|

|

Additional Information

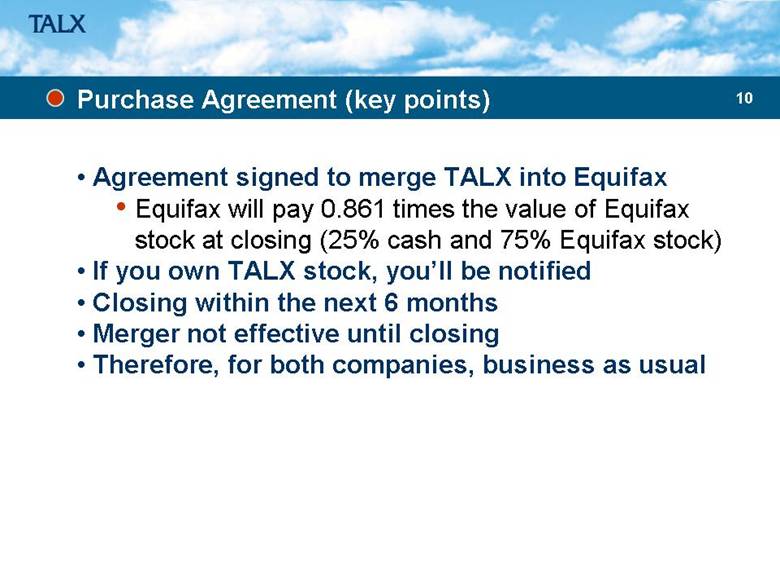

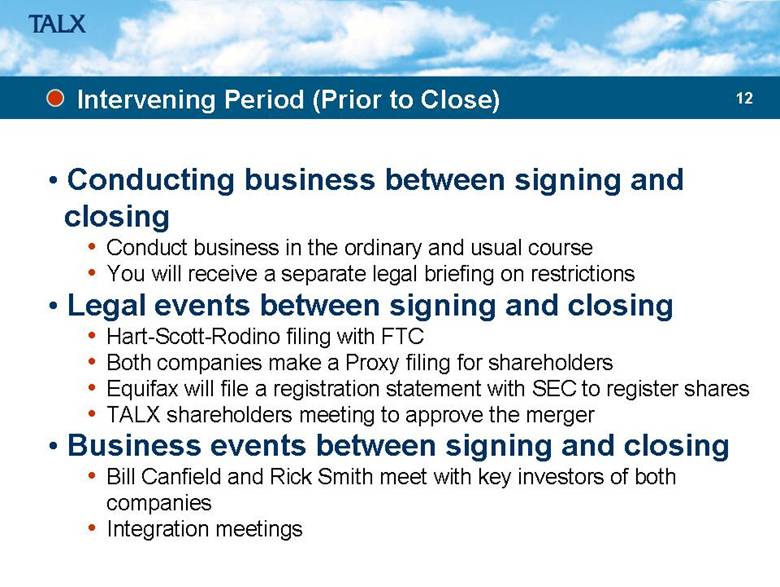

and Where to Find It In connection with the proposed transaction, a

registration statement of Equifax will be filed with the SEC. Equifax

and TALX shareholders are encouraged to read the registration statement and

any other relevant documents filed with the SEC, including the proxy

statement/prospectus that will be part of the registration statement, because

they will contain important information about Equifax, TALX, and the proposed

transaction. The final proxy statement/prospectus will be mailed to

shareholders of TALX. Investors and security holders will be able to

obtain free copies of the registration statement and proxy

statement/prospectus (when available) as well as other filed documents

containing information about Equifax and TALX, without charge, at the SEC’s

web site (http://www.sec.gov). Free copies of Equifax SEC filings are

also available on the Equifax website (www.equifax.com) and free copies of

TALX SEC filings are also available on the TALX website (www.talx.com).

Free copies of Equifax filings also may be obtained by directing a request to

Equifax, Investor Relations, by phone to (404) 885-8000, in writing to Jeff

Dodge, Vice President—Investor Relations, or by email to investor@equifax.com.

Free copies of TALX filings may be obtained by directing a request to TALX

Investor Relations, by phone to (314) 214-7252, in writing to Janine A. Orf,

Director of Finance, or by email to jorf@talx.com. This communication shall

not constitute an offer to sell or the solicitation of an offer to buy

securities, nor shall there be any sale of securities in any jurisdiction in

which such solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of such jurisdiction. Participants in

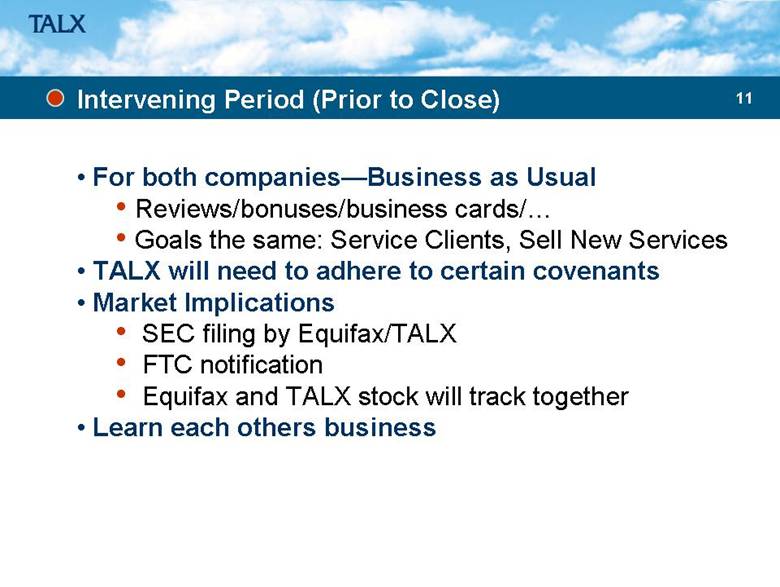

the Solicitation Equifax, TALX and their respective directors and executive

officers may be deemed, under SEC rules, to be participants in the

solicitation of proxies from TALX shareholders with respect to the proposed transaction.

Information regarding the directors and executive officers of Equifax is

included in its definitive proxy statement for its 2006 Annual Meeting of

Shareholders filed with the SEC on April 12, 2006. Information

regarding the directors and officers of TALX is included in the definitive

proxy statement for the TALX 2006 Annual Meeting of Shareholders filed with

the SEC on July 24, 2006. More detailed information regarding the

identity of potential participants, and their direct or indirect interests,

by securities holdings or otherwise, will be set forth in the registration

statement and proxy statement/prospectus and other materials to be filed with

the SEC in connection with the proposed transaction.

|