UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

EQUIFAX INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

1550 Peachtree Street, N.W.

Atlanta, Georgia 30309

April 14, 2003

DEAR SHAREHOLDERS:

We invite you to attend the 2003 annual meeting of shareholders on Wednesday, May 14, 2003, at 10:00 a.m. (EDT) at the Carter Presidential Center, 453 Freedom Parkway, Atlanta, Georgia.

Attached are the notice of the meeting and the proxy statement. Please read these materials so that you will know what we plan to do at the meeting. The proxy statement tells you more about the agenda and procedures for the meeting. It also describes how the Board operates and provides personal information about our directors and nominees for director. At this meeting, you will hear a current report on the activities of the Company, and you will also have the opportunity to meet our directors and executives.

Please review the accompanying proxy card and provide us with your proxy instructions as soon as possible. This way, your shares will be voted as you direct even if you cannot attend the meeting.

On behalf of the officers and directors, I thank you for your interest in Equifax and your confidence in our future.

Very truly yours,

THOMAS F. CHAPMAN

Chairman and Chief Executive Officer

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

PROXY STATEMENT

1550 Peachtree Street, N.W.

Atlanta, Georgia 30309

April 14, 2003

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Equifax Inc. will hold its annual meeting of shareholders at the Carter Presidential Center, 453 Freedom Parkway, Atlanta, Georgia, on Wednesday, May 14, 2003, at 10:00 a.m. (EDT). The purpose of the meeting is to consider and vote on the following items:

| 1. | The election of three directors; |

| 2. | Approval of the Equifax Director and Executive Stock Deferral Plan; |

| 3. | The shareholder proposal described in Item 3 of the Proxy Statement, if properly presented at the meeting; and |

| 4. | Any other matters that may properly come before the meeting. |

The record date for the annual meeting is March 5, 2003. Only shareholders of record at the close of business on March 5, 2003, can vote at the meeting.

Kent E. Mast

Secretary

PROXY STATEMENT

WHY AM I RECEIVING THIS PROXY STATEMENT?

The Board of Directors of Equifax Inc. is soliciting your proxy for the 2003 Annual Meeting of Shareholders and any adjournments thereof. The meeting will be held at 10:00 a.m., Eastern Daylight Time (EDT), on May 14, 2003, at the Carter Presidential Center, 453 Freedom Parkway, Atlanta, Georgia. This proxy statement contains information regarding items to be voted on at the meeting and other information regarding the Company. This proxy statement and proxy form are initially being provided to shareholders on or about April 14, 2003.

WHAT IS BEING VOTED UPON AT THE MEETING?

There are three items to be voted on at the meeting.

| (1) | The election of three directors |

| (2) | Approval of a stock deferral plan for directors and executives |

| (3) | A shareholder proposal relating to how the Company accounts for stock options |

We are not aware of any other matters to be presented to the meeting; however, the holders of the proxies will vote in their discretion on any other matters properly presented.

WHO CAN VOTE?

Persons who were shareholders of Equifax, as recorded in our stock register on March 5, 2003, may vote at the meeting. On that date, there were 144,852,287 shares of common stock outstanding and entitled to vote. Each shareholder has one vote for each share of common stock.

WHAT IS A PROXY?

Giving Equifax representatives your proxy means that you authorize them to vote your shares at the meeting and any adjournments thereof in the manner you direct. You may receive more than one proxy card depending on how you hold your shares. You will receive one proxy card representing shares registered in your name and shares held in your Investor’s Service Plan (dividend reinvestment) account. Equifax employees receive a separate card for any shares they hold in their 401(k) Retirement and Savings Plan. Also, if you hold shares through someone else, such as your stockbroker, you may get material from them asking how you want to vote.

HOW DO I GIVE VOTING INSTRUCTIONS?

You may give instructions via the Internet, by telephone, or by mail. Instructions are on the proxy card. You may also attend the meeting and give instructions in person. The proxy committee, named on the enclosed proxy card, will vote all properly executed proxies that are delivered pursuant to this solicitation and not subsequently revoked in accordance with the instructions given by you. Instead of voting by proxy, you may also choose to vote in person at the meeting. However, we recommend that you vote by proxy even if you plan to attend the meeting.

CAN I CHANGE MY VOTE?

You can revoke your proxy at any time before it is voted through one of the following four ways:

| (1) | By sending a written statement of revocation to the Secretary of Equifax; |

| (2) | By voting again by telephone or Internet; |

| (3) | By submitting another proxy card that is properly signed with a later date; or |

| (4) | By voting in person at the meeting. |

2

WHAT QUORUM IS REQUIRED?

For an item to be considered at the annual meeting, a quorum, which is a majority of the shares entitled to be voted, must be present in person or represented by proxy. Abstentions, votes withheld and “broker nonvotes” are counted as shares present for purposes of determining whether or not a quorum is present. A broker nonvote is where the shares held in brokerage accounts are not voted because a broker has not received voting instructions from the beneficial owner of the shares and does not have the discretionary authority to vote the shares.

HOW ARE THE VOTES COUNTED?

If a quorum is present, directors will be elected (Item 1—Election of Directors for terms ending in 2006) by a plurality of the votes cast. The directors receiving the most votes will be elected to fill the available vacancies, even if no one director receives a majority of votes cast. Abstentions and broker nonvotes will not be counted as votes cast, will not be included in vote totals, and will not affect the outcome of the vote.

Information regarding the Board and the three nominees for director begins on page 4 of this proxy statement. In voting for directors, you can specify whether your shares should be voted for all, some, or none of the nominees for director. If a director nominee for whom you authorize us to vote your proxy becomes unavailable before the election, your proxy authorizes us to vote for a replacement nominee if the Board names one. If you sign and return the proxy card, but do not specify how you want to vote your shares, we will vote them “For” the election of all nominees for director.

For all other matters, a majority of the votes cast is needed for the resolution to pass. Abstentions and broker nonvotes will not be counted as votes cast, will not be included in vote totals, and will not affect the outcome of the vote. If you sign and return the proxy card, but do not specify how you want to vote your shares, we will vote them “For” Item 2 and “Against” Item 3.

We do not expect any additional business to be presented to shareholders for a vote at the meeting. However, if at the meeting other business is properly raised on which a vote may properly be taken, your proxy card authorizes the people named as proxies to vote in accordance with their judgment.

WHO PAYS THE COST OF SOLICITING PROXIES?

Equifax pays the cost of soliciting proxies. We are paying Morrow & Co., Inc. a fee of $6,000, plus expenses, to help with the solicitation. We will also reimburse brokers, nominees, fiduciaries and other custodians for their reasonable fees and expenses for sending these materials to you and getting your voting instructions. In addition to this mailing, Equifax employees may solicit proxies in person, by telephone, facsimile transmission or electronically.

HOW CAN I REQUEST ADDITIONAL INFORMATION?

This proxy statement and the form of proxy will be provided to shareholders beginning on or about April 14, 2003. With this proxy statement, we are sending you Equifax’s 2002 Annual Report, including its consolidated financial statements. If you have questions or need more information about this proxy statement or the annual meeting, you may write to: Kent E. Mast, Secretary, Equifax Inc., P.O. Box 4081, Atlanta, Georgia 30302.

3

CAN I RECEIVE MY ANNUAL MEETING MATERIALS VIA THE INTERNET?

If you are a registered Equifax shareholder you can choose to view all future proxy statements and annual reports via the Internet instead of receiving them by mail each year. By reducing printing and postage costs, your choice to view these materials on the Internet will save the Company money and is friendlier to the environment. If you choose to access future proxy statements and annual reports online, you will continue to receive a proxy card in the mail, which will direct you to a website where you can view the proxy materials and submit your vote. No matter how you choose to receive your proxy materials, all shareholders will continue to have the option to vote via the Internet, by telephone, by mail, or at the annual meeting. If you wish to take advantage of this option, you should check the appropriate box on your proxy card when voting by mail. If you vote via the Internet or by telephone, you should respond to the related question when prompted.

If you hold your Equifax stock through a bank, broker or other nominee, you need to refer to the information provided by that entity for instructions on how to elect to view future proxy statements and annual reports via the Internet.

WHEN ARE SHAREHOLDER PROPOSALS OR DIRECTOR NOMINATIONS DUE FOR THE 2004 MEETING OF SHAREHOLDERS?

Shareholder proposals submitted for inclusion in the proxy materials for next year’s annual meeting must be received at the Company’s principal executive offices by December 12, 2003. Any shareholder proposal, including director nominations, that a shareholder intends to present at next year’s annual meeting other than through inclusion in the proxy materials must be received at the Company’s principal executive offices no later than February 7, 2004. Our bylaws contain certain additional requirements that must be complied with regarding proposals and nominations and should be consulted. All such proposals should be directed to the attention of the Company’s Secretary at Equifax Inc., P.O. Box 4081, Atlanta, Georgia 30302.

DIRECTORS AND CORPORATE GOVERNANCE

ITEM 1—ELECTION OF DIRECTORS FOR TERMS THAT CONTINUE UNTIL 2006

The Board of Directors is responsible for supervising management of the Company and consists of ten directors, only one which is an officer of the Company. In 2002 the Board elected John L. Clendenin as its Lead Director and established a Governance Committee, chaired by Mr. Clendenin, that is comprised of all non-employee directors. The Governance Committee and the other board committees are described beginning on page 7. The Board Mission Statement and Governance Guidelines can be viewed on the company’s website at www.equifax.com.

The Board is divided into three classes with approximately an equal number of directors in each class. Each class is elected for three-year terms. Steven J. Heyer was appointed to the Board in May 2002. Mr. Heyer elected not to stand for re-election at this Annual Meeting, due to the significant demands of his other business commitments. No votes will be cast for this position.

The Board has nominated for terms expiring in 2006 the three candidates named below. Each candidate is now a member of the Board whose term will expire at this year’s annual meeting. Each director will serve for three years or until he or she is succeeded by another qualified director.

4

The Board of Directors recommends that you vote “FOR” all nominees named below.

|

|

Larry L. Prince Director since 1988. Chairman of the Board and Chief Executive Officer of Genuine Parts Company, an automotive parts wholesaler, from 1990. He is also a director of SunTrust Banks, Inc.; Crawford & Co.; Southern Mills, Inc. and John H. Harland Company. Age: 64 |

|

|

Louis W. Sullivan, M.D. Director since 1995. President Emeritus of Morehouse School of Medicine, a private medical school located in Atlanta, Georgia, since July 2002 and President from 1993 to 2002. From March 1989 to January 1993, he was Secretary of the U.S. Department of Health and Human Services. He is also a director of Minnesota Mining and Manufacturing Company; Bristol-Myers Squibb; CIGNA Corporation; Georgia-Pacific Corporation; Biosante Pharmaceuticals; United Therapeutics, Inc. and Henry Schein Inc. Age: 69 |

|

|

Jacquelyn M. Ward Director since 1999. Outside Managing Director of Intec Telecom Systems, a computer software systems company since December 2000 and before that Chairman and CEO of Computer Generation Incorporated. Ms. Ward is also a former Chairperson of the Board of Regents of the University System of Georgia and is a director of Bank of America; Sanmina-SCI Corporation; Flowers Foods, Inc.; SYSCO Corporation; Anthem, Inc. and PRG-Schultz International, Inc. Age: 64 |

DIRECTORS WHOSE TERMS CONTINUE UNTIL 2005

|

|

Thomas F. Chapman Director since 1994. Became Chairman and Chief Executive Officer of Equifax Inc. in May 1999 and was previously President and Chief Executive Officer of the Company (1998-1999); President and Chief Operating Officer (1997-1998) and Executive Vice President and Group Executive of the Company’s former Financial Services Group (1993-1997). He is also a director of The Southern Company. Age: 59 |

|

|

D. Raymond Riddle Director since 1989. Since 1996, retired Chairman of the Board and Chief Executive Officer of National Service Industries, Inc., a diversified manufacturing and service company. He is also a director of AGL Resources Inc.; Atlantic American Corporation; and AMC, Inc. Age: 69 |

5

DIRECTORS WHOSE TERMS CONTINUE UNTIL 2004

|

|

Lee A. Ault III Director since 1991. Chairman of the Board of In-Q-Tel, Inc., an information technology company, since August 1999. During the prior five years, he was a private investor following his retirement from the Company in 1992 as Chairman and Chief Executive Officer of Telecredit, Inc., a subsidiary. He is also a director of Office Depot, Inc.; American Funds Insurance Series and Anworth Mortgage Asset Corporation. Age: 66 |

|

|

John L. Clendenin Director since 1982 and Lead Director since 2002. Retired Chairman of the Board of BellSouth Corporation, a communications services company. He served as Chairman, President and Chief Executive Officer of BellSouth Corporation from October 1983 until his retirement in December 1996. He continued to serve as Chairman until December 1997. He is also a director of The Kroger Company; Coca-Cola Enterprises, Inc.; The Home Depot, Inc.; Acuity Brands, Inc. and Powerwave Technologies. Age: 68 |

|

|

A. William Dahlberg Director since 1992. Chairman of the Board of Mirant Corporation, an international energy producer, since August 2000. Previously, from 1995 until 2001, he served as Chairman and Chief Executive Officer of The Southern Company and, prior to that time, was President and Chief Executive Officer of Georgia Power Company. He is also a director of SunTrust Banks, Inc. and Protective Life Corporation. Age: 62 |

|

|

L. Phillip Humann Director since 1992. Chairman, President and Chief Executive Officer of SunTrust Banks, Inc., a multi-bank holding company, since 1998. From 1991 to 1998 he served as President of SunTrust Banks. He is also a director of Coca-Cola Enterprises, Inc. and Haverty Furniture Companies, Inc. Age: 57 |

6

The compensation of non-employee directors consists of cash and stock options. Employee directors are not paid for their service as directors. The Company’s bylaws require all directors to own Equifax stock while serving as a director.

Non-employee director compensation consists of:

| Director Fees: |

|||

| Annual board membership fee |

$ |

35,000 | |

| Annual Executive Committee membership fee |

$ |

4,000 | |

| Annual Committee Chairman fee (except Executive Committee) |

$ |

5,000 | |

| Attendance fee for each Board and Committee meeting |

$ |

1,000 | |

Deferred Compensation Plan. In November 2002 the Board of Directors adopted the Equifax Director Deferred Compensation Plan (the “new plan”), which replaced the previous deferred compensation plan for directors. Under the new plan, a non-employee director may defer up to 100% of his or her director fees and invest them in Equifax common stock units. Balances held in the old plan were rolled over into the new plan and converted into Equifax common stock units. Each common stock unit is equal in value to a share of Equifax common stock. In general, amounts deferred under the plan are not paid until after the director retires from the board. However, directors may also establish up to two sub accounts from which amounts are to be paid on specific preretirement timetables established by the director (“Scheduled Withdrawal”). Amounts deferred are paid, at the director’s option, either in a lump sum or in annual installments over a period of up to fifteen years for retirement distributions, or up to five years for a Scheduled Withdrawal.

Stock Option Plan. Each year on the date of the annual shareholders’ meeting, non-employee directors receive an option to purchase shares of Equifax common stock. This year, pursuant to amendments adopted in August 2002, directors will receive options for 7,000 shares. The exercise price of the option will be equal to the fair market value of the common stock on May 14, 2003. These options become fully vested one year after the date granted and expire ten years from the date granted.

Stock Deferral Plan. Non-employee directors are eligible to participate in the Equifax Director and Executive Stock Deferral Plan which permits a director to defer the receipt of proceeds and the related taxation resulting from exercises of stock options that meet certain requirements. For a further description of the Equifax Director and Executive Stock Deferral Plan see “Item 2 – Approval of the Equifax Director and Executive Stock Deferral Plan” beginning on page 23.

COMMITTEES OF THE BOARD OF DIRECTORS

The Board of Directors appoints committees to help carry out its duties. Board Committees work on key issues in greater detail than is generally possible at full board meetings. Each committee regularly reviews the results of its meetings with the full board. Currently the Board has four committees, each of which is described below. During 2002, the Board of Directors met five times and each director attended at least 75% of the total board meetings and the meetings of the respective committees on which they serve, with the exception of Mr. Heyer. Each of the Committees operates pursuant to a written charter. The charters of the Audit, Compensation and Human Resources and Governance Committees can be viewed on the Company’s website at www.equifax.com.

7

| Director |

Executive |

Audit |

Compensation and Human Resources |

Governance | ||||

| No. of meetings in 2002 |

3 |

9 |

2 |

2 | ||||

| Ault |

X |

X | ||||||

| Chapman |

Chairman |

|||||||

| Clendenin |

X |

Chairman | ||||||

| Dahlberg |

X |

Chairman |

X | |||||

| Heyer |

X |

X | ||||||

| Humann |

X |

X | ||||||

| Prince |

Chairman |

X | ||||||

| Riddle |

X |

X |

X | |||||

| Sullivan |

X |

X | ||||||

| Ward |

X |

X | ||||||

Executive Committee. Subject to Board discretion, this Committee exercises the powers of the Board in managing the business and property of the Company during the intervals between Board meetings.

Audit Committee. The Committee is solely responsible for the selection and hiring of independent public accountants to audit the Company’s books and records and preapproves audit and all other work undertaken by the auditor. This Committee is also responsible for review of (1) the Company’s financial reports and other financial information, (2) systems of internal controls regarding finance, accounting, legal, compliance and ethics, and (3) auditing, accounting and financial reporting processes. The Committee meets with management and the director of internal audit as necessary. The Committee’s charter was amended in August 2002 and is attached to this proxy statement as Appendix 1.

Compensation and Human Resources Committee. This Committee is responsible for approving and monitoring the Company’s executive compensation plans, policies and programs. The Committee also approves the salary and other compensation of the Company’s senior management, although the salary and incentive compensation grants of the Chief Executive Officer are ratified by the Board of Directors. The Committee also (1) advises management on succession and other significant human resources matters, (2) monitors the effectiveness and funding of the U.S. Retirement Income Plan and 401(k) Retirement and Savings Plan and (3) approves or reviews significant employee benefit plan actions.

Governance Committee. The Committee, which is chaired by the Lead Director and comprised of all non-employee directors, exercises a leadership role in shaping the corporate governance of the Company and recommends to the Board corporate governance principles on a number of topics, including (1) board organization, membership, and function, (2) committee structure and membership, and (3) oversight of evaluation and compensation of the Board. As the nominating body of the Board, the Committee also interviews, evaluates, nominates and recommends individuals for membership on the Board and on the various committees of the Board. Shareholders may submit nominations to the Board by following the procedures described on page 4.

8

INFORMATION ABOUT INDEPENDENT PUBLIC ACCOUNTANTS

In March 2003, the Audit Committee retained Ernst & Young LLP as independent accountants to audit the Company’s books and records for fiscal year 2003. Representatives from Ernst & Young are expected to be present at the annual meeting, will have the opportunity to make a statement if they desire, and will be available to answer questions.

FEES PAID TO INDEPENDENT PUBLIC ACCOUNTANTS IN 2002

| Audit Fees Fees relating to audit of the Company’s annual financial statements for 2002 and the reviews of the financial statements filed on Forms 10-Q in 2002. |

$ |

600,000 | |

| Audit-Related Fees Fees for engagements traditionally performed by an auditor, such as statutory audits not relied upon for the consolidated financial statements audit, employee benefits plan audits, accounting consultation, acquisition due diligence, and other similar services. |

$ |

1,755,100 | |

| Other Fees Fees consist of $355,500 for tax compliance and tax consulting, and $40,000 for other professional services. |

$ |

395,500 | |

| Fees for Information Systems Services Financial Information Systems Design and Implementation Fees. |

$ |

0 | |

The Audit Committee of the Board of Directors is comprised of the five directors named below. Each member of the Committee is an independent director, as defined under the rules of the New York Stock Exchange. The Committee oversees the Company’s financial reporting process on behalf of the Board of Directors and operates under a written charter, a copy of which is attached to this proxy statement as Appendix 1.

The Company’s management has primary responsibility for the reporting process, including the systems of internal controls, and for preparing the Company’s financial statements. The Committee has reviewed and discussed the Company’s audited financial statements with management, which has represented to us that the 2002 consolidated financial statements were prepared in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). Ernst & Young, the Company’s independent accountants for 2002, are responsible for auditing the Company’s financial statements and expressing an opinion on their conformity with GAAP. The Committee also reviewed and discussed with Ernst & Young the audited financial statements for fiscal year 2002 that are included in the Company’s Annual Report.

We reviewed further with Ernst & Young its internal processes and the matters required to be discussed under Statement on Auditing Standards No. 61 (“Communication with Audit Committees”). The Committee also received from, and discussed with, Ernst & Young written disclosures and the letter required by Independence Standards Board Standard No. 1 (“Independence Discussions with Audit Committees”) and discussed with Ernst & Young its independence. The Committee concluded that provision of non-audit services by Ernst & Young is compatible with Ernst & Young’s independence.

The Committee also reviewed the overall scope and plans for their respective audits with the Company’s internal auditors and Ernst & Young. We met with the internal auditors and Ernst & Young, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls, the overall quality of the Company’s financial reporting, and other matters.

9

In reliance on the reviews and discussions referred to above, the Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2002 and appointed Ernst & Young as independent accountants to audit the Company’s books and records for the 2003 fiscal year.

A. William Dahlberg, Chairman

Steven J. Heyer

D. Raymond Riddle

Louis W. Sullivan, M.D.

Jacquelyn M. Ward

STATEMENT ABOUT FORMER ACCOUNTANTS

As recommended by the Audit Committee, the Board of Directors on March 28, 2002 decided to dismiss Arthur Andersen LLP as the Company’s independent accountants and appointed Ernst & Young to serve as the Company’s independent accountants for the fiscal year ending December 31, 2002. Arthur Andersen’s reports on the Company’s consolidated financial statements as of and for the fiscal years ended December 31, 2001 and 2000 did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope, or accounting principles.

During fiscal years 2001 and 2000, and subsequently through March 28, 2002, there were no disagreements with Arthur Andersen on any matter of accounting or practices, financial statement disclosures, or auditing scope or procedure which disagreements, if not resolved to Arthur Andersen’s satisfaction, would have caused it to make reference to the subject matter in connection with its reports on the Company’s consolidated financial statements for those periods. None of the reportable events described under Items 304(a)(1)(v) of Regulation S-K occurred during fiscal years 2001 or 2000, or subsequently through March 28, 2002. During fiscal years 2001 and 2000, and subsequently through March 28, 2002, the Company did not consult with Ernst & Young with respect to any of the matters or events set forth in Items 304(a)(2)(i) and (ii) of Regulation S-K.

Shown in the table below are the fees paid to Arthur Andersen LLP in 2002.

| Audit Fees Fees relating to 2001 audit of the Company’s annual financial statements. |

$ |

0 | |

| Audit-Related Fees Fees for engagements traditionally performed by an auditor, such as statutory audits not relied upon for the consolidated financial statements audit, employee benefits plan audits, and other similar services. |

$ |

151,896 | |

| Other Fees Fees consist of $229,705 for tax compliance and tax consulting, and $43,046 for other professional services. |

$ |

272,751 | |

| Fees for Information Systems Services Financial Information Systems Design and Implementation Fees. |

$ |

0 | |

10

STOCK OWNERSHIP AND PERFORMANCE

STOCK OWNERSHIP OF DIRECTORS AND EXECUTIVE OFFICERS

The table below shows the number of shares of Equifax common stock (and stock equivalents) each director, nominee for director, and each of the five most highly compensated executive officers (“Named Executive Officers”) beneficially owned as of March 5, 2003. We also show the aggregate number of shares beneficially owned by all directors and executive officers as a group.

| Name |

Amount and Nature of Beneficial Ownership(1) |

Percent of Class (Based on Number of Shares Outstanding as of March 5, 2003) | ||

| Directors and Nominees |

||||

| Lee A. Ault III |

114,450 |

* | ||

| John L. Clendenin |

26,163 |

* | ||

| A. William Dahlberg |

27,342 |

* | ||

| Steven J. Heyer |

0 |

* | ||

| L. Phillip Humann |

28,342 |

* | ||

| Larry L. Prince |

27,342 |

* | ||

| D. Raymond Riddle |

41,342 |

* | ||

| Louis W. Sullivan, M.D. |

22,402 |

* | ||

| Jacquelyn M. Ward |

14,112 |

* | ||

| Named Executive Officers |

||||

| Thomas F. Chapman |

2,021,345 |

1.4 | ||

| Mark E. Miller |

350,208 |

* | ||

| Karen H. Gaston |

277,424 |

* | ||

| Kent E. Mast |

194,092 |

* | ||

| Philip J. Mazzilli |

271,062 |

* | ||

| All Directors and Executive Officers as a Group (22 persons) (2) |

4,841,392 |

3.3 | ||

| Deferred Compensation and Stock Deferrals denominated as Common Stock Units (3) |

86,315 |

N/A |

| * | Less than 1% |

| (1) | Includes shares held in the Company 401(k) Retirement and Savings Plan and stock options exercisable on March 5, 2003, or 60 days thereafter, as follows: Mr. Ault — 16,890 option shares; Mr. Clendenin — 16,890 option shares; Mr. Dahlberg — 16,890 option shares; Mr. Humann — 16,890 option shares; Mr. Prince — 16,890 option shares; Mr. Riddle — 16,890 option shares; Dr. Sullivan — 16,890 option shares; Ms. Ward — 13,512 option shares; Mr. Chapman — 6,853 Savings Plan shares and 1,614,629 option shares; Mr. Miller — 245,208 option shares; Ms. Gaston — 4,882 Savings Plan shares and 235,543 option shares; Mr. Mast — 479 Savings Plan shares and 154,163 option shares; and Mr. Mazzilli — 2,365 Savings Plan shares and 161,562 option shares; and for all directors and Executive Officers as a Group — 39,809 Savings Plan shares and 3,788,021 option shares. |

| (2) | Includes 1,764,538 shares (1.23%) over which Michael Schirk, Vice President and Treasurer, shares voting and investment power as Investment Officer for the Equifax U.S. Retirement Income Plan. |

| (3) | Represents Director fees and stock deferred and invested in Equifax common stock units under the Director Deferred Compensation Plan and the Equifax Director and Executive Stock Deferral Plan, which performance mirrors that of Equifax common stock, as follows: Mr. Chapman — 10,736 units; Mr. Dahlberg — 9,539 units; Mr. Heyer — 187 units shares; Mr. Humann — 17,334 units; Mr. Prince — 17,707 units; Mr. Riddle — 15,913 units; Dr. Sullivan — 8,907 units; and Ms. Ward — 5,992 units. See Item 2 — Approval of the Equifax Director and Executive Stock Deferral Plan on page 23 for a description of the plan. |

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Based on Company records and other information, we believe that each of the directors and executive officers timely complied with all applicable Securities and Exchange Commission filing obligations for 2002 except that on May 3, 2002, Philip Mazzilli, Corporate Vice President, purchased 1,274 shares of Equifax stock by exercising a stock option and did not report this transaction to the SEC until June 20, 2002.

11

STOCK OWNERSHIP BY BENEFICIAL OWNERS

The table below shows the number of shares of common stock owned by persons or groups known to the Company to be beneficial owners of more than five percent of the common stock of the Company as of December 31, 2002, as reported to the Securities and Exchange Commission. The following information is derived solely from a Schedule 13G filed on February 10, 2003.

| Name and Address of Beneficial Owner(1) |

Amount and Nature of Beneficial Ownership |

Percent of Class |

|||

| The Governor and Company of the Bank of Ireland; IBI Interfunding; BancIreland/First Financial, Inc.; BIAM (US) Inc.(2) |

7,738,117 |

5.3 |

% | ||

| Iridian Asset Management LLC; LC Capital Management, LLC; CL Investors, Inc.; COLE Partners LLC; Iridian Private Business Value Equity Fund, L.P.(3) |

7,738,117 |

5.3 |

% | ||

| David L. Cohen(4) |

8,110,417 |

5.6 |

% | ||

| Harold J. Levy(4) |

8,110,417 |

5.6 |

% |

| (1) | The Governor and Company of the Bank of Ireland (“Bank of Ireland”) and IBI Interfunding (“IBI”) are located at Lower Baggot Street, Dublin 2, Ireland; BancIreland/First Financial, Inc. (“BancIreland”) is located at Junction Marketplace #27, 1011 N. Main Street, White River Junction, VT 05501; and BIAM (US) Inc. (“BIAM”) is located at Liberty Park #15, 282 Route 101, Amherst, NH 03110. All Iridian entities and Messers Cohen and Levy are located at 276 Post Road West, Westport, CT 06880. |

| (2) | Bank of Ireland, is the sole shareholder of IBI, which is the sole shareholder of BancIreland, which is the sole shareholder of BIAM, which is the controlling member of Iridian Asset Management LLC (“Iridian”). Because of these relationships, each entity may be deemed to possess beneficial ownership of the shares of common stock beneficially owned by the entity that it controls. |

| (3) | Iridian has direct voting power and investment power over 7,562,717 (5.2%) shares, which power CL Investors, Inc., LC Capital Management, LLC, David L. Cohen and Harold J. Levy may be deemed to share. Iridian has direct voting power and investment power over 175,400 shares held by Iridian Private Business Value Equity Fund, L.P., and CL Investors, Inc., LC Capital Management LLC, and COLE Partners LLC and Messrs. Cohen and Levy, each may be deemed to share such voting and investment power. |

| (4) | Messrs. Cohen and Levy, by virtue of their positions as principals and managers of the several Iridian entities referenced in note 3, each may be deemed to have shared voting and investment power for the combined 7,738,117 shares held by such Iridian entities referenced in such note and each shares voting and investment power over an additional 372,300 shares owned by First Eagle Fund of America, an open-end non-diversified mutual fund for which they are investment advisors. |

12

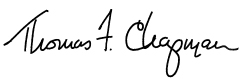

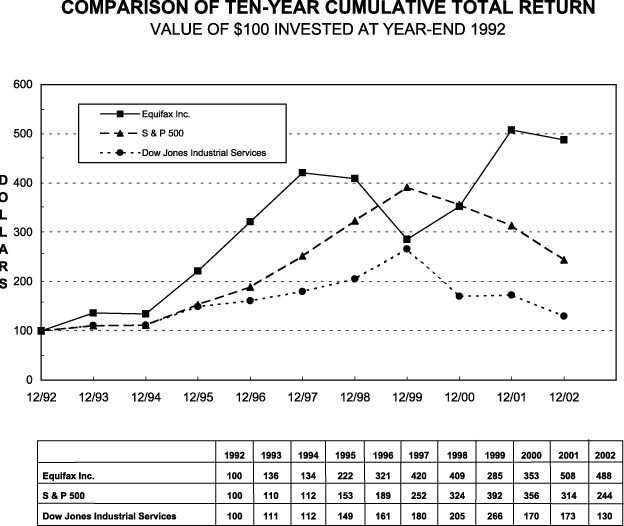

The following graphs compare the five-year and ten-year cumulative total return among investments in Equifax, the S&P 500 and the Dow Jones Industrial Services Index. The graphs assume that $100 was invested in Equifax stock and each index on December 31, 1997 (as required by the rules of the Securities and Exchange Commission) and December 31, 1992, respectively, and that all dividends were reinvested. The total cumulative dollar returns shown on the graphs represent the value that such investments would have had on December 31 of each subsequent year. On July 7, 2001, the spin-off of Certegy Inc. as a stock dividend was completed. The distribution of the Certegy shares to Equifax shareholders is treated as a special dividend for purposes of calculating shareholder return. It is assumed that the shares of Certegy received by shareholders were sold at the when-issued closing market price on July 7, 2001 and all of the proceeds were reinvested in shares of Equifax common stock at the when-issued closing market price on the same date.

13

14

EXECUTIVE OFFICER COMPENSATION

REPORT OF THE COMPENSATION AND HUMAN RESOURCES COMMITTEE ON EXECUTIVE COMPENSATION

Guiding Principles

The Compensation and Human Resources Committee is comprised of three non-employee directors and is responsible for setting salaries, incentive compensation and compensation policies for executive officers. The Board of Directors ratifies the salary and incentive compensation of the Chief Executive Officer. The Committee operates pursuant to a written charter, which can be viewed at www.equifax.com.

The Committee believes that in order to attract the highest caliber executive talent the Company must offer total compensation that is attractive in the relevant competitive marketplace. Targeted salaries are determined based on a broader peer group than that shown in the stock performance graphs appearing in this proxy statement, because the market for the executives that the Company seeks to attract and retain is broader than its direct competitors. The Committee periodically reviews the executive compensation program in light of competitive data and may modify the compensation components consistent with the best interests of the Company.

During 2002 the Committee reaffirmed its goals for the executive compensation program. The Committee reviewed executive officer compensation in regards to enhancing the Company’s ability to retain, and incent management. Among the objectives of the Committee’s review were the following:

| · | To provide equity to executive officers through methods competitive with the market |

| · | To enhance succession planning, retention and recruiting |

| · | To continue to have compensation emphasize the long-term performance of the Company |

| · | To continue to align the competitiveness of Equifax’s performance with the competitiveness of its executive compensation levels |

| · | To provide executives tax-advantaged methods of investing most forms of compensation |

Based upon its review and consultation with independent compensation advisors, the Committee believes that these considerations and the executive compensation program are consistent with the Company’s objective of enhancing shareholder value.

Section 162(m) of the Internal Revenue Code limits the deduction of compensation expense for income tax purposes to $1 million for the officers named in the compensation tables on the following pages (the “Named Executive Officers”), except for performance-based compensation meeting certain requirements. The Committee as a general matter seeks to facilitate deduction by the Company of compensation to the Named Executive Officers consistent with the requirements.

The Committee believes that ownership of the Company’s stock by management aligns management’s interests with those of shareholders. The Company uses various methods to encourage and facilitate such stock ownership. These include stock ownership guidelines that apply to the Company’s 200 most senior executives including the Named Executive Officers, and which have been established at levels consistent with those in other companies. Executive officers also may forego cash payment of annual incentives in favor of stock options.

15

Executive Officer Compensation Specifics

Executive officer compensation includes several principal elements: base salary, annual incentive and long-term opportunities. These elements are designed to provide a median competitive level of compensation equal to a competitive median, but to deliver above-market total compensation in response to outstanding performance by the officer and his or her business unit.

Salary. Executive officer salaries are determined on the basis of competitive market data, job performance, level of responsibility and other factors. Salary reviews are scheduled at 12-month intervals. The salaries earned by Mr. Chapman and the other Named Executive Officers were generally increased for 2002 in accordance with the foregoing practices.

Mr. Chapman’s base annual salary was increased in January 2002 to $825,000, representing an increase of 7.1%. In approving this salary increase, the Committee considered competitive salaries for comparable job responsibilities and Mr. Chapman’s personal performance.

Annual Incentive. Annual incentives are payable in cash for performance against objectives that are set at the beginning of each year based upon financial plans approved by the Board. A minimum level of performance is set, and no incentive is paid if this level of performance is not achieved. Levels of performance are established for threshold, target and maximum incentive payments.

For 2002, Mr. Chapman’s Annual Incentive was targeted to pay 80% of his salary, with a maximum opportunity of 240%. Mr. Chapman’s earned Annual Incentive for 2002 was 104% of salary, due to performance against the various criteria underlying the incentive: achievement of certain revenue and earnings per share profit growth targets and individual performance. For other executive officers, Annual Incentive was dependent on a combination of these Company financial criteria, business unit financial results, and certain non-financial goals, depending on their job roles. Other Named Executive Officers generally earned an Annual Incentive as performance criteria were met for the year.

Executive officers may elect to forego cash payment of all or part of an earned Annual Incentive and receive instead options to purchase Company stock. The Committee believes that this opportunity provides an excellent vehicle for expanding executive officers’ stock ownership and identification with shareholder interests, serving to further encourage management’s commitment to long-term performance of the Company. To encourage conversion elections and in recognition of the associated market risk and deferral of economic benefit, the multiple at which foregone Annual Incentive is converted to options increases with the percentage of Annual Incentive foregone. For 2002, Mr. Chapman elected to convert 25% of his earned Annual Incentive, and all other eligible executive officers voluntarily elected to receive stock options instead of cash for all or part of their earned Annual Incentive.

Transaction Bonus. In 2002, Mr. Chapman was paid $301,200, as the remainder of the cash bonus he was granted in 2001 in recognition of the instrumental role that he played in the successful spin-off of Certegy Inc.

Long-Term Compensation. The Company utilizes a number of vehicles to incent executive officers to remain with the Company and drive its long-term growth. Long-Term Incentives provide an opportunity to receive payments based on the extent to which financial criteria underlying the incentive are achieved over the applicable period. Long-Term Incentive grants are designed so that if paid at a targeted level, when combined with stock option grants, they deliver to the executive officer Long-Term Incentive compensation that, based on competitive data, approximates a median level.

16

Eligibility for payments under cash-based Long-Term Incentives for the measurement period July 2001 through December 2002, previously granted to Mr. Chapman and certain of the executive officers, was based on Company performance against the financial criteria underlying the incentives, primarily accumulative earnings per share growth. Based on the Company’s performance during the measurement period, these incentives were determined to be payable to Mr. Chapman and those other Named Executive Officers who held such incentives. Mr. Chapman earned $1,399,920, which represented a payout of 58.33% of the maximum award opportunity established for this Incentive.

During 2002, the Committee made grants of restricted stock and/or stock options to certain executive officers. Mr. Chapman was granted 130,000 stock options and 40,000 shares of restricted stock. The restricted stock and stock options granted to Mr. Chapman and the other Named Executive Officers are shown on the Summary Compensation Table, which appears on page 18 and in the Stock Options Granted Table, which appears on page 19, respectively. The stock options are 25% vested on date of grant and vest an additional 25% on the next three anniversaries, and the restricted stock vests 100% on February 5, 2005 and is forfeitable prior to then.

Split-Dollar Life Insurance. The Company maintains an Executive Life and Supplemental Retirement Benefit Plan, which is intended to maintain the competitiveness of the Company’s benefits relative to the competitive marketplace. Eligible executives, including the Named Executive Officers, but excluding Mark E. Miller, will receive life insurance coverage and deferred cash accumulation benefits. The Company pays policy premiums on behalf of each covered executive. In 2002, 36 executives participated in this plan. For the Named Executive Officers, the amount that the Company paid for the current life insurance benefit, and the economic benefit of the additional premiums paid that will ultimately be returned to the Company is included in the Summary Compensation Table under the heading “All Other Compensation.” The Committee is re-evaluating its split-dollar benefits in light of recent regulatory developments. As a result, the Company paid premiums for a life insurance benefit, but no deferred cash accumulation benefits, for Mr. Miller who joined the Company in August 2002. These amounts are included in the Summary Compensation Table under the heading “All Other Compensation”.

Deferred Compensation. In 2002 the Committee approved and the Board of Directors ratified the Executive Deferred Compensation Plan, a tax-deferred compensation program for a limited number of executives. We believe that this plan facilitates our primary goal of retaining and attracting top talent, by providing a tax-favorable vehicle for deferring salary and other compensation. Compensation is taxed at an executive officer’s then applicable rate when it is distributed from the plan. Approximately 125 officers are eligible to participate in this plan.

Stock Deferrals. The Equifax Director and Executive Stock Deferral Plan permits directors and executive officers to defer taxes on gains realized from certain stock options exercises or the vesting of restricted stock or stock units. The plan provides the executive officers another opportunity to retain Equifax stock and allows them to more effectively plan for future events such as retirement. This plan is being presented in this proxy for shareholder approval. See “Item 2—Approval of the Equifax Director and Executive Stock Deferral Plan”, beginning on page 23.

Larry L. Prince, Chairman

L. Phillip Humann

Lee A. Ault III

17

EXECUTIVE OFFICER SUMMARY COMPENSATION TABLE

The table below shows the before-tax compensation for the last three years for the Chief Executive Officer and the four next-highest paid individuals who were Executive Officers at December 31, 2002 (the “Named Executive Officers”). Information is reported for all periods during which each individual was an Executive Officer.

| Annual Compensation |

Long-Term Compensation | |||||||||||||||

| Grants |

Payouts | |||||||||||||||

| Name and Principal Position |

Year |

Salary($) |

Bonus($)(2) |

Other Annual Compensation ($)(3) |

Restricted Stock Grants ($)(4) |

Securities Underlying Options (#)(2) |

LTIP Payouts ($) |

All Other Compensation ($)(5) | ||||||||

| Thomas F. Chapman |

2002 |

822,885 |

641,850 |

21,552 |

1,020,000 |

211,081 |

1,399,920 |

489,800 | ||||||||

| Chairman and Chief |

2001 |

767,308 |

536,809 |

20,532 |

2,901,600 |

291,137 |

545,649 |

252,516 | ||||||||

| Executive Officer |

2000 |

696,078 |

194,711 |

19,920 |

0 |

17,862 |

0 |

30,173 | ||||||||

| Mark E. Miller(1) |

2002 |

226,154 |

0 |

820 |

1,724,650 |

323,958 |

0 |

62,291 | ||||||||

| President and |

||||||||||||||||

| Chief Operating Officer |

||||||||||||||||

| Karen H. Gaston |

2002 |

304,038 |

195,193 |

4,513 |

255,000 |

54,658 |

256,652 |

7,890 | ||||||||

| Chief Administrative Officer |

2001 2000 |

251,192 214,231 |

154,408 67,788 |

2,275 2,297 |

411,060 0 |

64,709 21,393 |

113,677 0 |

136,097 17,317 | ||||||||

| Kent E. Mast |

2002 |

309,115 |

158,761 |

5,934 |

255,000 |

70,711 |

256,652 |

11,010 | ||||||||

| Chief Development |

2001 |

288,846 |

142,043 |

6,099 |

411,060 |

51,148 |

0 |

147,548 | ||||||||

| Officer and General Counsel |

2000 |

32,885 |

50,000 |

0 |

0 |

59,124 |

0 |

3,136 | ||||||||

| Philip J. Mazzilli |

2002 |

330,831 |

127,370 |

6,711 |

255,000 |

50,687 |

349,980 |

11,730 | ||||||||

| Corporate Vice President |

2001 |

316,923 |

155,212 |

7,257 |

411,060 |

55,869 |

0 |

149,148 | ||||||||

| 2000 |

249,769 |

217,422 |

4,703 |

625,000 |

57,952 |

0 |

21,805 | |||||||||

| (1) | Mr. Miller joined the Company in August 2002; Ms. Gaston became an Executive Officer in April 1996 and Mr. Mast joined the Company in November 2000. Mr. Mazzilli was employed with the Company through June 1999 and rejoined the Company in February 2000. |

| (2) | The “Annual Compensation/Bonus” column represents any Annual Incentive earned and paid in cash for performance during the specified year. In 2000 and later years, the officers could elect to receive all or part of any Annual Incentive earned in the form of stock options. For any year, stock options granted in lieu of Annual Incentive earned are included under the “Long-Term Compensation/Securities Underlying Options” column, although the grants were not made until the following year. |

| (3) | “Annual Compensation/Other Annual Compensation” includes allowances for payroll taxes associated with providing executive financial planning, tax services, club memberships and tax related to split-dollar life insurance. |

| (4) | The value of restricted stock shown in the table is as of the grant date. As of December 31, 2002, total restricted stock awards outstanding and related fair market values were as follows: Mr. Chapman — 160,000 shares ($3,702,400); Mr. Miller — 85,000 shares ($1,966,900); Ms. Gaston — 27,000 shares ($624,780); Mr. Mast — 27,000 shares ($624,780) and Mr. Mazzilli — 52,000 shares ($1,203,280). |

| (5) | This column includes Company 401(k) matching contributions in the maximum amount of $6,000 (2002); $5,100 (2001); and $5,508 (2000), respectively, for each officer. Also included for 2002 are premiums paid by the Company pursuant to the Executive Life and Supplemental Retirement Benefit Plan for current life insurance, and the economic benefit of additional premiums that will ultimately be returned to the Company for each officer as follows: Mr. Chapman ($16,700/$49,494); Mr. Miller ($1,581/$0); Ms. Gaston ($1,890/$28,077); Mr. Mast ($5,010/$40,718) and Mr. Mazzilli ($5,730/$40,719). In the case of Mr. Miller the amount shown in the column represents the amount of binder premiums paid for life insurance on his behalf ($1,581) and relocation costs and related taxes ($60,710). Additionally, in 2002, Mr. Chapman was paid $165,900 for certain transportation expenses and related taxes, and $301,200 representing the remaining portion of a Transaction Bonus granted to him in 2000 as a result of the successful spin-off of the Company’s Payment Services business as Certegy Inc. (previously reported in the Company’s 2001 Proxy Statement). |

18

A stock option allows an individual to purchase shares of common stock at a fixed price (the exercise price) during a specific period of time. In general, whether exercising stock options is profitable depends on the relationship between the common stock market price and the option exercise price. At any given time, options can be “in the money” (the exercise price is greater than the market price) or “out of the money,” (the exercise price is less than the market price) depending on the current market price of the stock. The following two tables give more information on stock options granted during 2002 and held by the Named Executive Officers at year-end. The number of shares and exercise prices of options outstanding at July 7, 2001 were adjusted to reflect the spin-off of Certegy Inc.

Stock Options Granted During 2002

| Name |

Number of Securities Underlying Options Granted (#) |

% of Total Options Granted to Employees in Fiscal Year(3) |

Exercise Or Base Price ($/Share)(4) |

Expiration Date |

Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(5) | ||||||||

| 5% |

10% | ||||||||||||

| Thomas F. Chapman |

81,081(1) |

3.118 |

% |

$21.11 |

01/29/13 |

$1,076,429 |

$2,727,881 | ||||||

| 130,000(2) |

4.999 |

% |

$25.50 |

02/05/12 |

$2,084,785 |

$12,688,593 | |||||||

| Mark E. Miller |

198,958(1) |

7.650 |

% |

$21.11 |

01/29/13 |

$2,641,360 |

$6,693,724 | ||||||

| 125,000(2) |

4.806 |

% |

$20.29 |

08/06/12 |

$1,595,034 |

$4,042,129 | |||||||

| Karen H. Gaston |

24,658(1) |

.948 |

% |

$21.11 |

01/29/13 |

$327,359 |

$829,591 | ||||||

| 30,000(2) |

1.154 |

% |

$25.50 |

02/15/12 |

$481,104 |

$1,219,213 | |||||||

| Kent E. Mast |

40,111(1) |

1.542 |

% |

$21.11 |

01/29/13 |

$532,512 |

$1,349,491 | ||||||

| 30,000(2) |

1.154 |

% |

$25.50 |

02/05/12 |

$481,104 |

$1,219,213 | |||||||

| Philip J. Mazzilli |

20,687(1) |

.795 |

% |

$21.11 |

01/29/13 |

$274,640 |

$695,991 | ||||||

| 30,000(2) |

1.154 |

% |

$25.50 |

02/15/12 |

$481,104 |

$1,219,213 | |||||||

| (1) | Options have a ten-year term and vest 100% on the grant date. These grants are a result of each officer electing to receive all or a portion of his or her Annual Incentive earned for 2002 as a stock option grant rather than cash. These options were granted in 2003 and are included in the “Long-Term Incentive/Securities Underlying Options(#)” column of the Summary Compensation Table on page 18). |

| (2) | Options have a ten-year term and vest 25% on grant date and 25% on each of the next three grant date anniversaries. |

| (3) | Percentage of options granted in 2002. |

| (4) | The exercise price may be paid in cash or cash equivalent acceptable to the Compensation and Human Resources Committee or by the surrender of shares of common stock held for at least six months with an aggregate fair market value that is not less than the option price. |

| (5) | The dollar amounts under these columns are the result of calculations at 5% and 10% rates of appreciation as required by applicable securities laws. They are not intended to forecast possible future appreciation, if any, of Equifax stock price. |

Aggregated Option Exercises During 2002

The table below shows options exercised by the Named Executive Officers during 2002 and the total held by such officers at year-end.

| Shares Acquired on Exercise (#) |

Value Realized ($) or Payout |

Number of Securities Underlying Unexercised Options as of 12/31/02 (#) |

Value of Unexercised In-the-Money Options as of 12/31/02 ($)(1) | |||||||||

| Name |

Exercisable |

Unexercisable |

Exercisable |

Unexercisable | ||||||||

| Thomas F. Chapman |

— |

— |

1,547,491 |

215,000 |

11,126,826 |

— | ||||||

| Mark E. Miller |

— |

— |

31,250 |

93,750 |

89,062 |

267,188 | ||||||

| Karen H. Gaston |

18,324 |

227,143 |

195,885 |

40,000 |

1,162,701 |

— | ||||||

| Kent E. Mast |

— |

— |

99,052 |

54,781 |

128,697 |

42,899 | ||||||

| Philip J. Mazzilli |

4,750 |

59,482 |

112,259 |

61,116 |

521,395 |

176,129 | ||||||

| (1) | Represents aggregate excess of market value of shares under option as of December 31, 2002, over the exercise price of the options. |

19

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following chart shows certain issuance and exercise information regarding outstanding grants and shares available for grant under the company’s equity compensation plans. All information is as of December 31, 2002.

| (a) |

(b) |

(c) | ||||

| Plan Category |

Number of Securities to be Issued upon Exercise of Outstanding Options, Warrants and Rights |

Weighted-average Exercise Price of Outstanding Options, Warrants and Rights(1) |

Number of Securities Remaining Available for Future Issuance under Equity Compensation Plans (excluding Securities Reflected in Column(a)) | |||

| Equity Compensation |

||||||

| Plans Approved by |

||||||

| Security Holders(2) |

8,364,869 |

$16.9734 |

1,196,999(3) | |||

| Equity Compensation |

||||||

| Plans not Approved by |

||||||

| Security Holders(4) |

2,646,030 |

$20.1556 |

3,345,379(5) | |||

| Total |

11,010,899 |

$17.7381 |

4,542,378 |

| (1) | All exercise prices equaled fair market value at the date of grant. |

| (2) | Includes the Equifax Inc. 2000 Stock Incentive Plan (the “2000 Plan”) and the Equifax Inc. Omnibus Stock Incentive Plan. |

| (3) | Represents 1,196,999 shares available for future issuance under the 2000 Plan other than upon the exercise of an outstanding option, warrant or right. The 2000 Plan incorporates an evergreen formula pursuant to which on each January 1 (ending on January 1, 2007) the aggregate number of shares reserved for issuance will increase by a number of shares equal to 10% of the shares outstanding on that date. No additional grants will be made from the Equifax Inc. Omnibus Stock Incentive Plan. |

| (4) | Includes the following plans which have been approved by the Company’s Board of Directors but were not required to be approved by its shareholders: Equifax Employees Stock Incentive Plan (the “Incentive Plan”), Equifax Inc. 1995 Employees Stock Incentive Plan (the “1995 Plan”), Equifax Inc. 2001 Non-qualified Stock Incentive Plan (the “2001 Plan”), and the Equifax Inc. Non-Employee Director Stock Option Plan (the “Director Plan”). Each of these plans generally authorized a specified number of shares that may be granted as either options, stock appreciation rights, restricted stock, deferred shares (restricted stock units) and related dividend equivalents. Options issued under the various plans must be issued with an exercise price not less than to the fair market value of Equifax stock at the date of grant. Options generally, but need not, vest over a period of time specified at grant, usually not more than four years, and may be exercised during a 10-year period. Options granted under the 2001 Plan may be exercisable by redemption of restricted shares, deferred shares or other contingent shares, subject to performance criteria, or may include Reload Option Rights (additional option rights granted automatically upon the exercise of an option), if specified at the time of grant. Rights granted under the various plans generally accelerate upon a change of control as defined in the plans, which is generally similar to the definition contained in the Company’s change in control agreements and described on page 21. A Committee (or Administrator) appointed by the Board of Directors administer the plans. The Director Plan has terms similar to those described above, but authorizes an annual issuance to the directors on the date of the annual meeting of shareholders of a number of stock options determined by the Board of Directors, (for 2003 this number is 7,000). No additional grants may be made under the Incentive Plan and the 1995 Plan; however, options and other awards granted under these plans remain outstanding and are included in column (a). |

| (5) | Represents shares available for future issuance other than upon the exercise of an outstanding option, warrant or right under the following plans in the following amounts; the 2001 Plan, 3,116,833 shares; the Director Plan, 222,545 shares. In addition, any shares of stock subject to an option that remain unissued after the cancellation, expiration or change of such option and any restricted stock which is forfeited shall again become available for use under the plan. No additional grants will be made from the Incentive Plan or the 1995 Plan, although options granted under these plans are outstanding and included in column (a). |

20

EMPLOYMENT AGREEMENTS AND CHANGE IN CONTROL AGREEMENTS

The Company has entered into an employment agreement with Mark E. Miller, President and Chief Operating Officer, commencing on August 1, 2002 and continuing for an indefinite period, which sets forth the significant elements of Mr. Miller’s employment. The agreement provides for an annual base salary of $600,000; eligibility to participate in the Company’s Annual Incentive Plan with a guaranteed Incentive payment of not less than $420,000 for 2002; a grant of 125,000 stock options which vest in 25% increments beginning on the date of grant and on the anniversary of the grant; a grant of 85,000 shares of restricted stock that will vest in full on the third anniversary of the grant; and such other related matters as the right to participate in benefit plans. The agreement also provides to Mr. Miller certain severance payments in the event that he is terminated without cause (as such term is defined in the agreement). In addition, the agreement embodies a noncompetition agreement and nonsolicitation of customers agreement that would be binding on Mr. Miller for two years following the termination of his employment with the Company for any reason.

The Company has also entered into an employment agreement with Donald T. Heroman, Corporate Vice President and Chief Financial Officer, commencing on November 25, 2002 and continuing for an indefinite period, which sets forth the significant elements of Mr. Heroman’s employment. The agreement provides for an annual base salary of $370,000; eligibility to participate in the Company’s Annual Incentive Plan with a guaranteed Incentive of $300,000 for 2002; a grant of 60,000 stock options, which vest in 25% increments beginning on the date of grant and on the anniversary of the grant; a grant of 10,000 shares of restricted stock that will vest in full on the third anniversary of the grant and a grant of 12,000 shares of restricted stock that will vest 50% on the first and second anniversaries of the date of grant, and such other related matters as the right to participate in benefit plans. In addition, the agreement embodies a noncompetition agreement that would be binding on Mr. Heroman for two years following the termination of his employment with the Company for any reason.

The Company has Change in Control Agreements with each of the Company’s Named Executive Officers. These Agreements have renewable five-year terms and become effective only upon a change in control of the Company. A “change in control” is generally defined by the Agreements to mean (i) an accumulation by any person, entity or group of 20% or more of the combined voting power of the Company’s voting stock, or (ii) a business combination resulting in the shareholders immediately prior to the combination owning less than two-thirds of the common stock and combined voting power of the new Company, (iii) a sale or disposition of all or substantially all of Company assets, or (iv) a complete liquidation or dissolution of the Company. If any of these events happen and the executive’s employment terminates within three years after the date of the change in control, other than from death, disability or for cause or voluntarily other than for “good reason,” he or she is entitled to severance pay and other benefits described in the Agreements. The severance payment is equal to three times the sum of (i) that executive’s highest annual salary for the twelve months prior to termination, and (ii) the executive’s highest bonus for the three years prior to termination. Benefits payable under this Agreement and other compensation or benefit plans of the Company are not reduced because of Section 280G of the Internal Revenue Code. Any payments the executive receives will be increased, if necessary, so that after taking into account all taxes he or she would incur as a result of those payments, the executive would receive the same after-tax amount he or she would have received had no excise tax been imposed under Section 4999 of the Code. No payments have been made to any Named Executive Officer under these Agreements.

21

The Equifax Retirement Plan (“ERP”) is the Company’s tax-qualified retirement plan available to all U.S. employees and provides benefits based on length of service with the Company and a participant’s average total earnings up to a maximum of either 125% of base salary or base salary plus 75% of other earnings, whichever is greater. ERP benefits are computed by averaging the employee’s total earnings (Base Salary and Annual Incentive) for the highest paid thirty-six consecutive months of employment.

Equifax also has another retirement plan, the Supplemental Executive Retirement Plan (“SERP”), under which certain executives may receive additional pension benefits after retirement based on years of credited service (up to 40 years) and final average earnings (base salary and bonus). SERP benefits generally are computed by either multiplying an employee’s average total earnings by 1.5%, multiplied by years of credited service, as defined in the SERP, up to 40 years, or average total earnings multiplied by 3%, multiplied by years of credited service, up to 20 years, for the most Senior Executive Officer participants. The SERP was closed to new participants in 1992. As of December 31, 2002, the only Named Executive Officer eligible for both the ERP and the SERP was Thomas F. Chapman. The other Named Executive Officers are eligible only for the ERP.

The following table shows the annual retirement benefits that would be payable on January 1, 2003, on a combined basis under the ERP and SERP at normal retirement (age 65 or later) and various rates of final average earnings and years of service. The ERP benefits are computed in the form of a life annuity without survivorship benefits; however, survivorship benefits are available and are computed as the actuarial equivalent of the life annuity. The SERP benefits are provided in the same form as the ERP benefits. SERP benefits are reduced for ERP benefits and are paid without regard to limitations under federal Internal Revenue Code Sections 401(a) and 415. Neither ERP or SERP benefits are reduced for Social Security benefits.

Retirement Plan Table

| Final Average Earnings |

Years of Service | |||||||||||||||||||

| 15 |

20 |

25 |

30 |

35 | ||||||||||||||||

| $ 400,000 |

240,000 |

240,000 |

240,000 |

240,000 |

240,000 | |||||||||||||||

| 600,000 |

360,000 |

360,000 |

360,000 |

360,000 |

360,000 | |||||||||||||||

| 800,000 |

480,000 |

480,000 |

480,000 |

480,000 |

480,000 | |||||||||||||||

| 1,000,000 |

600,000 |

600,000 |

600,000 |

600,000 |

600,000 | |||||||||||||||

| 1,200,000 |

720,000 |

720,000 |

720,000 |

720,000 |

720,000 | |||||||||||||||

| 1,400,000 |

840,000 |

840,000 |

840,000 |

840,000 |

840,000 | |||||||||||||||

| 1,600,000 |

960,000 |

960,000 |

960,000 |

960,000 |

960,000 | |||||||||||||||

| 2,000,000 |

1,200,000 |

1,200,000 |

1,200,000 |

1,200,000 |

1,200,000 | |||||||||||||||

| 2,200,000 |

1,320,000 |

1,320,000 |

1,320,000 |

1,320,000 |

1,320,000 | |||||||||||||||

The credited years of service for each of the Named Executive Officers as of December 31, 2002 were as follows: Thomas F. Chapman—13 years; Mark E. Miller—0 years; Karen H. Gaston—25 years; Kent E. Mast—2 years; and Philip J. Mazzilli—10 years.

22

ITEM 2—APPROVAL OF THE EQUIFAX DIRECTOR AND EXECUTIVE STOCK DEFERRAL PLAN

The Board of Directors has adopted the Equifax Director and Executive Stock Deferral Plan (the “Plan”) and directed that it be submitted to the Company’s shareholders for approval. The Board believes that the Plan assists the Company in attracting and retaining the highest quality individuals in key executive positions. Approval of the Company’s shareholders is sought so that the Company and certain of the participating individuals may take advantage of certain favorable terms under the securities and tax laws. The Plan will be approved upon the affirmative vote of a majority of the votes cast by holders of the shares of Common Stock voting in person or by proxy at the Annual Meeting. The following description of the Plan is qualified in its entirety by reference to the text of the Plan, which is attached to this proxy statement as Appendix 2. Capitalized terms used in the description and not defined in the description have the same meaning as in the Plan.

The Board of Directors recommends that you vote “FOR” Item 2.

Description of the Plan

General. The purpose of the Plan is to promote the interests of the Company by providing key executives and directors who contribute the successful operation and performance of the Company with the opportunity to defer the taxation of gains on Stock Options and vesting of Restricted Stock and Deferred Shares to retirement or other termination of employment. The number of shares of Equifax Common Stock authorized for issuance under the Plan is 1,000,000 shares. However, the shares of Common Stock issued under the Plan will essentially replace shares that would have been issued under the Company’s various stock incentive plans and, therefore, the Plan should not result in additional dilution of existing shareholders.

Eligibility and Participation. Directors, elected officers or other highly compensated employees or independent contractors of the Company and its subsidiaries as designated by the Administrator (“Eligible Executives”) are eligible to participate in the Plan (“Participants”). Because the number of Directors, elected officers and other key management may change, and because the selection of additional Participants is discretionary, it is not possible to determine the exact number of individuals who will from time to time be eligible to participate in the Plan. However, the Company expects that the number of Eligible Executives would represent substantially less than one percent of the Company’s approximately 2,800 U.S. employees.

Deferral of Restricted Stock or Deferred Shares. A Participant may make an election at least six (6) months prior to the date when Restricted Stock or Deferred Shares vest (Vesting Date) to delay receipt of Restricted Stock or Deferred Shares granted under any of the Company’s stock incentive plans (“the Stock Incentive Plan”) and in exchange receive rights to a number of shares of Deferred Stock, as defined below, under the Plan equal to the number of shares of Restricted Stock or Deferred Shares deferred. A Participant may only make such an election with respect to Restricted Stock or Deferred Shares that he/she has not previously elected to take into income under Section 83(b) of the Internal Revenue Code. The Deferred Stock will not pay any dividends or dividend equivalents and the Participant will stand in the position of an unsecured general creditor with respect to the right to receive the Deferred Stock. Currently, no Director has been granted Restricted Stock or Deferred Shares.

23

Exercise and Deferral of Stock Options. A Participant may make an election at least six (6) months prior to the date on which an option is exercised (the Exchange Date) to delay receipt of any gains resulting from the option exercise and to receive instead rights to a number of shares of Deferred Stock equal to such gain. The Participant will exchange currently owned Common Stock for the exercise price of the options. The Deferred Stock will not pay any dividends and the Eligible Executive will stand in the position of an unsecured general creditor with respect to any right to receipt of the Deferred Stock under this Plan.

Deferred Stock. All benefits of a Participant are reflected as the right to receive shares of Common Stock of Equifax in the future, which are referred to as “Deferred Stock.” Participants are allocated a number of units of Deferred Stock equal to the number of shares of Restricted Stock/Deferred Shares or Stock Option gains deferred. Except upon a Participant’s death, Deferred Stock (including any and all benefits provided under the Plan) may not be sold, alienated, assigned, transferred, pledged or hypothecated by the Participant, or any Beneficiary and any attempt to do so shall be null and void. Deferred Stock shall not be subject to the claims of creditors or other claimants of the Participant or Beneficiary and any orders, decrees, levies, garnishment or executions to the fullest extent allowed by law. The number of units of Deferred Stock allocated to Participants and available for allocation and payment under the Plan may be adjusted if shares of the Company are increased, decreased or changed through reorganization, recapitalization, reclassification, stock dividend, stock split or reverse stock split, provided, however, that (except with respect to a stock split or reverse stock split) no such adjustment need be made if upon the advice of counsel, the Administrator determines that such adjustment may result in the receipt of federally taxable income to Participants hereunder or to the holders of Common Stock or other classes of the Company’s securities.

Participant Accounts. Deferred Stock credited to Participants will be maintained in one or more accounts for each Participant. The Administrator shall provide each Participant with statements at least quarterly setting forth the amount of Deferred Stock credited to a Participant’s Account(s) at the end of each quarter.

Distribution of Deferred Stock. All distributions of Deferred Stock credited to a Participant’s account under the Plan will be made in shares of Equifax Common Stock. Distributions under the Plan will be made (a) upon the Participant’s retirement, death or disability (b) at scheduled time periods determined by the Participant at the time of election not sooner than the third year after deferral (Scheduled Withdrawals), (c) subject to penalties, at any time upon the Participant’s request (Unscheduled Withdrawal), (d) due to financial hardship, or (e) upon the Participant’s Termination of Employment.

Retirement. Distribution of Deferred Stock upon retirement is made in a single lump sum unless the Participant makes a timely election prior to Retirement to divide the Deferred Stock into equal annual installments to be distributed over a specified period of not more than fifteen (15) years. A Participant may elect to change the form of payout not less than thirteen (13) calendar months prior to Termination of Employment.