falseDecember 31, 20192019FY0000033185--12-3111.210.90.010.0110.010.0001.251.25300.0300.0189.3189.3121.2120.667.568.10.60.61.561.561.5676.5588.493.195.60.70.70.7P3YP10YP40YP3YP7YP3YP10Y21162115105102515122P5YP3YP5YP1YP5YP10YP30YP10Y2.303.603.303.952.603.256.907.00P2YP3Y800.9380.5125.0380.5180.5100.010.0ThreeFourthree.6667Eightsix19,000P3YP10YP1YP3Y0.11.987.788.7—0.30.62.81.72.60.11.03.74.80.7—0.10.10.11.8———0.30.3——0.20.24.80.10.20.155——55——————3535——202015152020101010101010656515152540——556010200.65.9P1YP14YP5YP1Y00000331852019-01-012019-12-31iso4217:USD00000331852019-06-30xbrli:shares00000331852020-01-3100000331852018-01-012018-12-3100000331852017-01-012017-12-31iso4217:USDxbrli:shares0000033185us-gaap:ParentMember2019-01-012019-12-310000033185us-gaap:NoncontrollingInterestMember2019-01-012019-12-310000033185us-gaap:ParentMember2018-01-012018-12-310000033185us-gaap:NoncontrollingInterestMember2018-01-012018-12-310000033185us-gaap:ParentMember2017-01-012017-12-310000033185us-gaap:NoncontrollingInterestMember2017-01-012017-12-3100000331852019-12-3100000331852018-12-3100000331852017-12-3100000331852016-12-310000033185us-gaap:CommonStockMember2016-12-310000033185us-gaap:AdditionalPaidInCapitalMember2016-12-310000033185us-gaap:RetainedEarningsMember2016-12-310000033185us-gaap:AccumulatedOtherComprehensiveIncomeMember2016-12-310000033185us-gaap:TreasuryStockMember2016-12-310000033185us-gaap:TrustForBenefitOfEmployeesMember2016-12-310000033185us-gaap:NoncontrollingInterestMember2016-12-310000033185us-gaap:RetainedEarningsMember2017-01-012017-12-310000033185us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-01-012017-12-310000033185us-gaap:CommonStockMember2017-01-012017-12-310000033185us-gaap:AdditionalPaidInCapitalMember2017-01-012017-12-310000033185us-gaap:TreasuryStockMember2017-01-012017-12-310000033185us-gaap:CommonStockMember2017-12-310000033185us-gaap:AdditionalPaidInCapitalMember2017-12-310000033185us-gaap:RetainedEarningsMember2017-12-310000033185us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-12-310000033185us-gaap:TreasuryStockMember2017-12-310000033185us-gaap:TrustForBenefitOfEmployeesMember2017-12-310000033185us-gaap:NoncontrollingInterestMember2017-12-310000033185us-gaap:RetainedEarningsMember2018-01-012018-12-310000033185us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310000033185us-gaap:CommonStockMember2018-01-012018-12-310000033185us-gaap:AdditionalPaidInCapitalMember2018-01-012018-12-310000033185us-gaap:TreasuryStockMember2018-01-012018-12-310000033185us-gaap:RetainedEarningsMember2018-01-0100000331852018-01-010000033185us-gaap:CommonStockMember2018-12-310000033185us-gaap:AdditionalPaidInCapitalMember2018-12-310000033185us-gaap:RetainedEarningsMember2018-12-310000033185us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310000033185us-gaap:TreasuryStockMember2018-12-310000033185us-gaap:TrustForBenefitOfEmployeesMember2018-12-310000033185us-gaap:NoncontrollingInterestMember2018-12-310000033185us-gaap:RetainedEarningsMember2019-01-012019-12-310000033185us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310000033185us-gaap:CommonStockMember2019-01-012019-12-310000033185us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310000033185us-gaap:TreasuryStockMember2019-01-012019-12-310000033185us-gaap:CommonStockMember2019-12-310000033185us-gaap:AdditionalPaidInCapitalMember2019-12-310000033185us-gaap:RetainedEarningsMember2019-12-310000033185us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310000033185us-gaap:TreasuryStockMember2019-12-310000033185us-gaap:TrustForBenefitOfEmployeesMember2019-12-310000033185us-gaap:NoncontrollingInterestMember2019-12-310000033185efx:CommonStockRepurchaseProgramMember2017-01-012017-12-310000033185us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-12-310000033185us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-12-310000033185us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2017-12-310000033185efx:AccumulatedImpactofTaxCutsandJobsActof2017Member2019-12-310000033185efx:AccumulatedImpactofTaxCutsandJobsActof2017Member2018-12-310000033185efx:AccumulatedImpactofTaxCutsandJobsActof2017Member2017-12-31efx:segmentxbrli:pure0000033185efx:USInformationSolutionsMember2019-01-012019-12-3100000331852020-01-012019-12-3100000331852021-01-012019-12-3100000331852023-01-012019-12-3100000331852025-01-012019-12-310000033185us-gaap:EmployeeStockOptionMember2019-01-012019-12-310000033185us-gaap:EmployeeStockOptionMember2018-01-012018-12-310000033185us-gaap:EmployeeStockOptionMember2017-01-012017-12-310000033185us-gaap:OtherCurrentAssetsMember2019-12-310000033185us-gaap:OtherCurrentAssetsMember2018-12-310000033185srt:MinimumMemberefx:DataProcessingEquipmentCapitalizedInternalUseSoftwareAndSystemsCostsMember2019-01-012019-12-310000033185efx:DataProcessingEquipmentCapitalizedInternalUseSoftwareAndSystemsCostsMembersrt:MaximumMember2019-01-012019-12-310000033185us-gaap:BuildingMember2019-01-012019-12-310000033185srt:MinimumMemberus-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2019-01-012019-12-310000033185srt:MaximumMemberus-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2019-01-012019-12-310000033185us-gaap:ComputerSoftwareIntangibleAssetMembersrt:MinimumMember2019-01-012019-12-310000033185us-gaap:ComputerSoftwareIntangibleAssetMembersrt:MaximumMember2019-01-012019-12-310000033185us-gaap:PropertyPlantAndEquipmentMember2019-01-012019-12-310000033185us-gaap:PropertyPlantAndEquipmentMember2018-01-012018-12-310000033185us-gaap:PropertyPlantAndEquipmentMember2017-01-012017-12-310000033185us-gaap:OtherCurrentLiabilitiesMember2019-12-310000033185us-gaap:OtherCurrentLiabilitiesMember2018-12-310000033185efx:CybersecurityIncidentMemberus-gaap:OtherCurrentLiabilitiesMember2019-12-310000033185us-gaap:OtherIncomeMember2019-01-012019-12-310000033185us-gaap:OtherIncomeMember2018-01-012018-12-310000033185us-gaap:FairValueMeasurementsRecurringMember2019-12-310000033185us-gaap:FairValueInputsLevel1Member2019-12-310000033185us-gaap:FairValueInputsLevel2Member2019-12-310000033185us-gaap:FairValueInputsLevel3Member2019-12-310000033185srt:MinimumMemberus-gaap:DatabasesMember2019-01-012019-12-310000033185srt:MinimumMemberefx:TechnologyAndSoftwareMember2019-01-012019-12-310000033185us-gaap:NoncompeteAgreementsMembersrt:MinimumMember2019-01-012019-12-310000033185srt:MinimumMemberefx:ProprietaryDatabaseMember2019-01-012019-12-310000033185us-gaap:CustomerRelationshipsMembersrt:MinimumMember2019-01-012019-12-310000033185us-gaap:TradeNamesMembersrt:MinimumMember2019-01-012019-12-310000033185srt:MaximumMemberus-gaap:DatabasesMember2019-01-012019-12-310000033185srt:MaximumMemberefx:TechnologyAndSoftwareMember2019-01-012019-12-310000033185us-gaap:NoncompeteAgreementsMembersrt:MaximumMember2019-01-012019-12-310000033185srt:MaximumMemberefx:ProprietaryDatabaseMember2019-01-012019-12-310000033185us-gaap:CustomerRelationshipsMembersrt:MaximumMember2019-01-012019-12-310000033185us-gaap:TradeNamesMembersrt:MaximumMember2019-01-012019-12-310000033185efx:UnitedStatesConsumerInformationSolutionsMemberefx:OnlineInformationSolutionsMember2019-01-012019-12-310000033185efx:UnitedStatesConsumerInformationSolutionsMemberefx:OnlineInformationSolutionsMember2018-01-012018-12-310000033185efx:UnitedStatesConsumerInformationSolutionsMemberefx:OnlineInformationSolutionsMember2017-01-012017-12-310000033185efx:UnitedStatesConsumerInformationSolutionsMemberefx:MortgageSolutionsMember2019-01-012019-12-310000033185efx:UnitedStatesConsumerInformationSolutionsMemberefx:MortgageSolutionsMember2018-01-012018-12-310000033185efx:UnitedStatesConsumerInformationSolutionsMemberefx:MortgageSolutionsMember2017-01-012017-12-310000033185efx:FinancialMarketingServicesMemberefx:UnitedStatesConsumerInformationSolutionsMember2019-01-012019-12-310000033185efx:FinancialMarketingServicesMemberefx:UnitedStatesConsumerInformationSolutionsMember2018-01-012018-12-310000033185efx:FinancialMarketingServicesMemberefx:UnitedStatesConsumerInformationSolutionsMember2017-01-012017-12-310000033185efx:UnitedStatesConsumerInformationSolutionsMember2019-01-012019-12-310000033185efx:UnitedStatesConsumerInformationSolutionsMember2018-01-012018-12-310000033185efx:UnitedStatesConsumerInformationSolutionsMember2017-01-012017-12-310000033185efx:VerificationServicesMemberefx:WorkforceMember2019-01-012019-12-310000033185efx:VerificationServicesMemberefx:WorkforceMember2018-01-012018-12-310000033185efx:VerificationServicesMemberefx:WorkforceMember2017-01-012017-12-310000033185efx:EmployerServicesMemberefx:WorkforceMember2019-01-012019-12-310000033185efx:EmployerServicesMemberefx:WorkforceMember2018-01-012018-12-310000033185efx:EmployerServicesMemberefx:WorkforceMember2017-01-012017-12-310000033185efx:WorkforceMember2019-01-012019-12-310000033185efx:WorkforceMember2018-01-012018-12-310000033185efx:WorkforceMember2017-01-012017-12-310000033185efx:InternationalMembersrt:AsiaPacificMember2019-01-012019-12-310000033185efx:InternationalMembersrt:AsiaPacificMember2018-01-012018-12-310000033185efx:InternationalMembersrt:AsiaPacificMember2017-01-012017-12-310000033185srt:EuropeMemberefx:InternationalMember2019-01-012019-12-310000033185srt:EuropeMemberefx:InternationalMember2018-01-012018-12-310000033185srt:EuropeMemberefx:InternationalMember2017-01-012017-12-310000033185efx:InternationalMembersrt:LatinAmericaMember2019-01-012019-12-310000033185efx:InternationalMembersrt:LatinAmericaMember2018-01-012018-12-310000033185efx:InternationalMembersrt:LatinAmericaMember2017-01-012017-12-310000033185country:CAefx:InternationalMember2019-01-012019-12-310000033185country:CAefx:InternationalMember2018-01-012018-12-310000033185country:CAefx:InternationalMember2017-01-012017-12-310000033185efx:InternationalMember2019-01-012019-12-310000033185efx:InternationalMember2018-01-012018-12-310000033185efx:InternationalMember2017-01-012017-12-310000033185efx:GlobalConsumerSolutionsMember2019-01-012019-12-310000033185efx:GlobalConsumerSolutionsMember2018-01-012018-12-310000033185efx:GlobalConsumerSolutionsMember2017-01-012017-12-310000033185efx:PayNetMember2019-04-300000033185efx:DataXMember2018-07-310000033185efx:A2019AcquisitionsMember2019-12-310000033185efx:A2018AcquisitionsMember2018-12-310000033185us-gaap:CustomerRelationshipsMember2019-12-310000033185us-gaap:CustomerRelationshipsMember2019-01-012019-12-310000033185us-gaap:CustomerRelationshipsMember2018-12-310000033185us-gaap:CustomerRelationshipsMember2018-01-012018-12-310000033185efx:TechnologyAndSoftwareMember2018-12-310000033185efx:TechnologyAndSoftwareMember2018-01-012018-12-310000033185us-gaap:DatabasesMember2019-12-310000033185us-gaap:DatabasesMember2019-01-012019-12-310000033185us-gaap:DatabasesMember2018-12-310000033185us-gaap:DatabasesMember2018-01-012018-12-310000033185us-gaap:NoncompeteAgreementsMember2019-12-310000033185us-gaap:NoncompeteAgreementsMember2019-01-012019-12-310000033185us-gaap:NoncompeteAgreementsMember2018-12-310000033185us-gaap:NoncompeteAgreementsMember2018-01-012018-12-310000033185efx:TradenamesAndOtherMember2019-12-310000033185efx:TradenamesAndOtherMember2019-01-012019-12-310000033185efx:TradenamesAndOtherMember2018-12-310000033185efx:TradenamesAndOtherMember2018-01-012018-12-3100000331852018-01-012018-09-3000000331852017-01-012017-09-3000000331852019-01-012019-09-300000033185efx:USInformationSolutionsMember2017-12-310000033185efx:WorkforceMember2017-12-310000033185efx:InternationalMember2017-12-310000033185efx:GlobalConsumerSolutionsMember2017-12-310000033185efx:USInformationSolutionsMember2018-01-012018-12-310000033185efx:USInformationSolutionsMember2018-12-310000033185efx:WorkforceMember2018-12-310000033185efx:InternationalMember2018-12-310000033185efx:GlobalConsumerSolutionsMember2018-12-310000033185efx:USInformationSolutionsMember2019-12-310000033185efx:WorkforceMember2019-12-310000033185efx:InternationalMember2019-12-310000033185efx:GlobalConsumerSolutionsMember2019-12-3100000331852019-07-012019-09-300000033185efx:TechnologyAndSoftwareMember2019-12-310000033185efx:ReacquiredRightsMember2019-12-310000033185efx:ReacquiredRightsMember2018-12-310000033185efx:ProprietaryDatabaseMember2019-12-310000033185efx:ProprietaryDatabaseMember2018-12-310000033185us-gaap:CommercialPaperMember2019-12-310000033185us-gaap:CommercialPaperMember2018-12-310000033185us-gaap:RevolvingCreditFacilityMember2019-12-310000033185us-gaap:RevolvingCreditFacilityMember2018-12-310000033185efx:NotesTwoPointThreeZeroDueJuneTwoThousandTwentyOneMember2019-12-310000033185efx:NotesTwoPointThreeZeroDueJuneTwoThousandTwentyOneMember2018-12-310000033185efx:NotesThreePointSixZeroDueAugustTwoThousandTwentyOneMember2019-12-310000033185efx:NotesThreePointSixZeroDueAugustTwoThousandTwentyOneMember2018-12-310000033185efx:NotesFloatingRateDueAugustTwoThousandTwentyOneMember2019-12-310000033185efx:NotesFloatingRateDueAugustTwoThousandTwentyOneMember2018-12-310000033185efx:NotesThreePointThreeZeroDueDecemberTwoThousandTwentyTwoMember2019-12-310000033185efx:NotesThreePointThreeZeroDueDecemberTwoThousandTwentyTwoMember2018-12-310000033185efx:NotesThreePointNineFiveDueMayTwoThousandTwentyThreeMember2019-12-310000033185efx:NotesThreePointNineFiveDueMayTwoThousandTwentyThreeMember2018-12-310000033185efx:NotesTwoPointSixZeroDueDecember2024Member2019-12-310000033185efx:NotesTwoPointSixZeroDueDecember2024Member2018-12-310000033185efx:NotesThreePointTwoFiveDueJuneTwoThousandTwentySixMember2019-12-310000033185efx:NotesThreePointTwoFiveDueJuneTwoThousandTwentySixMember2018-12-310000033185efx:DebenturesSixPointNineZeroPercentDueJulyTwentyTwoEightMember2019-12-310000033185efx:DebenturesSixPointNineZeroPercentDueJulyTwentyTwoEightMember2018-12-310000033185efx:NotesSevenPointZeroZeroPercentDueJulyTwentyThirtySevenMember2019-12-310000033185efx:NotesSevenPointZeroZeroPercentDueJulyTwentyThirtySevenMember2018-12-310000033185efx:DebtOtherMember2019-12-310000033185efx:DebtOtherMember2018-12-310000033185efx:NotesTwoPointSixZeroDueDecember2024Member2019-11-150000033185efx:NotesTwoPointSixZeroDueDecember2024Member2019-01-012019-09-300000033185efx:NotesThreePointSixZeroDueAugustTwoThousandTwentyOneMember2018-05-310000033185efx:NotesThreePointNineFiveDueMayTwoThousandTwentyThreeMember2018-05-310000033185efx:NotesFloatingRateDueAugustTwoThousandTwentyOneMember2018-05-310000033185efx:NotesFloatingRateDueAugustTwoThousandTwentyOneMemberus-gaap:LondonInterbankOfferedRateLIBORMember2018-05-012018-05-310000033185efx:TermLoanMember2019-09-300000033185efx:TermLoanMember2019-01-012019-09-300000033185us-gaap:RevolvingCreditFacilityMember2019-09-300000033185us-gaap:RevolvingCreditFacilityMember2019-01-012019-09-300000033185us-gaap:RevolvingCreditFacilityMember2018-08-3100000331852019-09-30efx:extension0000033185us-gaap:CommercialPaperMember2019-09-300000033185srt:MaximumMember2019-04-012019-06-300000033185efx:ReceivablesSecuritizationFacilityMember2019-12-310000033185efx:NotesTwoPointThreeZeroDueJuneTwoThousandTwentyOneMemberus-gaap:SeniorNotesMember2016-05-120000033185efx:NotesTwoPointThreeZeroDueJuneTwoThousandTwentyOneMemberus-gaap:SeniorNotesMember2016-05-122016-05-120000033185us-gaap:SeniorNotesMemberefx:NotesThreePointTwoFiveDueJuneTwoThousandTwentySixMember2016-05-120000033185us-gaap:SeniorNotesMemberefx:NotesThreePointTwoFiveDueJuneTwoThousandTwentySixMember2016-05-122016-05-120000033185efx:NotesSevenPointZeroZeroPercentDueJulyTwentyThirtySevenMemberus-gaap:SeniorNotesMember2007-06-180000033185efx:NotesSevenPointZeroZeroPercentDueJulyTwentyThirtySevenMemberus-gaap:SeniorNotesMember2007-06-182007-06-180000033185efx:NotesThreePointThreeZeroDueDecemberTwoThousandTwentyTwoMemberus-gaap:SeniorNotesMember2012-12-170000033185efx:NotesThreePointThreeZeroDueDecemberTwoThousandTwentyTwoMemberus-gaap:SeniorNotesMember2012-12-172012-12-170000033185srt:MinimumMemberefx:DataProcessingOutsourcingServicesAndOtherAgreementsMember2019-01-012019-12-310000033185srt:MaximumMemberefx:DataProcessingOutsourcingServicesAndOtherAgreementsMember2019-01-012019-12-310000033185srt:MinimumMemberefx:DataProcessingOutsourcingServicesAndOtherAgreementsMember2019-12-310000033185efx:IbmOperationsSupportServicesAgreementMember2019-12-310000033185efx:GoogleAgreementMember2019-12-310000033185efx:GoogleAgreementMember2019-01-012019-12-310000033185efx:GoogleAgreementMember2018-01-012018-12-310000033185efx:GoogleAgreementMember2017-01-012017-12-310000033185srt:MinimumMember2019-01-012019-12-310000033185srt:MaximumMember2019-01-012019-12-310000033185efx:PerformanceBondsMember2019-12-310000033185us-gaap:LetterOfCreditMember2019-12-310000033185efx:CybersecurityIncidentMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2019-01-012019-12-310000033185efx:CybersecurityIncidentMember2019-07-222019-07-220000033185efx:CybersecurityIncidentMember2019-01-012019-12-310000033185efx:CybersecurityIncidentMemberefx:MSAGGroupMember2019-07-012019-09-300000033185efx:CybersecurityIncidentMemberefx:CFPBMember2019-07-012019-09-300000033185efx:CybersecurityIncidentMemberefx:NYDFSMember2019-07-012019-09-30efx:claim0000033185efx:IndianTribesAndNationsMember2019-12-31efx:lawsuit0000033185efx:CybersecurityIncidentMemberstpr:GA2019-12-310000033185efx:CybersecurityIncidentMemberstpr:GA2019-01-012019-12-310000033185country:CA2019-12-31efx:plaintiff0000033185country:CA2019-01-012019-12-310000033185efx:UnitedStatesFederalMemberefx:ExpireAtVariousTimesBetween2021and2038Member2019-12-310000033185us-gaap:StateAndLocalJurisdictionMemberefx:ExpireAtVariousTimesBetween2021and2038Member2019-12-310000033185us-gaap:ForeignCountryMember2019-12-310000033185efx:ExpireAtVariousTimesBetween2020And2039Memberus-gaap:ForeignCountryMember2019-12-310000033185efx:NetOperatingLossIndefiniteLifeMemberus-gaap:ForeignCountryMember2019-12-310000033185efx:CapitalLossIndefiniteLifeMemberus-gaap:ForeignCountryMember2019-12-310000033185efx:ExpireInYears2025Through2027Memberus-gaap:ForeignCountryMember2019-12-310000033185efx:SateAndForeignTaxAuthorityMember2019-12-310000033185us-gaap:DomesticCountryMember2019-12-310000033185us-gaap:StateAndLocalJurisdictionMember2019-12-310000033185efx:OperatingLossandCapitalLossandForeignTaxCreditCarryforwardsandResearchandDevelopmentCreditMember2019-12-310000033185srt:MinimumMember2019-12-310000033185srt:MaximumMember2019-12-31efx:plan00000331852013-05-012013-05-310000033185us-gaap:CostOfSalesMember2019-01-012019-12-310000033185us-gaap:CostOfSalesMember2018-01-012018-12-310000033185us-gaap:CostOfSalesMember2017-01-012017-12-310000033185us-gaap:SellingGeneralAndAdministrativeExpensesMember2019-01-012019-12-310000033185us-gaap:SellingGeneralAndAdministrativeExpensesMember2018-01-012018-12-310000033185us-gaap:SellingGeneralAndAdministrativeExpensesMember2017-01-012017-12-310000033185us-gaap:EmployeeStockOptionMembersrt:MaximumMember2019-01-012019-12-310000033185us-gaap:EmployeeStockOptionMember2019-01-012019-12-310000033185us-gaap:EmployeeStockOptionMember2018-01-012018-12-310000033185us-gaap:EmployeeStockOptionMember2017-01-012017-12-310000033185us-gaap:EmployeeStockOptionMember2019-12-310000033185srt:MinimumMemberefx:UnvestedStockAwardsMember2019-01-012019-12-310000033185srt:MaximumMemberefx:UnvestedStockAwardsMember2019-01-012019-12-310000033185efx:UnvestedStockAwardsMember2016-12-310000033185efx:UnvestedStockAwardsMember2017-01-012017-12-310000033185efx:UnvestedStockAwardsMember2017-12-310000033185efx:UnvestedStockAwardsMember2018-01-012018-12-310000033185efx:UnvestedStockAwardsMember2018-12-310000033185efx:UnvestedStockAwardsMember2019-01-012019-12-310000033185efx:UnvestedStockAwardsMember2019-12-310000033185country:USus-gaap:PensionPlansDefinedBenefitMember2019-01-012019-12-310000033185us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2019-01-012019-12-310000033185country:USus-gaap:PensionPlansDefinedBenefitMember2018-01-012018-12-310000033185us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2018-01-012018-12-310000033185us-gaap:PensionPlansDefinedBenefitMember2018-12-310000033185us-gaap:PensionPlansDefinedBenefitMember2017-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2017-12-310000033185us-gaap:PensionPlansDefinedBenefitMember2019-01-012019-12-310000033185us-gaap:PensionPlansDefinedBenefitMember2018-01-012018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-01-012019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2018-01-012018-12-310000033185us-gaap:PensionPlansDefinedBenefitMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembercountry:US2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembercountry:US2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2018-12-310000033185us-gaap:PensionPlansDefinedBenefitMember2017-01-012017-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2017-01-012017-12-310000033185country:USus-gaap:PensionPlansDefinedBenefitMember2019-12-310000033185us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000033185us-gaap:DefinedBenefitPlanEquitySecuritiesLargeCapMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000033185us-gaap:DefinedBenefitPlanEquitySecuritiesLargeCapMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2019-12-310000033185us-gaap:DefinedBenefitPlanEquitySecuritiesLargeCapMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000033185us-gaap:DefinedBenefitPlanEquitySecuritiesLargeCapMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2019-12-310000033185efx:DefinedBenefitPlanEquitySecuritiesMidCapandSmallCapMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000033185efx:DefinedBenefitPlanEquitySecuritiesMidCapandSmallCapMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2019-12-310000033185efx:DefinedBenefitPlanEquitySecuritiesMidCapandSmallCapMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000033185efx:DefinedBenefitPlanEquitySecuritiesMidCapandSmallCapMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2019-12-310000033185us-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000033185us-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2019-12-310000033185us-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000033185us-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2019-12-310000033185us-gaap:FixedIncomeSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000033185us-gaap:FixedIncomeSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2019-12-310000033185us-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000033185us-gaap:FixedIncomeSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2019-12-310000033185us-gaap:PrivateEquityFundsMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000033185us-gaap:PrivateEquityFundsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2019-12-310000033185us-gaap:FairValueInputsLevel2Memberus-gaap:PrivateEquityFundsMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000033185us-gaap:PrivateEquityFundsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2019-12-310000033185us-gaap:PensionPlansDefinedBenefitMemberus-gaap:HedgeFundsMember2019-12-310000033185us-gaap:PensionPlansDefinedBenefitMemberus-gaap:HedgeFundsMemberus-gaap:FairValueInputsLevel1Member2019-12-310000033185us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:HedgeFundsMember2019-12-310000033185us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:HedgeFundsMember2019-12-310000033185us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanRealEstateMember2019-12-310000033185us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanRealEstateMember2019-12-310000033185us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanRealEstateMember2019-12-310000033185us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanRealEstateMember2019-12-310000033185us-gaap:DefinedBenefitPlanCashMemberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000033185us-gaap:DefinedBenefitPlanCashMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2019-12-310000033185us-gaap:DefinedBenefitPlanCashMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000033185us-gaap:DefinedBenefitPlanCashMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2019-12-310000033185us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2019-12-310000033185us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000033185us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2019-12-310000033185us-gaap:DefinedBenefitPlanEquitySecuritiesLargeCapMemberus-gaap:PensionPlansDefinedBenefitMember2018-12-310000033185us-gaap:DefinedBenefitPlanEquitySecuritiesLargeCapMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2018-12-310000033185us-gaap:DefinedBenefitPlanEquitySecuritiesLargeCapMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2018-12-310000033185us-gaap:DefinedBenefitPlanEquitySecuritiesLargeCapMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2018-12-310000033185efx:DefinedBenefitPlanEquitySecuritiesMidCapandSmallCapMemberus-gaap:PensionPlansDefinedBenefitMember2018-12-310000033185efx:DefinedBenefitPlanEquitySecuritiesMidCapandSmallCapMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2018-12-310000033185efx:DefinedBenefitPlanEquitySecuritiesMidCapandSmallCapMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2018-12-310000033185efx:DefinedBenefitPlanEquitySecuritiesMidCapandSmallCapMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2018-12-310000033185us-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:PensionPlansDefinedBenefitMember2018-12-310000033185us-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2018-12-310000033185us-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2018-12-310000033185us-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2018-12-310000033185us-gaap:FixedIncomeSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2018-12-310000033185us-gaap:FixedIncomeSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2018-12-310000033185us-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2018-12-310000033185us-gaap:FixedIncomeSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2018-12-310000033185us-gaap:PrivateEquityFundsMemberus-gaap:PensionPlansDefinedBenefitMember2018-12-310000033185us-gaap:PrivateEquityFundsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2018-12-310000033185us-gaap:FairValueInputsLevel2Memberus-gaap:PrivateEquityFundsMemberus-gaap:PensionPlansDefinedBenefitMember2018-12-310000033185us-gaap:PrivateEquityFundsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2018-12-310000033185us-gaap:PensionPlansDefinedBenefitMemberus-gaap:HedgeFundsMember2018-12-310000033185us-gaap:PensionPlansDefinedBenefitMemberus-gaap:HedgeFundsMemberus-gaap:FairValueInputsLevel1Member2018-12-310000033185us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:HedgeFundsMember2018-12-310000033185us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:HedgeFundsMember2018-12-310000033185us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanRealEstateMember2018-12-310000033185us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanRealEstateMember2018-12-310000033185us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanRealEstateMember2018-12-310000033185us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanRealEstateMember2018-12-310000033185us-gaap:DefinedBenefitPlanCashMemberus-gaap:PensionPlansDefinedBenefitMember2018-12-310000033185us-gaap:DefinedBenefitPlanCashMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2018-12-310000033185us-gaap:DefinedBenefitPlanCashMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2018-12-310000033185us-gaap:DefinedBenefitPlanCashMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2018-12-310000033185us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2018-12-310000033185us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2018-12-310000033185us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2018-12-310000033185efx:PrivateEquityCommitmentsMember2019-12-310000033185efx:PrivateEquityCommitmentsMember2018-12-310000033185efx:RealAssetCommitmentsMember2019-12-310000033185efx:RealAssetCommitmentsMember2018-12-310000033185us-gaap:PrivateEquityFundsMember2017-12-310000033185us-gaap:HedgeFundsMember2017-12-310000033185us-gaap:DefinedBenefitPlanRealEstateMember2017-12-310000033185us-gaap:PrivateEquityFundsMember2018-01-012018-12-310000033185us-gaap:HedgeFundsMember2018-01-012018-12-310000033185us-gaap:DefinedBenefitPlanRealEstateMember2018-01-012018-12-310000033185us-gaap:PrivateEquityFundsMember2018-12-310000033185us-gaap:HedgeFundsMember2018-12-310000033185us-gaap:DefinedBenefitPlanRealEstateMember2018-12-310000033185us-gaap:PrivateEquityFundsMember2019-01-012019-12-310000033185us-gaap:HedgeFundsMember2019-01-012019-12-310000033185us-gaap:DefinedBenefitPlanRealEstateMember2019-01-012019-12-310000033185us-gaap:PrivateEquityFundsMember2019-12-310000033185us-gaap:HedgeFundsMember2019-12-310000033185us-gaap:DefinedBenefitPlanRealEstateMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesLargeCapMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesLargeCapMemberus-gaap:FairValueInputsLevel1Member2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesLargeCapMemberus-gaap:FairValueInputsLevel2Member2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesLargeCapMemberus-gaap:FairValueInputsLevel3Member2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberefx:DefinedBenefitPlanEquitySecuritiesMidCapandSmallCapMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberefx:DefinedBenefitPlanEquitySecuritiesMidCapandSmallCapMemberus-gaap:FairValueInputsLevel1Member2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberefx:DefinedBenefitPlanEquitySecuritiesMidCapandSmallCapMemberus-gaap:FairValueInputsLevel2Member2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberefx:DefinedBenefitPlanEquitySecuritiesMidCapandSmallCapMemberus-gaap:FairValueInputsLevel3Member2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:FairValueInputsLevel1Member2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:FairValueInputsLevel2Member2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:FairValueInputsLevel3Member2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel1Member2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Member2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel3Member2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:PrivateEquityFundsMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:PrivateEquityFundsMemberus-gaap:FairValueInputsLevel1Member2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PrivateEquityFundsMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:PrivateEquityFundsMemberus-gaap:FairValueInputsLevel3Member2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:HedgeFundsMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:HedgeFundsMemberus-gaap:FairValueInputsLevel1Member2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:HedgeFundsMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:HedgeFundsMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanRealEstateMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanRealEstateMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanRealEstateMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanRealEstateMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashMemberus-gaap:FairValueInputsLevel1Member2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashMemberus-gaap:FairValueInputsLevel2Member2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashMemberus-gaap:FairValueInputsLevel3Member2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesLargeCapMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesLargeCapMemberus-gaap:FairValueInputsLevel1Member2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesLargeCapMemberus-gaap:FairValueInputsLevel2Member2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesLargeCapMemberus-gaap:FairValueInputsLevel3Member2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberefx:DefinedBenefitPlanEquitySecuritiesMidCapandSmallCapMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberefx:DefinedBenefitPlanEquitySecuritiesMidCapandSmallCapMemberus-gaap:FairValueInputsLevel1Member2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberefx:DefinedBenefitPlanEquitySecuritiesMidCapandSmallCapMemberus-gaap:FairValueInputsLevel2Member2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberefx:DefinedBenefitPlanEquitySecuritiesMidCapandSmallCapMemberus-gaap:FairValueInputsLevel3Member2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:FairValueInputsLevel1Member2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:FairValueInputsLevel2Member2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:FairValueInputsLevel3Member2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel1Member2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Member2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel3Member2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:PrivateEquityFundsMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:PrivateEquityFundsMemberus-gaap:FairValueInputsLevel1Member2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PrivateEquityFundsMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:PrivateEquityFundsMemberus-gaap:FairValueInputsLevel3Member2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:HedgeFundsMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:HedgeFundsMemberus-gaap:FairValueInputsLevel1Member2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:HedgeFundsMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:HedgeFundsMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanRealEstateMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanRealEstateMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanRealEstateMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanRealEstateMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashMemberus-gaap:FairValueInputsLevel1Member2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashMemberus-gaap:FairValueInputsLevel2Member2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashMemberus-gaap:FairValueInputsLevel3Member2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesLargeCapMembercountry:US2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesLargeCapMembercountry:US2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberefx:DefinedBenefitPlanEquitySecuritiesMidCapandSmallCapMembercountry:US2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberefx:DefinedBenefitPlanEquitySecuritiesMidCapandSmallCapMembercountry:US2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMembercountry:US2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMembercountry:US2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembercountry:USus-gaap:PrivateEquityFundsMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembercountry:USus-gaap:PrivateEquityFundsMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembercountry:USus-gaap:HedgeFundsMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembercountry:USus-gaap:HedgeFundsMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembercountry:USus-gaap:DefinedBenefitPlanRealEstateMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembercountry:USus-gaap:DefinedBenefitPlanRealEstateMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMembercountry:US2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMembercountry:US2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashMembercountry:US2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashMembercountry:US2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberefx:CanadianEquitySecuritiesMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberefx:CanadianEquitySecuritiesMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:FixedIncomeSecuritiesMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:FixedIncomeSecuritiesMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:MoneyMarketFundsMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:MoneyMarketFundsMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberefx:AlternativeCreditMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberefx:AlternativeCreditMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2019-01-012019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2018-01-012018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2017-01-012017-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesLargeCapMembersrt:MinimumMembercountry:US2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesLargeCapMembersrt:MinimumMembercountry:US2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberefx:DefinedBenefitPlanEquitySecuritiesMidCapandSmallCapMembersrt:MinimumMembercountry:US2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberefx:DefinedBenefitPlanEquitySecuritiesMidCapandSmallCapMembersrt:MinimumMembercountry:US2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMembersrt:MinimumMembercountry:US2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMembersrt:MinimumMembercountry:US2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembersrt:MinimumMembercountry:USus-gaap:PrivateEquityFundsMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembersrt:MinimumMembercountry:USus-gaap:PrivateEquityFundsMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembersrt:MinimumMembercountry:USus-gaap:HedgeFundsMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembersrt:MinimumMembercountry:USus-gaap:HedgeFundsMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembersrt:MinimumMembercountry:USus-gaap:DefinedBenefitPlanRealEstateMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembersrt:MinimumMembercountry:USus-gaap:DefinedBenefitPlanRealEstateMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMembersrt:MinimumMembercountry:US2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMembersrt:MinimumMembercountry:US2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembersrt:MinimumMemberus-gaap:DefinedBenefitPlanCashMembercountry:US2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembersrt:MinimumMemberus-gaap:DefinedBenefitPlanCashMembercountry:US2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesLargeCapMembersrt:MaximumMembercountry:US2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesLargeCapMembersrt:MaximumMembercountry:US2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberefx:DefinedBenefitPlanEquitySecuritiesMidCapandSmallCapMembersrt:MaximumMembercountry:US2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberefx:DefinedBenefitPlanEquitySecuritiesMidCapandSmallCapMembersrt:MaximumMembercountry:US2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMembersrt:MaximumMembercountry:US2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMembersrt:MaximumMembercountry:US2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembersrt:MaximumMembercountry:USus-gaap:PrivateEquityFundsMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembersrt:MaximumMembercountry:USus-gaap:PrivateEquityFundsMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembersrt:MaximumMembercountry:USus-gaap:HedgeFundsMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembersrt:MaximumMembercountry:USus-gaap:HedgeFundsMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembersrt:MaximumMembercountry:USus-gaap:DefinedBenefitPlanRealEstateMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembersrt:MaximumMembercountry:USus-gaap:DefinedBenefitPlanRealEstateMember2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMembersrt:MaximumMembercountry:US2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FixedIncomeSecuritiesMembersrt:MaximumMembercountry:US2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembersrt:MaximumMemberus-gaap:DefinedBenefitPlanCashMembercountry:US2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMembersrt:MaximumMemberus-gaap:DefinedBenefitPlanCashMembercountry:US2018-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:ForeignPlanMembersrt:MinimumMemberefx:CanadianEquitySecuritiesMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:FixedIncomeSecuritiesMembersrt:MinimumMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:ForeignPlanMembersrt:MinimumMemberus-gaap:MoneyMarketFundsMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberefx:AlternativeCreditMembersrt:MinimumMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:ForeignPlanMembersrt:MaximumMemberefx:CanadianEquitySecuritiesMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:FixedIncomeSecuritiesMembersrt:MaximumMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:ForeignPlanMembersrt:MaximumMemberus-gaap:MoneyMarketFundsMember2019-12-310000033185us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberefx:AlternativeCreditMembersrt:MaximumMember2019-12-310000033185us-gaap:AccumulatedTranslationAdjustmentMember2018-12-310000033185efx:AccumulatedDefinedBenefitPlansAdjustmentAttributabletoParentNetofTaxEffectsMember2018-12-310000033185us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2018-12-310000033185us-gaap:AccumulatedTranslationAdjustmentMember2019-01-012019-12-310000033185efx:AccumulatedDefinedBenefitPlansAdjustmentAttributabletoParentNetofTaxEffectsMember2019-01-012019-12-310000033185us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-01-012019-12-310000033185us-gaap:AccumulatedTranslationAdjustmentMember2019-12-310000033185efx:AccumulatedDefinedBenefitPlansAdjustmentAttributabletoParentNetofTaxEffectsMember2019-12-310000033185us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-12-310000033185us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2019-01-012019-12-310000033185us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2019-01-012019-12-310000033185us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-01-012019-12-310000033185us-gaap:SellingGeneralAndAdministrativeExpensesMember2019-01-012019-03-310000033185us-gaap:SellingGeneralAndAdministrativeExpensesMember2018-10-012018-12-310000033185efx:RestructuringChargesIncurredIn2019Member2019-01-012019-12-310000033185efx:RestructuringChargesIncurredIn2018Member2019-01-012019-12-310000033185efx:RestructuringChargesIncurredIn2018Member2018-01-012018-12-310000033185us-gaap:PreviousAccountingGuidanceMember2019-12-310000033185us-gaap:AccountingStandardsUpdate201602Member2019-12-310000033185us-gaap:OperatingSegmentsMemberefx:USInformationSolutionsMember2018-01-012018-12-310000033185us-gaap:OperatingSegmentsMemberefx:USInformationSolutionsMember2017-01-012017-12-310000033185us-gaap:OperatingSegmentsMemberefx:WorkforceMember2018-01-012018-12-310000033185us-gaap:OperatingSegmentsMemberefx:WorkforceMember2017-01-012017-12-310000033185us-gaap:OperatingSegmentsMemberefx:InternationalMember2018-01-012018-12-310000033185us-gaap:OperatingSegmentsMemberefx:InternationalMember2017-01-012017-12-310000033185us-gaap:OperatingSegmentsMemberefx:GlobalConsumerSolutionsMember2018-01-012018-12-310000033185us-gaap:OperatingSegmentsMemberefx:GlobalConsumerSolutionsMember2017-01-012017-12-310000033185us-gaap:OperatingSegmentsMemberefx:USInformationSolutionsMember2019-01-012019-12-310000033185us-gaap:OperatingSegmentsMemberefx:WorkforceMember2019-01-012019-12-310000033185us-gaap:OperatingSegmentsMemberefx:InternationalMember2019-01-012019-12-310000033185us-gaap:OperatingSegmentsMemberefx:GlobalConsumerSolutionsMember2019-01-012019-12-310000033185us-gaap:CorporateNonSegmentMember2019-01-012019-12-310000033185us-gaap:CorporateNonSegmentMember2018-01-012018-12-310000033185us-gaap:CorporateNonSegmentMember2017-01-012017-12-310000033185us-gaap:OperatingSegmentsMemberefx:USInformationSolutionsMember2019-12-310000033185us-gaap:OperatingSegmentsMemberefx:USInformationSolutionsMember2018-12-310000033185us-gaap:OperatingSegmentsMemberefx:WorkforceMember2019-12-310000033185us-gaap:OperatingSegmentsMemberefx:WorkforceMember2018-12-310000033185us-gaap:OperatingSegmentsMemberefx:InternationalMember2019-12-310000033185us-gaap:OperatingSegmentsMemberefx:InternationalMember2018-12-310000033185us-gaap:OperatingSegmentsMemberefx:GlobalConsumerSolutionsMember2019-12-310000033185us-gaap:OperatingSegmentsMemberefx:GlobalConsumerSolutionsMember2018-12-310000033185us-gaap:CorporateNonSegmentMember2019-12-310000033185us-gaap:CorporateNonSegmentMember2018-12-310000033185country:US2019-01-012019-12-310000033185country:US2018-01-012018-12-310000033185country:US2017-01-012017-12-310000033185country:GB2019-01-012019-12-310000033185country:GB2018-01-012018-12-310000033185country:GB2017-01-012017-12-310000033185country:AU2019-01-012019-12-310000033185country:AU2018-01-012018-12-310000033185country:AU2017-01-012017-12-310000033185country:CA2018-01-012018-12-310000033185country:CA2017-01-012017-12-310000033185efx:OtherCountriesMember2019-01-012019-12-310000033185efx:OtherCountriesMember2018-01-012018-12-310000033185efx:OtherCountriesMember2017-01-012017-12-310000033185country:US2019-12-310000033185country:US2018-12-310000033185country:GB2019-12-310000033185country:GB2018-12-310000033185country:AU2019-12-310000033185country:AU2018-12-310000033185country:CA2018-12-310000033185efx:OtherCountriesMember2019-12-310000033185efx:OtherCountriesMember2018-12-3100000331852019-01-012019-03-3100000331852019-04-012019-06-3000000331852019-10-012019-12-3100000331852018-01-012018-03-3100000331852018-04-012018-06-3000000331852018-07-012018-09-3000000331852018-10-012018-12-310000033185efx:CybersecurityIncidentInvestigationRemediationLegalAndOtherProfessionalServicesMember2019-01-012019-12-310000033185us-gaap:AllowanceForCreditLossMember2018-12-310000033185us-gaap:AllowanceForCreditLossMember2019-01-012019-12-310000033185us-gaap:AllowanceForCreditLossMember2019-12-310000033185us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2018-12-310000033185us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-01-012019-12-310000033185us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-12-310000033185us-gaap:AllowanceForCreditLossMember2017-12-310000033185us-gaap:AllowanceForCreditLossMember2018-01-012018-12-310000033185us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2017-12-310000033185us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2018-01-012018-12-310000033185us-gaap:AllowanceForCreditLossMember2016-12-310000033185us-gaap:AllowanceForCreditLossMember2017-01-012017-12-310000033185us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2016-12-310000033185us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2017-01-012017-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-06605

____________________________________

EQUIFAX INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Georgia | | 58-0401110 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

| | |

| | |

| | | | | | | | | | | | | | | | | |

| 1550 Peachtree Street | N.W. | Atlanta | Georgia | | 30309 |

| (Address of principal executive offices) | | | | | (Zip Code) |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Registrant’s telephone number, including area code: 404-885-8000

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $1.25 par value per share | | EFX | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None.

____________________________________

Indicate by check mark if Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Exchange Act (“Act”). ☒ Yes ☐ No

Indicate by check mark if Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ☒ | Large accelerated filer | | ☐ | Accelerated filer | | ☐ | Non-accelerated filer | | ☐ | Smaller reporting company | | ☐ | Emerging growth company |

| | | | | | | | | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ YES ☒ NO

As of June 30, 2019, the aggregate market value of Registrant’s common stock held by non-affiliates of Registrant was approximately $16,348,175,266 based on the closing sale price as reported on the New York Stock Exchange. At January 31, 2020, there were 121,235,722 shares of Registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Registrant’s definitive proxy statement for its 2020 annual meeting of shareholders are incorporated by reference in Part III of this Form 10-K.

TABLE OF CONTENTS

PART I

ITEM 1. BUSINESS

Overview

Equifax Inc. is a global data, analytics and technology company. We provide information solutions for businesses, governments and consumers, and we provide human resources business process outsourcing services for employers. We have a large and diversified group of clients, including financial institutions, corporations, government agencies and individuals. Our services are based on comprehensive databases of consumer and business information derived from numerous sources including credit, financial assets, telecommunications and utility payments, employment, income, demographic and marketing data. We use advanced statistical techniques, machine learning and proprietary software tools to analyze available data to create customized insights, decision-making solutions and processing services for our clients. We also provide information, technology and services to support debt collections and recovery management. Additionally, we are a leading provider of payroll-related and human resource management business process outsourcing services in the United States of America (“U.S.”). For consumers, we provide products and services to help people understand, manage and protect their personal information and make more informed financial decisions.

We currently operate in four global regions: North America (U.S. and Canada), Asia Pacific (Australia, New Zealand and India), Europe (the United Kingdom (“U.K.”), Spain and Portugal) and Latin America (Argentina, Chile, Costa Rica, Ecuador, El Salvador, Honduras, Mexico, Paraguay, Peru and Uruguay). We maintain support operations in the Republic of Ireland, Chile, Costa Rica and India. We also offer Equifax branded credit services in Russia through a joint venture, have investments in consumer and/or commercial credit information companies through joint ventures in Cambodia, Malaysia, Singapore and the United Arab Emirates, have an investment in a consumer and commercial credit information company in Brazil and have an investment in an identity authentication company in Canada.

Equifax was originally incorporated under the laws of the State of Georgia in 1913, and its predecessor company dates back to 1899. As used herein, the terms Equifax, the Company, we, our and us refer to Equifax Inc., a Georgia corporation, and its consolidated subsidiaries as a combined entity, except where it is clear that the terms mean only Equifax Inc.

We are organized and report our business results in four operating segments, as follows:

•U.S. Information Solutions (“USIS”) — provides consumer and commercial information solutions to businesses in the U.S. including online information, decisioning technology solutions, fraud and identity management services, analytical services, portfolio management services, mortgage reporting and marketing services.

•Workforce Solutions — provides services enabling customers to verify income and employment (Verification Services) of people in the U.S., as well as providing our employer customers with services that assist them in complying with and automating certain payroll-related and human resource management processes throughout the entire cycle of the employment relationship, including unemployment cost management, employee onboarding, tax credits and incentives, I-9 management and compliance, tax form management services and Affordable Care Act management services (Employer Services). Workforce Solutions has recently established Verifications Service operations in Canada and is working toward a similar operation in Australia.

•International — provides products and services similar to those available in the USIS operating segment but with variations by geographic region. We also provide information, technology and services to support debt collections and recovery management. This operating segment is comprised of our Canada, Europe, Latin America and Asia Pacific business units.

•Global Consumer Solutions — provides products to consumers in the U.S., Canada and the U.K., enabling them to understand and monitor their credit and monitor and help protect their identity. We also sell consumer credit information to resellers who may combine our information with other information to provide direct-to-consumer monitoring, reports and scores.

2017 Cybersecurity Incident

In 2017, we experienced a cybersecurity incident following a criminal attack on our systems that involved the theft of certain personally identifiable information of U.S., Canadian and U.K. consumers. Criminals exploited a software vulnerability in a U.S. website application to gain unauthorized access to our network. In March 2017, the U.S. Department of Homeland

Security distributed a notice concerning the software vulnerability. We undertook efforts to identify and remediate vulnerable systems; however, the vulnerability in the website application that was exploited was not identified by our security processes. We discovered unusual network activity in late-July 2017 and upon discovery promptly investigated the activity. Once the activity was identified as potential unauthorized access, we acted to stop the intrusion and engaged a leading, independent cybersecurity firm to conduct a forensic investigation to determine the scope of the unauthorized access, including the specific information impacted. Based on our forensic investigation, the unauthorized access occurred from mid-May 2017 through July 2017. No evidence was found that the Company’s core consumer, employment and income, or commercial reporting databases were accessed. We continue to cooperate with law enforcement in connection with the criminal investigation into the actors responsible for the 2017 cybersecurity incident. On February 10, 2020, the U.S. Department of Justice announced that four members of the Chinese People’s Liberation Army were indicted on criminal charges for their involvement in the 2017 cybersecurity incident.

The Company has taken actions to provide consumers with tools to protect their credit data. Immediately following the announcement of the 2017 cybersecurity incident, the Company devoted substantial resources to notify people of the incident and to provide free services to assist people in monitoring their credit and identity information. Since then, the Company has been focused on implementing significant improvements to its data security systems, technology platforms and risk management processes, in an effort to underpin its business strategy.

Our Business Strategy

Our vision is to be a trusted global leader in data, advanced analytics and technology that creates innovative solutions and insights for our customers. Our business strategy is driven by the following imperatives:

•Lead our industry in data security. We are focused on becoming a leader in our industry in the effectiveness of our data and technology security practices. This includes building an Equifax culture that considers data and technology security, and more broadly risk management, as a primary requirement in all decisions. This also includes the extensive use of advanced data and technology security tools, techniques, services and processes in order to enhance our ability to protect the information with which we are entrusted from fraudulent access.

•Transform our technology. We are rebuilding our technology infrastructure, accelerating our migration to a public cloud environment, employing virtual private cloud deployment techniques, and rationalizing and rebuilding our application portfolio using cloud-native services. This technology transformation is a significant part of our goal of leading our industry in data and technology security capability. Our goal is to deliver market-leading capabilities to our customers in terms of speed of bringing new products and services to market; ease of customer and partner implementation and integration; ease of consumer access to and interaction with Equifax; system resiliency and uptime; and ultimately cost to serve. We are undergoing a multi-year technology transformation which is already broadly impacting our internal and external information technology systems.

•Lead in data and analytics, to develop unparalleled analytical insights leveraging Equifax’s unique data. We use proprietary advanced analytical platforms, including capabilities in machine learning and advanced visualization tools, to leverage our unique data to develop leading analytical insights that enhance the precision of our customers’ decisioning activities. We strive to continue to advance these capabilities through ongoing data monetization activities, the acquisition of distinctive and differentiated assets, and continued advancement of capabilities in artificial intelligence and machine learning. As part of our technology transformation, we are investing to simplify our customers’ access to our leading analytical platforms, in order to speed the development of unique insights and the conversion of these insights into new products and services consumable by our customers through our delivery platforms.

We offer a wide array of products, ranging from custom products for large clients, to software-as-a-service-based decisioning and data access technology platforms that are cost-effective for clients of all sizes. We also develop predictive scores and analytics, some of which leverage multiple data assets, to help clients acquire new customers and manage their existing customer relationships. We develop a broad array of industry, risk management, cross-sell and account acquisition models to enhance the precision of our clients’ decisioning activities. We also develop custom and generic solutions that enable customers to effectively manage their debt collection and recovery portfolios.

•Improve the consumer user experience. Equifax understands the importance of providing consumers with user-friendly capabilities to see, understand and question their consumer credit file and information. As part of our

technology transformation, we are rebuilding our digital and call center technology infrastructure to provide an experience focused on making consumers’ interactions with Equifax as effective and efficient as possible.

•Foster a culture of customer centricity. We are focused on building a culture in which the customer is at the center of our decision processes and we exceed customer expectations by delivering solutions with speed, flexibility, stability and performance. Our focus on customer centricity will enable us to be more proactive in solving problems better and faster for customers while delivering enhanced operational readiness to provide a better customer experience.

•Deliver growth while enhancing profitability and shareholder returns. We strive to accelerate innovation through expanded customer focus and collaboration. We intend to leverage our unique data assets and capabilities, as well as customer expertise and customer data and technology assets, to help us jointly create high-value analytical products and services targeted at a broader range of customer needs. We seek to expand partnerships in order to further broaden the key customer domains and verticals that our products and services are able to serve.

We seek to increase our share of clients’ spend on information-related services through these new products and services, price our products and services in accordance with the value they represent to our customers, increase the range of current products and services utilized by our clients, and improve the quality and effectiveness of our support for both customers and consumers.

We believe there are opportunities to continue to expand in the U.S. and internationally, across the existing financial, mortgage, telecommunications, automotive, insurance, healthcare, government and other markets that we serve, as well as in new and emerging market segments. We continue to invest, including through acquisitions and partnerships, to expand our addressable markets and the data and capabilities we offer to solve customer challenges ranging from identity authentication to risk management.

We seek to enhance shareholder value through the disciplined execution of these imperatives and by positioning ourselves as a premier and trusted provider of high value information solutions.

•Build a world-class Equifax team by investing in talent to drive our strategy and promote a culture of innovation. We attract top talent by providing opportunities to grow and lead within our company. We regularly undertake talent initiatives to engage, develop and retain our top talent.

Markets and Clients

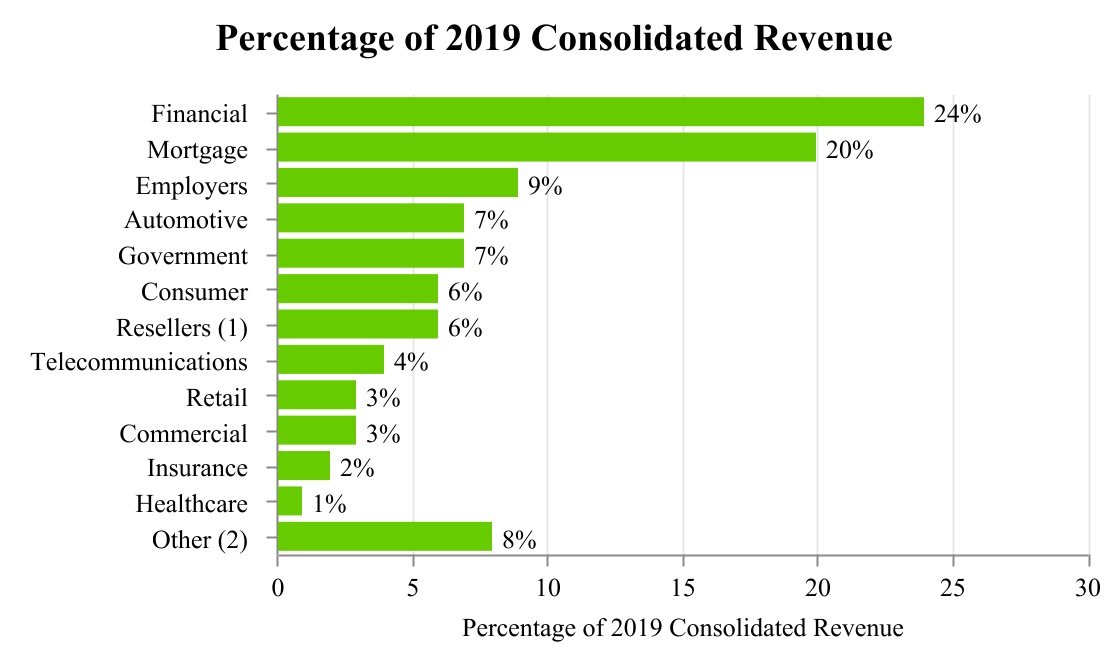

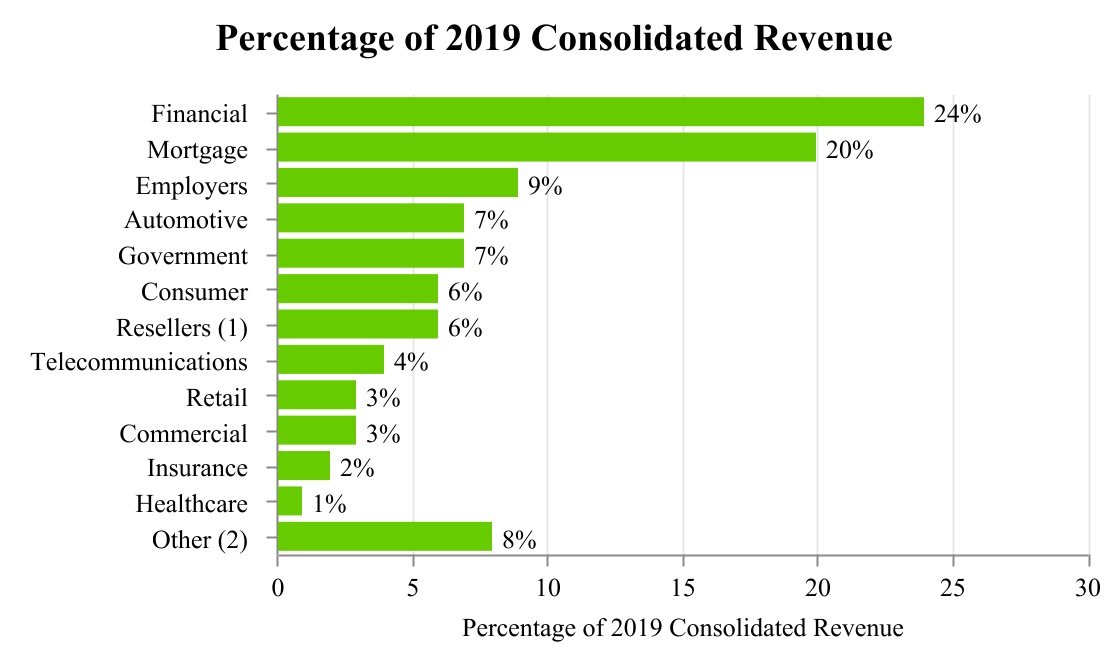

Our products and services serve clients across a wide range of verticals, including financial services, mortgage, state and federal government, employers, consumer, commercial, telecommunications, retail, automotive, utilities, brokerage, healthcare and insurance industries. We also serve consumers directly. Our revenue streams are highly diversified with our largest client providing less than 3% of total revenue. The following table summarizes the various end-user markets we serve:

(1)Predominantly sold to companies who serve the direct-to-consumer market and includes other small end user markets. Mortgage and auto resellers are excluded from this category as they are included within their respective categories above.

(2)Other includes revenue from other miscellaneous end-user markets.

We market our products and services primarily through our own direct sales organization that is structured around sales teams that focus on client segments typically aligned by vertical markets and geography. Sales groups are based in field offices located throughout the U.S., including our headquarters in Atlanta, Georgia, and in the countries where we have operations. We also market our products and services through indirect channels, including alliance partners, joint ventures and other resellers. In addition, we sell through direct mail and the internet.

Revenue from international clients, including end users and resellers, amounted to 27% of our total revenue in 2019, 29% of our total revenue in 2018 and 29% of our total revenue in 2017.

Products and Services

Our products and services help our clients make more informed decisions with higher levels of confidence by leveraging a broad array of data assets. Analytics are used to derive insights from the data that are most relevant for the client’s decisioning needs. The data and insights are then processed through proprietary software and generally transmitted to the client’s operating system to execute the decision.

The following chart summarizes the key products and services offered by each of the business units within our segments:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| USIS | | | | | | Workforce Solutions | | | | International | | | | | | | | |

| Online Information Solutions | | Financial Marketing Services | | Mortgage Services | | Verification Services | | Employer Services | | Europe | | Asia Pacific | | Latin America | | Canada | | Global Consumer Solutions |

| Online data | X | | | | X | | X | | | | X | | X | | X | | X | | X |

| Portfolio management services | X | | X | | X | | X | | | | X | | X | | X | | X | | |

| Analytical services | X | | X | | X | | X | | X | | X | | X | | X | | X | | X |

| Technology services | X | | | | X | | | | | | X | | X | | X | | X | | |

| Identity management and fraud | X | | | | | | X | | | | X | | X | | X | | X | | X |

| Marketing Services | | | X | | X | | | | | | | | X | | X | | X | | |

| Direct-to-consumer credit monitoring | | | | | | | | | | | | | X | | | | | | X |

| Employment and income verification services | | | | | | | X | | | | | | X | | | | | | |

| Business process outsourcing (BPO) | | | | | | | X | | X | | | | X | | | | | | |

| Debt collection software, services and analytics | | | | | | | | | | | X | | X | | X | | X | | |

Each of our operating segments is described more fully below. For the operating revenue, operating income and total assets for each segment see Note 13 of the Notes to the Consolidated Financial Statements in this report.

USIS

USIS provides consumer and commercial information solutions to businesses in the U.S. through three product and service lines, as follows:

Online Information Solutions. Online Information Solutions’ products are derived from multiple large and comprehensive databases of consumer and commercial information that we maintain about individual consumers and businesses, including credit history, current credit status, payment history and address information. Our clients utilize the information and analytical insights we provide to make decisions for a broad range of financial and business purposes, such as whether, and on what terms, to approve auto loans or credit card applications, and whether to allow a consumer or a business to open a new utility or telephone account. In addition, this information is used by our clients for cross-selling additional products to existing customers, improving their underwriting and risk management decisions, and authenticating and verifying consumer and business identities. We also sell consumer and credit information to resellers who may combine our information with other information to provide services to the financial, mortgage, fraud and identity management, and other end-user markets. Our software platforms and analytical capabilities can integrate all types of information, including third-party and client information, to enhance the insights and decisioning process to help further mitigate the risk of granting credit, predict the risk of bankruptcy, indicate the applicant’s risk potential for account delinquency, ensure the identity of the consumer, and reduce exposure to fraud. These risk management services enable our clients to monitor risks and opportunities and proactively manage their portfolios.

Online Information Solutions’ clients access products through a full range of electronic distribution mechanisms, including direct real-time access which facilitates instant decisions. We also develop and host customized applications that enhance the decision-making process for our clients. These decisioning technology applications assist with a wide variety of decisioning activities, including determining pre-approved offers, cross-selling of various products, determining deposit amounts for telephone and utility companies, and verifying the identity of their customers. We have also compiled commercial databases regarding businesses in the U.S., which include loan, credit card, public records and leasing history data, trade accounts receivable performance, and Secretary of State and Securities and Exchange Commission registration information. We offer scoring and analytical services that provide additional information to help mitigate the credit risk assumed by our clients.