UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

EQUIFAX INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

1550 Peachtree Street, N.W.

Atlanta, Georgia 30309

April 14, 2005

DEAR SHAREHOLDERS:

We cordially invite you to attend Equifax’s 2005 annual meeting of shareholders. The meeting will be held on Tuesday, May 17, 2005 at 9:30 a.m. (EDT) in the Cecil B. Day Chapel at The Carter Center, 453 Freedom Parkway, N.E., Atlanta, Georgia 30307.

Attached are the notice of the meeting and the proxy statement. Please read these materials so that you will know what we plan to do at the meeting. The proxy statement tells you more about the agenda and procedures for the meeting. It also describes how the Board operates and provides personal information about our directors and nominees for director. At this meeting, you will hear a current report on the activities of Equifax, and you will also have the opportunity to meet our directors and executives.

Please review the accompanying proxy card and provide us with your proxy instructions as soon as possible. This way, your shares will be voted as you direct even if you cannot attend the meeting.

On behalf of the officers and directors, I thank you for your interest in Equifax and your confidence in our future.

Very truly yours,

THOMAS F. CHAPMAN

Chairman and Chief Executive Officer

1550 Peachtree Street, N.W.

Atlanta, Georgia 30309

NOTICE OF 2005 ANNUAL MEETING OF SHAREHOLDERS

| TIME AND DATE: |

9:30 a.m. (EDT) on Tuesday, May 17, 2005 | |

| PLACE: |

Cecil B. Day Chapel | |

| The Carter Center | ||

| 453 Freedom Parkway, N.E. | ||

| Atlanta, Georgia 30307 | ||

| ITEMS OF BUSINESS: |

(1) To elect four directors, each for a three-year term; | |

| (2) To ratify the appointment of Equifax’s independent registered public accounting firm; and | ||

| (3) To transact any other business as may properly come before the meeting. | ||

| WHO MAY VOTE: |

Shareholders of record on March 9, 2005. | |

| ANNUAL REPORT: |

A copy of our 2004 Annual Report to Shareholders is enclosed. | |

| DATE OF MAILING: |

This notice and the proxy statement are first being mailed to shareholders on or about April 14, 2005. | |

| By order of the Board of Directors, |

| Dean C. Arvidson |

| Corporate Secretary |

April 14, 2005

TABLE OF CONTENTS

| Page | ||

| 1 | ||

| 3 | ||

| 7 | ||

| 7 | ||

| 8 | ||

| 9 | ||

| 11 | ||

| 11 | ||

| 12 | ||

| PROPOSAL 2—RATIFICATION OF APPOINTMENT OF EQUIFAX’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

13 | |

| 13 | ||

| 14 | ||

| 14 | ||

| 15 | ||

| 17 | ||

| 18 | ||

| 18 | ||

| Report of the Compensation, Human Resources & Management Succession Committee |

18 | |

| 24 | ||

| 25 | ||

| 27 | ||

| 28 | ||

| 28 | ||

| Securities Authorized for Issuance under Equity Compensation Plans |

29 | |

| 30 | ||

| 32 | ||

| 32 | ||

| 32 | ||

| 33 | ||

| 33 | ||

| 33 | ||

| 33 | ||

| 34 | ||

| 34 | ||

| 34 | ||

| 34 | ||

| 35 | ||

| 35 | ||

1550 Peachtree Street, N.W.

Atlanta, Georgia 30309

April 14, 2005

PROXY STATEMENT

We are sending you this proxy statement in connection with the solicitation of proxies by our Board of Directors for the 2005 annual meeting of shareholders. We are mailing this proxy statement and the accompanying form of proxy and 2004 Annual Report to Shareholders on or about April 14, 2005. In this proxy statement, we refer to Equifax Inc. as the “Company,” “we” or “us.”

DATE AND LOCATION

We will hold the annual meeting on Tuesday, May 17, 2005 at 9:30 a.m. (EDT) in the Cecil B. Day Chapel at The Carter Center, 453 Freedom Parkway, N.E., Atlanta, Georgia 30307.

RECORD DATE

The record date for the annual meeting is March 9, 2005. You may vote all shares of Equifax’s common stock that you owned as of the close of business on that date. Each share of common stock entitles you to one vote on each matter to be voted on at the annual meeting. On the record date, 135,067,175 shares of common stock were outstanding.

VOTING SHARES REGISTERED IN YOUR NAME

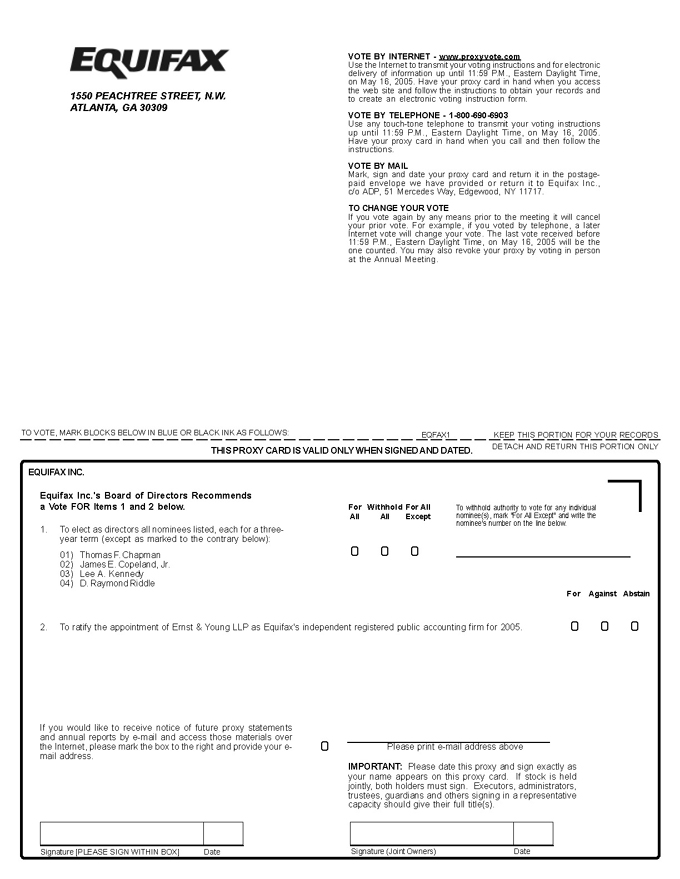

Shareholders can vote at the annual meeting in person or by proxy. There are three ways to vote by proxy:

| · | By Telephone—Shareholders located in the U.S. and Canada can vote by telephone by calling 1-800-690-6903 and following the instructions on the proxy card; |

| · | By Internet—You can vote over the Internet at www.proxyvote.com by following the instructions on the proxy card; or |

| · | By Mail—You can vote by mail by signing, dating and mailing the enclosed proxy card in the postage-paid envelope. |

Telephone and Internet voting facilities for shareholders of record will be available 24 hours a day and will close at 11:59 p.m. (EDT) on May 16, 2005.

If you vote by proxy, the individuals named on the proxy card (your “proxies”) will vote your shares in the manner you indicate. The members of Equifax’s Board of Directors designated to vote the proxies returned pursuant to this solicitation are Thomas F. Chapman, James E. Copeland, Jr., Larry L. Prince, John L. Clendenin and D. Raymond Riddle. You may specify whether your shares should be voted for all, some or none of the nominees for director and whether your shares should be voted for or against or abstain as to each of the other proposals. If you sign and return the proxy card without indicating your instructions, your shares will be voted FOR the election of the four nominees for directors and FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2005.

VOTING SHARES HELD IN “STREET NAME”

If you hold shares through a broker, follow the voting instructions you receive from the holder of record. Telephone and Internet voting also will be offered to shareholders owning shares through certain banks and brokers. If you want to vote in person, you must obtain a legal proxy card from your broker and bring it to the annual meeting.

VOTING SHARES HELD IN EQUIFAX EMPLOYEE SAVINGS PLANS

If you are a participant in the Equifax Inc. 401(k) Plan, your vote will serve as voting instructions to the trustee of the plan for all shares you own through the plan. Fidelity Management Trust Company is the trustee for the plan. Participants in the plan must vote their proxies no later than 11:59 p.m. (EDT) on Sunday, May 15, 2005. The trustee will vote plan shares that are not voted by this deadline in the same proportion as the shares held by the trustee for which voting instructions have been received. Participants in the plan may not vote the shares owned through such plan after the deadline, including at the annual meeting. As of March 9, 2005, there were 1,788,101 shares held in the plan.

If you are a participant in the Equifax Canada Retirement Savings Program for Salaried Employees, your vote will serve as voting instructions to the trustee of the plan for all shares you own through the plan. Fidelity Investments Canada Limited is the trustee for the plan. Participants in the plan must vote their proxies no later than 11:59 p.m. (EDT) on Sunday, May 15, 2005. The trustee will only vote the plan shares for which voting instructions are received prior to this deadline. Participants in the plan may not vote the shares owned through such plan after the deadline, including at the annual meeting. As of March 9, 2005, there were 15,913 shares held in the plan.

REVOKING A PROXY

Whether you vote by mail, telephone or via the Internet, you may later revoke your proxy by:

| · | Sending a written statement to that effect to the Corporate Secretary of Equifax; |

| · | Submitting a properly signed proxy with a later date; |

| · | Voting by telephone or via the Internet at a later time; or |

| · | Voting in person at the annual meeting (except for shares held in Equifax employee savings plans, see above). |

QUORUM REQUIREMENT

We need a majority of the shares of common stock outstanding on the record date present, in person or by proxy, to hold the annual meeting. Abstentions and broker non-votes will be counted for purposes of establishing a quorum at the annual meeting.

2

VOTE REQUIRED

Directors are elected by a plurality of the votes, which means the four nominees who receive the highest number of properly executed votes will be elected as directors. Shares represented by proxies that are marked “withhold authority” for the election of one or more director nominees will not be counted in determining the number of votes cast for those persons.

The affirmative vote of a majority of the votes cast is needed to ratify the appointment of Ernst & Young LLP as Equifax’s independent registered public accounting firm for the year 2005, and to approve any other matters properly considered at the annual meeting.

If you abstain from voting on a matter, your shares will be counted for the purpose of determining if a quorum is present, but will not be included in the vote totals and will not affect the outcome of the vote.

LIMITATIONS ON BROKERS’ AUTHORITY TO VOTE SHARES

Your shares may be voted if they are held in the name of a brokerage firm, even if you do not provide the brokerage firm with voting instructions. Brokerage firms have the authority, under the rules of the New York Stock Exchange (“NYSE”), to vote shares on certain “routine” matters for which their customers do not provide voting instructions. The election of directors and the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year 2005 are considered routine matters. When a proposal is not a routine matter and the brokerage firm has not received voting instructions from the beneficial owner of the shares with respect to that proposal, the brokerage firm cannot vote the shares on that proposal. This is called a “broker non-vote.” In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal. Accordingly, broker non-votes will have no effect on the outcome of any matter being voted on at the annual meeting, assuming that a quorum is otherwise obtained.

THE BOARD OF DIRECTORS

The Board of Directors is responsible for supervising the management of Equifax. As of the date of this proxy statement, the Board of Directors of Equifax consists of ten members, nine of whom are non-employee directors. The Board is divided into three classes with approximately an equal number of directors in each class. Each class is elected for three-year terms.

CORPORATE GOVERNANCE GUIDELINES

The Board’s Mission Statement and Guidelines on Significant Corporate Governance Issues (the “Governance Guidelines”), as well as the charters of all committees, provide the framework for the governance of the Company. The Governance Guidelines are intended to comply with the requirements of Section 303A.09 of the NYSE Listed Company Manual. The Governance Guidelines and committee charters can be viewed at our website on the Internet, at www.equifax.com/corp/aboutefx/ethics/governance.shtml, or in print upon request to the Corporate Secretary, Equifax Inc., P.O. Box 4081, Atlanta, Georgia 30302.

On June 16, 2004, Equifax’s chief executive officer, as required by Section 303A.12(a) of the NYSE Listed Company Manual, submitted his certification to the NYSE that he was not aware of any violation by Equifax of the NYSE’s Corporate Governance Listing Standards.

3

DIRECTOR INDEPENDENCE

Our Governance Guidelines require that a majority of the Board of Directors be comprised of independent directors. The Board annually assesses and makes an affirmative determination of each director’s independence status by reviewing any material relationships, potential conflicts of interest and outside obligations, based on the criteria used to determine independence which are detailed in the Governance Guidelines. The Governance Guidelines conform to the independence criteria specified by the NYSE. After considering the Governance Guidelines, the NYSE standards and any other commercial or charitable relationships between the directors and Equifax, the Board has determined that the following current nonemployee directors and director nominees are independent: Lee A. Ault III, John L. Clendenin, James E. Copeland, Jr., A. William Dahlberg, L. Phillip Humann, Lee A. Kennedy, Larry L. Prince, D. Raymond Riddle and Jacquelyn M. Ward. The Board also determined that Board committee members meet all applicable independence standards.

The independent directors listed below are affiliated with companies that have business relationships with Equifax. The Board of Directors has determined that none of these relationships is material, and that the relationships do not prevent the directors from being “independent directors.” In the opinion of management, the terms of such banking and credit arrangements and other services are fair and reasonable and as favorable to Equifax and its subsidiaries as those which could have been obtained from unrelated third parties at the time of their execution.

L. Phillip Humann is Chairman and Chief Executive Officer of SunTrust Banks, Inc. Larry L. Prince, a member of the Board, is also a director of SunTrust. SunTrust Bank, an indirect subsidiary of SunTrust, provides banking, including the making of loans on customary terms, cash management, transfer agent and trust services to Equifax in the ordinary events of business. In 2004, Equifax paid approximately $2.8 million to SunTrust or its subsidiaries for such services, including interest, which was less than 1% of SunTrust’s gross revenue for the last fiscal year. In making the determination that this relationship is not material and does not prevent Mr. Humann from being an “independent” director, the Board took into account the fact that the fees paid to SunTrust are comparable to those paid to other banks for similar services, and that the amount of fees paid to SunTrust is insignificant to both Equifax and SunTrust.

Lee A. Kennedy is Chairman and Chief Executive Officer of Certegy Inc. Certegy, which was spun off to Equifax’s shareholders in 2001 as a stock dividend, provides printing and mailing services to Equifax. In 2004, Equifax paid approximately $9.2 million to Certegy for such services, which was less than 1% of Certegy’s gross revenue for the last fiscal year. In making the determination that this relationship is not material and does not prevent Mr. Kennedy from being an “independent” director, the Board took into account the fact that the fees paid to Certegy are comparable to those paid to other firms for similar services, and that the amount of fees paid to Certegy is insignificant to both Equifax and Certegy.

LEAD DIRECTOR

The non-employee members of the Board annually select one independent director to serve as the Lead Director for all meetings of the outside directors held in executive session. The Lead Director also has other authority and responsibilities that are described in the Governance Guidelines. D. Raymond Riddle has served as the Lead Director since April 2004.

4

EXECUTIVE SESSIONS

Pursuant to the Governance Guidelines, our independent directors meet in regularly scheduled executive sessions without management present. The Lead Director chairs all regularly scheduled executive sessions, and also has authority to convene meetings of the independent directors at any time with appropriate notice.

COMMUNICATIONS WITH DIRECTORS

Equifax security holders and other interested parties may communicate with the Board, the Lead Director, the non-employee directors as a group, or individual directors by writing to them in care of the Corporate Secretary, Equifax Inc., P.O. Box 4081, Atlanta, Georgia 30302. Correspondence will be forwarded as directed by the writer. Equifax may first review, sort, and summarize such communications, and screen out solicitations for goods or services and similar inappropriate communications unrelated to Equifax or its business. All concerns related to audit or accounting matters will be referred to the Audit Committee of our Board of Directors.

PROCESS FOR NOMINATING POTENTIAL DIRECTOR CANDIDATES

The Governance Committee of our Board of Directors is responsible for selecting potential director candidates and recommending qualified candidates to the full Board for nomination. In determining whether to nominate an incumbent director for reelection, the Governance Committee evaluates each incumbent’s continued service in light of its assessment of the Board’s collective requirements at the time such director’s class comes up for reelection. Committee considerations include the results of any evaluations of such director’s performance.

When the need for a new director arises (whether because of a newly created Board seat or vacancy), the Governance Committee may proceed by whatever means it deems appropriate to identify a qualified candidate or candidates, including by engaging third party search firms. The Committee reviews the qualifications of each candidate. The Committee makes its recommendation to the Board based on its review, interviews and all other available information. The Board makes the final decision on whether to invite the candidate to join the Board. Invitations are extended through the Chairman of the Governance Committee and the Chairman and Chief Executive Officer of Equifax.

The Governance Committee develops and recommends to the Board criteria for the selection of qualified directors. At a minimum, director candidates should have demonstrated accomplishment in his or her chosen field, character and personal integrity, and the ability to devote sufficient time to carry out the duties of an Equifax director. In addition, the Governance Committee and the Board consider all information relevant in their business judgment to the decision of whether to nominate a particular candidate, taking into account the then-current composition of the Board and assessment of the Board’s collective requirements. These factors may include a candidate’s professional and educational background, reputation, industry knowledge and business experience, and the relevance of that background, reputation, knowledge and experience to Equifax and its Board (including the candidate’s understanding of markets, technologies and international operations); whether the candidate will complement or contribute to the mix of talents, skills and other characteristics that are needed to maintain the Board’s effectiveness; the candidate’s ability to fulfill responsibilities as a director and a member of one or more of Equifax’s standing Board committees; Board diversity; the candidate’s other board commitments; and whether the candidate is independent.

Nominations of individuals for election to the Board at any annual meeting or any special meeting of shareholders at which directors are to be elected may be made by any Equifax shareholder entitled to vote for the election of directors at that meeting by complying with the

5

procedures set forth in Section 1.12 of our bylaws. Section 1.12 generally requires that shareholders submit nominations by written notice to the Corporate Secretary setting forth certain prescribed information about the nominee and the nominating shareholder. Section 1.12 also requires that the nomination notice be submitted a prescribed time in advance of the meeting. The deadline for submission of a nomination notice in connection with Equifax’s 2006 annual meeting of shareholders is January 17, 2006.

The Governance Committee may consider and make recommendations to the Board concerning nominees for director submitted by the shareholders. In order for the Committee to consider such nominees, the nominating shareholder should submit a nomination notice in accordance with the procedures set forth in Section 1.12 of Equifax’s bylaws.

The nominating shareholder should expressly indicate that such shareholder desires that the Committee consider the shareholder’s nominee for inclusion with the Board’s slate of nominees for the applicable meeting. The nominating shareholder and shareholder’s nominee should also undertake to provide all other information the Governance Committee or the Board may request in connection with their evaluation of the nominee.

Any shareholder’s nominee must satisfy the minimum qualifications for any director described above in the judgment of the Governance Committee and the Board. In evaluating shareholder nominees, the Governance Committee and the Board may consider all relevant information, including the factors described above, and additionally may consider the size of the nominating shareholder’s holdings in Equifax and the length of time such shareholder has owned such holdings; whether the nominee is independent of the nominating shareholder and able to represent the interests of Equifax and its shareholders as a whole; and the interests and/or intentions of the nominating shareholder.

No candidates for director nominations were submitted to the Governance Committee by any shareholder in connection with our 2005 annual meeting.

CODES OF CONDUCT

Equifax has adopted codes of ethics and business conduct applicable to its directors, officers and employees, available at www.equifax.com/corp/aboutefx/ethics/main.shtml. Any amendment or waiver of a provision of these codes of ethics that applies to any Equifax director or executive officer will also be disclosed there.

6

PROPOSAL 1—ELECTION OF DIRECTORS

Our Board of Directors consists of ten members, nine of whom are non-employee directors. The Board is divided into three classes with three-year terms. The terms are staggered (“classified”) so that the term of one class expires at each annual meeting of Equifax shareholders.

Consistent with the Company’s policies, Dr. Louis W. Sullivan, who served as a director from 1995, retired in November 2004. Lee A. Ault III, who has served as a director since 1991, has advised the Board of his intention to retire from the Board at the annual meeting for personal reasons. The Board appreciates the long and valuable service on the Board of these outstanding directors.

Although Mr. Riddle has reached the normal retirement age of 70, at the request of the Board, Mr. Riddle has agreed to continue serving as a director if elected at the annual meeting.

Lee A. Kennedy was appointed to the Board on May 3, 2004, and was recommended to the Governance Committee by D. Raymond Riddle, who currently serves as the Lead Director. The Committee assessed Mr. Kennedy as a candidate and considered his strength as a director and knowledge of Equifax’s business as demonstrated during his years of prior service as President and Chief Operating Officer of Equifax. The Committee unanimously recommended to the full Board that Mr. Kennedy be elected as a director serving in the class of directors whose term expires at the 2005 annual meeting. The Board agreed with the Committee’s recommendations.

The term of office of our Class II directors will expire at the 2005 Annual Meeting. Four Class II directors named below have been nominated, upon the recommendation of the Governance Committee, for election at this meeting to serve for a three-year term expiring at the 2008 annual meeting. Each candidate is now a member of the Board whose term will expire at this year’s annual meeting. Each of these directors will serve for three years or until his successor has been elected and qualified. All nominees for election have consented to being named in this proxy statement and to serve as directors if elected. If any of the nominees are unable to accept election, proxies will be voted for the election of another candidate recommended by the Board. There is no family relationship between any of the directors, nominees for director or executive officers.

The Board of Directors unanimously recommends that you vote “FOR” the election of all nominees named below.

NOMINEES FOR ELECTION TO A TERM EXPIRING IN 2008 (CLASS II):

|

Thomas F. Chapman Director since 1994. Became Chairman and Chief Executive Officer of Equifax Inc. in May 1999 and was previously President and Chief Executive Officer of Equifax (1998-1999); President and Chief Operating Officer (1997-1998) and Executive Vice President and Group Executive of Equifax’s former Financial Services Group (1993-1997). He is also a director of The Southern Company. Age: 61

|

7

|

D. Raymond Riddle Director since 1989 and Lead Director since April 2004. Since 1996, retired Chairman of the Board and Chief Executive Officer of National Service Industries, Inc., a diversified manufacturing and service company. He is also a director of AGL Resources Inc., Atlantic American Corporation and AMC, Inc. Age: 71 | |

|

James E. Copeland, Jr. Director since 2003. Retired Chief Executive Officer of Deloitte & Touche LLP and Deloitte Touche Tohmatsu, public accounting firms. He served in such capacity from 1999 until his retirement in 2003. Prior to that time, Mr. Copeland served as National Managing Partner and a member of the Office of the Chief Executive for Deloitte & Touche LLP. He is also a director of Coca-Cola Enterprises Inc. and ConocoPhillips. Age: 60 | |

|

Lee A. Kennedy Director since 2004. Chairman and Chief Executive Officer of Certegy Inc. Mr. Kennedy served as President and Chief Executive Officer of Certegy from July 2001 to February 2002 when he was also elected as Chairman. Prior to the spin-off of Certegy, Inc. from Equifax, he served as President and Chief Operating Officer of Equifax from June 1999 until June 2001. Age: 54 | |

DIRECTORS WHOSE TERMS CONTINUE UNTIL 2007 (CLASS III)

|

Lee A. Ault III A director since 1991, he has advised the Board of his intention to retire as a director at the 2005 annual meeting. Chairman of the Board of In-Q-Tel, Inc., an information technology company, since August 1999. During the prior five years, he was a private investor following his retirement from the Company in 1992 as Chairman and Chief Executive Officer of Telecredit, Inc., a subsidiary. He is also a director of Office Depot, Inc.; American Funds Insurance Series and Anworth Mortgage Asset Corporation. Age: 68 | |

|

John L. Clendenin Director since 1982 and Lead Director from 2002 until May 2004. Retired Chairman of the Board of BellSouth Corporation, a communications services company. He served as Chairman, President and Chief Executive Officer of BellSouth Corporation from October 1983 until his retirement in December 1996. He continued to serve as Chairman until December 1997. He is also a director of The Kroger Company, Coca-Cola Enterprises Inc., The Home Depot, Inc., Acuity Brands, Inc. and Powerwave Technologies, Inc. Age: 70 | |

8

|

A. William Dahlberg Director since 1992. Chairman of the Board of Mirant Corporation, an international energy producer, since August 2000. Previously, from 1995 until 2001, he served as Chairman and Chief Executive Officer of The Southern Company and, prior to that time, was President and Chief Executive Officer of Georgia Power Company. Age: 64 | |

|

L. Phillip Humann Director since 1992. Chairman and Chief Executive Officer of SunTrust Banks, Inc., a multi-bank holding company, since 2004. Served as Chairman, President and Chief Executive Office of SunTrust Banks from 1998 to 2004. From 1991 to 1998 he served as President of SunTrust Banks. He is also a director of Coca-Cola Enterprises, Inc. and Haverty Furniture Companies, Inc. Age: 59 | |

DIRECTORS WHOSE TERMS CONTINUE UNTIL 2006 (CLASS I)

|

Larry L. Prince Director since 1988. Retired Chairman of the Board and Chief Executive Officer of Genuine Parts Company, an automotive parts wholesaler. Chairman of the Board from August 2004 until February 2005, and Chairman of the Board and Chief Executive Officer from 1990 until August 2004. He remains a director of Genuine Parts Company and is also a director of SunTrust Banks, Inc., Crawford & Co. and John H. Harland Company. Age: 66 | |

|

Jacquelyn M. Ward Director since 1999. Outside Managing Director of Intec Telecom Systems, PLC, a computer software systems company since December 2000 and before that Chairman and Chief Executive Officer of Computer Generation Incorporated. Ms. Ward is also a former Chairperson of the Board of Regents of the University System of Georgia and is a director of Bank of America Corporation, Sanmina-SCI Corporation, Flowers Foods, Inc., SYSCO Corporation and WellPoint, Inc. Age: 66 | |

BOARD AND COMMITTEE MEETINGS

During 2004, the Board of Directors met nine times and all directors attended at least 75% of the total board meetings and the meetings of the respective committees on which they serve.

The Board of Directors appoints committees to help carry out its duties. Board committees work on key issues in greater detail than is generally possible at full board meetings. Each committee regularly reviews the results of its meetings with the full board. Currently the Board has five committees composed entirely of independent directors as defined in the NYSE listing standards.

9

Each of the Committees operates pursuant to a written charter. The charters of the committees can be viewed on Equifax’s website at www.equifax.com/corp/aboutefx/ethics/committee.shtml. Additional information on the committees is set forth below.

| Director | Executive | Audit | Compensation, Human Resources & |

Finance | Governance | |||||

| Number of meetings in 2004 |

0 | 10 | 6 | 5 | 4 | |||||

| Ault |

X | |||||||||

| Chapman |

||||||||||

| Clendenin |

X | X | Chairman | |||||||

| Copeland |

X | Chairman | ||||||||

| Dahlberg |

X | |||||||||

| Humann |

X | X | ||||||||

| Kennedy |

X | |||||||||

| Prince |

X | Chairman | ||||||||

| Riddle |

Chairman | X | Chairman | |||||||

| Ward |

X |

Executive Committee. Subject to Board discretion and applicable law, this Committee exercises the powers of the Board in managing Equifax’s business and property during the intervals between Board meetings.

Audit Committee. This Committee is responsible for review of (1) the integrity of Equifax’s financial statements and other financial information, (2) Equifax’s systems for complying with legal and regulatory requirements, (3) the independent auditor’s qualifications, independence, and performance, (4) the performance of Equifax’s internal audit function and (5) the integrity of Equifax’s internal controls and financial reporting processes. The Committee’s charter was amended in January 2004 and a copy was attached to the 2004 proxy statement as Appendix 1. The Board has determined that Mr. Copeland is an “audit committee financial expert” as defined in Item 401(h) of Regulation S-K of the Securities and Exchange Commission (“SEC”).

Compensation, Human Resources & Management Succession Committee. This Committee assists the Board in fulfilling its oversight responsibility with respect to (1) determining and evaluating the compensation of the Chief Executive Officer and the other executive officers, (2) approving and monitoring Equifax’s executive compensation plans, policies and programs and (3) advising management on succession planning and other significant human resources matters.

Finance Committee. The Finance Committee has overall responsibility for reviewing Equifax’s financial goals and strategies, including strategic considerations in the allocation of corporate resources, and for oversight of Equifax’s financial policies, plans and programs.

Governance Committee. The Governance Committee assists the Board with respect to (1) Board organization, membership, and function, (2) committee structure and membership and (3) oversight of evaluation and compensation of the Board. The Committee exercises a leadership role in shaping Equifax’s corporate governance and recommends to the Board corporate governance principles. The Governance Committee is responsible for recommending to the Board nominees for director, as described above under “Corporate Governance—Process for Nominating Potential Director Candidates.”

10

DIRECTOR ATTENDANCE AT ANNUAL MEETINGS

The Board believes that it is important for directors to make themselves available to Equifax’s shareholders by attendance at each annual meeting of shareholders. At last year’s annual meeting, all of our directors were in attendance with the exception of Dr. Louis W. Sullivan.

Director Fees. In 2004, non-employee directors received an annual retainer of $35,000. Directors also received $1,000 for each Board and Committee meeting attended. In addition, the directors who acted as Chairs of Board Committees received an annual retainer of $5,000.

Deferred Compensation Plan. Under the Equifax Director Deferred Compensation Plan, a non-employee director may defer up to 100% of his or her retainer and meeting fees and invest them in Equifax common stock units. Each common stock unit is equal in value to a share of Equifax common stock. Common stock units track the performance of Equifax common stock, but do not receive dividend credit. In general, amounts deferred are not paid until the director retires from the Board. However, directors may also establish up to two sub-accounts from which amounts are to be paid on specific pre-retirement timetables established by the director (“Scheduled Withdrawal”). Amounts deferred are paid in cash, at the director’s option, either in a lump sum or in annual installments over a period of up to fifteen years for retirement distributions, or up to five years for a Scheduled Withdrawal. Equifax pays all costs and expenses incurred in the administration of the Deferred Compensation Plan.

Stock Option Plan. On the date of the 2004 annual meeting of shareholders, each non-employee director received a non-qualified option to purchase 7,000 shares of Equifax common stock with an exercise price equal to the fair market value of the common stock on the date of the meeting. These options become fully vested one year after the date granted and expire ten years from the date granted.

Stock Deferral Plan. Non-employee directors are eligible to participate in the Equifax Director and Executive Stock Deferral Plan which permits a director to defer the receipt of any gains and the related taxation resulting from exercises of stock options that meet certain requirements. Stock deferrals track the performance of Equifax common stock, but do not receive dividend credit. The director receives instead the right to a number of shares of deferred stock equal to such gain. In general, amounts deferred under the Stock Deferral Plan are not paid until the director retires from the Board. However, directors may also establish up to two sub-accounts from which amounts are to be paid on specific pre-retirement timetables established by the director (“Scheduled Withdrawal”). Amounts deferred are paid in Equifax common stock, at the director’s option, either in a lump sum or in annual installments over a period of up to fifteen years for retirement distributions, or up to five years for a Scheduled Withdrawal. Equifax pays all costs and expenses incurred in the administration of the Stock Deferral Plan.

Other. Equifax reimburses all directors for travel and other necessary business expenses incurred in the performance of their services to Equifax.

Changes in Director Compensation for 2005. Our compensation plan for non-employee directors has been revised in certain respects for 2005. Director meeting fees have been increased to $1,500 per Board or Committee meeting attended. In lieu of stock option grants, all incumbent and newly-elected members of the Board will be eligible to receive an annual restricted stock unit (“RSU”) grant of 3,000 shares at the conclusion of each annual meeting of Equifax’s shareholders. This grant will become fully vested one year after the date granted with

11

accelerated vesting in the event of death, disability, retirement or Change in Control of Equifax. A director may elect to have the RSUs credited to a deferred compensation account under the Equifax Director and Executive Stock Deferral Plan. Also, beginning in 2005, an initial grant of 4,000 RSUs will be made to each new director upon election to the Board to support recruitment efforts and to engage new directors through equity ownership. Directors serving at the conclusion of the first Board meeting in 2005 received a one-time grant of 4,000 RSUs. This grant will vest on the third anniversary of the grant date with accelerated vesting in the event of death, disability, retirement or Change in Control of Equifax. No dividend equivalents are paid on outstanding RSUs. On October 28, 2004 and November 1, 2004, respectively, the Compensation, Human Resources & Management Succession Committee and the Governance Committee of the Board approved amendments to the Equifax Inc. 2000 Stock Incentive Plan to permit the issuance of deferred shares of Equifax common stock in the form of RSUs to non-employee directors of Equifax as part of its overall stock compensation plan for directors.

DIRECTOR STOCK OWNERSHIP GUIDELINES

Equifax’s bylaws require all directors to own Equifax stock while serving as a director. In 2004, the Board also implemented Stock Ownership Guidelines that require each non-employee director to own Equifax stock, the value of which is at least four times the annual cash retainer, no later than the fourth anniversary of the annual meeting coincident with a director’s initial election to the Board. For current directors, the guideline must be met no later than the 2008 annual meeting of shareholders.

12

PROPOSAL 2—RATIFICATION OF APPOINTMENT OF

EQUIFAX’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of our Board of Directors has appointed Ernst & Young LLP as Equifax’s independent registered public accounting firm for 2005 and presents this selection to the shareholders for ratification. Ernst & Young will audit our consolidated financial statements for 2005 and perform other permissible, pre-approved services. If the shareholders do not ratify the appointment, the Audit Committee will reconsider it. Even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interests of Equifax and its shareholders.

Ernst & Young has audited Equifax’s consolidated financial statements for the past three years. Representatives of Ernst & Young will be present at the annual meeting and will have the opportunity to make a statement, if they desire to do so, and to respond to appropriate questions.

Additional information regarding fees paid to Ernst & Young can be found below under “Independent Auditors’ Fees” and in the “Report of the Audit Committee” beginning on page 15.

The Board of Directors unanimously recommends a vote “FOR” the ratification of Ernst & Young LLP’s appointment as Equifax’s independent registered public accounting firm.

PRE-APPROVAL OF INDEPENDENT AUDITOR SERVICES

The Audit Committee pre-approves all audit and permitted non-audit services (including the fees and terms thereof) to be performed for Equifax by Ernst & Young. The Chairman of the Audit Committee may pre-approve additional permissible proposed non-audit services in amounts not exceeding $75,000 that arise between Committee meetings, provided that the Audit Committee is informed of the decision to pre-approve the services at its next scheduled meeting.

Our Audit Committee has adopted restrictions on our hiring of any current or former employee of Ernst & Young as our company’s chief executive officer, chief financial officer, controller or chief accounting officer (or any equivalent position), or in an accounting or financial reporting oversight role, who has participated in the Equifax audit engagement in any capacity during the one-year period preceding the date of initiation of Equifax’s audit. The Committee also requires key Ernst & Young partners assigned to our audit to be rotated at least every five years.

13

The following table summarizes the aggregate fees (including related expenses) for professional services provided by Ernst & Young for 2004 and 2003. The Audit Committee pre-approved all 2004 and 2003 services.

| 2004 | 2003 | |||||

| Audit Fees(1) |

$ | 3,262,420 | $ | 947,000 | ||

| Audit-Related Fees(2) |

270,280 | 365,000 | ||||

| Tax Fees(3) |

90,034 | 111,150 | ||||

| All Other Fees(4) |

0 | 0 | ||||

| Total Fees |

$ | 3,622,734 | $ | 1,423,150 | ||

| (1) | Audit Fees were for professional services rendered for the audit of Equifax’s annual consolidated financial statements, issuance of consents, statutory audits and review of documents filed by Equifax with the SEC and accounting consultation on various accounting matters. Audit Fees for 2004 also include the audit of management’s report on the effectiveness of Equifax’s internal control over financial reporting, as required by Section 404 of the Sarbanes-Oxley Act of 2002. |

| (2) | Audit-Related Fees were for engagements traditionally performed by an auditor, such as statutory audits not relied upon for the consolidated financial statements audit, employee benefit plan audits, consultation concerning financial accounting and reporting and due diligence related to potential business acquisitions and dispositions. |

| (3) | Tax Fees include consultation on tax matters, expatriate employee tax services and the final payment of $31,975 in 2003 related to the state income tax review project discussed below in the Report of the Audit Committee. |

| (4) | There were no other professional services rendered in 2004 and 2003. |

STATEMENT ON SARBANES-OXLEY ACT SECTION 404

Section 404 of the Sarbanes-Oxley Act of 2002 (“Section 404”), requires that we make an assertion as to the effectiveness of our internal control over financial reporting beginning with the 2004 Annual Report on Form 10-K, which is reviewed by our independent registered public accounting firm. In order to make our assertion, we were required to identify material financial and operational processes, document internal controls supporting the financial reporting process and evaluate the design and effectiveness of those controls. We began preparing for Section 404 prior to 2004, establishing a project manager to facilitate ongoing internal control reviews, coordinate the process for those reviews and provide direction to the business and control groups involved in the initiative and assist in the assessment of internal control over financial reporting. We also formed a Section 404 steering committee comprised of senior management personnel to set uniform guiding principles and policies, review the progress of the initiative and update the Audit Committee on an ongoing basis. Equifax also retained a consulting firm to assist in its compliance with Section 404, and made numerous improvements to its internal control processes and systems. The Section 404 project involved many of our employees around the world, including participation by the business and control groups.

Our total external and internal Section 404 compliance-related expenses related to 2004 were approximately $5.1 million and $0.8 million, respectively. A substantial portion of our increased professional fees was the approximately $3.7 million in total fees incurred with our independent auditors for all services provided, an increase of 162% compared to 2003. These Section 404 expenses do not include an allocation of the substantial management time devoted to compliance, planned technology enhancements to reduce the burden of compliance or the ongoing costs of compliance with this legislation.

14

The following Report of the Audit Committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Equifax filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent Equifax specifically incorporates this Report by reference therein.

The Audit Committee of the Board has furnished the following report for 2004.

The Audit Committee is comprised of the three directors named below. Each member of the Audit Committee is an independent director as defined by applicable SEC rules and NYSE listing standards. In addition, our Board of Directors has determined that James E. Copeland, Jr. is an “audit committee financial expert” as defined by the applicable SEC rules and satisfies the “accounting or related financial management expertise” criteria established by the NYSE. The Audit Committee operates under a written charter adopted by the Board of Directors. A copy of this charter was attached to our 2004 proxy statement.

Management is responsible for the financial reporting process, including Equifax’s system of internal controls, for the preparation of consolidated financial statements in accordance with generally accepted accounting principles (“GAAP”) and for the report on Equifax’s internal control over financial reporting. Equifax’s independent registered public accounting firm, Ernst & Young LLP, is responsible for expressing opinions on the conformity of the company’s audited financial statements with GAAP and on management’s assessment of the effectiveness of the company’s internal control over financial reporting. In addition, Ernst & Young will express its own opinion on the effectiveness of the company’s internal control over financial reporting. The Audit Committee’s responsibility is to oversee and review the financial reporting process, to review and discuss management’s report on Equifax’s internal control over financial reporting and to appoint the independent accountants. The Audit Committee does not provide any expert or special assurance as to Equifax’s financial statements concerning compliance with laws, regulations or GAAP. In performing the oversight function, the Audit Committee relies, without independent verification, on the information provided to it and on representations made by management and the independent accountants.

The Audit Committee reviewed and discussed Equifax’s consolidated financial statements for the year ended December 31, 2004 with management and the independent accountants. Management represented to the Audit Committee that Equifax’s consolidated financial statements were prepared in accordance with GAAP. The Audit Committee discussed with the independent accountants matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees.

Equifax’s independent accountants provided to the Audit Committee the written disclosures required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, and the Committee discussed with the independent accountants their independence. The Audit Committee concluded that Ernst & Young’s provision of non-audit services, as described in the following section of this proxy statement, to Equifax and its affiliates is compatible with Ernst & Young’s independence.

In May of 2004 the chief accountant of the Securities and Exchange Commission advised the American Institute of Certified Public Accountants (“AICPA”) that he did not concur with the treatment of certain contingent fee engagements which the AICPA had considered to be consistent with its standards for auditor independence. Ernst & Young had been relying on the AICPA interpretation in advising Equifax that their independence was not impaired by the

15

performance of a contingent fee engagement relating to certain state tax services during fiscal 2003 and 2004 (see “Independent Auditors’ Fees” above). Following a meeting with the staff of the SEC by representatives of the major accounting firms, Ernst & Young advised the Audit Committee that it proposed to restructure the compensation relating to this engagement to eliminate any contingent aspect, and to establish a fixed fee for the remainder of the engagement. The Committee approved the restructuring of the fee for this engagement and concurred with Ernst & Young’s assessment that, because they had relied in good faith on an interpretation of the AICPA that was generally recognized in the accounting profession, there had been no impairment of Ernst & Young’s independence with respect to the conduct of these engagements.

The Audit Committee reviewed the overall scope and plans for their respective audits with Equifax’s internal auditors and the independent accountants. We met with the internal auditors and Ernst & Young, with and without management present, to discuss the results of their examinations, their evaluations of Equifax’s internal controls, the overall quality of Equifax’s financial reporting, and other matters.

In addition, the Committee reviewed key initiatives and programs directed at strengthening the effectiveness of Equifax’s internal and disclosure control structure. As part of this process, the Committee continued to monitor the scope and adequacy of Equifax’s internal auditing program, reviewing staffing levels and steps taken to implement recommended improvements in internal procedures and controls.

Based on the Audit Committee’s discussions with management and the independent accountants and the Audit Committee’s review of the representation of management and the report of the independent accountants, and subject to the limitations on our role and responsibilities referred to above, the Committee recommended to the Board of Directors that the Board approve the inclusion of Equifax’s audited consolidated financial statements in Equifax’s Form 10-K for the year ended December 31, 2004, for filing with the SEC. The Committee has also selected Ernst & Young as Equifax’s independent registered public accounting firm for the year ending December 31, 2005 and is presenting the selection to the shareholders for ratification at the 2005 annual meeting.

Respectfully submitted,

THE AUDIT COMMITTEE

James E. Copeland, Jr., Chairman

A. William Dahlberg

D. Raymond Riddle

16

STOCK OWNERSHIP BY DIRECTORS AND EXECUTIVE OFFICERS

The following table shows the amount of Equifax common stock beneficially owned by our directors, the executive officers named in the Summary Compensation Table on page 27, and all directors and executive officers as a group as of March 9, 2005.

| Name |

Amount and Nature of Beneficial Ownership(3)(4) |

Percent of Class March 9, 2005) | ||

| Directors and Nominees |

||||

| Lee A. Ault III |

120,270 | * | ||

| John L. Clendenin |

40,785 | * | ||

| James E. Copeland, Jr. |

16,000 | * | ||

| A. William Dahlberg |

39,720 | * | ||

| L. Phillip Humann |

40,628 | * | ||

| Lee A. Kennedy |

4,516 | * | ||

| Larry L. Prince |

39,153 | * | ||

| D. Raymond Riddle |

54,162 | * | ||

| Jacquelyn M. Ward |

31,623 | * | ||

| Executive Officers |

||||

| Thomas F. Chapman |

1,857,786 | 1.4 | ||

| Donald T. Heroman |

178,931 | * | ||

| Karen H. Gaston |

304,239 | * | ||

| Kent E. Mast |

230,531 | * | ||

| David J. Gunter |

24,648 | * | ||

| All Directors and Executive Officers as a Group (17 persons)(1) |

5,030,512 | 3.7 | ||

| Deferred Compensation denominated as Common Stock Units(2) |

94,173 | N/A |

| * | These shares represent in the aggregate less than 1% of the outstanding shares. |

| (1) | Includes 1,764,538 shares (1.3%) over which Michael Schirk, Treasurer, shares voting and investment power as Investment Officer for the Equifax Inc. U.S. Retirement Income Plan and the Equifax Inc. Pension Plan. |

| (2) | Represents director fees invested in Equifax common stock-based units under the Equifax Director Deferred Compensation Plan. The performance of the units tracks that of Equifax common stock, without reinvestment of dividends. Although the units may not be transferred or voted, and units are payable in cash on final distribution, they are included to show the total economic interest of the directors in the performance of Equifax stock. The ownership of units by directors is as follows: Mr. Clendenin — 4,404 units; Mr. Copeland — 2,687 units; Mr. Dahlberg — 12,678 units; Mr. Humann — 21,365 units; Mr. Prince – 21,994 units; Mr. Riddle — 21,012 units; and Ms. Ward — 10,033 units. |

| (3) | The number of shares shown includes shares that are individually or jointly owned, as well as shares over which the individual has either sole or shared investment or voting authority. Includes for executives shares held in Equifax’s 401(k) Plan, and for directors and executives, shares that may be acquired currently or within 60 days after March 9, 2005 through the exercise of stock options, as follows: Mr. Ault — 17,134 option shares; Mr. Clendenin — 24,134 option shares; Mr. Copeland – 7,000 option shares; Mr. Dahlberg — 24,134 option shares; Mr. Humann — 24,134 option shares; Mr. Prince — 24,134 option shares; Mr. Riddle — 24,134 option shares; Ms. Ward — 24,134 option shares; Mr. Chapman — 7,291 Plan shares and 1,449,466 option shares; Mr. Heroman — 431 Plan shares and 82,500 option shares; Ms. Gaston — 203 Plan shares and 197,452 option shares; Mr. Gunter — 5,398 Plan shares and 13,750 option shares; Mr. Mast — 925 Plan shares and 122,737 option shares; and for all directors and executive officers as a group — 18,839 Plan shares and 2,240,588 option shares. Also includes unvested, non-deferred restricted stock units awarded to executive officers under equity-based plans as follows: Mr. Chapman —137,000 units; Mr. Heroman – 72,000 units; Ms. Gaston – 62,000 units; Mr. Mast – 60,000 units; Mr. Gunter – 5,500 units; and all executive officers as a group—381,000 units. |

| (4) | Includes deferred shares held in the Equifax Director and Executive Stock Deferral Plan. The performance of deferred shares tracks that of Equifax common stock, without the reinvestment of dividends. The ownership of deferred shares by directors and executive officers is as follows: Mr. Chapman – 60,000 shares; Mr. Ault – 788 shares; Mr. Dahlberg – 567 shares; Ms. Gaston – 13,500 shares; Mr. Heroman – 12,000 shares, Mr. Humann – 521 shares; Mr. Mast – 13,500 shares; Mr. Riddle – 788 shares; and Ms. Ward – 110 shares. |

17

STOCK OWNERSHIP BY CERTAIN BENEFICIAL OWNERS

The following table shows the number of shares of common stock owned by each person who, we believe, beneficially owned more than five percent of Equifax’s outstanding common stock as of March 9, 2005. There are no arrangements known to Equifax that may result in a change in control of Equifax upon the occurrence of some future event.

| Name and Address of Beneficial Owner |

Number of Shares Beneficially Owned |

Approximate Percentage of Class |

|||

| Ariel Capital Management, LLC(1) 200 E. Randolph Drive, Suite 2900 Chicago, Illinois 60601 |

8,737,425 | 6.4 | % | ||

| Morgan Stanley(2) 1585 Broadway New York, New York 10036 |

7,083,631 | 5.2 | % | ||

| (1) | Information based on a Schedule 13G, Amendment No.1 filed by Ariel Capital Management, LLC with the SEC on February 14, 2005, which reported the beneficial ownership of 8,737,425 shares, of which Ariel has sole voting power with respect to 7,206,425 shares and sole dispositive power with respect to 8,635,180 shares. |

| (2) | Information based on a Schedule 13G, Amendment No. 1 filed by Morgan Stanley with the SEC on February 15, 2005, which reported the indirect beneficial ownership of 7,083,631 shares, of which Morgan Stanley has sole voting power and sole dispositive power with respect to 6,616,501 shares deemed to be beneficially owned by its subsidiaries, none of which is the beneficial owner of more than 5% of the class of securities. |

The following Report of the Compensation, Human Resources & Management Succession Committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Equifax filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent Equifax specifically incorporates this Report by reference therein.

Report of the Compensation, Human Resources & Management Succession Committee on Executive Compensation

The Compensation, Human Resources & Management Succession Committee of the Board has furnished the following report on executive compensation for 2004.

Guiding Principles

The Compensation, Human Resources & Management Succession Committee (the “Committee”) consists of three independent directors. The Committee is responsible for assisting the Board in fulfilling its oversight responsibility with respect to executive compensation. The Committee determines and evaluates the compensation of executive officers, approves and monitors Equifax’s executive compensation plans, policies and programs, and advises management on succession planning and other significant human resources matters. The Committee operates pursuant to a written charter, which can be viewed on Equifax’s internet website at:

www.equifax.com/corp/aboutefx/ethics/committee.shtml#compensation.

18

The Committee believes that in order to attract, retain and motivate the highest caliber executive talent Equifax must offer total compensation that is attractive in the relevant competitive marketplace. The Committee periodically reviews the executive compensation program in light of competitive data and seeks to have a competitive compensation program that results in pay levels that are commensurate with individual and company performance.

In 2004, the Committee reviewed executive officer compensation to confirm that the Company’s policies remained aligned with the following objectives:

| · | To align executive compensation levels with individual and Company performance; |

| · | To provide equity-based compensation programs that link executives’ interests with those of shareholders; |

| · | To enhance recruitment, retention and succession planning; and |

| · | To emphasize the long-term performance of Equifax. |

The combined use of base salary, short-term incentives and long-term incentives is designed to provide a balanced total compensation package that will reward achievement of near-term objectives but provide other rewards only upon long-term sustained success. Long-term incentive compensation elements are targeted to key members of management to not only ensure sustained performance but to also provide retention over a longer term. In allocating the value of base salary, short-term incentive and long-term incentives, the Committee believes that a large percentage of executive officer compensation should be at risk, both with respect to Company-specific performance as well as individual performance and commitment to the Company. Stock options (which are granted at fair market value) and the targeted annual incentive (which requires increased company and individual performance to result in an award) are performance-based and completely at risk. Also, executives must generally commit to the Company for three years to vest in any restricted stock unit (“RSU”) award. The Committee believes this allocation of total compensation supports a performance-driven culture and our objective to reward and retain the Company’s best performers.

We engaged Hewitt Associates to provide independent analysis of our executive compensation programs and to make the Committee aware of market activity both within general industry and within the financial information and business services industries. The Committee reviewed the company’s most significant executive compensation programs, including base salary, short and long-term incentives and supplemental retirement programs and believes that the Company’s executive compensation programs are consistent with Equifax’s objective of enhancing shareholder value.

Section 162(m) of the Internal Revenue Code limits the annual deduction of compensation expense for income tax purposes to $1 million for the officers named in the Summary Compensation Table on page 27 (the “Named Executive Officers”), except for performance-based compensation meeting certain requirements. The Committee as a general matter seeks to facilitate deduction by Equifax of compensation to the Named Executive Officers consistent with these requirements. Approximately $278,000 of Mr. Chapman’s 2004 compensation has been determined to be non-exempt under the provisions of Section 162(m), of which $176,000 was due to the portion of his annual incentive award that reflects achievement of individual goals that do not meet the objective standards of Section 162(m). The remainder of the non-exempt compensation was attributable to perquisites and tax gross-up amounts which do not qualify as performance-based compensation under the provisions of Section 162(m).

The Committee believes that ownership of Equifax’s stock by management aligns management’s interests with those of shareholders. Equifax uses various methods to encourage and facilitate such stock ownership. These include stock ownership guidelines that apply to approximately 150

19

of Equifax’s executives, including the Named Executive Officers. The ownership guidelines that apply to the Named Executive Officers range from two times to six times annual base salary in outright ownership (or, alternatively, from four times to ten times base salary in outright ownership plus vested, unexercised stock options) based on the executive’s level within the Company. The guidelines must be attained no later than four years following entry into the covered officer position. All of the Named Executive Officers are currently in compliance with the ownership guidelines.

Executive Officers’ 2004 Compensation

Executive officer compensation includes several principal elements: base salary, annual incentive, and long-term incentive opportunities. These elements are designed to provide a median competitive level of compensation for performance at targeted levels, but to deliver above-market total compensation in response to outstanding performance by the officer and the Company.

Base salary plus “Other Annual Compensation” and “All Other Compensation” (shown in the Summary Compensation Table on page 27) paid to executive officers in 2004 (except Mr. Chapman) represented less than one-third of total direct compensation (only 20% if the special RSU grant made at the end of 2004 for transition retention and severance protection is included). The remainder of total direct compensation was in the form of annual incentive opportunity, option grants and RSU awards, which are subject to significant risk and will require excellent company and individual performance and commitment to the Company to realize their value.

Salary: The salary for fiscal year 2004 for each executive officer (other than the Chief Executive Officer, discussed below) was based on competitive compensation data, and took into account the executive’s performance, experience, abilities, and expected future contribution. Salaries are targeted to be between the market 50th and 65th percentiles which were determined using a general industry peer group compiled by Hewitt Associates, regressed to represent companies with a revenue size similar to Equifax. Salary reviews are scheduled at 12-month intervals. The salaries earned by executive officers were increased for 2004 in accordance with the foregoing practices.

Annual Incentive: Equifax’s Annual Incentive Plan is a management incentive program (covering approximately 30% of Equifax’s global workforce) that provides cash compensation to participants based upon the achievement of certain financial and individual objectives appropriate for the business for which they perform services. Incentive amounts for achievement of target levels of performance are established based on each participant’s position and generally reflect a median market level. For 2004, incentive targets for executive officers other than the Chief Executive Officer ranged from 40% to 60% of salary. Annual incentives were earned based on company and individual performance against the specific criteria established for 2004 which were allocated as follows: earnings per share (which represented 65% of target incentive), revenue (which represented 15% of target incentive) and performance against individual objectives (which represented 20% of target incentive). The financial measures to be used for target incentives require the achievement of outstanding company performance relative to expectations. For 2004, the maximum opportunity for all annual incentive participants was two times the targeted percentage. The maximum is payable only if significant and challenging financial performance goals are achieved. In establishing performance objectives for incentives above the target level, the Committee also takes into account the percentage of incremental earnings that will be shared with participants if such performance levels are achieved. Finally, a threshold level of performance is set (typically representing no less than the prior year’s actual performance) at which level the annual incentive would be 25% of the targeted incentive. No incentive is paid if performance falls below this threshold.

20

For 2004, the annual incentive payments for the Named Executive Officers other than the CEO ranged from 61% to 98% of salary earned and these amounts are shown in the Summary Compensation Table on page 27.

Long-Term Incentives: The Committee believes a combination of RSUs and stock options provides the most effective balance of equity-based programs to drive Equifax’s long-term share appreciation and to motivate and retain certain key management talent. RSUs provide executive officers an economic interest equivalent to a share of Equifax common stock but without dividend or voting rights. Most RSUs granted by the company vest at the end of the three-year period commencing on the date of grant. No dividend equivalents are paid on outstanding RSUs.

RSUs were granted on December 20, 2004 as part of a program to provide special retention protection to the Company and severance protection to certain key executives as the Company transitions to a new CEO. These grants were made in lieu of the next three annual RSU grants and will vest in one-third increments on the third, fourth and fifth anniversaries of the grant date. As a means of also providing market competitive severance protection of a type not otherwise available to executives receiving the grants, the grant value of the awards is equal to approximately two times the executive’s annual base salary and bonus and will vest in the event the executive is terminated without cause or the executive resigns for good reason, which are defined to include events that would typically trigger severance. The following Named Executive Officers of Equifax received a grant of RSUs: Karen H. Gaston, 42,000 RSUs; Donald T. Heroman, 42,000 RSUs; and Kent E. Mast, 42,000 RSUs.

Stock options grant officers a right to purchase shares of Equifax common stock at a fixed price in the future. Stock options granted in 2004 vested 25% on the date of grant and vest an additional 25% on each of the next three anniversaries.

In making long-term incentive grants, the Committee considers competitive market-median levels (determined based on a blend of general industry data and data from the peer group described on page 20) for the position as well as individual contributions to Equifax. The Committee also seeks to manage the overall level of equity distributed to employees. In balancing the objectives to competitively compensate employees and motivate long-term company performance while also managing the dilutive impact of equity grants, the Company applies rigorous performance standards to making equity awards. As a result, the total number of stock options granted in 2004 was less than 1% of common shares outstanding.

The restricted stock units and stock options granted to executive officers in 2004 are shown on the Summary Compensation Table, which appears on page 27, and in the Option Grants in Last Fiscal Year Table, which appears on page 28.

Deferred Compensation: In 2002, the Committee approved and the Board of Directors ratified the Equifax Executive Deferred Compensation Plan, a tax-deferred compensation program for a limited number of executives. The plan was effective January 1, 2003. The Committee believes that this plan facilitates our primary goal of retaining and attracting top talent by providing a tax-favorable vehicle for deferring salary and other compensation. Approximately 150 officers are eligible to participate in this plan. Under the Equifax Executive Deferred Compensation Plan, an executive may defer up to 75% of his or her base salary and up to 100% of any incentive. Deferred balances are credited with gains or losses which mirror the performance of benchmark investment funds selected by the participant from among 16 available funds. In general, amounts deferred under the plan are not paid until after the participant retires or otherwise terminates employment. However, participants may also establish up to two sub-accounts from which amounts are to be paid on specific pre-termination timetables established by the participant

21

(“Scheduled Withdrawal”). Amounts deferred are paid, at the participant’s option, either in a lump sum or in annual installments over a period of up to fifteen years for retirement or termination distributions, or up to five years for a Scheduled Withdrawal. Equifax pays all costs and expenses incurred in the administration of the Deferred Compensation Plan.

Stock Deferrals. The Equifax Director and Executive Stock Deferral Plan permits directors and executive officers to defer taxes on gains realized from certain stock option exercises or the vesting of restricted stock units. Stock deferrals track the performance of Equifax common stock, but do not receive dividend credit. The executive officer receives instead the right to a number of shares of deferred stock equal to such gain. Distributions under the plan are made in shares of Equifax common stock. The plan provides the executive officers another opportunity to retain Equifax stock and allows them to more effectively plan for future events such as retirement. Approximately 150 officers are eligible to participate in this plan.

Contributions to the cash and stock deferral plans are funded entirely by executive deferrals—there are no supplemental Company contributions to these plans. Also, there are no above-market earnings credited under these plans. The Named Executive Officers have the following total deferred balances under these two plans as of December 31, 2004: Mr. Chapman, $3,979,872; Mr. Heroman, $561,524; Ms. Gaston, $238,850; and Mr. Mast, $311,186.

Life Insurance: The Equifax Inc. Executive Life and Supplemental Retirement Benefit Plan (the “Plan”) was adopted effective January 1, 2000, to provide executive life insurance benefits as well as supplemental retirement benefits. The retirement benefit amounts are designed to approximate the value of tax-qualified retirement benefits which are lost for some executives as a result of the limitations on compensation that can be considered under current tax law (commonly referred to as “restoration benefits”). The Plan is funded with life insurance policies. On February 3, 2005, the Committee amended the Plan to provide that (1) executive officers will receive only life insurance benefits and no retirement benefits under the Supplemental Plan, in order to make permanent Equifax’s suspension of premium payments after July 30, 2002 in compliance with Sarbanes-Oxley Act prohibitions against Company loans to executive officers; (2) participants will receive a federal and state income tax reimbursement for the imputed interest charges on cumulative premiums paid pursuant to new tax regulations (instead of providing a reimbursement for the economic value of the life insurance provided to each participant under the plan, as originally adopted, and subject to company discretion to charge interest and not provide a reimbursement); and (3) all future executives who are terminated because their job is eliminated (through a consolidation of jobs, an office closing or other similar event) will become fully vested and will have a “rollout” of their policies, meaning that all Company premiums must be repaid to the Company to the extent of policy cash values in exchange for the release of all company restrictions on the policy. As of December 31, 2004, 26 executives participated in this plan. For executive officers, the amount that Equifax paid for the current life insurance benefit is included in the Summary Compensation Table under the heading “All Other Compensation.”

Executives also participate on a voluntary basis in customary benefit programs generally available to employees, including Equifax’s 401(K) plan.

Chief Executive Officer’s 2004 Compensation

For the 2004 fiscal year, Mr. Chapman received base salary, annual incentive and grants of stock options and restricted stock units based on the Committee’s review of competitive compensation for comparable job responsibilities within a peer group. In advising the Committee, Hewitt Associates provided competitive market data from multiple sources, including the Hewitt Associates Total Compensation Database of executive information (which was used to develop

22

market data for annual incentive and long-term incentive grants), a Towers Perrin executive compensation survey (which was used to develop market data for annual incentive) and a custom peer group proxy analysis (which was used to provide data for the base salary and long-term incentive grants) and which included the following companies: Acxiom Corp., Advo, Inc., Bisys Group Inc., Choicepoint Inc., Concord EFS, Inc., Convergys Corp., Dow Jones & Co. Inc., Dun & Bradstreet Corp., Fair Isaac Corporation, First Data Corp., Fiserv Inc., Harte Hanks Inc., Intuit Inc., Knight Ridder Inc., McGraw-Hill Companies Inc., Moody’s Corp., NCO Group Inc., Teletech Holdings Inc., Total System Services Inc. and Valassis Communications Inc. Hewitt Associates found this peer group to be representative of the financial information and business services industries in which Equifax competes and, at $1.1 billion median revenue, a reasonable benchmark for companies of Equifax’s size.

Much of Mr. Chapman’s compensation opportunity for 2004 was provided through annual incentive, stock options and restricted stock units and therefore was linked closely to performance on behalf of shareholders and to appreciation in the price of Equifax common stock. Base salary plus “Other Annual Compensation” and “All Other Compensation” (shown in the Summary Compensation Table on page 27) paid to Mr. Chapman in 2004 represented one-quarter of his total direct compensation. The remainder of total direct compensation was in the form of annual incentive opportunity, option grants and restricted stock unit awards, which are subject to significant risk and will require excellent Company and individual performance to realize this value.

Mr. Chapman’s base salary was increased in March 2004 to $885,000, representing an increase of 3.5%. In approving the salary increase, the Committee considered competitive salaries for comparable job responsibilities and Mr. Chapman’s personal performance.

For 2004, Mr. Chapman participated in the Annual Incentive Plan described above with an annual incentive target of 80% of his salary upon the successful achievement of targeted performance. Hewitt Associates provided data to the Committee that indicates an 80% target incentive is slightly below the median for CEOs of comparably sized companies. Mr. Chapman’s earned annual incentive for 2004 was 123.1% of salary, based on performance against the specific criteria established for 2004 incentives: earnings per share (which represented 65% of his targeted incentive), revenue (which represented 15% of his targeted incentive) and performance against individual objectives as set by the Board (which represented 20% of his targeted incentive).