, combining the Chairman and CEO positions and utilizing a Presiding Director, is the most appropriate leadership structure for the Company and its shareholders at the present time. Combining the Chairman and CEO roles fosters clear accountability, effective decision-making, alignment with corporate strategy, direct oversight of management, full engagement of the independent directors and continuity of leadership. As the officer ultimately responsible for the day-to-day operation of the Company and for execution of its strategy, the Board believes that the CEO is the director best qualified to act as Chairman of the Board and to lead Board discussions regarding the performance of the Company.

The Company’s governance practices provide for strong independent leadership and oversight, independent discussion among directors, and independent evaluation of, and communication with, members of our senior leadership team. These governance practices are reflected in the Governance Guidelines and the various charters of the Board Committees which are described below. Some of the relevant practices include:

| Ÿ | The annual election by the independent directors of a Presiding Director with clearly defined leadership authority and responsibilities. |

| Ÿ | At each regularly scheduled Board meeting, the non-management directors meet in executive session and deliberate on matters such as CEO succession planning and performance. |

| Ÿ | A substantial majority of our Board should be independent. Nine of our ten current directors are independent, which is substantially above the NYSE requirement that a majority of directors be independent. Each director is an equal participant in decisions made by the full Board. All of our Board Committees are comprised of independent directors. |

| Ÿ | In 2011, the Company completed the phase-in of the annual election of all directors by our shareholders to enhance accountability to our shareholders. |

The Board’s Role in Risk Oversight

Our Board oversees an enterprise-wide risk management program which is designed to support the achievement of our organizational and strategic objectives, to identify and manage risks, to improve long-term organizational performance and to enhance shareholder value. On an annual basis, the Board performs an enterprise risk assessment with management to review the principal risks facing the Company and monitors the steps management is taking to map and mitigate these risks. The Board then sets the general level of risk appropriate for the Company through business strategy reviews. Risks are assessed throughout the business, focusing on two primary areas: (1) financial, operational and strategic risk, and (2) ethical, legal, regulatory and other compliance risks. Each business unit and corporate support unit has primary responsibility for assessing risks within their respective areas of responsibility and mitigating those risks. The CEO and our senior leadership team receive comprehensive periodic reports on the most significant risks from these units and from the head of our internal audit department.

In addition, each of our Board committees considers the risks within its areas of responsibility. For example, the Audit Committee reviews risks related to financial reporting; discusses material violations,

9

if any, of Company ethics, legal, regulatory and other compliance policies; considers the Company’s annual audit risk assessment which identifies internal control risks and drives the internal and external audit plan for the ensuing year; and considers the impact of risk on our financial position and the adequacy of our risk-related internal controls. The Compensation, Human Resources & Management Succession Committee (the “Compensation Committee”) reviews compensation, human resource and management succession risks, as summarized under “Management of Compensation-Related Risk” on page 49. The Governance Committee focuses on corporate governance risks, including evaluation of our leadership and risk oversight structure to ensure that it remains the optimal structure for our Company and shareholders. The Technology Committee enhances the Board’s focus on technology-related risks and opportunities.

The Board believes that the administration of the Board’s risk oversight function has not affected its leadership structure.

The Board’s Role in CEO and Executive Succession Planning

Our Board is accountable for the development, implementation and continual review of a succession plan for the CEO and other executive officers. Board members are expected to have a thorough understanding of the characteristics necessary for a CEO to execute a long-term strategy that optimizes operating performance, profitability and shareholder value creation. As part of its responsibilities under its charter, the Compensation Committee oversees the succession planning process for the CEO and the senior leadership team. The process ensures that critical business capabilities are safeguarded, executive development is accelerated and strategic talent is leveraged to focus on current and new business imperatives. The ongoing succession process is designed to reduce vacancy, readiness and transition risks and develop strong leadership quality and executive bench strength. The specific criteria for the CEO position are aligned with our long-term growth strategy we refer to as our Growth Playbook, and succession and development plans are monitored for each of the CEO’s direct reports including high potential internal CEO succession candidates, all of whom have ongoing exposure to the Board and are reviewed annually with the Board by the CEO and the Chief Human Resources Officer. The Committee and the Board also review the foregoing in executive session on a regular basis.

Meetings of the Board and its Committees

During 2013, the Board held six meetings; the Audit Committee met five times; the Compensation, Human Resources & Management Succession Committee met five times; the Governance Committee met four times; and the Technology Committee met four times. The Executive Committee did not meet; regular executive sessions of the Board were held as described under “Executive Sessions” on page 15. All director nominees attended 75% or more of the aggregate of the meetings of the Board and of the committees of the Board on which such directors served.

Attendance of Directors at 2013 Annual Meeting of Shareholders

All directors are expected to attend the Company’s annual meeting of shareholders. All of the Company’s directors then serving attended the 2013 annual meeting of shareholders.

Board Committees

The Board appoints committees to help carry out its duties and work on key issues in greater detail than is generally possible at Board meetings. Committees regularly review the results of their meetings with the Board. The Board has five standing committees, all of which are composed of independent directors as defined in the NYSE rules. The current members of each committee are shown on page 1 of this Proxy Statement.

10

Each committee operates pursuant to a written charter which is available as described under “Corporate Governance Guidelines” on page 13. The charters for each of our Board committees are available on our website at: www.equifax.com/about_equifax/corporate_governance/committee_charters/en_us.

The Audit Committee has sole authority to appoint, review and discharge the Company’s independent registered public accounting firm. The committee reviews and approves in advance the services provided by our independent registered public accounting firm, reviews and discusses the independence of that firm, oversees the internal audit function, reviews our internal accounting controls and financial reporting process, oversees our regulatory compliance program, and administers our Code of Ethics and Business Conduct. The committee reviews the Company’s guidelines and policies related to enterprise risk assessment and risk management.

The committee meets separately with the internal and external auditors to ensure full and frank communications with the committee. The Board has determined that Messrs. Copeland, Daleo, Feidler and McKinley are each “financially literate” under NYSE rules and that Messrs. Copeland, Daleo and Feidler are each an “audit committee financial expert” under the rules of the SEC.

The Audit Committee has appointed Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014, and is recommending that our shareholders ratify this appointment at the Annual Meeting. See Proposal 2 on page 24 and the Audit Committee Report on page 69.

The Compensation, Human Resources & Management Succession Committee (“Compensation Committee”) determines the compensation for our executive officers, establishes our compensation policies and practices, and reviews annual performance under our employee incentive plans. The Compensation Committee also provides assistance to the Governance Committee from time to time in connection with its review of director compensation. The Compensation Committee also advises management and the Board on succession planning and other significant human resources matters.

Role of Compensation Committee and Management in Determining Executive Compensation. The Compensation Committee reviews and makes decisions about executive policies and plans, including the amount of base salary, cash bonus and long-term incentive awarded to our named executive officers. Our Chairman and CEO and other executives may assist the Committee from time to time in its evaluation of compensation elements or program design or by providing mathematical calculations, historical information, year-over-year comparisons and clarification regarding job duties and performance. The Compensation Committee also considers the recommendations and competitive data provided by its compensation consultant and makes decisions, as it deems appropriate, on executive compensation based on its assessment of individual performance and achievement of goals both by the individual and the Company.

The CEO’s performance is reviewed by the Compensation Committee with input from the other non-employee members of the Board. The CEO annually reviews the performance of each other executive officer who reports to him, including the named executive officers listed in the Summary Compensation Table on page 52. The conclusions reached and recommendations made based on these reviews, including with respect to salary adjustments and annual award amounts, are presented to the Compensation Committee for approval. Members of management play various additional roles in this process:

| Ÿ | The CEO makes recommendations to the Compensation Committee regarding executive salary merit increases and compensation packages for the executive officers (other than himself) based on his evaluation of the performance of the executives who report to him against their goals established in the first quarter of each year. |

11

| Ÿ | The Chief Human Resources Officer and her staff provide the Compensation Committee with details of the operation of our various compensation plans, including the design of performance measures for our annual incentive plan and the design of our equity incentive program. |

| Ÿ | The Chief Financial Officer provides information and analysis relevant to the process of establishing performance targets for our annual cash incentive plan as well as any other performance-based awards and presents information regarding the attainment of corporate financial goals for the preceding year. |

| Ÿ | The Corporate Secretary attends meetings of the Compensation Committee to provide input on legal issues, respond to questions about corporate governance and assist in the preparation of minutes. |

The Compensation Committee considers these recommendations and exercises discretion in modifying any recommended adjustments or awards to executives based on considerations it deems appropriate. Although members of our management team participate in the executive compensation process, the Compensation Committee also meets regularly in executive session without any members of the management team present. The Compensation Committee makes the final determination of the executive compensation package provided to each of our named executive officers, with input from the non-employee members of the Board in executive session with respect to CEO compensation.

Compensation Consultant Services and Independence. The Compensation Committee has the authority to engage independent advisors to assist it in fulfilling its responsibilities. The Committee has retained Meridian Compensation Partners LLC (“Meridian”), a national executive compensation consulting firm, to provide advice with respect to compensation for our named executive officers and other officers. Meridian performs services solely on behalf of the Committee and does not provide any other services to us. Management of the Company had no role in selecting the Committee’s compensation consultant and had no relationship with Meridian. The Committee has assessed the independence of Meridian pursuant to SEC rules and concluded that no conflict of interest exists that would prevent Meridian from independently representing the Committee.

In 2013, Meridian performed the following services for the Committee:

| Ÿ | provided market benchmark information; |

| Ÿ | advised the Committee on incentive risk assessment and proxy disclosure; |

| Ÿ | provided regulatory and governance guidance; |

| Ÿ | assisted the Committee in determining appropriate levels of compensation for the CEO and other executive officers; and |

| Ÿ | attended all Committee meetings upon invitation and participated in executive sessions thereof without management present. |

The Executive Committee is authorized to exercise the powers of the Board in managing our business and property during the intervals between Board meetings, subject to Board discretion and applicable law.

The Governance Committee reviews and makes recommendations to the Board regarding nominees for director; recommends to the Board, and monitors compliance with, our Governance Guidelines and other corporate governance matters; conducts an annual review of the effectiveness of our Board; makes recommendations to the Board with respect to Board and committee organization, membership and function; and exercises oversight of Board compensation. Our process for receiving and evaluating Board member nominations from our shareholders is summarized under the captions “Director Qualifications and Nomination Process” on page 14 and “Shareholder Proposals and Director Nominations for 2015 Annual Meeting” on page 72.

12

The Technology Committee assesses our technology development strategies and makes recommendations to the Board as to scope, direction, quality, investment levels and execution of technology strategies; oversees the execution of technology strategies formulated by management and technology risk and opportunities; provides guidance on technology as it may pertain to, among other things, investments, mergers, acquisitions and divestitures, research and development investments, and key competitor and partnership strategies.

Corporate Governance Guidelines

The Governance Committee is responsible for overseeing the Governance Guidelines adopted by the Board and annually reviews them and makes recommendations to the Board concerning corporate governance matters. The Board may amend, waive, suspend, or repeal any of these guidelines at any time, with or without public notice, as it deems necessary or appropriate in the exercise of the Board’s judgment or fiduciary duties. Among other matters, the Governance Guidelines include the following items concerning the Board:

| Ÿ | Non-management directors shall retire at the next Board meeting following the director’s 72nd birthday, unless requested by the Board to stay. Directors who are employees of the Company in the normal course resign from the Board when their employment ceases or they reach age 65, absent a Board determination that it is in the best interests of the Company for the employee to continue as a director. |

| Ÿ | Directors are limited to service on five public company boards other than our Board. |

| Ÿ | The CEO reports at least annually to the Board on succession planning and management development. |

| Ÿ | The Presiding Director and the Chair of the Governance Committee manage a process whereby the Board and its Committee members are subject to an annual evaluation and self-assessment. |

Our Governance Guidelines are posted at www.equifax.com/about_equifax/governance_principals/en_us.

Code of Ethics

We have adopted codes of ethics and business conduct applicable to our directors, officers and employees, available at www.equifax.com/about_equifax/corporate_governance/en_us, or in print upon request to the Office of Corporate Secretary, Equifax, P.O. Box 4081, Atlanta, Georgia 30302, telephone (404) 885-8000. Any amendment or waiver of a provision of these codes of ethics or business conduct that applies to any Equifax director or executive officer will also be disclosed on our website.

Director Independence

The Board has determined that all directors, excluding Mr. Smith, are independent under the applicable NYSE and SEC rules. In making these determinations, the Board considered the types and amounts of the commercial dealings between the Company and the companies and organizations with which the directors are affiliated. Each of these transactions was significantly below the thresholds set forth in the categories of immaterial relationships described in our Director Independence Standards which are attached as Appendix B to this Proxy Statement. See “Review, Approval or Ratification of Transactions with Related Persons” on page 71.

Communicating with Directors

Shareholders and other interested parties who wish to communicate with our directors, a committee of the Board of Directors, the Presiding Director, the non-management directors as a group, or the Board generally should address their correspondence accordingly and send by mail to Equifax Inc., c/o Corporate Secretary, P.O. Box 4081, Atlanta, Georgia 30302. All concerns related to audit or accounting matters will be referred to the Audit Committee.

13

Director Qualifications and Nomination Process

The Governance Committee of our Board is the standing committee responsible for selecting the slate of director nominees for election by our shareholders. The Committee recommends those nominees to the full Board for approval and often utilizes the services of a third party search firm to assist in the identification and evaluation of potential director nominees. The Committee Chair and Presiding Director are furnished with copies of the resumes provided by the search firm and review them as appropriate with the Governance Committee, the CEO and the full Board.

Our Governance Committee determines the selection criteria and qualifications for director nominees. As set forth in our Governance Guidelines, a candidate must have demonstrated accomplishment in his or her chosen field, character and personal integrity, the capacity and desire to represent the balanced, best interests of the Company and the shareholders as a whole and not primarily a special interest group, and the ability to devote sufficient time to carry out the duties of an Equifax director. The Committee and the Board consider whether the candidate is independent under the standards described above under “Director Independence.” In addition, the Committee and the Board consider all information relevant in their judgment to the decision of whether to nominate a particular candidate, taking into account the then-current composition of the Board and an assessment of the Board’s collective requirements. These factors may include a candidate’s educational and professional experience; reputation; industry knowledge and business experience and relevance to the Company and the Board (including the candidate’s understanding of markets, technologies, financial matters and international operations); whether the candidate will complement or contribute to the mix of talents, skills and other characteristics that are needed to maintain Board effectiveness; and the candidate’s ability to fulfill his or her responsibilities as a director and as a member of one or more of our standing Board committees.

Although the Committee does not have a formal diversity policy for Board membership, it considers whether a director nominee contributes or will contribute to the Board in a way that can enhance the perspective and experience of the Board as a whole through diversity in gender, ethnicity, geography and professional experience. When current Board members are considered for nomination for re-election, the Committee also takes into consideration their prior Board contributions, performance and meeting attendance records. The effectiveness of the Board’s skills, expertise and background, including its diversity, is also considered as part of the Board’s annual self-assessment.

The Board believes that nomination of a candidate should not be based solely on these factors noted above. The Governance Committee and the Board do not assign specific weights to particular criteria, and no particular criterion is a prerequisite for Board membership. We believe that the backgrounds and qualifications of our directors, considered as a group, should provide a complete mix of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities. Our current Board is geographically diverse; there is a balance of different ages; gender diversity includes one female director; and directors have diverse industry backgrounds which include banking, investment banking, venture capital, consumer products manufacturing, accounting and consulting, information and technology, telecommunications, and legal. The backgrounds and qualifications of our current directors and nominees are further described under “Proposal 1—Election of Directors” beginning on page 18.

The Governance Committee will consider for possible nomination qualified Board candidates that are submitted by our shareholders. Shareholders wishing to make such a submission may do so by sending the following information to the Governance Committee by November 18, 2014, c/o Corporate Secretary, P.O. Box 4081, Atlanta, Georgia 30302: (1) a nomination notice in accordance with the procedures set forth in Section 1.12 of the Bylaws; (2) a request that the Governance Committee consider the shareholder’s candidate for inclusion in the Board’s slate of nominees for the applicable meeting; and (3) along with the shareholder’s candidate, an undertaking to provide all other information the Committee or the Board may request in connection with their evaluation of the candidate. See “Shareholder Proposals and Director Nominations for 2015 Annual Meeting” on page 72. A copy of our Bylaws is available on our website at www.equifax.com/about_equifax/corporate_governance/en_us or by writing to the Corporate Secretary.

14

Any shareholder’s nominee must satisfy the minimum qualifications for any director described above in the judgment of the Governance Committee and the Board. In evaluating shareholder nominees, the Committee and the Board may consider all relevant information, including the factors described above, and additionally may consider the size and duration of the nominating shareholder’s holdings in the Company; whether the nominee is independent of the nominating shareholder and able to represent the interests of the Company and its shareholders as a whole; and the interests and/or intentions of the nominating shareholder.

No candidate for director nomination was submitted to the Governance Committee by any shareholder in respect of the Annual Meeting.

Executive Sessions

The non-management directors generally meet in executive session without management at every regularly scheduled in-person Board meeting. The Presiding Director or his designee presides at Board executive sessions.

Compensation Committee Interlocks and Insider Participation

Ms. Marshall and Messrs. Daleo, Driver, Humann and Templeton were the members of the Compensation Committee during 2013. None of these directors is or has been an executive officer of the Company, or had any relationship requiring disclosure by the Company under the SEC’s rules requiring disclosure of certain relationships and related party transactions. None of the Company’s executive officers served as a director or a member of a compensation committee (or other committee serving an equivalent function) of any other entity, the executive officers of which served as a director of the Company or a member of the Compensation Committee during 2013.

Director Compensation

The table below sets forth the compensation received by our non-management directors during 2013:

Director Compensation Table

| Name |

Fees Earned or Paid in Cash ($) |

Stock Awards(1)(2) ($) |

Option Awards(3) |

All

Other Compensation(4) ($) |

Total ($) |

|||||||||||||||

| James E. Copeland, Jr. |

95,000 | 133,089 | 0 | 100 | 228,189 | |||||||||||||||

| Robert D. Daleo |

92,500 | 133,089 | 0 | 100 | 225,689 | |||||||||||||||

| Walter W. Driver, Jr. |

86,250 | 133,089 | 0 | 320 | 219,659 | |||||||||||||||

| Mark L. Feidler |

88,750 | 133,089 | 0 | 100 | 221,939 | |||||||||||||||

| L. Phillip Humann |

93,750 | 133,089 | 0 | 100 | 226,939 | |||||||||||||||

| Robert D. Marcus |

12,432 | 167,974 | 0 | 300 | 180,706 | |||||||||||||||

| Siri S. Marshall |

90,000 | 133,089 | 0 | 130 | 223,219 | |||||||||||||||

| John A. McKinley |

92,500 | 133,089 | 0 | 320 | 225,909 | |||||||||||||||

| Mark B. Templeton |

86,250 | 133,089 | 0 | 0 | 219,339 | |||||||||||||||

| (1) | Represents the grant date fair value for restricted stock unit (RSU) awards made on May 2, 2013 (2,198 RSUs for each director then serving), other than Mr. Marcus whose initial RSU grant was made on November 1, 2013 (2,685 RSUs), computed in accordance with FASB ASC Topic 718. |

| (2) | As of December 31, 2013, each current non-employee director held 2,198 shares of unvested RSUs other than Mr. Marcus, who held 2,685 shares. |

| (3) | Prior to 2005, each non-employee director received an annual grant of a nonqualified option to purchase 7,000 shares of Company common stock with an exercise price equal to the fair market value closing price on the NYSE of the common stock on the grant date. These options became fully vested one year after the date granted and expire ten years from the date granted. As of December 31, 2013 directors with options outstanding included Mr. Copeland, 7,000, and Mr. Humann, 7,000. All director stock options were fully vested prior to 2011. |

| (4) | Reflects the market price of annual membership to certain of our credit monitoring products. |

15

Director Fees. For 2013, director cash compensation consisted of an annual cash retainer of $75,000, and an annual cash retainer of $20,000 for the Audit Committee chair, $15,000 for the Compensation Committee chair, and $7,500 each for the chairs of the Governance and Technology Committees. An annual cash retainer is also paid equal to $10,000 for Audit Committee members, $7,500 for Compensation Committee members and $3,750 for all other Committee members.

By paying directors an annual retainer and eliminating meeting fees, the Company compensates each non-employee director for his or her role and judgment as an advisor to the Company, rather than for his or her attendance or effort at individual meetings. Directors with added responsibility are recognized with higher cash compensation as noted above. The Governance Committee believes that this additional compensation is appropriate.

Equity Awards. Each non-employee director receives an initial and an annual long-term incentive grant of restricted stock units under our shareholder-approved 2008 Omnibus Incentive Plan on the date of the annual meeting of shareholders to further align their interests with those of our shareholders and to attract and retain highly qualified directors through equity ownership. For 2013, directors received a fixed value in shares computed as of the grant date ($175,000 initial one-time grant to new directors and $135,000 annual grant). The annual grants and initial grants vest one year and three years, respectively, after the grant date with accelerated vesting in the event of the director’s death, disability, retirement or a change in control of the Company. No dividend equivalents are paid on outstanding unvested restricted stock units.

Director Deferred Compensation Plan. Each non-employee director may defer receipt of up to 100% of his or her stock-based or cash retainer fees. The director is credited with a number of share units having an equivalent value at the end of each quarter based on his or her advance deferral election. Share units are equivalent to shares of the Company’s common stock, except that share units have no voting rights and do not receive dividend credit. In general, amounts deferred are not paid until the director retires from the Board. However, directors may also establish sub-accounts from which amounts are to be paid on specific pre-retirement timetables established by the director. At the end of the applicable deferral period, the director receives a share of common stock for each share unit awarded. Such shares are received either in a lump sum or over a period not to exceed 15 years for retirement distributions, or up to five years for a scheduled withdrawal, as elected in advance by each director.

Director and Executive Stock Deferral Plan. Each director may defer taxes otherwise due upon the vesting of restricted stock units. Due to changes in federal tax laws, no deferral elections for stock options are currently permitted under the plan. The director is credited with a number of share units as of the vesting date based on his or her advance deferral election. In general, amounts deferred under the plan are not paid until the director retires from the Board. However, directors may also establish sub-accounts from which amounts are to be paid on specific pre-retirement timetables established by the director. Amounts deferred are paid in shares of our common stock, at the director’s option, either in a lump sum or in annual installments over a period of up to 15 years for retirement distributions, or up to five years for a scheduled withdrawal. We make no contributions to this plan, but we pay all costs and expenses incurred in its administration.

Director Stock Ownership Guidelines. Our Bylaws require all directors to own our stock while serving as a director. Our stock ownership guidelines require that each non-employee director own shares of our stock having a value of at least five times the annual cash retainer, no later than the fifth anniversary of the annual meeting of shareholders at which the director was first elected to the Board.

Indemnification. Under our Articles of Incorporation and Bylaws, the directors and officers are entitled to indemnification from the Company to the fullest extent permitted by Georgia law. We have entered into indemnification agreements with each of our directors and executive officers. Those agreements do not increase the extent or scope of the indemnification provided, but do establish processes and procedures for indemnification claims.

16

Other. Non-employee directors are reimbursed for customary and usual expenses incurred in attending Board, committee and shareholder meetings. Directors are also reimbursed for customary and usual expenses associated with other business activities related to their Board service, including participation in director education programs and memberships in director organizations. We pay premiums on directors’ and officers’ liability insurance policies that we maintain that cover our directors. We do not provide retirement benefits to non-employee directors.

EXECUTIVE OFFICERS

The executive officers of the Company and their ages and titles are set forth below. Business experience for the past five years and other information is provided in accordance with SEC rules.

Richard F. Smith (54) has been Chairman and CEO since December 2005.

Lee Adrean (62) has been Corporate Vice President and CFO since October 2006.

John J. Kelley III (53) was appointed Corporate Vice President and Chief Legal Officer effective January 1, 2013. His responsibilities include legal services, global sourcing, security and compliance, government and legislative relations, corporate governance and privacy functions. Mr. Kelley was a senior partner in the Corporate Practice Group of the law firm of King & Spalding LLP from January 1993 to December 2012, specializing in a broad range of corporate finance transactions and securities matters, advising public clients regarding SEC reporting and disclosure requirements, and other corporate governance and compliance matters.

Coretha M. Rushing (57) has been Corporate Vice President and Chief Human Resources Officer since 2006.

Paul J. Springman (68) has served as Corporate Vice President and Chief Marketing Officer since February 2004.

David C. Webb (58) became Chief Information Officer in January 2010. Prior to joining the Company, he served as Chief Operations Officer for SVB Financial Corp. since 2008.

J. Dann Adams (56) has been President, Workforce Solutions since April 2010. Previously, he was President, U.S. Consumer Information Solutions since 2007.

Rodolfo O. Ploder (53) has been President, U.S. Consumer Information Solutions since April 2010 and before that was President, International from January 2007.

Paulino Do Rego Barros, Jr. (57) has been President, International since April 2010. Prior to joining the Company, he was founder of PB&C—Global Investments LLC, an international business consulting firm, and served as its President from October 2008.

Joseph M. Loughran, III (46) has been President, North America Personal Solutions since January 2010. He was Senior Vice President—Corporate Development from April 2006 to December 2009.

Alejandro Gonzalez (44) has been President, North America Commercial Solutions since January 2010. He was Senior Vice President of Strategic Marketing from December 2005 to December 2009.

Nuala M. King (60) has been Senior Vice President and Controller since May 2006.

17

PROPOSAL 1—ELECTION OF DIRECTORS

All members of our Board are elected to serve until the next annual meeting of shareholders and until their successors have been elected and qualified. The ten nominees for election listed below each have consented to being named in this Proxy Statement and to serve if elected. Presented below is biographical information for each of the nominees. Each nominee was elected at the 2013 Annual Meeting with the exception of Mr. Marcus, who was appointed a director by the Board effective November 1, 2013 and became a member of the Governance Committee on January 1, 2014.

Our directors have a variety of backgrounds, which reflects the Board’s continuing objective to achieve a diversity of perspective, experience, knowledge, ethnicity and gender. As more fully discussed below, director nominees are considered on the basis of a range of criteria, including their business knowledge and background, reputation and global business perspective. They must also have demonstrated experience and ability that is relevant to the Board’s oversight role with respect to Company business and affairs. Each director’s biography includes the particular experience and qualifications that led the Board to conclude that the director should serve on the Board.

| THE BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH NOMINEE

LISTED BELOW. |

| Nominees for Directors | ||||

|

Ÿ Director since 2003 Ÿ Independent Ÿ Chair of Audit Committee |

James E. Copeland, Jr., 69 – Retired Chief Executive Officer of Deloitte & Touche LLP and Deloitte Touche Tohmatsu, public accounting firms. Mr. Copeland served in such capacity from 1999 until his retirement in 2003. He also is a director of ConocoPhillips and Time Warner Cable, Inc., and a former director of Coca-Cola Enterprises, Inc. | |||

|

Significant Experience/Competencies |

Overview of Board Qualifications | |||

|

Ÿ Former Large Company CEO Ÿ General Management & Business Operations Ÿ Mergers & Acquisitions Ÿ International Ÿ Strategy Development Ÿ Accounting Ÿ Risk Management Ÿ Finance |

Mr. Copeland has invaluable expertise in the areas of audit, accounting and finance, including operating experience as the CEO of a major international accounting firm. His knowledge of the Company’s structure, operations, compliance programs and risk oversight as Chairman of the Audit Committee is of particular importance to our Board. The Board also values Mr. Copeland’s insight and judgment gained through years of public company board experience with companies operating in industries as diverse as oil and gas, beverages and entertainment, including experience on audit, executive, compensation and finance committees of other publicly traded companies. | |||

18

|

Ÿ Director since 2006 Ÿ Independent Ÿ Audit Committee Ÿ Compensation Committee |

Robert D. Daleo, 64 – Retired Vice Chairman of Thomson Reuters. Mr. Daleo was Executive Vice President and Chief Financial Officer of Thomson Reuters or its predecessors from 1997 through 2011, Vice Chairman from 2011 until his retirement in December 2012, and a member of The Thomson Corporation board of directors from 2001 to April 2008. Thomson Reuters is a global provider of integrated information solutions to business and professional customers. From 1994 to 1998, Mr. Daleo served in senior operations, planning, finance and business development positions with Thomson Reuters. Mr. Daleo currently serves on the Board of Directors of Citrix Systems, Inc. | |||

|

Significant Experience/Competencies |

Overview of Board Qualifications | |||

|

Ÿ

Former Public Company |

Mr. Daleo has developed extensive | |||

|

Ÿ Director since 2007 Ÿ Independent Ÿ Governance Committee Ÿ Compensation Committee |

Walter W. Driver, Jr., 68 – Chairman–Southeast of Goldman, Sachs & Co., a global investment banking, securities and investment management firm, since January 2006. He also serves on the Goldman Sachs Board of International Advisors. Prior to joining Goldman Sachs, Mr. Driver served as Managing Partner or Chairman of King & Spalding LLP, an international law firm, from 1999 through 2005. He currently serves on the Board of Directors of Total System Services, Inc. | |||

|

Significant Experience/Competencies |

Overview of Board Qualifications | |||

|

Ÿ International Investment Banking Ÿ Former Head of International Law Firm Ÿ General Management & Business Operations Ÿ Mergers & Acquisitions Ÿ International Ÿ Strategy Development Ÿ Finance Ÿ Legal, Corporate Governance and Compliance |

Mr. Driver has extensive investment banking expertise in evaluating corporate acquisitions, strategies, operations and risks. The Board values his judgment, skills and experience in legal and regulatory matters gained through leadership of a major international law firm. Mr. Driver also has corporate governance experience and insight gained through his legal practice and public company directorships, including service on compensation and governance committees. | |||

19

|

Ÿ Director since 2007 Ÿ Independent Ÿ Audit Committee Ÿ Technology Committee |

Mark L. Feidler, 57 – Founding Partner of MSouth Equity Partners, a private equity firm based in Atlanta, since February 2007. Mr. Feidler was President and Chief Operating Officer and a director of BellSouth Corporation, a telecommunications company, from 2005 until January 2007. He was appointed Chief Operating Officer of BellSouth Corporation in January 2005 and served as its Chief Staff Officer during 2004. From 2001 through 2003, Mr. Feidler was Chief Operating Officer of Cingular Wireless and served on the Board of Directors of Cingular from 2005 until January 2007. He also serves as Lead Director on the Board of Directors of the New York Life Insurance Company. | |||

|

Significant Experience/Competencies |

Overview of Board Qualifications | |||

|

Ÿ Former Public Company President & COO Ÿ General Management & Business Operations Ÿ Mergers & Acquisitions Ÿ International Ÿ Strategy Development Ÿ Finance |

Mr. Feidler has extensive operating, financial, legal and regulatory experience through his prior position with a major regional telecommunications company, as well as expertise in private equity investments and acquisitions. This background is relevant to us as we market our products to companies in telecommunications and other vertical markets, while his private equity experience is relevant to our new product development, marketing and acquisition strategies. His public company operating experience and background in financial, accounting and risk management are an important resource for our Audit Committee and Board. | |||

|

Ÿ Director since 1992 Ÿ Independent Ÿ Presiding Director Ÿ Chair of Compensation, Ÿ Governance Committee |

L. Phillip Humann, 68 – Retired Executive Chairman of the Board of SunTrust Banks, Inc., a multi-bank holding company. Mr. Humann was Executive Chairman of the Board of SunTrust Banks, Inc. from 2007 to April 2008; Chairman and Chief Executive Officer from 2004 through 2006; Chairman, President and Chief Executive Officer from 1998 to 2004; and President from 1991 to 1998. He also is a Director of Coca-Cola Enterprises Inc. and is the Lead Director of Haverty Furniture Companies, Inc., where he was Non-Executive Chairman from May 2010 to December 2012. | |||

|

Significant Experience/Competencies |

Overview of Board Qualifications | |||

|

Ÿ Former Public Company CEO Ÿ Industry Experience Ÿ General Management & Business Operations Ÿ Mergers & Acquisitions Ÿ International Strategy Development Ÿ Finance Ÿ Retail Ÿ Corporate Governance & Compliance Ÿ Risk Management Ÿ Banking |

Mr. Humann has over 41 years of experience in the banking, mortgage and financial services industry. The Board highly values his experience and insights regarding how our customers use our services and products to manage their risk and retention objectives. The Board also values his leadership skills and deep knowledge of our business and perspective gained from 21 years of service on the Board and at other public companies. | |||

20

|

Ÿ Director since 2013 Ÿ Independent Ÿ Governance Committee |